Introduction

The main goal of every business organization is to make profits, increase in its customer base, while still securing sustainability in the market. However, in the case of companies that come together for a merger, it is difficult to establish the likely ultimate impact of the merger on their operations and business goals.

Despite the risk that a merger could as well disadvantage a company, if well planned, mergers open up possibilities for companies. A balanced scorecard is an important tool used in harmonizing processes during a merger. In order to design a well-balanced scorecard, it is very essential to bring together all the critical factors within those organizations (Silverthorne, 2008).

The balanced scorecard provides four perspectives from which to view organization so that one can consequently design metrics, obtain data, and synthesize them to attain organizational objectives (Balanced Scorecard Institute, 1998). This paper looks into the merger between Utah Opera and Utah symphony to highlight critical areas that must be addressed in the merger.

Action plan for Anne Ewers

Before developing an action plan, it is critical to first evaluate the strategic objectives of both Utah Opera and Utah Symphony in order to see whether, if they decided to go on with a merger, the companies can meet their individual objectives or not. Moreover, it is critical to determine, the kind of challenges that the two organizations are likely to face due to merging.

Understanding the challenges is critical for management to identify a suitable approach to those challenges. Definitely, management is keen on ensuring that the integration of the two companies is successful.

Secondly, as desired, the merger has to be designed in a way that ensures reduction in expenses and maximization of profits. To guiding principle of the action plan is to ensure that despite the merger, the current customer base is maintained or increased.

Analysis of the financial and leadership strengths of Utah Symphony

Financial Strengths

Based on the information provided in the case, the following are the strengths of Utah Symphony. First, Utah Symphony’s revenues total up to $3,836,513; a figure that is $2808336 more than that of Utah Opera. It also receives government grants totaling to $3,124,999, an amount that is $2,147,677 more than the one obtained from Utah Opera. Utah Symphony also receives contributions that total up to $4,460,268. This figure is actually $ 2,270,281 more than the one collected by Utah Opera.

Secondly, regarding investments, Utah Symphony has so far gained an investment income of $817,505. Moreover, the company still projects this figure to reach $919,013.

From the given figures, it is clear that, based on revenue and contributions from the previous periods, Utah Symphony are advantaged compared to Utah Opera. This makes it more advantaged than Utah Opera. For instance, its total revenue and contribution is $12,398,548.

Leadership strengths

Utah Opera has a very experienced management team. For instance, Keith Lockhart, who had joined the Utah Symphony in 1998, had served as a Boston Pops Orchestra conductor (Delong & Ager, 2005). In addition, Keith had been a conductor at both the Cincinnati Symphony and Cincinnati Pops Orchestras. Lockhart’s experience is quite extensive, for he had been a conductor to more than 600 concerts.

Moreover, he has also successfully built some 50 television shows. The mentioned strengths notwithstanding, Keith remains a sort after guest artist in major states in the US. This experience puts Keith at an upper hand in terms of management.

Leadership Weakness

The major weakness of Utah Symphony in terms of leadership relates to the nature of experience that its leaders have in order to manage the group. It is the analyst’s view that even though Keith’s experience is vast, it has more to do with orchestra than with opera.

Therefore, the kind of responsibilities allocated to Keith are way beyond the experience acquired implying that Keith could not be in a position to make efficient strategic decisions pertaining to Symphony’s progress towards organizational objectives because the manager is better suited to work with Utah.

Symphony than Utah Opera

Analysis of the financial and leadership strengths and weaknesses

Leadership Strengths and weaknesses

Anne Ewers, who was brought to office in 1999, was previously the general director at the Boston Lyric Opera, lead Utah Symphony. At Boston, she had helped clear a debt of $450,000, debt previously held (Delong & Ager, 2005). She also helped in the establishment of endowment fund, in addition to increase in productions to three from an initial unit production. Ewers, therefore, has a very rich experience in managing Opera entertainment.

She especially had a successful career as a stage director across the US as well as abroad. Her skills are without doubt very profound especially in fundraising both within and outside the US, and in managing both the Orchestra and Opera business. However, despite the rich experience, sales and support for arts have been waning thus need for more concerted effort by management to keep the arts industry vibrant and dynamic.

Recommended steps prior to the Merger

Before going into the merger, the two leaders should have a talk on their experiences and undergo some workshop experience in which one reveals to the other the secret behind the success either of the organizations.

They should bear in mind the fact that a merger will only flourish if they can work in improving one another’s skills. The workshop experience will be beneficial to the two leaders as they are likely to discover ways of ways of working together.

Financial Strengths and Weaknesses of Utah Opera

Utah Opera has continually grown in its annual productions, that is, from three productions to four. In addition, it has boasts of an audience of 130,000 patrons, and already performed to over 70,000 students in view of increasing its scope.

Recommended Steps Prior to the Merger

Compared to Utah Symphony, the Opera group needs to improve in its financial base. They should engage in a campaign to raise more funds through fundraising or through issuing of shares to the public.

In fact, since Anne is recognized as an excellent fundraiser, they should engage her in coming up with a plan towards more funds to kick them off. Issuance of shares could also work in their favor. However, success in such a step largely depends on how well the merger is planned and executed.

The Four Aspects of the Scorecard

Different cultures and visions for each company

Although the two companies have different visions, there is a lot of similarity. Utah Symphony’s vision is to attain excellent symphony.

They intend to attain this through increased quality standard in its concerts in order to maintain the 83 full-time musicians that it is currently in contract with. Utah Opera’s vision is to become a nationally renowned opera entertainment house. This vision is to be attained through optimal quality in its performances as well as in the endowment funds.

Financial Strategy

Utah Opera’s financial strategic goal is to be financially stable by increasing is reserve fund, and to generate annual profitability, but the critical success factor is through increased annual endowments. In addition, the financial measure of this success is to increase total revenue and contributions from $4,741,206 to $5,116,049 (Delong & Ager, 2005).

Utah Symphony’s financial strategic goal is to be financially stable, through orchestra performances. The critical success factor in achieving this aim is through increased number of performances and increased audiences. Finally, the financial measures will be through increased performance revenues from $1,028,177 to $4,516,308 (Delong & Ager, 2005).

Customer Factor

Utah Opera’s strategic goal is to be regionally renowned for opera performances. The critical success factor is to attain excellent performances. Performance measure is to sell out all their performances. Utah Symphony’s strategic goal is to attain excellent performance in the Orchestra performances.

The critical success factor is to hire the best talent. The performance measure is to delight in customer feedback especially from its patron customers.

Internal processes

Utah Opera’s strategic goal is to attract and retain the best talent in the industry. The critical success factor is to have a successful negotiation process with the selected performers (Delong & Ager, 2005).

The performance measure is to increase its profitability and to carry out reviews that identify the quality of performances. Utah Symphony’s strategic goal is to have a flexibly reduced expenditure plan on periods of no fundraising campaign. To continually negotiate their contracts with musicians in order to motivate them. The performance measure on this factor is increased profitability.

Learning and Growth

Utah Opera’s strategic goal in relation to this factor is to ensure high quality performance in the forthcoming period. The critical success factor in this case is to establish increased endowment fund, as well as ticket sales. The performance measure is to have its capital being taken care of by the sale of tickets.

Utah Symphony’s strategic goal is offer, increased number of symphonies in order to attract increased audience base. The performance measure is to improve the sale of tickets, as well as bringing back audiences

From the above overview of the balanced scorecard, it is evident that the two companies reflect varied organizational culture and visions. As a result, this poses a challenge especially related to the aforementioned factors of financial and leadership strengths and weaknesses.

The scorecard does address the so mentioned weaknesses and strengths. For instance, the problem of financial stability has been addressed in both the scorecards of Utah Symphony and Utah Opera.

Both the strategic goals, critical success factors and the performance measures are very different. One point though is that the scorecard addresses the financial factor more than the leadership issues. For instance, the two personalities have experiences that are quite different from the roles they perform.

The fact that the balanced scorecard does not address the leadership issue arouses concern because it is through efficient leadership that the two companies are to be able to attain the objectives mentioned.

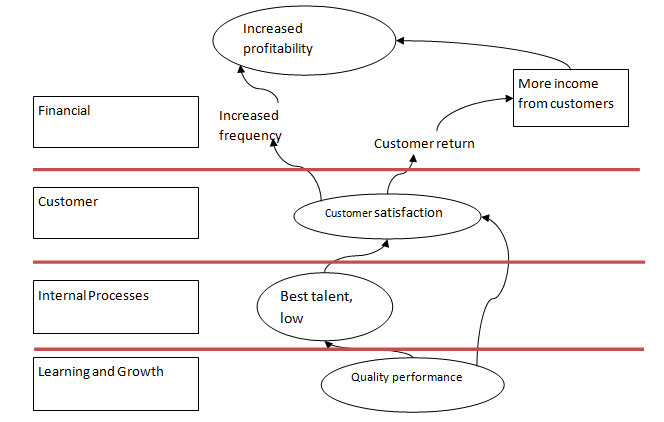

A balanced Scorecard for the merged company based on the specified strategy

In the figure above, a balanced scorecard has been presented that should take into consideration the merger between the two companies. According to the established balanced scorecard, the first factor to be handled should be learning and growth in order to improve performance in both companies, leading to the retention of the best talents due to employee satisfaction and enjoyment.

Similarly, quality performance shall lead to customer satisfaction, which will consequently create increased frequency of attendance as well as increased customer return. Ultimately, the result of the merge is to be financial stability and optimal performance.

The Strengths and weaknesses of proposed merged company

Strengths

The following strengths are to be realized in the event of a merger. To start with, the proposed merger is expected to consolidate the management of the two companies. Given both leaders have diverse knowledge; they are likely to come up with very different ideas in order to boost the management of both organizations.

Additionally, the merger will facilitate resource sharing and maximum utilization. The proposed plan could help enhance resource use thus help to avoid underutilization of resources. Moreover, the proposed plan could greatly increase the customer base due to diversity in the products and services provided by the two companies.

Merging could help improve the strategic positioning of the two companies in the market through management process. Finally, improved internal processes through learning might also reduce the costs incurred in using underperforming staff.

Possible Weaknesses in the Merger

The proposed merger might experience problems when it comes to cultural transformation. The two companies have different cultures, which might become very difficult to manage. Moreover, the proposed plan might lead to customer dissatisfaction in the sense that each group has its own customers who have their own preferences. The merged entity might assume brand characteristics that do not appeal to certain hitherto customers.

There is likelihood of problems arising in the internal processes because of the varied corporate objectives from both groups. This is likely to pose a challenge.

It is also possible that the financial objectives fail to be achieved as both groups have different ways of managing and attaining their finances. Finally, the process of learning and transforming the cultures of the two corporations might become very unattainable due to resistance to change within the two companies

Probable Issue that might arise during the merger

The likely issues that might arise during the merger have to do with finance, human resource and customer satisfaction. When it comes to finance, issues may arise with regard to methods of allocating funds and sharing returns. As for the human resource management, it will be challenging to determine which employees to use and which tasks to assign to employees from either organizations in the merger.

Finally, the managers have to plan on how to deal with customer satisfaction related issues. Unless, the merger works right, the mode of estimating each group’s contribution towards customer satisfaction may become a cause of disagreement. Moreover, if the merged entity comes up with very different ways of operation, this could alienate the customers.

Mitigating Actions that the new merged company executive could take

The issues likely to arise relate to finances, human resource and customer management. With regard to human resources management, the two companies have to find ways of ensuring synergy. Immediately the merger gets underway, each of the companies needs to address the issue of quality in performance. In this regard, the top executives should organize for a workshop that brings together all the staff members.

Such sessions will helps towards better understanding of the operations of both organizations. By so doing, both parties could feel part of one group. Additionally, staff should familiarize with the cross cutting operations. Such familiarization is important towards increasing efficiency.

Customer management will only become tricky if the two organizations operate as two conflicting brands under one merged entity. Consequently, it is important that the top manager impresses on the executives to work on harmonizing their customer approach methods. An analysis of each company’s customer relations should help the managers synchronize operations.

The customers should find even more value for their money from the merged entity. If merger company services are enhanced than what the different companies were offering, customers will appreciate. However, the two managers have to ensure that merging does not make operations too different from what customers were used to.

Financial gain is at the heart of doing business. Often, partnerships break up due to finance sharing related problems. It is recommendable that the top manager works with the directors to on a formula of generating finances, assigning finances to operations and finally sharing whatsoever gains from her operations.

There is need to come up with a financial plan before starting operations. This ensures that money realized is assigned properly with the priorities of the merged entity serving all stakeholders.

Conclusion

The balanced scorecard widely applied in corporations. It is an important tool because it addresses the various indicators of progress in attaining organizational objectives (Kaplan & Norton, 1996, p.53). As the executives of the two companies prepare for a merger, they should use harmonized balanced scorecard to translate the visions of the two companies into operational activities.

It is important that they meet before the merger to agree on a number of things. As identified, they have to look into human resource, customer and finance management issues. Unless, the mentioned are addressed properly, enormous problems are likely to emerge after the merger.

Reference List

Ager, and Delong (2005). “Utah Symphony and Utah Opera: A merger proposal”. Harvard Business School, 9-404-611.

Balanced Scorecard Institute. (1998). Balanced Scorecard Basics. Web.

Kaplan, R. S. & Norton, D.P. (1999). Linking the Balanced Scorecard to Strategy. California Management Review, 39 (1), 53-79.

Silverthorne, S. (2008). Executing Strategy with the Balanced Scorecard. Web.