Key Trends and Consumers

- Technology supports online streaming; during the next 10 to 20 years, the industry will migrate to internet television instead of traditional or cable television. In addition, the U.S. and other developed nations are maturing, whereas international emerging markets are just getting started.

- Consumers want customization

- The gap between the wealthy and the poor in the United States is growing.

- The U.S. economy is recovering slowly.

- Cascade to +65 Yrs. as U.S. baby boomers retire to give them time to become more tech-savvy

My analysis is that more millennials are using the service than baby boomers. Take away is trends are net overall supportive, but U.S. growth is slow while Int’l market is in the early growth stage (Alexis). The business should work with suitable famous people to appeal to the affluent, expanding middle class, and generational sectors.

Strategy Options

- Brand Positioning & Product – Keep innovating & boost original content to improve brand difference with consumers & invest in enabling customer personalization.

- Pricing: Opportunism in pricing to retain top market share, skimming must aid BMH&F while maintaining the best CVP compared to Amazon and Hulu.

- Target & Promotion – Increase to Baby Boomers & +65 years since this customer segment is under-represented.

- Decisions Regarding Distribution & BVC – Continue Direct to End User and Shift to Lower Risk & Cost Value chain for content production

- Maximizing spending on current digital and offline marketing to support BMH&F and retain top market share.

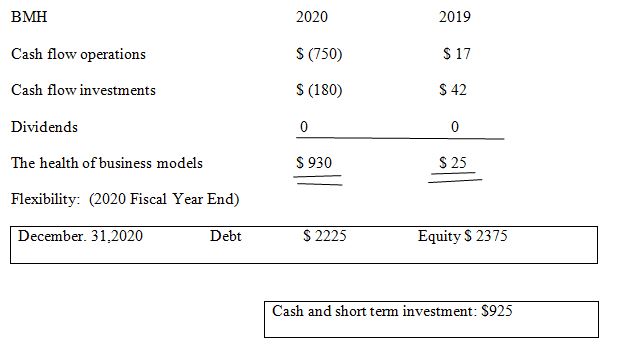

Business Models Health and Flexibility

Based on my analysis the BHM is positive and growing with 2019 at $25 and 2020 at $930. Equity being greater than debt, cash and short-term investment at $ 925.

Therefore, my takeaway is that Netflix has a strong BMH&F to drive strategies and growth.

The firm is recommended to maximize its presence online and offline marketing expenditures to preserve its dominant market position and support BMH&F.

SWOT Analysis

The analysis is that Netflix is the fastest growing since it is more focused. The takeaway is Netflix has a substantial competitive advantage from a positive network effect with Top Market Share, but this is likely a race of sprinters. As Amazon is rising, heritage content providers feel threatened, and new entrants from local emerging countries will probably enter. Therefore, the recommendation is that the firm should use opportunistic price skimming to help BMH&F.

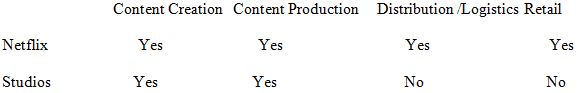

Basic Value Chain

Based on my analysis Netflix controls 100% of the primary value chain compared to the studio. The studio holds only 50% of the creation, production, and retail (The Walt Disney Company, 2019). Therefore, my takeaway is that Netflix’s rise is threatening traditional content providers. They should continue increasing and pioneering original content to raise brand differentiation and invest in growing customer personalization.

Market Strategy Options

Long term prize “… a12X increase to 90B Revenues”

Works Cited

Alexis, Marcus. “Marketing Laws and Marketing Strategy.” Journal of Marketing, vol. 26, no. 4, 2020, p. 67.

Cadogan, John W. Marketing Strategy. 4, Marketing Mix Strategies – Distribution Strategy and Pricing Strategy. Los Angeles, Sage, 2019.

Thewaltdisneycompany.com, Web.