The discovery of gold deposits in Victoria Australia changed the country’s economy fundamentally. Edward Hargraves is claimed to have discovered small amounts of gold in a water hole in Bathurst. As a result, there have been numerous developments socially, economically and environmentally. This discovery led to an influx of immigrants into Australia (Government of Australia Para 1, 6, 13).

However, the most significant developed is on the economy. Numerous mining companies being formed by entrepreneurs who sought to exploit Australia gold reserves. One of the biggest mining companies in the Australia as well as in world is Newcrest Mining Limited (NCM).

NCM is an explorer, miner and exporter of gold and copper. Its activities are centrally located in Australia but with branches in Indonesia, Papua New Guinea and Fiji. In 1919, the company changed its name from Newmont Australia Ltd.

The company business model involves controlling regions with the biggest potential in gold deposits such as Cadia and Telfer as well as joint ventures and outsourcing with local and international firms interested in exploration, mining and export of minerals (Invest Smart Para 1-4; Newcrest(a) Para 9).

The company’s fortune took an upward trend, mostly because of the appointment of Mr. Ian Smith as the new CEO in 2006, which resulted in the company achieving positive results for first time since 2001. It is planed that by 2014, the company will, increase its gold pdrodcutin significantly to 2.3 million ounces (Fat Prophets para 7, 9).

By the end of the year 2009, the company controlled about 17 business entities in mining supplies, exploration and exporting. As such the company has a very healthy business profile which yielded A$248.1 million after tax profits for the year 2009 (Newcrest (a) Para 14). This report thus endeavors to give a comprehensive analysis of the company especially in regard to its financial performance and the effects at the local and international level.

The financial performance as well as the business model of NCM was affected largely by the global financial crisis, which started in 2007, and the effects are being felt currently in some quarters.

The crisis has been attributed to several factors such as the collapse of the mortgage industry in the USA, while some technocrats have credited the banks in US for involuntarily triggering the crisis by offloading their bad loans as securities (Shah para 17). the crisis was so catastrophic that even the most developed countries has to commit colossal amounts of money to save their financial sectors (para 1).

The mining industry was nom exception and the effects were severe. This is because the industry depends a lot on the fluidity of major world currencies. When the exchange rates are affected, the supply of minerals across the globe is also affected. Prices and demand of minerals therefore plummets.

The situation is worsened by the rising of production cost occasioned by the rising cost of energy. As such, an industry that depends largely on the forex trade cannot go unharmed by a crisis that touches on the world financial market.

Newcrest Mining Limited as one of the leading gold miners and exporter in Australia was not spared the effects of the global financial crisis. Its manager Ian Smith reports that the year 2009 was so tough because of the aforementioned crisis. The company has had to adjust its human resource management principles to shield itself from further losses.

It reduced the number of its employees by 3% because of the unpredictable future occasioned by the crisis. Thus the company took several initiative to ensure the retention of the best employees in the industry.

These initiatives included organizing and being a major participant in mining fairs, graduate internship/apprenticeship programs and the establishment of an up to date website with information about careers in Newcrest (Newcrest(c) Para 19 ).

To retain the best employees and avoid the cost of hiring new ones the company engaged a new scheme that involved financial incentives for its most talented employees (Para 20).

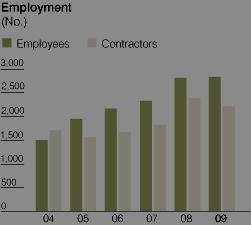

The company also embarked on a program aimed at training and hiring the locals, mostly from the aboriginal community to meet its human resource needs at minimum cost. The figure below indicates the human resource trends for up to 2009 and that the numbers slightly reduced that year.

Source: Newcrest c), 2011

Other than tightening employee hiring and retention strategies, Newcrest also shelved efforts to mine and sell gold from one of the most lucrative sites in the world. The site at O’Callaghans is estimated to be the world most valuable tungsten mining area and has a market value of about 4 billion US dollars (Chambers para 1).

Newcrest rested the efforts to exploit this site during the global financial crisis and cushion itself from any losses that would have occurred had it exploited the site. Now that the crisis seems to have abated and effects contained significantly, the company is reconsidering utilizing this valuable site through a number of ways. There are thoughts to just sell it with interested bidders coming from China, Japan and Europe.

Other possible alternatives include joint venture with interested partners or just mine and sell the tungsten itself (para 13). To improve its cash flow the company decide to “Eliminate its gold hedge positions which resulted in greater financial gains” (Newcrest (d) 6 ). The result was a significant improvement in the prices of copper.

As mentioned earlier, the mineral trade largely depends on foreign exchange rates. Foreign exchange rates are so unpredictable and the slightest occurrence in the international arena can trigger massive differences amongst the world major currencies. If this industry is affected, then the effects are directly transferred to the mining industry.

As a result, this company has undertaken several measures to minimize the risk of any fluctuation in foreign exchange rates. Newcrest activities are spread in different countries such Chile the US, Indonesian and Australia. Under normal circumstances business would be conducted in local currencies. However the unpredictable nature of foreign exchange would result in increased cost of doing business.

There would also be massive losses associated with the risk of fluctuation in foreign exchange. There is a lot of movement of its minerals and mineral products between these countries and as such fluctuations in the exchange rate will hurt it business so much. To minimize the risk, Newcrest avoids as much as possible the amounts of balances in cash held by its subsidiaries in these countries.

However there is need to keep operations of these foreign subsidiaries moving, while minimizing the losses that may result from the said fluctuations. Thus, to facilitate operations in foreign countries, the company only transfers enough in foreign currencies to facilitate business (Exeter Resource Corp 7). Furthermore, the company has taken to secure its financial assets and liabilities from losses accrued from forex interest rates.

As such, all its financial assets are only exposed to minimum foreign exchange risk, as they are short term investments that have a very short period to maturity (8). This translates to disposal of such assets before any major shift in forex rates occurs. The company has also has a established a policy that allows its foreign subsidiaries to have an agreed and fixed forex rate.

This means that they can to conduct foreign trade with consistent and constant exchange rate and thus evade any losses that may occur out of any unpredicted fluctuation (9). The company operates many branches in many countries and as such operational and administrative cost may sore up if no sufficient effort is implemented to counter this.

To cushion the company from any inflated administrative fees occasioned by an uncertain forex trade the company calculates this expenditure by excluding foreign exchange interests (6). This means that administrative costs are kept at a minimum and do not fluctuate with the volatile forex rates thus saving the company a lot of money.

Financial position

A thorough analysis of the company’s statements of account reveals a very impressive performance during the post global crisis era.

The company’s future outlook has been secured as a result of the effective policies implemented to manage the global economic crisis. some of these policies include mergers with credible miners such as Lihir Gold limited, Bonikro and Mt Rawdon, which in effect increased the companies production and the thus the profits also increased significantly.

As a result the company’s account for the six months ended December 31 2011, show a very healthy financial base which guarantees a brighter future for the company and its shareholders.

The increase in profits in the said period is not only attributed to the increase in mining and processing of minerals from existing mines but also the consolidation of all financial and physical assets through mergers. This increased gold production by a massive 70%. The company increased its financial commitment inform of increased investment especially in its fixed assets.

For that six months duration the company increased its investment in developing its mines by more than 90% (up to A$802.2), while expenditure on its exploration of minerals went up to A$61.8. This increased investment has realized a total assets worth of A$16 billion, up from A$ billion six months prior (Newcrest (d) 3). As a result, the profits portfolio for Newcrest Mining Limited is as follows.

It profits from the Underlying asset portfolio increased by 96% to 523.1 million Australian dollars. After the company deducted its total expenses and losses in such areas as forex trade and increase in energy costs, it realized a Statutory Profit increaments of aboput 148%, amounting to A$437.8 million for the corresponding period.

After deducting all operational expenses, the company realized a 92% increase in compared to the same period in the previous financial year. This increase is equivalent to 922.1 million Australian dollars. The significant gain in profits can be attributed to the increase in supply and sale of gold during this period by an impressive 86% realizing 1,641.6 million Australian dollars.

In the previous year the increase in gold sales revenue was recorded at 58%. For the six months leading up to 31 Dec 2011, the prices of gold went up 16%. However, volumes of sales in copper experience a decrease but still reflected a 19% improvement from the previous year.

All these put into consideration, the company realized an incredible before tax profit margin of 80%, (equivalent to 768.1 Australian million dollars). The impressive results can be considerably attributed to gains made by reducing significantly losses from foreign exchange, which secured the company’s international trade.

After all taxes were deducted, the company realized the most impressive growth in recent years: a 140 % increase profit (equivalent to 142.1 Australian million dollars). The company has thus found it worthy to reward its shareholders with a dividend of 10 cents for every share held (2).

The company financial ratios also show a very good performance, where its assets realized a profitable returns for the said period. There was an impressive return on assets at 9.32% compared to 4.99 the previous year. The return on invested capital rose almost double to 12.00 %.

This means that the company investments was paying handsome dividends as it was realizing better returns from each of the assets and thus the increased profits (Morning Star n.pgn.).

The table below is a summary of the company’s financial ratio for the six month ending December 31, 2010

Source: Morning Star.

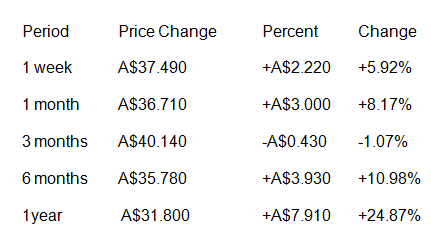

The companies share is one of the most lucrative in the Australian stock exchange. It has experienced a significant growth in value for the lastt one year. Shareholders have seen their fortunes in Newcrest stock go up by 24%. The trend has been on an up ward growth in the last one year, averaging 2% increase in share value per month.

This is despite depreciation in value by a marginal 1% in a three-month analysis of its performance in the stock exchange. Currently the share is selling at an average price of 38 Australian dollars. This has been influenced by a number of factors such as a 5 point improvement on the value o asset returns, increase in mine investment activities and profitable mergers that in effect increase Newcrest Supplies and sales in Gold.

The effect is also seen in the impressive increase in total asset worth. Importantly Newcrest has acquired a valuable assets in O’Callaghans mines a significant tungsten resource that will increase the companies resource significantly in the very future.

These factors combined with its meticulous and ingenious way of reducing to a bare minimum not only the risk associated with foreign exchange but also its international operations costs results to a very healthy and solid outlook. As such, the price in its share is expected to remain stable and continue its impressive performance in the Australian stock exchange.

Shareholders should thus hold on to their shares to benefit from the 10 cents per share dividends, which will be paid mid 2011, and the future benefits that will results from its expected growth. The table below shows the performance of Newcrest shares in Australia stock exchange.

Source: Digital Look

Newcrest Mining Limited is a company with a very promising future. This is facilitated by the commendable effort of its management lead by Mr. Ian Smith in solidifying the current gains while expanding opportunities for future benefit.

It has some of the best recruitment and employee retention practices in the world that aims to appraise its employee’s thorough continuous training as well as tapping the most talented workers through apprenticeship. The company has acquired the best gold and copper mines in Australia as well ass expanded its exploration activities.

The investment in exploration has also yielded the O’Callaghans mines, which will make Newcrest the largest exporter of the mineral, sought for its use manufacturing drilling equipment. Newcrest also has a very healthy business profile that includes at least 27 subsidiaries and it continues to expand by seeking mergers with credible companies such as Lihir Gold.

This leads to an increase in production of mineral and thus improves its financial outlook. Significantly, the company has had an ingenious way of evading losses especially from forex rate fluctuations. As such, it employs a standard rate for all its subsidiaries while, excluding interest when factoring administrative charges.

The Newcrest shareholder is currently happy with the performance of the company under the leadership of Mr. Ian Smith. However, the only dark spot in its otherwise bright future is his resignation.

This leaves a doubt as to how the new CEO will consolidate gains made during Mr. Ian’s tenure while moving the company forward. However, the fears should be rested as the company is on solid ground and the minerals market is looking good at the present

Works Cited

Chambers, Matt. “Newcrest Talks up Tungsten Resources in WA.”Top Stocks. 2009. Web.

Digital Look. “Newcrest Mining Limited: Share Price.” Digital look. 2011. Web.

Exeter Resource Corp. “Managements Discussion And Analysis.” Docstoc. 2011. Web.

Managements-Discussion-And-Analysis—EXETER-RESOURCE-CORP— 11-17-2010.

Fat Prophets. “Newcrest Mining.” Fat Prophets. 2010. Web.

Government of Australia. “The Australian Gold Rush.” Ciulcture.gov.au. 2010.

Invest Smart Para 1-4. Newcrest Mining Limited (NCM) 2011. Web.

Morning Star. “Newcrest Mining Limited.” Morning Star. 2011. Web.

Newcrest (a). “Organisational Profile.” Newcrest, 2011. Web.

Newcest (b). “Chairman’s Address – 2010 AGM.” Newcrest, 2011. Web.

Newcrest(c). “Labor Practices and Decent Work.” Newcrest, 2011. Web.

Newcrest (d). Financial Results. Newcrest Mining Limited, 2011. Web.

Shah, Anup. “Global Financial Crisis.” Global issues, 2010. Web.