A Monopolistic competition is a market structure which is identified through the large quantity of comparatively small firms with the products of the firms being similar with only a slight variation to differentiate them. Therefore, the similarity in products makes the firms that exist in a monopolistic competition to be very competitive.

However, due to the fact that each of the firms has a slightly unique product compared to the rest of the firms, then each firm has a specific consumer and hence each of the firms maintains market control to a lesser extent. Examples of monopolistic competition include restaurants and clothing stores.

Features of a Monopolistic competition

There are basically four features that are used to identify a monopolistic competition. The first feature is the noticeable large amount of small firms which leads to the production of comparable products which are however not alike in detail (Ison & Wall, 2006). The mobility of a monopolistic competition is more or less excellent but it does not amount to the ideal resource which therefore makes it widespread but not perfect in comprehension of products to the consumer.

Large Number of Small Firms

In a monopolistically competition, almost every production business has a large number of small firms (Ison & Wall, 2006). The size of each of the firms is comparatively small when compared to the extent of the market as a whole.

This therefore means that all the active firms more or less compete against each other for consumer attention and since the firms are many and are all successful in producing the needed products, then each of the firms controls a small market share thus have limited control over the market price or the number of products in the market (Colander, 2008).

Relative Resource Mobility

Firms in a monopolistic competition are free to go into or go out of a production business venture especially when compared with a perfect competition or a monopoly (Pindyck & Rubinfeld, 2001). The rules governing the operation and the general business of the firms in a monopolistic competition are relatively few or none.

Such firms are for the most part free of government interference, a standardized system, operational policy and are at liberty to raise their own capital and endure start-up costs without facing any stern obstructions from the government or other firms (Ison & Wall, 2006). This therefore makes the firms less mobile in an ideal threshold especially when compared with the mobility of a perfect competition.

Extensive market Knowledge

In monopolistic competition, consumers have reasonably comprehensive knowledge about the prices of different products as well as the fairly complete information regarding the subtle differences in the products for example color, brand names among others(Pindyck & Rubinfeld, 2001).

On the other hand, sellers of the products also have reasonably inclusive information in relation to production methods which affect prices and hence sellers are also aware of the prices of their competitors’ products (Pindyck & Rubinfeld, 2001).

Similar Products

The firms in a monopolistically competitive market produce analogous products which are however not completely identical (Colander, 2008). This makes each of the firms and the products to aim at satisfying very similar basic want or need.

Therefore, the products that are put into the market by these firms are near proxies and are very comparable but are nevertheless not perfect substitutes (Ison & Wall, 2006). Even though the products might in actual sense have substitutes or slight physical differences, consumers of the products are the only ones who might perceive them to be different because the similarities between the products are usually more than the differences (Pindyck & Rubinfeld, 2001).

Therefore, firms in a monopolistically competition at any given moment have a great number of potential competitors since the products are usually almost the same and at the same time have a great number of potential consumers who are currently buying the competitors’ products.

Reason why monopolistic competitive firms can only make normal profits in the long term

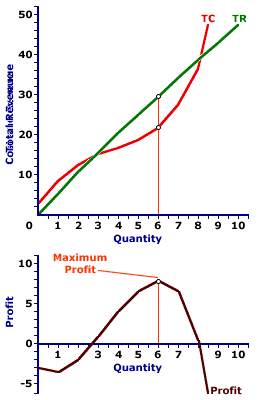

A firm in a monopolistic competition increases on the profit by opting for the output that creates the maximum difference between the total income line and the total cost line. However, over the long run, a firm produces less output and charges a higher price which is even greater than its marginal cost (Pindyck & Rubinfeld, 2001).

The difference in price and marginal cost effectively goes against the vital order of efficiency because income is not being utilized to create the utmost level of consumer satisfaction. The graphs in Figure 1.1 represents the trends of such;

Fig 1.1: Marginal Revenue Curve and Operational Barrier Curve by (Chamberlin, E. 1999).

TC= Total Cost

TR= Total Revenue

This leads to inefficiency which is basically caused by the minimal market control monopolistically competitive firms have over the overall market, and hence most of the firms experience a negatively-sloped demand curves where price is greater than marginal revenue where the price is placed equivalent to marginal cost in order to maximize profit (Figure 2).

Therefore, as firms continue to receive income through sales, the income is translated into production in order to produce more goods of higher quality to satisfy the market needs (Ison & Wall, 2006).

Furthermore, monopolistic competitive firms can only make normal profits in the long term because they only control a small portion of the market which cannot be expanded due to the presence of several competitors (Colander, 2008). If the firm were to produce superior quality goods, then the cost of production would be at a similar ratio to the percentage sales hence the profits will be normal in the long run.

Conclusion

A Monopolistic competition is the toughest yet most common market structure due to its relatively unregulated mode of operation. It is also quite simple to establish a firm in a monopolistic competition as compared to other market structures. Firms that operate in a Monopolistic competition each have a small portion of the market in their control and hence due to the dissimilarity in product, neither of the firms has control of the price of the products hence the price becomes market driven.

References

Chamberlin, E. (1999). A Supplementary Bibliography on Monopolistic Competition. The Quarterly Journal of Economics, Vol. 75, No. 28, pp. 629-638.

Colander, D. (2008) Microeconomics. 7th Ed. London: McGraw-Hill.

Ison, S. and Wall, S. (2006) Economics. 4th Ed. New York: Financial Times in assoc with Prentice Hall.

Pindyck, R & Rubinfeld, D. (2001) Microeconomics. 5th Ed. New York: Prentice-Hall.