Strategy

Choice of strategic alternatives

Mercury’s mission statement requires strategies that will push for innovation, so as to get desired results. The product leadership strategy has led to a reduction in the product development time. Therefore, new products will be quickly available in the market before competitors have time to react, and this might lead to a sizeable increase in the company’s market share.

Cost savings can also be achieved from this process, as well as from a reduction in overheads, and thereby be utilized in research and development. The team therefore has a directional strategy, given by the Mercury Shoes’ overall orientation towards growth and stability.

Main challenges facing Mercury at the beginning of the SIM

Cost variances in various geographical regions affect manufacturing patterns, whereby companies will seek to move their production facilities to areas that offer cheaper alternatives. Subsequently, it becomes difficult to measure and compare performance in the different areas. Mercury has not invested substantially in research and development (R&D) and marketing initiatives. The market will therefore be unaware of its products, and the company may lose potential revenue to market leaders.

Bad debts increased in the period prior to the simulation, from $ 2.79 million in 2007, to $ 3.37 million in 2009 for the whole company. Bad debts, if not well managed, will have a negative impact on the company’s balance sheet and profitability. This could be a signal that procedures on debt collection are not effective.

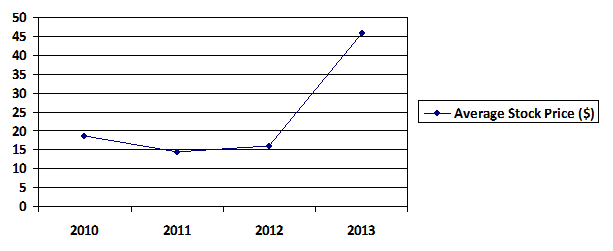

Investments in R&D are not optimal, which may force Mercury Shoes to be a follower in the market, instead of an innovator. The sub-optimal investments in R&D could be an indicator as to why the stock prices have been stagnant in the same period (figure 1). The company is largely reactive in its strategies, rather than being proactive, because there is evidence that after-sale service processes are not adequate.

The company’s overall view towards its products cannot be said to be ambitious, since there was no plan on developing new products.

Mercury Shoes had a limited product line, which states that the company was using a defensive strategy. Such a strategy aims on improving the efficiency and effectiveness of existing operations, which makes the company in an unlikely position to innovate and exploit new areas.

Assessment of the strategic choices

In the first round of the simulation, the team focused on investing in research and development, in alignment with Mercury’s mission statement, which illustrates the importance of innovation. The team strived to establish solutions that could help save money for use in R&D purposes. The supply chain strategy, while effective, failed to deliver a broader range of materials that could be used for the production of various products.

As a result, the company failed to meet demand of non-specialized products, thereby incurring an opportunity cost. The team also set high prices so as to satisfy margins, a strategy that failed given the fact that competitors would offer lower prices for similar products. Non-the-less, the team achieved an increase in Mercury’s market share due to the R&D initiative, which also led to a decline in the product development time.

The second round tries to pick up on the successes of the first round, while correcting on the failures. The team had to tackle cost containment, while meeting demand in the market. The R&D program was still beneficial, awarding Mercury brand more global market share, an increase of 20.8 percent from the previous round.

Studying faults in the production model used earlier, which had failed to meet demand, the team improved the system so as to ensure factory utilization. Product prices used in the previous quarter were decreased, but the levels were too low, thus affecting the bottom line negatively.

By marketing new products too early, without a clear pricing policy, the strategy could not be successful since it reached the wrong target market. The team failed in achieving its targets since the market could not maintain interest levels.

In the third round, the team increased the price of Mercury’s products, which led to an increase in cash flows, product revenue and subsequently, a.55 percent increase in the company’s share price, as demonstrated in figure 1.

Figure 1: Average Share Price movements for years 2010, 2011, 2012 and 2013

Efficiency in the factory has increased, thereby reducing labor costs per unit of production, and the output was sufficient in meeting demand. Non-operating expenses in the Americas have risen at an alarming rate, which could be partly due to the heavy marketing practices.

Bolt team decided to examine the problem, and make further recommendations on cost savings. Price continues to be an issue, since the team failed to establish a suitable price for its new products. A marketing strategy cannot be successful if there is uncertainty regarding price and target group for the new products.

The fifth round seeks to streamline Mercury Shoes Company, with an emphasis on costs. Americas is still an area of focus on this, but the team has not yet established the root problems. Instead, Bolt has decided to cut back on personnel requirements. R&D personnel are increasing at a slower pace than in recent years, which means that the team has shifted goals of the company, from innovation driven to cost savings.

This could give competitors a chance to overtake and create a significant gap between themselves and Mercury Shoes. Investments in other products have been put off, until the current new products have reached their target levels. This strategy will give the company a chance to profit from the investments made.

Opinion and recommendation

The team has managed to attain some of the targets set by management, especially concerning R&D spending. The team has failed in implementing a suitable pricing strategy, which has led to loss in market share due to lack of appropriate strategies.

Mercury Shoes ought to divest in products that have reached the end of their product lives. Companies should have at least a minimal R&D capability if they are to correctly evaluate the value of technology developed by others (Wheelen & Hunger, 2005).

According to Wheelen and Hunger, R&D generates the ability of a firm to understand and exploit new knowledge, a capability termed as “absorptive capacity”, which is a valuable by-product of routine in-house R&D activities.

Absorptive capacity is a company’s capability to value, assimilate, and utilize new technology. Firms that have this capacity are in a better position to use the knowledge acquired externally to improve on the productivity of their research and development expenditures. Without this absorptive capacity, a company would be locked out on its ability to assimilate the technology at a future time.

Mission And Values

Balance of margins and mission

The mission statement states that Mercury Shoes should strive for innovation as the major force behind the company’s growth ambitions. The team has raised R&D expenditure so as to attain the mission target.

Marketing and advertising costs have also increased, though they should be properly managed so as to safeguard the bottom lines. The team has tried to focus on cost control measures instead so as to improve margins, a strategy that has improved the company’s profitability in the fifth round.

Integration of values into the decision process

Investors don’t seem to have a positive outlook for the future of the company, given by the decrease in the price-earnings (PE) ratio, which could indicate a decline in confidence in the company.

Decisions that were meant to control costs have improved the bottom line of the company, since the operating margin has increased to around 10 percent, an improvement from the previous round. The decision to invest in R&D has paid off, whereby annualized revenues have been improving in all rounds during the four years.

Opinion and recommendation

The team should adopt a clear strategy formulation and implementation process. The mission statement describes a company’s reason for existence. The company’s mission should be used to guide the objectives that will be established. Objectives are the medium term goals or targets that are to be accomplished within a given time frame.

Stated objectives in turn lead to appropriate strategies, which provide the guidelines for decision making. Through out the entire process, feedback mechanisms should be put in place so as to ensure that the company is moving forward in the right direction, as per its long term ambitions.

Performance

Areas of Mercury Shoes the team managed effectively

The team managed to revamp the R&D department, which ensured that Mercury was at the forefront of innovation in the apparel industry.

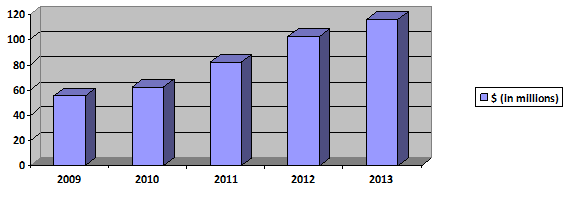

Increased R&D expenditure has paid off, given the increase in revenue, and shorter product development times, from 12 to 9 months. Increase in R&D spending can be seen by the market that there is a chance of growth for the company, and future profitability, hence the increase in the company’s share prices in later years (Henry 2008).

Figure 2: Investment in R&D

Areas of Mercury Shoes the team struggled

The team had difficulties in setting prices for the products. There was lack of an efficient and effective pricing policy, regarding both current and new products. The team had decided to satisfy margins by charging high prices, rather than setting a price that favors both customers and the bottom line of the company. High prices gave room for competitors to undercut Mercury Shoes with their own substitute products.

Low prices in the second round, on the other hand hurt, the bottom line of the company. Pricing continued to be an issue enough returns for its investments. The team also struggled with marketing issues, which have led to high costs but have failed to tackle the large inventory.

Effectiveness of the decision making process used by the team

The team gauged past round performances, kept on improving on beneficial strategies, and modifying or eliminating failed methods. While objective, the procedure could be seen as a trial and error mechanism, which could be quite costly to implement due to the risks involved. The team’s decision making process uses mostly planning and adaptive modes.

The planning mode involves the systematic gathering of appropriate information for situational analysis, the generation of feasible alternatives and the rational selection of the most suitable alternative. The adaptive part of the decision making process is characterized by reactive solutions to existing troubles, such as the pricing problem, rather than the proactive management of new opportunities.

A strategic decision making process involves the evaluation of current performance results, followed by an examination of the current company mission, objectives, strategies and policies.

Thereafter, the management should review corporate governance issues, a process which assesses both the internal and external environment of the firm.

Dess, et al (2009) notes external factors comprise of opportunities and threats facing the company, while the internal factors include the company’s strengths and weaknesses.” The team has conducted a SWOT analysis so as to capture these factors, and developed several strategies in light of the current situation.

The team has not displayed evidence of review and revision of the company’s mission and objectives, a procedure that appears to be necessary. If the strategies were to be reviewed, then alternative strategies could be generated, and the most suitable one could be recommended.

The team could subsequently implement the best alternative, which gives guidance on how to manage programs, budgets and procedures. Evaluation and control procedures should be formulated and implemented so as to measure the performance of the chosen strategy.

Performance measurement used by the team

The team’s measurement performance system relies on comparison of prior year data, though the set management target of achieving 10 million unit sales has been considered as a driving force for strategy. All key performance indicators in the financial statements have been documented.

Environmental scanning provides reasonably hard data on the present situation and current trends, but intuition and a play of luck are necessary to correctly predict or forecast results if the trends are to continue. Faulty assumptions are the most frequent cause of forecasting errors.

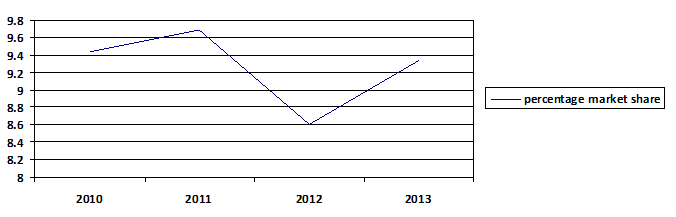

Figure 3: Percentage proportions of Mercury Shoes market share in the industry

Organization structure selected for the team

The team has selected a functional structure, which is usually suitable for medium-sized firms with several related product lines in a particular industry. Employees have been divided along functional lines, such as R&D, marketing, personnel and administration.

There seems to be conflicting and duplicated roles in the organizational structure, since a miscommunication between marketing and production departments resulted in the overproduction of Sweatless Apparel. The team had to counter this by shipping the excess stock to Asia.

The team has adopted contraction policy towards the end of the final round, in an effort to “stop the bleeding” with general across the board cutback in size and costs.

Externalities

International and economic issues and business practices on the team’s management of Mercury Shoes

The team is right to recommend an investment in China, especially after regarding the WTO agreement. The Chinese economy has one of the highest growth rates in the world, therefore management cannot afford to ignore the potential of this region. An investment in the youth segment may result in a substantial increase in value for the Mercury brand.

The team has done well to evaluate the cost differentials across boarders, which will impact the bottom line of the company. Production facilities could shift east to Asia, a region which has cheaper labor costs than the west. The team is wrong to assume that strategies meant for China will apply to other countries in the region. More research should be done in Asia, especially highly populated countries such as Japan, India and Singapore.

Effect of competition

Competitors such as Nike and Adidas dominate the market due to their innovativeness and marketing proficiency. Mercury is currently not the market leader in the apparels industry, but could gain market share if it learned from the success of the market leaders.

The company’s competitors are much larger than Mercury in terms of capital and market penetration, which makes them reap the benefits of R&D intensity and publicity. Brands such as Nike, Puma and Adidas can sported in most sporting activities, implying that consumers relate well with them. Appropriate public figures could be used to endorse the Mercury brand in the various geographical regions.

The R&D expenditure, which has been illustrated as being below average in the industry, should be increased so as to make the Mercury brand more recognized in terms of innovation. Nike aggressiveness in developing and pushing for new products might eat up a proportion of Mercury’s market share. New entrants have also been regarded as a threat to the company.

Big budget companies will try to be more efficient in production capabilities, thereby retaining much of the cost savings or retained earnings for R&D purposes, which could further their innovation strategies. There are no long-term constraints into the market for new participants, who look to focus on niche markets, which forms part of Mercury Shoes’ market segment.

According to Michael Porter, an authority in competitive strategy, there are five factors that affect the intensity of competition in an industry. The company should consider the threat of new entrants and the threat of substitute products.

Buyers and suppliers are also to be regarded, since they both have considerable buying powers which affect the company’s margins and long term survival. Stakeholders, such as governments and unions will also affect the company’s profitability.

A company may be capable of using its resources and abilities to increase its competitive advantage, but this does not mean that it will be enough to sustain that advantage. Dess Et al (2009) notes “ there are two distinctive factors that determine the sustainability of a company’s competitive advantage.

The first factor to consider is durability of the company’s underlying resources and capabilities, since they may depreciate or become obsolete.” The second factor, imitability, measures the rate at which the company’s underlying resources and competencies can be duplicated by competitors. The apparel industry consequently has a low level of resource sustainability, since products are easy to imitate and duplicate.

Political environment

China’s political landscape is quite unpredictable. Import restrictions could set ceiling limits on the amount of revenue that can be generated from China, therefore Mercury Shoes will not realize the full potential of investing in that region.

The political environment should be assessed in advance before making any major investment decisions. Tax laws should be reviewed in order to ascertain whether they are favorable, for instance, Mercury Shoes is currents paying corporate tax even in fiscal years that it has made a loss.

A country like China would wish to protect its local companies by establishing certain policies, such as higher tax rates for foreign companies, or pricing policies which limit the price companies can charge for certain products. A pricing policy would hamper Mercury Shoes margins and profitability. Licensing requirements should also be looked at.

A country may discourage foreign direct investment by requiring the market entrant to form a strategic partnership with a local company, or even issue stock to the local investors, which forces the market entrant to forfeit some of the control. A policy favoring minimum wages could be enforced, thereby impacting the bottom line of the company negatively.

Conclusions

The team has demonstrated proficiency in tackling current problems within Mercury Shoes Company. The company has shortened the product development time, which could be a demonstration of improved efficiency in its production processes. Non-the-less, Mercury Shoes should engage itself in a feedback mechanism that will ensure continual communication and cooperation with its customers, so as to build on brand loyalty.

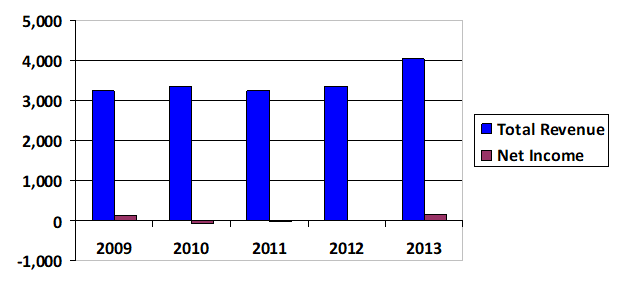

The high costs are dampening the company’s high revenues, as can be seen from figure 4 below. The net income does not seem to reflect the significantly healthy revenues of the whole company.

This could be as a result of cost management issues within the company and partly due to the unnecessary marketing expenses in the Americas, while the products had seemingly reached the end of their life cycles in that particular region. Cost control could be implemented so as to satisfy the margins.

Figure 4: Analysis of Mercury Shoes total revenue and net income for years 2009-2013

In a multinational company, like Mercury Shoes, corporate strategy is aimed primarily on the choice of direction of the firm as a whole. The strategy chosen is also about managing the various product lines and business units for maximum value.

In this illustration, the corporate headquarters play the role of an organizational parent, which has to make sure that its various business units and products are in line with its established targets. (Mercury S., 2010)

References

Dess, G. G. Et al. (2009). Strategic management: Creating Competitive Advantages. 5th ed. Sturgis, KY: McGraw-Hill.

Henry, A. (2008). Understanding Strategic Management. Sturgis, KY: Oxford University Press.

Mercury S. (2010). Financial and Management Statements. Statesville, NC: Mercury shoes ltd.

Wheelen, T. L., & Hunger J. D. (2005). Strategic management and business policy. 11th ed. Bloomington, MN: Pearson/Prentice Hall.