Objectives

The goals of the study include exploring the current financial issues faced by McDonald’s, determining the factors that define its performance, analyzing its current position, and suggesting improvements. The company has been operating in the global market for quite a while, yet it seems to have been facing difficulties over the past few years. Thus, new approaches toward marketing and product pricing will have to be explored.

Market Conditions

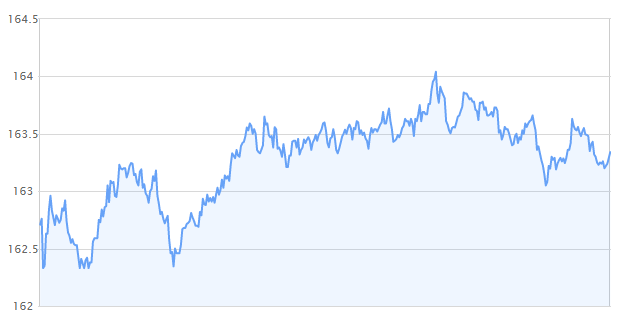

The current market conditions can be defined as favorable for McDonald’s. The company’s current shares are at the 163.34 mark and have been experiencing a rather steady rise, which can be deemed as a positive tendency (see Fig. 1).

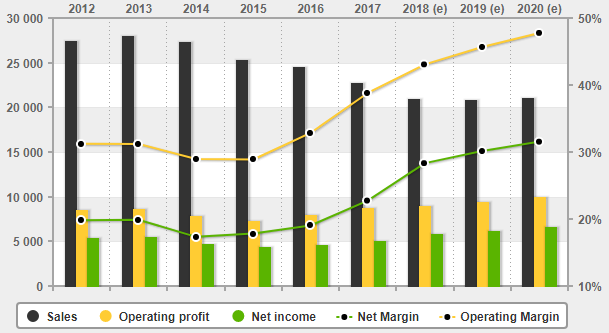

As Fig. 1 provided above shows, despite a minor hiccup in 2016, McDonald’s has been experiencing a rather impressive success and has enjoyed gradual economic growth. The identified phenomenon can be defined as rather impressive given the vast range of competitors with which the company has to deal in the context of the global economy. The presence of firms such as KFC, Taco Bell, and Subway, makes the process of not only increasing the company’s revenues but also retaining its current profit margins rather difficult (see Fig. 2).

Buying Decision Triggers

When considering the factors that condition buyers to purchase particular products, one must mention the efficacy of repetitions, as well as psychological approaches to pricing. Much to its credit, McDonald’s uses both approaches. However, in its attempt to attract its target audience, the company lacks subtlety. By using the approach that requires ending each price in.90, the company creates an impression of reducing its price by $0.10, which is believed to be perceived on a subconscious level and, thus, compels target audiences to choose McDonald’s products over the ones offered by other companies. However, seeing that the identified approach is used by a variety of other organizations, it can hardly be considered as an advantage for McDonald’s.

Marketing Plan

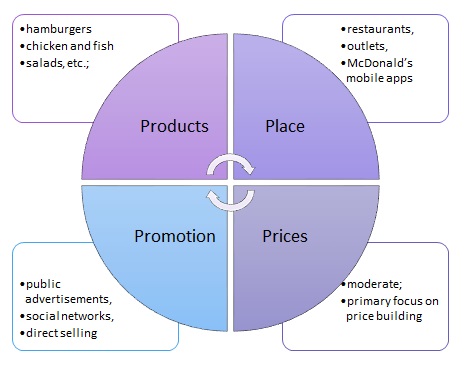

When considering the current Marketing Mix (see Fig. 3) used by the company, one must give McDonald’s credit for targeting a wide range of customers. Therefore, the issue of diversity remains one of the key areas on which the firm prefers to work. On the one hand, in light of the firm’s recent tendency to expand into new markets, the said choice is fully legitimate. On the other hand, it does not allow McDonald’s to invest in its R&D processes in order to explore new opportunities for introducing new and healthier products into its production line.

The fact that the organization uses price building as the key step toward developing a coherent pricing strategy can be viewed as a touch flawed. It can be supposed that the organization would have benefitted significantly from the focus on the use of discounts for its loyal customers, as well as gift cards and other opportunities. As a result, buyers would be more eager to purchase the firm’s products.

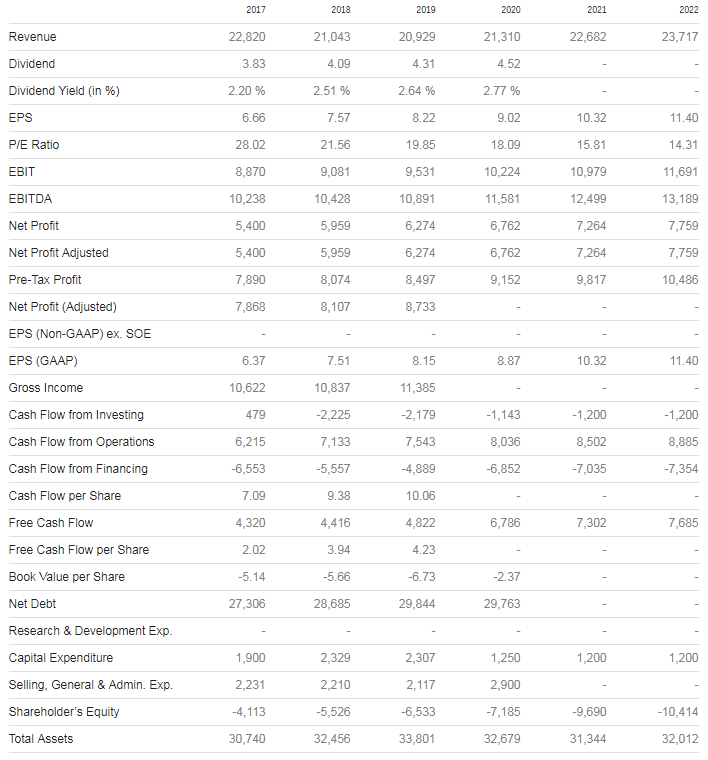

It is assumed that McDonald’s is going to suffer certain losses in the future as far as its financial assets and profit margins are concerned (see Fig. 14). As the figure shows, the current 5-year projections indicate a steep drop in the P&E ratio, as well as a significant negative trend in cash flow from investing and financing.

Nevertheless, the general trend can be described as rather positive. The estimated rise in the revenue, as well as the EPS, can be considered a sign of the company’s readiness to operate in the realm of the global market.

It could be argued, however, that the propensity toward the consistent growth of the net debt of the organization should be viewed as a reason for concern. The current projected revenue correlates negatively with the rise in the debt levels; particularly, there is a tendency for the net debt to increase at a faster pace than the company’s revenue. Thus, the slightest hiccup in McDonald’s economic growth may impact the company negatively, therefore, leading to its untimely demise.

The projected increase in the rates of the free cash flow can also be interpreted as a sign of McDonald’s being able to enjoy a range of financial opportunities in the future. The identified tendency indicates that the organization will manage its expenditures successfully and be able to use its financial assets in a more sustainable manner. As a result, a gradual rise in the organization’s economic efficacy is expected.

As shown in Fig. 4, McDonald’s is also likely to experience a drop in capital expenditure rates. The identified information can be explained by the fact that the company will be able to introduce an enhanced waste management framework. As a result, a shift toward the use of the lean management principles and, thus, the development of an integrated approach toward key production processes will become a possibility.

McDonalds has experienced drastic changes in its revenue streak over the years of its existence in the target market. With the recent focus on healthy food and the promotion of healthy dieting choices, the organization is likely to suffer impressive negative changes in its revenue streak. As a result, the overall economic growth of the firm will be jeopardized. To address the specified concerns, McDonald’s may have to reconsider its current approach toward corporate management processes, particularly, the management of its financial assets.

Increasing store sales can be viewed as one of the possible steps toward increasing the changes for the organization to survive in the target market. Although the company’s current marketing strategy seems to be rather efficient, it needs an improvement to handle the negative effects of the drop in store sales. Particularly, rebranding the company as an organization that offers not only traditional fast food but also options for an especially healthy diet, should be considered a necessity

Conclusion

McDonald’s has seen significant changes in its economic growth over the past few years, yet it seems to have been improving its current score. With a closer focus on product differentiation, exploration of other markets, and especially on creating opportunities for people to experience options for healthy dieting, the company is likely to increase its profit margins extensively. Furthermore, the organization will have to reconsider its current approach toward its financial strategy by reducing the psychological pricing strategy and offering its customers discounts and other opportunities for saving their money.

Works Cited

“MCD – McDonald’s Corp (NYSE).” Investopedia. Web.

“McDonald’s Corporation (MCD).” 4-Traders.com. 2018. Web.

“McDonald’s: Stocks.” Business Insider, n.d. Web.