Jumeirah Group of Hotels and Resorts is a luxury hotel chain that is based in Dubai, and it has facilities not only in the United Arab Emirates (UAE) but also globally. Jumeirah Group was established in 1997, and today, this business is a leader in the hospitality industry in the UAE (“Jumeirah Group Portfolio” par. 1). However, in order to discuss the effectiveness of the company’s strategy regarding the development of the product portfolio, it is necessary to conduct the business analysis with the focus on the Boston Consulting Group’s (BCG) matrix. The purpose of this paper is to present BCG matrices that reflect the relative market share and market growth in relation to Jumeirah Group’s products and services.

BCG Matrix

The BCG matrix is a business tool that is used in order to analyze the position of the company’s products within the market. This matrix is effective to represent the company’s ‘cash cows’ that are characterized by the high market share in the market with the low growth rate; ‘stars’ that are characterized by the high market share in the actively developed markets; ‘question marks’ that are characterized by the low market share in the actively developed market; ‘dogs’ that are characterized by the low market shares and representation in the slowly developed market (Mooradian, Matzler, and Ring 112; Spee and Jarzabkowski 224). This matrix is important to be utilized in order to evaluate the appropriateness of the Jumeirah Group’s product portfolio to cover more markets and gain more profits.

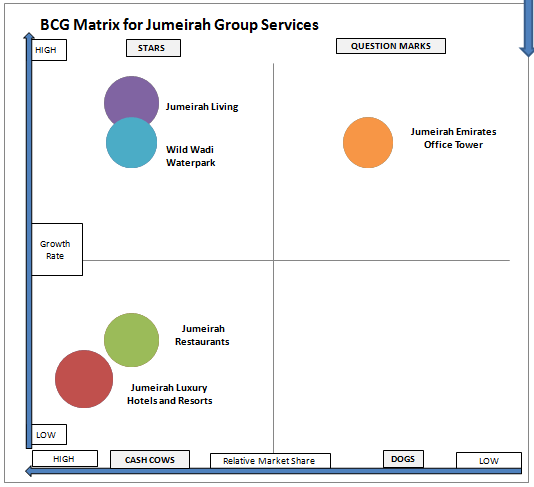

BCG Matrix for Jumeirah Group’s Services

Currently, Jumeirah Group develops its operations while proposing five main types of services, including hotels, restaurants, living areas, a waterpark, and offices (Ahmed 22). Figure 1 presents the BCG matrix that explains what market share is covered by each type of service and in what markets the company is presented. Jumeirah Luxury Hotels and Resorts have the highest share in the stable market related to the hospitality industry.

Therefore, these types of services provide the company with high profits and guarantee the stability of the business. Jumeirah Restaurants are also discussed as ‘cash cows’ because they are often located in hotels, and their popularity and image depend on the reputation of hotels in the market.

Figure 1 also indicates that Jumeirah Living areas can be discussed as ‘stars’ because this market is actively developing, and Jumeirah Group gained the largest market share in it. Wild Wadi Waterpark is one more ‘star’ because this waterpark remains to be the leader in the UAE and region. However, there are also ‘question marks’, and the company needs to focus on the status and development of Jumeirah Emirates Office Tower. The problem is in the fact that offices proposed by Jumeirah Group are characterized by the high rent prices that affect their competitiveness level.

BCG Matrix for Jumeirah Group of Luxury Hotels and Resorts

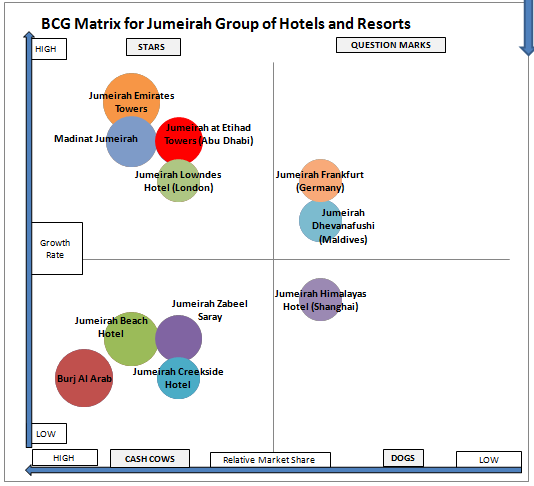

While focusing on the Jumeirah Group of luxury hotels and resorts, it is important to develop the BCG matrix that reflects the position of different hotels that have various statuses in the market. This analysis is important to discuss the strategy for Jumeirah Group that can be the most effective one in order to guarantee the win of higher positions in the market of the UAE, as well as the global market (Wilson, Eckhardt, and Belk 26).

Figure 2 represents the situation for the Jumeirah Group of luxury hotels and resorts. In this case, the ‘cash cows’ are Burj Al Arab, Jumeirah Beach Hotel, Jumeirah Zabeel Saray, and Jumeirah Creekside Hotel because these hotels are most famous, and their positions in the market are stable. The company spends the limited resources in order to promote Burj Al Arab and Jumeirah Beach Hotel because these hotels gained world recognition.

Currently, much attention is paid to the promotion of ‘stars’ because it is necessary to gain a higher share in the market. For Jumeirah Group, ‘stars’ are Jumeirah Emirates Towers, Madinat Jumeirah, Jumeirah at Etihad Towers located in Abu Dhabi, and Jumeirah Lowndes Hotel located in London. The financial and marketing success depends on the active promotion of these hotels in the UAE and globally.

Much attention is paid to promoting the hotels because, in addition to Burj Al Arab and Jumeirah Beach Hotel, the services proposed in such hotels as Jumeirah Emirates Towers, Madinat Jumeirah, and Jumeirah at Etihad Towers are competitive, and managers focus on them to address such competitors as Four Seasons, Hilton, Ritz-Carlton, and Radisson in the UAE and the Middle Eastern region.

Figure 2 also indicates that there are two hotels that can be evaluated as ‘question marks’ for the Jumeirah Group. The company should concentrate on the positions of Jumeirah Dhevanafushi (Maldives) and Jumeirah Frankfurt (Germany) in high growth markets. These hotels have a low market share, and they need more investment in order to take the position of the market leaders in the stated countries. Jumeirah hotels have only one hotel that can be regarded as a ‘dog’ because of being presented in the low growth market with a comparably low market share (Balakrishnan 38). Jumeirah Himalayas Hotel that is located in Shanghai, has a low level of popularity among the local and global public.

Recommendations

In order to improve the product portfolio strategy for Jumeirah Group, it is necessary to focus on promoting those services and hotels that are regarded as ‘question marks’ according to the BCG matrices. The problem is in the fact that those hotels and facilities that are described as ‘stars’ or ‘cash cows’ are profitable, and their development is based on an effective strategy. However, more improvements are necessary in order to guarantee that hotels representing the high growth market could win higher market shares.

From this point, it is necessary to focus on diversification and differentiation as strategies to support the promotion of services that are proposed by Jumeirah Emirates Office Tower, as well as Jumeirah Dhevanafushi that is located in the central part of the Maldives and Jumeirah Frankfurt located in Germany.

For Jumeirah Group, the better contribution is associated with the activities of Burj Al Arab and Jumeirah Beach Hotel. In order to win the larger share market on the Maldives and in Germany, it is necessary to adapt the strategies used for Burj Al Arab and Jumeirah Beach Hotel to the realities of the foreign countries. Moreover, it is also necessary to ensure that the quality of the provided services is high. For Jumeirah Himalayas Hotel, the opposite strategy should be selected, and much attention should be paid to accentuating the unique services proposed in the hotel.

Works Cited

Ahmed, Abdel Moneim. “Customer Relationship and Satisfaction: The Jumeirah Beach Hotel Case Study.” Managing Customer Trust, Satisfaction, and Loyalty through Information Communication Technologies 2.1 (2013): 20-28. Print.

Balakrishnan, Melodena Stephens. Jumeirah Group: Stay Different. Dubai: University of Wollongong, 2011. Print.

Jumeirah Group Portfolio. 2016. Web.

Mooradian, Todd, Kurt Matzler, and Larry Ring. Strategic Marketing. New York: Pearson, 2013. Print.

Spee, Andreas Paul, and Paula Jarzabkowski. “Strategy Tools as Boundary Objects.” Strategic Organization 7.2 (2009): 223-232. Print.

Wilson, Jonathan, Giana Eckhardt, and Russell Belk. “Luxury Branding Below the Radar.” Harvard Business Review 12.1 (2015): 26-27. Print.