Introduction

Implementation of information systems has helped companies in the management of their activities on a functional basis. The management has since considered managing of activities within the context of processes and sub-processes. This calls for the need of companies in improving both individual and entire set of activities for the purposes of obtaining positive results.

Development of processes such as activity-based costing and activity-based management systems enabled easy management of activities within companies. Output comes as a result of activity input within same processes and sub-processes.

The activities are connected in such a way a slight improvement in one activity could result into problems or efficiencies within downstream activities. There are several process-based management models which fall under process value analysis and process re-engineering (Construction Industry Institute, 1997, pp 113).

Various changes are necessary within organizations in various departments such as financial, economic, and regulatory amongst others. This assists the organization in the process of meeting new changes within the business environment. The whole processes require reorganization of organizational structure of the real estate and development company through thorough restructuring.

Changes are required in various fields including asset holdings, financial issues, management of leadership all of which assist in enhancing the firm’s competitive positions. Real estate firm requires integral management since it operates within an environment which is quite often faced by intense competition as well as technological advancements.

The reorganization would involve property acquisitions, disposals, leaseback and sales; this helps in increasing the organization’s profitability since it enhances absolute changes in real estate holdings and reduces systematic risks (Burke, 1999).

Table 1: The following table gives the general framework concerning real estate reorganization and restructuring

‘As is’ model – mapping and discussion

The traditional real estate model has been perceived as operating under passive management despite being considered as comprising of highest cost category. This calls for effective and efficient management of real estate as a business entity since property forms one of the essential and costly factors of production.

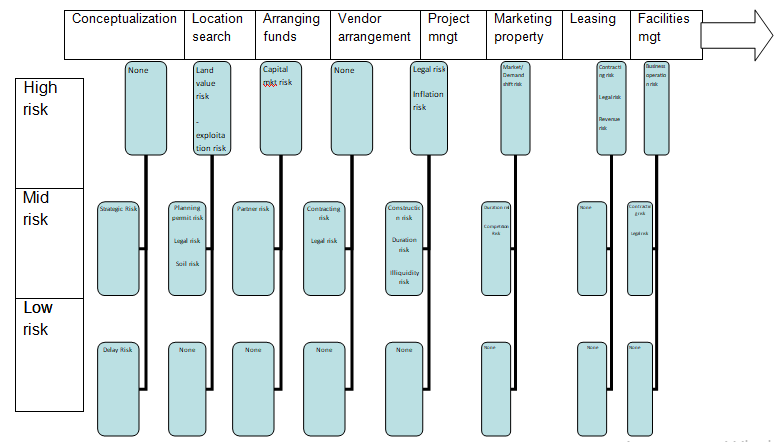

Real estate ownership is at times motivated by the need for firms to indulge in property investments (Chan, et al, 2002, pp 120-128). The following diagram gives detailed processes as well as risks involved within each section.

Figure 1: Property development process and associated risks (Chapman and Ward,1997)

How project management influence other departments and functions of this firm

Operations are considered as core functional activities within any business organization. Management of any business organization involves performing important activities which revolves around various sectors such as marketing, finance and human resource management.

The project system operation processes takes into consideration reengineering channels, while the processes on marketing involves understanding of consumers’ needs and providing them with the right product at the right time for their full satisfaction.

Financial stability is a requirement for smooth running of various operations within the market and management of the working capital. Human resource management on the other hand is concerned with management of work force and addressing of various issues related to employees within the Real estate investment and development firm (Chapman and Ward, 1997)

These functional areas work in close relationship hence enabling easy determination of the outcome results within the real estate firm. Overall planning in this case starts from the marketing function. This is because it helps in estimating real estate level of investment and a mount of sales for subsequent periods of time.

It forms the platform for the level of service required and provides basis for planning procurement processes which drives towards the estimation of required funds. Planning activities involve sequence of events which demand lots of attention. However, the process of implementation requires more of interactions between the workers and the customer.

The employees within the real estate firm places lots of emphasis on the mode of interaction since some percentage of this kind of business is a service oriented. The functions of the department of human resource management have influence on manpower which ultimately affects the level of productivity.

In this business, the level of service provided determines the extent of marketing activities and ultimately the numbers of customers served. This ultimately determines the amount of revenues collected from the overall sales (Jaafari, 2001, pp 89-101)

Project management provides key planning tool for real estate investment and development. The firm has hence experienced considerable growth within the industry and this requires quick remodeling and strategies for the existing branches and departments. All these are achieved through project management techniques which ensure pure maintenance of schedules within the anticipated budget.

Several tools are also applied for advertisement purposes; these tools include mobile marketing, use of special events, audiovisual materials, news and public service activities. These means have the capability of creating strong impact on public awareness at the lowest cost possible.

When utilized correctly PR can be a powerful tool for such an organization dealing with real estate especially in improving and building the brand name of the firm. It is often used to promote the company by wooing investors and improving product publicity (Burke, 1999).

The use of public relations within such advertisement assumes the fact that consumers always go for what they think is best owing to the type of advertisement they are exposed to. This means that most of their decisions on purchase of products are basically based on their perceptions other than reality. They tend to go for a product based on its exposed impressions that they have either experienced or heard from others.

All these factors that add on to the value of the product are portrayed through communication that tends to deliver the true information to consumers. However, advertisement and promotional activities must be handled well as marketing communication tools since they help in creating and building organization’s brand name.

Real estate investment and development has had a systematic approach concerning the way they conduct their operations. They are organized in such a manner that allows easy detection and understanding of issues and problems arising within the business, the specific measures for performances and the use of appropriate analytical methods enable efficient solutions to existing problems.

In the process of expansion, Real estate investment and development firm has tried developing strategy on how to extend their services to every region and market sector making it possible for consumers to access their services through their established joints. The firm is also concerned with creation of job opportunities to many individuals as well as making the business a profitable entity (Burke, 1999).

The department of marketing is concerned not only with the nature of office buildings, apartment rentals and industrial units offered, but also with the quality of products given to customers. The department is also concerned with the means by which their services meet consumer expectations and desires. This advantage has made the real estate firm to stay ahead of others by delivering services and products in a distinguished manner.

The qualities of office buildings, apartment rentals and industrial units offered have measurable and non-measurable standards which are placed into consideration by the management during the preparation period. However, there is need to decide on appropriate costs of products in relation to the quality level.

Most of the decisions made on cost and quality are done before selling off the final buildings or units. At this point the management meets together and draws some workable proposition while keeping the corporate strategy in mind (Jaafari, 2001, pp 89-101).

This process ensures that quality services are provided which could meet the huge demand from the large market share held by real estate globally. The consumer market is never stagnant therefore keeps on changing with time, this calls for high level of preparedness and strategies that can counter the uncertainties that accompanies consumer preferences.

This ensures that services and office buildings, apartment rentals and industrial units offered maintain delivery value at all times. Change in quality and types of apartments offered may sometimes lead to undesirable results.

Where there is a degree of uncertainty in design performance levels, customer preferences, and even in the goals, the design itself have to change immediately to ensure that the services reaches consumers while at the same quality anticipated from every Real estate investment and development branch (Jaafari, 2001, pp 89-101).

There is deficiency in provision of adequate briefing about organizational culture at Real estate investment and development and how it would be affected when the organization goes global. Culture could be referred to as an integration of human societal beliefs and knowledge. Work culture is a great compliment to business operation and performance.

It is believed that good work culture is a critical prerequisite for an improved organizational development. Management of organizations which are in the process of transforming towards global scale is usually faced with tasks such as adoption and integration of inherent work culture on global level for performance driven business.

It is stated clearly that in the ever dynamics of the business world, flexibility in work culture has to be embraced for the purposes of meeting local specifications so that it could not act as a hindrance to company’s performance (Jaafari, 2001, pp 89-101).

The Efficiency of Real estate investment and development

Studies of real estate investment and development focus on benefits and enhanced value within the real estate industry. Research reveals that the economic reasons for real estate firms selling multiple products include appropriate use of fixed capacity resources, demand for customer desired products within a short period of time and product combination strategies.

Early research findings revealed that there was no benefit the firms gained from consolidation or merging with existing real estate companies.

However, there was an argument which sought to prove that spanning both short-term and long-term equity structures in the financial intermediation process and attracting and keeping individual customers and clients from established firms could real estate business beneficial to both clients and the firms.

Other studies of the effect of real estate expansion into non-traditional industries mainly focus on the risk reduction and value enhancement effects. Despite all these, real estate ownership processes has been found to be consistent with the overall reduction of risks.

Bigger firms with corporate ownership have greater cost advantages in sales than individually owned companies because of larger economies of scale gained through members. Pricing within real estate industry, changes significantly depending on the economic stability which ultimately affects material costs (Burke, 1999).

Most early research results about real estate investment and development agreed that firms gained benefits or cost advantages in corporate consolidation, but the findings were not consistent when they looked at individual benefits from the real estate investment and development.

The studies on consolidation revealed no consensus on whether real estate investment and development would be a profitable strategy to individual or corporate firms (Jaafari, 2001, pp 89-101).

The Efficiency of various models implemented

Many firms within the industry employed the traditional Data Envelopment Analysis (DEA) in exploring the efficiency of business activities. DEA could assist in helping companies monitor and control legal service and costs. It could as well be used to examine the activities in relation to acquisitions, efficiency, and economies of scale within the real estate industry over a period of time.

Efficiency levels could be realized and fully recognized within the new market structure reengineering. Efficiency measure within real estate industry help in identifying level of competencies within despite favorable terms offered to consumers.

Within the sub-processes, labor and capital represented some of the input factors while ultimate benefits and costs were output factors which measured the efficiency various real estate development firms.

The inputs used within the model used in designing the processes incorporated such items as labor, business services, assets cost and investment costs incurred. On the output side, important items comprised of such things as return on assets (Construction Industry Institute, 2002).

For the purposes of obtaining valuable managerial insights, efficiency of real estate firms requires evaluation by use of modern techniques. Series of relationships within the processes and sub-processes should be modified and accounted for within the company.

The relational model used in these processes proves to be more reliable in measuring the efficiencies since they assist in the adequate identification of various gaps existing within the system. The inputs used from the initial stages of acquisition include operating expenses involved in the procurement processes. This results into outputs of the system, which includes overall profits as well as investment profits.

According to the system processes intermediate products within the system, form part of the outputs of the first stage as well as the inputs of the subsequent stages. The application of the model allows for the integration of the production and investment efficiency hence providing the management with an overall performance evaluation with various adjustments on the systematic flow on the procurement processes.

The input factors in the model were labor expense, general operating expense and capital equity. The outputs included items such as net profit on investments amongst others (Construction Industry Institute, 2002).

‘Should be’ model – mapping, discussion, and justification

Reinforcement of goals within the real estate company demands implementation of lean process-oriented organizational structure.

This would replace the current functional organization with various steps put in place which include; mapping of key processes and sub-processes, definition of key performance indicators, establishment of performance targets for each indicator, training of managers on Six Sigma and ensuring that unit managers takes full responsibility of ensuring improvement within process segment (Eisner, 2008).

At the same time restructuring of the real estate would promote selling of assets, creation of new business opportunities as well as formidable change in financial structure.

Major changes would be instituted within the strategies and policies concerning asset composition, operations as well as asset and liability patterns. Restructuring of assets would ensure rightful ownership of the firm’s assets, divesting of surplus property, sale of property assets as well as spin-offs. This would require close supervision by the company’s managers to ensure adequate utilization of available resources (Eisner, 2008).

Restructuring leads to creation of financial benefits for firms operating in losses. This calls for diversification of conglomerates which assist in improving the business towards unrelated business lines. The processes help in the creation and facilitation of efficient leadership and decision making skills. Reorganization of the real estate investment and development process revolves around four generic strategies.

These include business portfolio, financial, operational and organizational restructuring. Business portfolio restructuring would entail checking the various strategic business units alongside their value within the entire business. The process would help in removing unprofitable units while maintaining the existing units.

The firm would divest some of the small business units by selling together with everything including land and buildings. This would enable the firm to meet new investment opportunities within the current market. Selling off may also help the real estate firm to correct earlier investment mistakes owing to economic challenges (McNeill, 2009, pp 12-29).

At times the cash flow might reflect insufficient funds which make it difficult for the firm to cover current financial obligations. The situation calls for restructuring of assets and liabilities to enable lasting solutions. The cash flow could be freed through selling of assets, reduction of labor force and capital expenditure on research and development. Financial commitments are rearranged to accommodate frequent cash flows.

This process would ensure that the company remains above liquidation level hence ensuring adequate financial security. It also prevents chances of venturing into property market at the peak of the economy. However, several options could be utilized and these include refinancing, receivership, liquidation and fund raising (McNeill, 2009, pp 12-29).

Restructuring within organization structure, helps in realigning the company’s business strategies. Such moves affects operational and occupation status within the real estate firm, since it results into cost cutting and hence improvement in productivity.

On the other hand restructuring of the operations comes as a result of technological changes, which may result into reduction of overhead costs and integration of facilities. There are also revenue enhancement strategies comprising of good use of excess capacity and utilization of market mix (McNeill, 2009, pp 12-29).

The firm develops ways on strategic alignment processes where the Strategic Path systems establishes long-run vision, objectives and appropriate strategies which ultimately becomes part of the company’s strategic plan. In addition to this, leadership excellence systems within the firm would help in promoting management leadership with a vision.

All the employees require thorough training concerning culture and tools one requires to be successful. Incorporation of processes and systems programs help in promoting continuous upgrade within the ongoing processes and systems enabling attainment of both short-run and long-run goals.

This provides strong base for Strategic Path goals since reliable programs such Work Smart and Six Sigma are applied for the purposes of improving work performances. These mechanisms combined help in identifying existing gaps within actual and planned performance levels (Construction Industry Institute, 1997, pp 113).

The strategic path system have been used to assist in handling the overall strategic plan for the firm while Leadership Excellence feedback systems have been used to address matters related to human resource. Target Smart and Work Smart systems could be applied to assist in matters to do with organizational problems.

Leadership Excellence could be improved through vigorous training on cultural set-ups, technical developments as well as those involving organizational development. Employees are given thorough training for the competencies and necessary leadership skills for future performance.

Trainees are presented with reading assignments besides being given final test on the entire course covered. The firm could use Six Sigma along with process reengineering to assist in bridging gaps between what customers expect and the actual performance on the ground.

Operating at lower sigma levels proves to be cost effective and at the same time operates towards satisfying consumer specifications. Operations done at slightly lower five Sigma levels contribute towards higher defect rates of close to 232 p.p.m. to the satisfaction of customers dealing with real estate investments (Eisner, 2008).

Using this method, quality is defined through the application of both internal and external customers. The firm applies Pareto Charts and project evaluation matrices for the purposes of grading potential projects based on their effects on customers and overall financial performance.

Improvement could be realized within the existing processes when processes are mapped, customer requirements validated to achieve desired quality targets. T

arget Smart could be used to collect funds for capital projects which have vital contributions towards improving overall results. Process engineering necessitated the integration and standardization of policies and procedures for the purposes of obtaining economies of scale (Eisner, 2008).

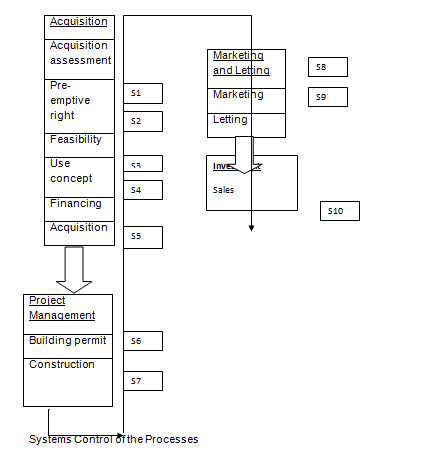

Figure 2: Showing Value creation steps

Measurement models are necessary for the purposes of monitoring performances geared towards attaining system’s objectives. Strategic Path progress is monitored through control system while scoreboards could be used in monitoring management performances.

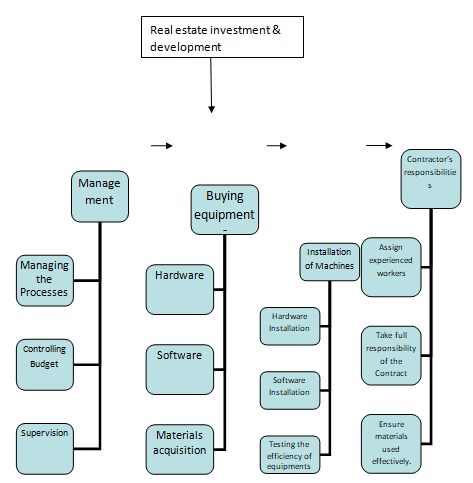

The project system should start with wide consultations on the best contractor to be hired, the finances available, the suitability of each section, sections to be given first priority during construction and equipments required for initial processes.

Decision processes should look into details on various experts within the company who could be entrusted with specific areas. This should be done in accordance to the level of qualifications and expertise areas (Construction Industry Institute, 2002).

The main construction work should be divided into levels starting from the foundation; this is so as to eliminate some element of confusion which at times occurs. This helps managers and the contractors to easily understand the specific order required. In this case the acquisition process should come after the construction work is complete.

This allows the company to attain to its main target of improving on its production capacity before making the offices smart. The process of renovation should be budgeted for based on the company’s income level at present and future projections on profit.

The financial control should be left to Finance and administration instead of the controller, and every financial transaction should as well be recorded and filed appropriately to enable easy access (Construction Industry Institute, 2002).

Success of the Project

Projects success can be realized when each and every activity within the plan is completed within the scheduled time. The understanding of the project contract by the managers is a clear indication that the project could be headed the right direction. Whether the project is going to be successful or not can be identified from the start by looking at the plan produced.

This plan shows the amount of finances required, the duration to be taken by each activity and the kinds of materials required either locally available or not. The management should clearly indicate the protocol to be followed when undertaking any process, who should be involved for purposes of approval and what duration apportioned every individual (Construction Industry Institute, 2002).

The scope sequence is very important and helps in determining how to merge and integrate some specific works that are more interrelated. This can be achieved through grouping together specific tasks that depend on each other plus their elements.

The final construction work should be assessed, tested and approved by quality assurance contractor trusted by the manager. The specialist in-turn reports the quality outcome which is either approved or rejected by the manager. The contractors’ duties and responsibilities together with his team should be well indicated and timed.

Figure 3: Management of various processes

Incorporating public relations within the system, acts as a means of direct contact with the customers through reliable channels such as internet and the media. Successful public relations always have great impact in the creation of awareness and reaching out to potential buyers.

Using the right PR leads to publicity of the firm’s services as well as boosting marketing strategies leading to creation of new sales opportunities. Public relations are mostly focused on the media and this could make it possible for the advertisement to reach specialized journalists and targeted consumers within the right time (Haris, 1998).

The level of interactions implemented enhances the techniques used in marketing real estate services; it can be used to improve the search engine results used within the internet. This increases the level of sales owing to the fact that so many people currently use internet. The integration of the marketing communication within a business is considered advantageous since it serves as a strategic tool within the organization.

The communication process involves use of public relations which serves effectively in relaying the right information about the real estate and associated services offered by the firm. Public relations offer some uniqueness in the marketing field because of its ability to capture interest and attention of the consumers.

The drama it portrays together with the information it carries acts as automatic attraction to the willing buyers (Haris, 1998). This makes public relations to be considered as one of the most important aspects in the integrated marketing.

Other considerations

The current problem at the institution is flexibility in embracing demands of both local and global clients through provision of dedicated central management accounting system. Locally, the organization has thrived due to their strong association with social values, tradition and systems of the immediate environment.

Application of six sigma principles in organizational culture is recommended for (Fontaine, 2007) business which is undergoing transformation process from local to global status. The purpose is provision of training solutions with large avenues of transforming duties in management structure, being largely driven by diverse consumer needs.

It is critical for a transforming company to make decisions based on analysis of site, specific conditions of a market, offering efficient management strategies used in driving profits and revenues towards new levels.

The solution for this is selecting competent management personnel as future leaders, who are capable of integrating systematic new work culture change without causing shocks within business operations through well laid transformational process.

General account at real estate investment and development

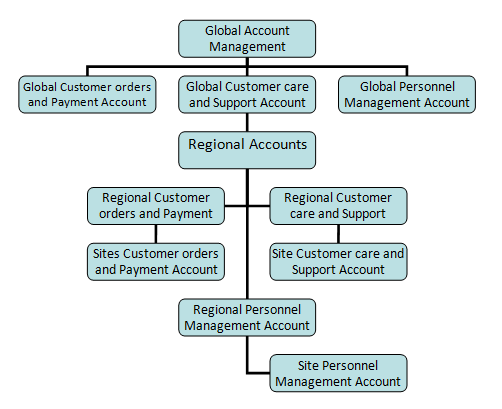

In designating a Global Account Management, real estate investment and development requires a three tier framework. The first tier comprises global accounts (Customer orders and payment, Customer support and care and Personnel management) managed according to categories related to Global markets, so that customers are categorized to achieve economies of scale (Watts and Chapman, 1982).

Second tier comprises regional management of accounts while third tiers have site specific accounts for specific areas of business operations as shown in figure below.

Figure 3: Financial management

Figure 3: Proposed Global Account Management for the Company.

Management

The GAM should be headed by a Chief Executive Officer whose functions are to direct and implement strategies for the business as provided for by the management board. Directly under him/her are the global account managers whose mandates are coordinating and executing management of global accounts to whom regional mangers report to.

At the very end are site managers who are critical in providing tailor made solutions for local customers. In resolution of conflicts, personnel managers at each tier will be mandated to execute settlement of conflicts specific to each area of operation (McNeill, 2009, pp 12-29).

Focus of GAM

GAM should be rolled out limited to specific customers, covering more of them over time. This provides time for management to be tandem with the use of the system gradually and also to cultivate new work culture among the employees avoiding the unnecessary burden of shock in work culture. Lastly this process will allow feeding of relevant data at specific tier of GAM management (McNeill, 2009, pp 12-29).

Conclusion and recommendations

Various challenges are encountered in the process of implementing PERT and CRM some of which include thorough aspects of planning projects. There is difficulty in making sure that all functional areas are active and aims at attaining realistic goals that proves commitment in performance. Another challenge is how to control manpower required for accomplishing some projects.

There is conflict in time when it comes to the leadership required for a given project deadline. Strong positive leadership is required to lead the people towards achieving specific goals and keep away any destructive elements. There is also the challenge of controlling the basic technical definition of the project which ensures management that is cost-effective.

There is a big challenge in the process of monitoring performance based on costs and efficiency of all elements of the initiated projects. The same challenge also lies in practicing judgment and leadership on determination of root cause of problems and their specific solutions. The completion of any project should happen within the confines of scheduled time and at the required costs (Hill, 2000).

Real estate investment and development issues on acquisition processes are many and challenging to the very existence of its many branches. The issues are generated not only from managing the wide variety of products but continually striving for error in generating highest customer satisfaction. The watchword of quality office buildings, apartment rentals and industrial units’ acquisition is innovation.

There is stiff competition within the market place that unless Real estate investment and development caters for, it cannot sustain itself within the market. The firm should keep innovation through management team, it should consider the fact that every customer’s need is catered for and new initiatives are optimized to meet the needs of the ever changing consumer desires.

This is critical to the success of any project systems development. An ideal marketing mix should be approached by the organization so that project systems and processes methods are optimized. This would help in sustaining the advantage of product development issues since the products offered by Real estate investment and development are considered of quality (Hill, 2000).

Managerial Implications

A number of managerial implications should be put in place for the purposes of the firm’s sales on real estate investment. The firm at the same time should consider merging with other potential partners within the same field so as to enhance service provision. The current firms which perform better in traditional selling channels may not perform similarly in real estate investment and development acquisition and procurement processes.

Performance of real estate firms on investment and development has nothing to do with the firm’s own sales team but it is related to the market and economic situation.

Therefore, to perform better in real estate investment and development channels, choosing appropriate partner becomes the most important factor within the industry. The only product that real estate investment and development representatives prefer to sell is investment-linked insurance.

Reference List

Burke, R., 1999. Project management: planning and control techniques. 3rd edition. Chichester. John Wiley & Sons ltd. London.

Chan, A.P.C., Scott D., & Lam, E.W.M., 2002. Framework of Success Criteria for Design/Build Projects. Journal of Management in Engineering, 18 (3), pp. 120–128.

Chapman, C. & Ward, S., 1997. Project Risk Management-Processes, Techniques and insights. UK: John Wiley & Sons Ltd

Construction Industry Institute, 1997. Alignment during Pre-Project Planning – A Key to Project Success. Implementation Resource (3), pp 113

Construction Industry Institute, 2002. Best Practices Guide for improving Project Performance. Implementation Resource, (3).

Construction Industry Institute, 2002. Constructability Implementation Guide. Bureau of Engineering Research. Austin: The University of Texas. Publication , 2 (34)

Eisner, H., 2008. Essentials of Project and Systems Engineering Management. England: John Wiley and Sons

Fontain, C., 2007. Six Sigma’s Contribution to Organizational Culture. Berlin: Northeastern University, Print.

Harris, T.L., 1998. Value-added public relations. The secret weapon of integrated Marketing. Lincolnwood: NTC Business Books.

Hill, T., 2000. Operations management: strategic context and managerial analysis. London. Macmillan Press LTD

Jaafari, A., 2001. Management of risks, uncertainties and opportunities on projects: Time for a fundamental shift. International Journal of Project Management, (19), pp. 89-101

McNeill, R. G., 2009. The Go-To-Market Frontier: Global Account Management (GAM). Journal of Global Business and Technology (1), pp 12-29

Watts, J. M., & Chapman, R.,1982. Engineering Economics. Washington DC: National Institute of Standards and Technology