Introduction

In the last decade, Mergers and Acquisitions (M &A) have increased drastically in North America and across the world. To many organizations, mergers and acquisitions present an opportunity to enhance competitive advantage, expand operations, and/or drive tangible bottom-line improvements (Schweiger & Goulet, 2005). Worldwide unions and acquisitions have increasingly become central business tactics for Multinational Corporations (MNCs) to develop, branch out, and combine their activities.

For instance, in 2006, mergers and acquisitions exceeded USD$4.5 trillion with cross border, amounting USD$1.6 trillion (DePamphilis, 2008). However, despite the enormous activity on mergers and acquisitions, their success rate in meeting the goals of the involved organizations is wanting. For instance, despite the brightness that surrounds amalgamations and acquisitions, only a few of them achieve their monetary prospects. According to Moller and Schlingemann (2005), up to 83% of mergers are unsuccessful.

Such mergers end up lowering the involved parties’ value, profitability, and shareholder bottom line. Despite this discouraging statistics on the success of mergers and acquisitions, cross-border mergers and acquisitions remain a very popular way through which MNCs venture into the international markets (DePamphilis, 2008). In this paper, the reasons for the failure of mergers will be analyzed with the view of presenting important recommendations for ensuring a smooth merger for Metso Corporation of Finland and Mitsubishi Heavy Industries of China.

Failure of Mergers

A considerable amount of research on the failure of international mergers and acquisitions focuses on organizational behavioral perspectives on the performance of M&As. For instance, Arikan (2004) points out that the cultural difference between the involved parties is an important contributing factor and a hindrance to a successful and smooth merger process. Lack of ‘national and organizational culture fit’ between the involved parties may lead to low employee commitment, voluntary turnover of top managers (Very & Schweiger, 2001), and at worst complications in the post-merger integration process.

However, many researches offer mixed and inconclusive findings on the correlation between culture and the success levels of international mergers. For instance, while some studies reveal a negative impact of cultural distance (Datta & Puia, 2005), others show a positive correlation (Uhlenbruck, 2004). Moreover, others find no or insignificant impact on the post-merger performance of an organization. In the case of Metso Corporation and Mitsubishi Heavy Industries, the cultural distance will be discussed as a hindering factor towards the success of the merger. Recommendations will be offered accordingly.

Another important factor in the success of mergers relates to human resource management. Mergers have far-reaching human resource implications. In most cases, they are not only threatening but also produce anxiety and stress to employees. Patterns of emotional reactions of employees towards mergers or acquisitions are evident, a phenomenon that is labeled as ‘merger-emotions syndrome.’ The merger-emotions syndrome consists of different emotions, including but not limited to denial, fear, anger, sadness, acceptance, relief, interest, liking, and enjoyment. If not handled and well managed, mergers have the potential to cause emotional havoc in employees. Consequently, the situation affects the post-merger performance of the combined organizations.

In the process of researching and analyzing business ventures such as mergers and acquisitions, scholars and many business analysts focus on financial and operational perspectives. While such a plan gives a clear roadmap on paper on how the merger will improve the value and performance of the involved parties, it comes as a surprise when such ventures struggle and, in some instances, fail to succeed. According to Arikan (2004), the role of leadership in the success of a merger is often overlooked to the disadvantage of the organization. Leadership is the determining factor in how the organization approaches other challenges, such as cultural differences, human resource problems, and the general management processes (Datta & Puia, 2005).

Successful Cultural Integration in Mergers

International mergers bring two or more cultures together. If not handled well, the integration of the two cultures to the organization’s practices can spell doom to the post-merger performance. In international mergers, two dimensions of cultures are important in the process of cultural integration. Firstly, the organizational culture refers to the consistent and mutually supporting combination of activities, viewpoints, and postulations that are shared by members of an association.

These activities differ from one business to another and hence play centrally in the ‘politics’ of mergers (Gertsen, Soderberg, & Torp, 2008). Responsibilities in an organization’s culture are often unconscious, acquired, and studied through interaction to guide how things are done within the business. The second cultural perspective relates to national cultures from which the two companies originate. Countrywide civilization includes the existing principles of a community such as faith, customs, speech, chronological inheritance, and conventions. It helps distinguish members of one group from another.

Since international mergers involve the combination of two or more cultures, the ability to integrate the cultures of the two organizations plays a central role in the post-merger performance of the organization. According to Arikan (2004), most organizations often focus on the financial performance of the transaction. They miscalculate or pay no attention to the cultural aspects of the process.

In this case, they fail to put in place clear strategies to guide the process of cultural integration in the merger. In international mergers, dissimilar organizational culture, which is exacerbated by differences in the national cultures, leads to what is referred to as ‘dual cultural clash’, which is linked to a high failure rate of international mergers and acquisitions (Uhlenbruck, 2004).

To avoid the dual cultural clashes, international mergers must put in place ‘twofold layered acculturation’ to address the differences in organizational and national cultures. Organizations that put in place measures to address organizational and national cultural differences are 26% successful in the post-merger performance relative to those that do not adopt such a plan. In a survey carried by Veiga et al. (2000), organizations whose organizational and national cultures were different, but were made compatible after mergers, reported the high post-merger performance.

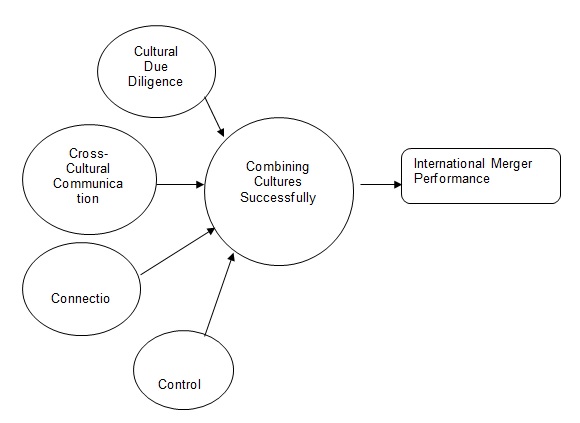

According to Datta and Puia (2005), a successful cultural combination is a very important factor in successful international mergers. It involves four key factors that include cultural due diligence, cross-cultural communication, connection, and control. This framework for successful cultural combination can be represented in a diagram as follows:

Cultural Due Diligence

From the above discussion, it is doubtless that international mergers involve the combination of organizational and national cultures where the success of the integration process is a key determinant of the post-merger success of the organizations. The combination of the cultures occurs after the merger has been finalized. Hence, organizations are forced to work together (Datta & Puia, 2005).

In many organizations, while they go to a greater extent to perform financial due diligence for the determination of transaction prices and payment methods, they fail to attach equal importance to factors such as culture in the process of carrying out the due diligence. According to Gertsen et al. (2008), cultural due diligence is the process of determining cultural compatibility during international mergers and acquisitions. This element should not be confused with cultural similarity since it is concerned with whether any two cultures are combinable.

Just like financial due diligence is important in determining whether a merger will offer good returns on investment, pre-merger cultural due diligence is equally imperative in determining whether the combination of two cultures will be successful in the post-merger stage. According to Angwin (2001), most companies in mergers attach low importance to cultural due diligence as part of pre-merger overall conscientiousness.

For Metso Corporation and Mitsubishi Heavy Industries merger, it is important to carry out cultural diligence to identify areas of compatibility and incompatibility and hence determine whether post-merger cultural integration measures will be successful or not. For instance, the 2003 merger between Tokyo Bank and Mitsubishi Bank presents an important lesson and a reason why cultural due diligence is important.

In this case, the two companies had very different cultures where Mitsubishi Bank’s employees exercised promptness, put on fair garments, and expressed gratitude to their supervisors at the end of the period for receiving earnings. Tokyo banks’ employees were not familiar with this culture. They found it very strict about following. The situation led to many of them voluntarily leaving the combined organization (DePamphilis, 2008). Such a problem would have been easily avoided if the organization had considered cultural due diligence. As such, it is important for the Metso Corporation and Mitsubishi Heavy Industries to carry out cultural due diligence to determine whether the merger will be successful.

Cross-Cultural Communication

In the post-merger integration period, the value of communication cannot be underestimated. While merging culturally different organizations, it is important for the leadership to understand that stereotypes and prejudices about ‘the others’ are bound to happen, and in many cases, with devastating consequences on the performance of the combined organization (Very & Schweiger, 2001).

There is a need to maintain effective communication with all employees in order to dispel such negative stereotypes and prejudices, which may lead to hostile attitudes that are detrimental to the success of the organization. According to Moeller and Schlingemann (2005), poor communication is common during mergers because of ineffective management post-merger integration process.

It is important for an organization to ensure that all pertinent issues of concern to employees, shareholders, and other stakeholders are communicated timely and clearly to ensure a smooth transition. In international mergers, this factor is even more important since the merger is characterized by cross-cultural differences such as language, religion, nationalistic attitudes, and even xenophobia (Uhlenbruck, 2004).

Such underlying issues may lead to hostilities and fear of losing jobs, which can completely affect employee performance (Schweiger & Goulet, 2005). For instance, laying-off employees are common during mergers. When it reaches such a stage, it is important to communicate openly to all employees, especially those who are likely to be laid off, the reasons why such a measure has been taken. They also deserve to be assisted where and when possible, to have a smooth transition from their jobs, such as providing assistance towards finding new employment (Very & Schweiger, 2001).

Putting in place a two-way communication process where managers and workers can articulate their worries and doubts is an important step towards a successful cultural combination in a merger. For instance, without effective contact, workers may unnecessarily have suspicions of having their occupations interrupted or lost. The situation leads to voluntary turnover of talented personnel. The turnover can contribute to the failure of the post-merger organization (Arikan, 2004). Therefore, it is important for Metso Corporation and Mitsubishi Heavy Industries to put in place effective communication channels that will ensure that everything is above board and that all fears relating to the merger are dispersed before they worsen an already precarious situation.

Connection

When dealing with international mergers, successful connection between the merging companies is associated with successful cross-cultural integration. Connection refers to structural, relational social ties, and networks between organizations that are involved in the merger. Structural ties indicate the official organizational communication and reporting channels as represented in hierarchy of authority (Moeller & Schlingemann, 2005). In the post-merger stage, it is important to establish an organizational structure spanning the combined organizations to allow interaction between managers from both sides of the involved parties.

For relational links, the association process takes advantage of the hierarchical arrangement by going beyond its formal configuration to establish casual systems and communication links in the work environment. These relational ties are important in developing the common values, trust, collective identity, and norms of reciprocity (Angwin, 2001). Therefore, an organization should not only focus on the creation of formal structures but also on employees to establish relational ties and networks (Moeller & Schlingemann, 2005).

For instance, to undertake this process, it is important for Metso Corporation to put in place measures that will promote connection between its workers and those of Mitsubishi Heavy Industries. Some of the effective measures include scheduling of formal and informal meetings, establishing specialized taskforces, and institution of inter-subsidiary committees and cross-culture teams among others.

With the current technological advancement, other methods of promoting connections include organization wide-intranet and online chat rooms (DePamphilis, 2008). Such measures allow workforce to share information and exchange knowledge. In the process, they establish relationships that are important in creating a ‘we’ culture rather than ‘them’ and us’ The ‘us’ and ‘them’ culture is common in mergers where there is no emphasis on cross-cultural integration.

Control

Most international mergers fail to succeed due to lack of control in the post-merger integration. Companies often announce the process as a ‘merger of equals’. The indication is that the responsibilities and control of the organization will be equally shared (Angwin, 2001). However, this ‘skin-thick’ kind of approach to mergers is far from reality once the merger is completed since there must be an establishment of hierarchy of authority, which affects how control is exercised by the two organizations before the merger (Arikan, 2004). Such changes may lead to confusion among workers on who is actually in control. If not well handled, it can lead to operations disruptions and further complication of the cultural combination process that can be costly to the combined organizations.

To avoid the problem of control, it is important for Metso Corporation and Mitsubishi Heavy Industries to put in place measures that will ensure no ambiguity in terms of control. This strategy will guarantee a smooth transition. For instance, through specialized teams, cross-functional teams of managers and employees may encourage mutual socialization and relational ties, which help the workforce to understand all control processes and authority in the new organization (Datta & Puia, 2005).

For teams, control and authority are no longer factors since teams concentrate on working together to complete tasks. This unity encourages them to focus on strengths of each member rather than cultural differences among them. Ensuring that control is managed effectively leads to increased cultural integration and successful combination. Such an observation acts as an advantage rather than a barrier towards a successful post-merger organizational performance. Hence, it is important to clearly state who is in control to avoid unnecessary conflicts, which may delay or derail the successful merger of the companies.

Human Resource Implications in Mergers

The human resource department has a crucial role to play in any organization when it comes to the subject of merger and acquisitions. This department is endowed with providing the necessary advice and qualified personnel to identify, tackle, and predict any issue pertaining to the planned merger. The human factor that includes employees on both sides of the merger is very significant in the success of a merger.

According to Arikan (2004), employees give an organization an opportunity to realize its change objectives. This goal is achieved the moment they realize and truly understand the need for change. They have to engage in the change process whilst knowing the direction the change is taking the organization. As such, it is important for the employees during merger process to be actively engaged in the process. As previously mentioned, mergers and acquisitions present a period of anxiety and stress among employees.

This period is referred to as merger-emotions syndrome, which if not well handled, can throw the merger process into disarray, thus defeating the core objective of achieving better performance and higher bottom-line for the two organizations (DePamphilis, 2008). Other than just informing employees on the impeding merger, it is important for the organizations to have mechanisms of determining how such reports affect the workforce and consequently putting in place measures to alleviate the situation.

It is important for the organization to put in place measures of managing employee stress. Mergers can present a period, which is threatening, unsettling, and stressful to employees. Organizations must strive to ensure open communication to address all worries relating to future job status such as transfers, compensations, job losses, power, and prestige (Schweiger & Goulet, 2005).

For instance, the organization should carry out merger-stress financial checking to understand worker awareness on the union. It should conduct merger previews and trainings to ensure that employees are well informed and that all their fears are addressed. When necessary, it should provide individual counseling for those who have difficulties in managing stress.

Another important aspect of managing human resource is through communication. Keeping effective communication channels allows employees to know where to go and who to talk to during the process (Angwin, 2001). Further, the organization should ensure that all requisite information regarding the process is passed in a timely an efficient manner. For example, since mergers may involve laying-off of employees, this process should be done fast without unnecessary delays that may increase anxiety and stress.

Lastly, it is common for employee turnover to increase after a merger. This situation may be due to many reasons, including the inability to adjust to the new culture, organizational management processes, and other reasons. Therefore, it is important for the organization to put in place measures to increase employee job satisfaction, improve integration, and relational ties among employees whilst ensuring effective communication and control throughout the organization.

The Role of Leadership in Mergers

The leadership of an organization plays an important factor in the success of a merger process. Firstly, the leaders of an organization are actively involved in the merger discussions and negotiations of behalf of the organization. Hence, they are aware of all details and progress of such processes. Secondly, as people in position of power, they must initiate and support measures to ensure smooth transition for the organization and its human resource. Thirdly, their support for the outcomes of the discussions on the post-merger integration projects is important for the success of the combined organizations.

The leadership of the organization must be in the forefront in reinforcing organizational values. During mergers, the leadership must make it clear that the new values of the combined organizations represent an opportunity to strengthen the former values rather than an overhaul, which may lead to confusion among workers who have been accustomed to the values of their respective organizations.

Leadership facilitates a good environment through which other factors of merger integration such as cultural integration can take place seamlessly. Since they are important decision makers on resource allocations and in the approval of organizational projects, leaders must exercise sensitively an understanding of the prevailing situation in the organization and where possible allocate adequate resources that are required for smooth transition.

After all, leaders bare the greatest responsibility in the success or failure of organizational project. This claim highlights the need to ensure that all that can be done has been done for the greater good of the organization. Without support from leadership, the organizations cannot successfully go through a merger. This devastating effect will lead to a defeat of the main aim of the merger, which is to offer better financial status and improved brands among other objectives of the merger.

Conclusion

The merger process can present an opportunity for an organization not only to access new markets and financial resources, but also to improve its performance, resilience, and ability to expand to other markets. On the other hand, if not handled well, a merger can have devastating consequences on the involved organizations. Owing to the failure rate of mergers where researchers put it between 50% and 83%, it is important for an organization to take all the necessary actions to ensure it is successful.

These measures include addressing cultural difference as an important factor for the success of a merger. Further, a merger can lead to negative human resource implication, which must be addressed effectively to ensure low employee stress and increased job satisfaction. Lastly, leadership must play an active role in ensuring all the initiatives towards successful transition are successful. By taking the measures recommended in this paper, Metso Corporation and Mitsubishi Heavy Industries are likely to have a successful merger process.

Reference List

Angwin, D. (2001). Mergers and acquisitions across European Borders: National perspectives on pre-acquisition due diligence and the use of professional advisors. Journal of World Business, 36(1), 32-57.

Arikan, A. (2004). Cross-border mergers and acquisitions: What have we learned? Ann Arbor, MI: The University of Michigan Press.

Datta, D., & Puia, G. (2005). Cross-border acquisitions: An examination of the influence of relatedness and cultural fit on shareholder creation in U.S. acquiring firms. Management International Review, 35(4), 337-359.

DePamphilis, M. (2008). Mergers, acquisitions, and other restructuring activities. Amsterdam: Elservier/Academic Press.

Gertsen, M., Soderberg, A., & Torp, J. (2008). Cultural Dimensions of International Mergers and Acquisitions. Berlin: Walter De Gruyter.

Moeller, S., & Schlingemann, F. (2005). Global diversification and bidder gains: A comparison between cross-border and domestic acquisitions. Journal of Banking & Finance, 29(1), 533-64.

Schweiger, D., & Goulet, P. (2005). Facilitating Acquisition Integration through deep-level cultural learning interventions. Organizational Studies, 26(1), 1477-1499.

Uhlenbruck, K. (2004). Developing acquired foreign subsidiaries: the experience of MNEs in transition economies. Journal of International Business Studies, 35(1), 109-123.

Very, P., & Schweiger, D. (2001). The acquisition process as a learning process: Evidence from a study of critical problems and solutions in domestic and cross-border deals. Journal of World Business, 36(1), 11-31.