- Introduction

- Description of financial reporting environment in the USA

- Converging IFRS and US GAAP into a global set of accounting standards

- Johnson and Johnson financial and non-financial reporting

- The information provided in the annual report 2011

- Additional reporting (Sustainability reporting)

- How financial reporting environment has influenced company’s reporting practices

- Conclusions

- References

Introduction

Efficiency in management and accounting process and procedure has become one of the most critical aspects in the management of companies in pharmaceutical industry in the United States in because it determines their ability to articulate their objectives in tandem with the national and global demands. Employing the correct accounting methodologies is a bridge and an indicator of an organization’s sustainability consideration as analysed in this paper from Johnson and Johnson Company.

Cox (2010, p. 310) indicates that implementing the Generally Accepted Accounting Principles (GAAP) or the International Financial Reporting Standards (IFSR) forms the best mechanism for improving performance and therefore promotes the economic growth of a nation or business entity. It is from this consideration that this paper explores the cultural and political history of financial reporting in the USA and the outcomes of converging GAAP and IFSR applications in accounting. The paper particularly employs financial accounting theory to evaluate the applications of financial reporting standards on accounting and management.

Purpose

An understanding of the main purpose of the report is critical in the sense that it links the findings from Johnson and Johnson’s annual reports as well as sustainability reporting in the US financial reporting environment to the expected impacts it will inculcate to a business.

Since the convergence of IFRS and US GAAP into a global set of accounting standards is increasingly being felt in the pharmaceutical industry in the US, the affects in the operations of Johnson and Johnson are particularly crucial. Hence, the report results will provide timely information that will assist stakeholders at Johnson and Johnson to adopt better financial accounting standards. Additionally, it is worth noting that the report is significant in generating necessary guidelines for managing accounting practices and financial reporting.

The findings from the annual reports and sustainability reporting by Johnson and Johnson will be critical in making particularistic conclusions on its efficacy in terms of interaction between consumers and the company’s products as well as the changes in sales of products. From the findings, stakeholders and managers of the company will be in a position to clearly understand the essence of adopting better financial accounting practices for successful business operations.

Scope

The scope of this report is limited to Johnson and Johnson, a pharmaceutical company in the USA, and how it conducts its sustainability and financial reporting. In this respect, the report gathers various findings from its annual reports as well as events that have changed financial reporting environment in the USA.

Limitations

Reports on financial reporting at Johnson and Johnson as well as sustainability reporting environment has not been fully conducted, a consideration that prompts the report to use exclusive, restricted and limited materials at different stages of its development. This becomes a major bias on the information used in the report. Besides, there is a high possibility that the report will replicate past errors that could have been incorporated in previous reports.

It is imperative to highlight that lack of sufficient information can be taken to mean that the findings in this report are on the same platform as others. As such, high possibility of omitting major issues due to the changes occurring in the financial reporting environment in the US can be realized.

Assumptions

There are quite a number of key assumptions that have been made to ensure that the report conforms to specific standards. One such assumption is that there is significant burden that the US companies in the pharmaceutical industry face in raising capital and preparing sets of financial statements for operating in local and foreign nations in line with the GAAP. Experts point out that most of the set standards of financial operations application are supported by similar systems of effecting transactions.

Description of financial reporting environment in the USA

Historical events

Financial reporting (FR) in the US is a process that consolidates all the component entities such as financial statements by a government into a single report. Weldon (2011, p. 20) indicates that component entities in the US government bodies like the United States Postal Services, Pension Guarantee Corporation services, independence agencies such as Securities and Exchange Commission and the treasury department have been providing their financial statements and reports.

Financial reporting initially began with the private sector and was later owned by the treasury department in the US. So far, financial reporting has been conducted for over thirty years. Studies indicate that the initial financial report was done by the Arthur Anderson firm in the fiscal years of 1973-1974 (Smith 2011, p. 6).

The prototype financial reporting was conducted by the financial management service also referred to as the Treasury Bureau of Government Financial Operations under the leadership of William Simon. This trend of producing financial reports has grown and developed over the years with organizations using relatively simple formats and also making their publications annual. Besides, organizations have employed various private and public accounting firms such as the Price Waterhouse and Arthur Anderson to carry out their accounting practices and review their documents as well as sources of data.

As noted earlier, financial reporting in the US has taken various turns that have led to its current position. One such development was experienced in the early 1990’s when the legislature sought to transform its format and content to that which was developed by the board known as the Federal Accounting Standards Advisory Board (FASAB) (Smith 2011, p. 6). The latter was incepted in 1990 and was headed by the Chief Financial Officers (CFOA) to set up accounting standards necessary for the preparation of financial statements. It is imperative to highlight that CFOA was very instrumental in ensuring greater accountability and efficiency in the practice of financial reporting.

Cultural influences

Financial reporting has been greatly affected by issues of business culture as many organizational structures and leaderships fail to fail to choose an important and favourable accounting treatment on GAAP. This practice affects a clear reporting on economic issues of a business. Mary Jo Hatch posits in her model of culture and business dynamics that many managers are driven by their organizational cultures and therefore fail to make proper decisions based on accounting.

They focus more on the economic gains of their businesses. In his overview of the financial accounting theory, Goetz (2010, p. 1044) highlights that even though GAAP earnings often increase with transactions, this may affect a business culturally since it may fail to meet the interests of shareholders. Thus, in terms of reporting, an organization’s culture may impact on financial reporting and lead to bad reporting or misallocation of resources.

Political influences

Political influence on financial reporting in the USA has been a major stumbling block towards the implementation of reporting standards. Reports indicate that political influence erode investor base, elevates market and funding pressures and cuts the dollar area credit. Protiviti (2010, p. 5) indicates that overcoming such influences calls for creating of supportive liquidity and monetary policies and also resolving banks’ balance sheets and asst quality.

Converging IFRS and US GAAP into a global set of accounting standards

Financial reporting has had its foundation based on GAAP which has been a key point of measuring the value of business in a marketplace. Financial accounting theory points out that finding a perfect compromise in financial reporting forms a key principle in establishing successful business operations. Even so, GAAP and IFRS differ and have certain limitations to their implementations. For instance, GAAP imperfectly compromises the information a company offers.

Babin and Nicholson (2011, p. 50) indicate that even though there is need to combine IFRS and GAAP, it is critical to observe that reporting of the Generally Accepted Accounting Principles (GAAP) does not actually give the exact and precise position of a company in terms of performance.

In addition to the two accounting methods, Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFSR) are considered to be very relevant in accounting compared to the previous traditional accounting. Dhaliwal et al (2011, p. 90) indicate that these accounting methods differ in terms of application. There is need for greater harmonization of the two methods especially on changes classification for the IRFS to employ better guidelines for the practices

According to Boerner (2011, p. 35), converging both GAAP and IFSR will enhance financial reporting practices since both methods will be critical in enhancing the ability to recognize two types of incomes in both manufacturers’ and dealers’ statements. GAAP considers the financial income over the business period and the initial profit on sales as a consideration of the price during inception. On the other hand, IFSR uses the equivalent of the profit or loss made from the sale of products which reflect on the agreed discount.

Boerner adds that both methods record profit and loss at the time in accordance to the employed policies. However, critics have noted that GAAP in manufacturing statements only considers the implicit rate while IFSR factors the interest rate or the market rate. Under this consideration, IFSR is more considerate of the actual returns from sale by alternating between the quoted and market rate in order to gain better output.

Johnson and Johnson financial and non-financial reporting

The practice of financial and non-financial reporting among businesses in the pharmaceutical industry in the US has become increasingly popular, a consideration which is attributes to the presence of efficient accounting standards and enhanced stakeholder reporting.

In Johnson and Johnson, financial reporting is a process that has been used by the management to create meaningful innovation to the lives and heath of its consumers and patients. This has generated the company’s potential business value. Geraghty (2010, p. 145) indicates that financial reporting in this company is a crucial practice that involves the exercise of disclosing and measuring accountability by external and internal stakeholders for the sake of high performance and sustainable development.

The following are some of the annual financial and performance reports of Johnson and Johnson Company.

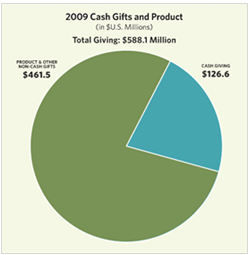

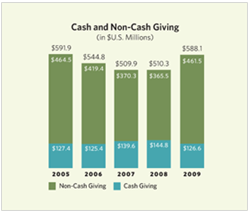

In its reporting, Johnson and Johnson financial reports highlight the area of philanthropy in their giving to the community. About $126.6 million was allocated in 2009 to communities in cash and another $10.7 million in matching gifts program.

The information provided in the annual report 2011

The 2011 annual report by Johnson and Johnson indicates positive growth in overall sales. The report notes that its adjusted earnings have been on constant growth for over 38 years with a 5.6% growth ($65 billion) in worldwide sales (Mayo 2011, p. 158).

The reports also indicate that the company has launched new products and added value to pharmaceutical business segment, a factor that has saw it attain an increase in sales with a margin of 2.8%. Besides, the company’s global market share position based on its products has heightened its sales by 70% with some of its old brands still attracting up to 35% of sales (Mayo 2011, p. 158). Its 2011 financial report attributes this growth to financial discipline which saw its adjusted earnings at $13.9 billion. This represents about 4.4% growth.

It is imperative to note that the company has also made certain huge investments in advanced robust pipelines as well as in research and development (R&D) totalling to $7.5 billion (Mayo 2011, p. 158). Additionally, it points out that it has been able to increase its shareholder dividend, maintain its AAA credit and generate $11.4 billion as free cash flow.

Additional reporting (Sustainability reporting)

Johnson and Johnson Company has also been keen in conducting sustainability reporting. This has been very important in maintaining a customer base that is effective and strong. The Greenwash Index survey indicates that based on sustainability reporting by Johnson and Johnson, consumers of its products have grown alongside enhanced sales.

In addition, Boerner (2011, p. 34) points out that the financial report by the company in 2011 concerning consumer spending indicated that despite economic issues, ethical consumerism has not been halted and the overall market performance is high. The takeaway of the position of the report is that sustainable business practice develops major competitive advantages to a business.

In Johnson and Johnson Company, sustainability reporting is becoming a major practice upon which it provides detailed report on its sales activities, programs, performance and operations. Its sustainability reporting is an exercise which aids it in benchmarking its performances.

How financial reporting environment has influenced company’s reporting practices

Shareholders at Johnson and Johnson have experienced the impact of financial reporting environment in the US. For instance, the current regulatory and legislative environments on their investments have been affected. It is imperative to highlight that the financial reporting environment in the US has developed and made it easier for businesses to publish their reports without much challenges.

As such, financial reporting in this environment provides necessary information to agents and investors thereby reducing adverse selection when they are making decision on the allocation of capital. Johnson and Johnson has set up information intermediary measures and institutional mechanisms to limit cases of manipulation of information within this environment for the sake of investors and stakeholders.

Conclusions

To sum up, it is imperative to reiterate that efficiency in management and accounting process and procedure has become one of the most critical aspects in the management of companies in pharmaceutical industry in the United States. From the above discussion, it is clear that financial reporting under the GAAP and IFSR is a critical process that aids a business in benchmarking its performance.

Of critical importance to note is the effect of the practice at Johnson and Johnson Company whereby financial reporting has been instrumental in its sales and profit performance. However, political and cultural influences may impact negatively on a business’ financial reporting. Therefore, a business entity should set up measures that will ensure that the interests of its investors are safeguarded.

References

Babin, R & Nicholson, B 2011, “How green is my outsourcer? Measuring sustainability in global IT outsourcing”, Strategic Outsourcing: an International Journal, vol. 4 no. 1, pp. 47-66.

Boerner, H 2011, “Sustainability and ESG reporting frameworks: issuers have GAAP and IFRS for reporting financials-what about reporting for intangibles and non-financials?” Corporate Finance Review vol.15 no. 5, pp. 34-37.

Cox, J D 2010, “Reforming the culture of financial reporting: the pcaob and the metrics for accounting measurements.” Washington University Law Quarterly, Vol. 81 no.4, pp. 301-327

Dhaliwal, D. et al. 2011, “Voluntary nonfinancial disclosure and the cost of equity capital: the initiation of corporate social responsibility reporting.” The Accounting Review, vol. 86 no. 1, pp. 59-100.

Geraghty, L 2010, “Sustainability reporting— measure to manage, manage to change, keeping good companies.”vol. 5 no.1, pp. 141-147.

Goetz, KS 2010, “Encouraging sustainable business practices using incentives: a practitioner’s view.” Management Research Review vol. 33 no. 11, pp. 1042-1053.

Mayo, E 2011, “Co-operative performance.” Sustainability Accounting, Management and Policy Journal vol. 2 no. 1, pp. 158-164.

Protiviti, L 2010, IFRS and U.S. GAAP convergence projects update-revenue recognition,.

Smith, PAC 2011, “Elements of organizational sustainability.” The Learning Organization vol. 18 no.1, pp. 5-9.

Weldon, W 2011, Johnson and Johnson 2011 annual report.