Executive Summary

Exploring oil and gas requires an investment of capital and other resources. It is noted that production is a profitable venture. However, it is labor and capital-intensive. Seismic technology is one of the components involved in this exploration. Consequently, companies operating in this sector need to acquire this technology. Consequently, several specialized suppliers have emerged to serve this demand. The supply of seismic technology is determined by several factors. They include the nature of the exploration and the environment within which the activity is taking place.

Introduction

Seismic acquisition supply is a critical component of exploring oil and gas. According to Booth (2010) the procurement category is vital in the generation of energy people need to power their homes and business. ADCO utilizes seismic surveys for various purposes. One of them is to generate configurations of underground rocks. The corporation utilizes the information garnered to determine the location and size of oil and gas reservoirs.

Onshore undertakings involve seismic cues. The signals are produced using dedicated trucks. The machines are fitted with heavy plates. When the procedure is organized as required, it can be done in sensitive locations without causing destruction to the environment and buildings. However, the process needs powerful computers, specialized skills, and sophisticated software.

The market of Seismic Acquisition Survey in Onshore Operations

As a procurement category, the seismic survey is an open market. It is characterized by free competition. Anyone can take part in the business. There are no rigid barriers to entry. However, participation is influenced by sufficient money, income, and assets.

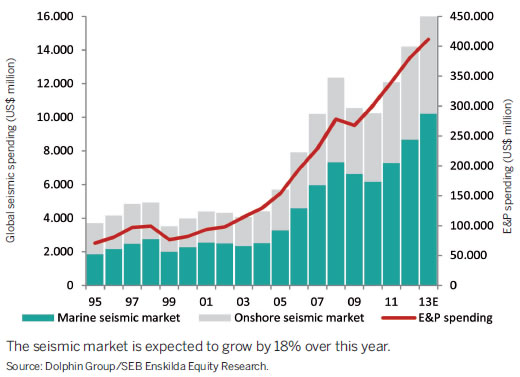

Over the years, the market of seismic acquisition surveys has experienced continuous growth. In 2012, for example, the total spending grew by 19%. In 2013, the rate registered an increase of 18%. However, two-thirds of the growth is influenced by Marine seismic operations. In terms of suppliers, the business is competitive with a wide range of companies. The total revenue generated annually by the businesses ranges between $15 and $17 billion. A majority of these companies offer 2D, 3D, and 4D surveys.

The major players in the global seismic survey include SeaBird Exploration Group, Kuwait Oil Company, Terraseis, Polaris Seismic International, and Dolphin Group ASA. Others are Petroleum Geo-Services MMA Offshore Limited, and TerraSond. The figure below is a representation of seismic market growth.

Geokinetics is a major player in the oil and gas industry. The entity provides its stakeholders with data related to seismic activities. The company has over 25 years of experience in the business operating in tough markets with challenging environments.

To maintain the top spot, Geokinetics has adopted advanced technology and approaches tailored for varying situations. A major player in the competitive field is Petroleum Geo-Services. Similar to Geokinetics, (PGS) majors in data acquisition, processing, reservoir analysis, and interpretation. Currently, the company has 9 onshore crews on 4 continents. In addition, it has 23 data processing centers.

Demand and Supply Factors that Impact on Seismic Acquisition Survey

Supply and demand is the model employed to determine product prices in the market. The relationship between the two entities is considered to be the driving force in free markets. When the demand for a service or commodity rises, the price also increases. In instances where the supplies are in excess, the prices tend to drop.

In seismic acquisition survey market, various supply and demand factors impact the competitive sector. According to a National Petroleum Council (NPC) report, the energy demand will increase by 50 to 60% by 2030. The reason behind this is that oil and gas will continue to be the major source of energy for all people across the globe. To meet the rising demand, oil companies will need to increase their supply. To meet their goal, the corporations will require the services of seismic acquisition survey firms.

Other factors that affect seismic acquisition surveys are technological breakthroughs in alternative sources such as solar and nuclear power, and biofuels. The new developments have a huge impact on the demand and supply of energy from hydrocarbons. Another feature that impacts supply and demand seismic acquisition is the production costs. The element entails the cost a company incurs to produce goods. The expenditure is calculated using several components. They include raw materials and wages.

Cowell (2006) notes that access to resources also affects demand and supply. In certain areas such as North America, most oil companies are restricted from accessing known oil and gas deposits. The major reason cited for this restraint is environmental concerns. In addition, inhabitants residing near areas with promising deposits claim to be affected by the site of drilling procedures. Due to such constraints, NPC calls for surveying companies to create environment-friendly technology for both onshore and offshore operations.

In the survey process, some companies use diesel as the only source of energy. The cost of diesel at the time tends to impact supply and demand. In different onshore operations in areas far from cities or people’s areas of residence, oil-powered generators are used to provide the electricity needed for equipment.

Pricing Mechanism and Factors that Affect Costs of Seismic Surveys

Seismic surveys have become the primary tool for exploration in both onshore and offshore operations. Currently, there are two major forms of survey used. The development of 3D has revolutionized the oil and gas industry. The reason is that advanced survey procedures facilitate the exploration of reservoirs that are not easily located. Before the invention of the 3D, seismic surveys were carried out along a single line. The information garnered was then analyzed in 2-dimensional forms.

3-dimensional surveys can be carried out in different environments. The average charge for such an undertaking range. The lowest figure is maybe $40,000. However, it can be as high as $100,000. The cost is calculated per square mile. The data gathered from the exploration process is often in raw form. Before being used, it has to be processed. The procedure involves the use of advanced technology. The cost is determined by the volume of garnered data. A comparison of two the technological surveys reveals 3D seismic procure costs as much as six times more than 2D.

The pricing of seismic practice is influenced by a number of factors. They include, among others, the availability of equipment, as well as the size and shape of the survey to be conducted. A number of features related to shape and size are used to determine cost. They entail the type of play, offset or depth, and percentage of the fold in question. Other factors include line spacing and bin size. Play types are categorized into six divisions. They include high res, shallow, and paleo U/C. The remaining three are D-3, deep, and foothills. It is noted that ‘high res’ entails use of 4 dimensions technology. If focuses on shallow reclamation activities to detect steams.

Geological risks act as another major influence of pricing in seismic surveys. According to Waisman et al (2014) most of the easy to get oil and gas reservoirs have been tapped. The few remaining are in the process of being extracted. Due to this, oil companies have opted to take their drilling practices to less friendly environs.

In such areas is extraction tends to be a difficult process. In addition, corporations are faced with the risk of getting less deposit than estimated. To reach the oil and gas deposits in less friendly areas, more sophisticated equipment is needed. Due to this, the process turns out to be more expensive and time-consuming. The equipment needs to be acquired in advance. In addition, a lot of preparations are needed.

The pricing of seismic surveys is influenced by the cost of labor and energy. The cost of oil and gas tends to rise and decrease based on various factors. The triggers include elasticity of demand, Geopolitical flashpoints, and American shale. An increase in oil prices results in hiking in the costs of conducting surveys. The reason behind this is that oil is the primary source of energy used in running machines in the procedure.

Conclusion

Oil and gas have been a major source of energy for the entire world. Due to its importance and widespread use, numerous onshore and offshore geological and geophysical surveys have been conducted for decades. The primary aim of the processes is to identify properties with the potential to generate commercial quantities of oil and natural gas. In addition, the surveys facilitate the identification of suitable locations for drilling wells. Despite the discovery of new forms of energy such as solar power, the worldwide demand for oil and gas continues to increase.

Research by various organizations and experts reveals that demand is influenced by two key factors. They include the increase in the world’s population and peoples’ desire to improve the living standards. To meet the high demand, oil companies will need to use more technologically advanced and environment-friendly procedures to extract oil and gas. In addition, the total number of wells put in place each year will have to be increased.

References

Bacon, M & R Simm, 3-D seismic interpretation, Cambridge, U.K, Cambridge UP, 2003.

Booth, C, Strategic procurement organising suppliers and supply chains for competitive advantage, London, Kogan Page, 2010.

Cowell, FA, microeconomics: principles and analysis, Oxford, Oxford UP, 2006.

Graaff, N, ‘Oil elite networks in a transforming global oil market’, International Journal of Comparative Sociology, 53, no. 4, 2012.

Handfield, RB, M Primo & M Paulo, ‘The role of effective relationship management in successful large oil and gas projects: insights from procurement executives’, Journal of Strategic Contracting and Negotiation, vol. 1, no. 1, 2015, pp. 15-41.

Hilyard, J, The oil & gas industry a nontechnical guide, Tulsa, Okla, PennWell, 2012.

Inkpen, AC & MH Moffett, The global oil and gas industry, Glendale, AZ, Thunderbird School of Global Management, 2013.

Lieberman, M & RE Hall, Principles and applications of economics, 6th edn, Mason, Ohio, South-Western Cengage Learning, 2012.

Rouzaut, N & J Favennec, Oil and gas exploration and production reserves, costs, contracts, 3rd edn, Paris, France, Editions Technip, 2011.

Waisman, HD, C Cassen, HD Meriem & JC Hourcade, ‘Sustainability, globalisation, and the energy sector Europe in a global perspective’, The Journal of Environment & Development, vol. 23, no. 1, 2014, pp. 101-132.