Balfour Beatty is an engineering, construction, services, and investment group (Anon., 2009). They are a leading construction company that has made and maintained major roads, airports, hospitals, etc. in the UK, US, Dubai, and Asia. Their customers are government and private customers. Their business is spread into railways where they provide high-speed electrification and power supply systems, track systems, track components, signaling, and plant for network owners. They presently provide finance for projects in the UK, which they intend to expand to other markets. Their core business can be segregated into the following:

- “UK regional contracting;

- Professional and technical services;

- Extension of our investment business into new markets;

- Establishing strong domestic businesses in selected overseas markets based on our UK model.” (Anon., 2009)

The categories where they provide their expertise are in construction and finance of airports, commercial property and interiors, rail, defense, refurbishment, education, roads, roads, health, social housing, heritage and culture, other infrastructure, leisure, water, gas, and oil, and power.

Given this brief background of the company, we can further our discussion into the Indian market where the company is to enter. This paper discusses the macro and micro conditions of India which will facilitate and cause hindrance in the company’s expansion plans. So we will discuss the macro environment of the country, especially pertaining to the property market in India and the target market of the company.

Macro Analysis

For an external environment analysis, we will first conduct a political and economic analysis to ascertain the macro condition of the Indian economy.

Political: India is one of the largest democracies of the world, with a population of 1,182,160,000 (Euromonitor, 2009). India is a federation of 28 states and seven union territories, encompassing a large number of ethnic groups. The social change in India is widespread with the country moving towards an age of consumerism. The religions predominant in the country are Hindu, Muslims, Sikhs, Christians, and others according to the 2001 census (CIA, 2008). The head of the state is the President who is the titular head according to the Indian constitution. The Prime Minister along with his cabinet takes all legislative decisions. Presently it is a coalition government headed by Doctor Manmohan Singh. On the international front, India has bitter-sweet relation with Pakistan has led to terrorist activities in the country. But overall the situation is stable in the country politically even the relationship with Pakistan is expected to remain under stress, but there are few chances of an armed conflict (The Economist, 2009).

Economic: The liberal economic reforms in the country in the past decades have made the economy growing. The GDP growth rate of the country has been 5.3 percent in 2008 which is expected to increase by an average of 6.7 percent till 2013 (The Economist, 2009). The FDI inflow has more than doubled in the economy between 2004 and 2007. But the government policy prevents foreign investment in the retail and financial services industry (Euromonitor, 2009). The currency is expected to become stable in the future. Inflation too is expected to decline through 2013 (The Economist, 2009) which has increased from 4.25 percent in 2005 to 6.75 percent in 2009 (Euromonitor, 2009). Thus, it is evident that India is experiencing a strong economic expansion.

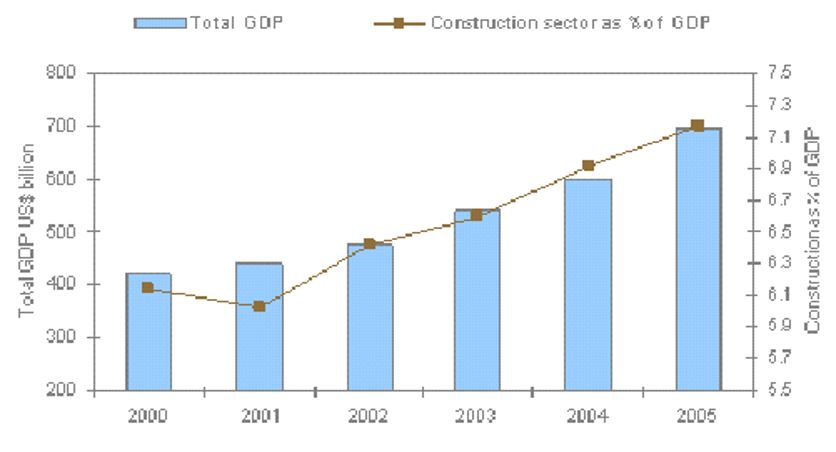

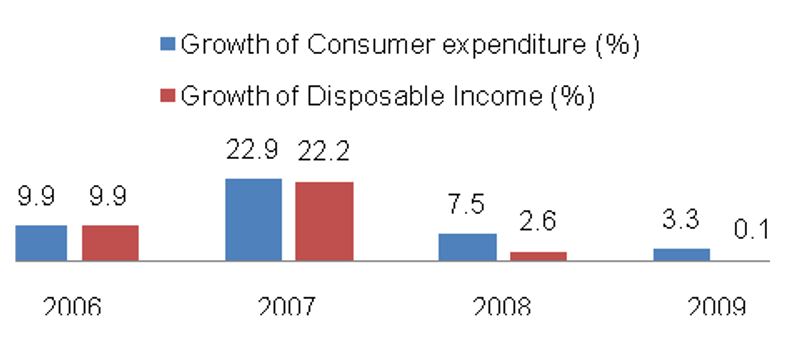

In terms of the property industry in the country is concerned, there is expected to be growth in the industry in the country. The construction sector’s growth compared to the GDP has been growing since 2001 (Euromonitor, 2007). The residential real estate prices had increased in the major metros of the country and property prices have gone up 50 percent in 2006 (Euromonitor, 2007). The country dwells in a plethora of diversity of languages and cultures. Consumer expenditure has increased stably but the rate of growth has declined over the years (see figure 2). Further, there has been an increase of households in India from 148 million in 1990 to 210 million in 2006 (Euromonitor, 2007) which increases the property market in the country.

The construction sector has grown by 20 percent and 14percent per annum in 2006 and 2007 respectively (MarketResearch.com, 2009). Further according to the Business Standard report, the interest rates in project finance have increased from 9-11 percent in 2006 to 14-16 percent in 2007 (MarketResearch.com, 2009). This shows that the Indian property market is expected to grow in the near future even with the fear of recession.

Target Market

The market for the property industry in India is growing (Euromonitor, 2007; MarketResearch.com, 2009). The potential target customers of Balfour Beatty in India can be segregated into three sectors: Government, Commercial, and Corporate, and residential.

The Indian Government is heavily spending on infrastructure building for which it is expected to spend US$ 2 billion to make highways which is just the first phase of the multi-billion dollar project called ‘Golden Quadrilateral’ program (MarketResearch.com, 2009). The Indian government has also taken a loan of US$ 3 billion in 2008 for infrastructural spending (MarketResearch.com, 2009).

As far as spending in the residential realty market is concerned, it is already in a boom phase. The government also plans to provide subsidized rates, the ceiling on interest rates, and also to absorb the cost of higher rates for house loans which will boost the property spending. Further, there are increasing numbers of non-residential Indians who are interested in investing in the Indian property market which has induced domestic property financers like HDFC to open their operations in the UK (Telegraph.co.uk, 2007). Further, the lifestyle spending of the Indians residing in the country is also increasing due to an increase in wage rates which shows that more investments are likely to occur in the future (Vaswani, 2008).

Clearly, the report shows that the Indian property market is expected to grow and the investments in the market by foreign investors are not very difficult. The market conditions in the Indian property market show positive trends for the interest of the company. The economic condition of the country is expected to grow. As economic theories show the growth phases of any country call for increased infrastructural investment which is evident from the Indian government’s expenditure on infrastructure. Further, the domestic market too is in a boom stage with near about doubling of property prices in a few years. The target market is expected to grow in the near future even with the impending fear of a recession. Evidently, India holds immense opportunities for foreign investors.

References

Anon., 2009. Ballfour Beatty. Web.

CIA, 2008. The World Factbook – India. Web.

Euromonitor, 2007. India’s fast-growing property market. Web.

Euromonitor, 2009. India-Country Factfile. Web.

MarketResearch.com. India Infrastructure Report Q1 2009. Web.

Telegraph.co.uk, 2007. Home is where the money’s going. Web.

The Economist, 2009. Economic data. Web.

Vaswani, K., 2008. India’s wages surge but risks multiply. Web.