Internal Analysis

In 1995, Mr. David Walsh acquired the Moorilla Estate in Hobart, and by 2005, the business had incorporated iconic brands with the Aim of becoming Australia’s most respected wine-producing Estate, although the company is not among the industry top ten wine producers in terms of revenue or tonnage the company boasts of superior wine production and maturation technologies led by Conor van der Reest who is Mooralla’s winemaker.

Cornor Van Der Reest is an experienced winemaker who has gathered a lot of experience as far as winemaking is concerned and has a lot of knowledge as far as conventional wine preparation techniques are concerned with a lot of talent and skill with current emerging bio-dynamic techniques which are commonly used in cool climatic regions such as Tasmania (Moorilla 2011).

With Van Der Reest on the helm of premium wine development and manufacturing then Moorilla is most likely to produce elegant premium wine that has an elegant taste and can compete equally in the Australian wine industry. The company has relatively adequate resources to pursue its goals and objectives.

However, competition slows down the growth capabilities and the ability of the company in the Australian market like other well-established companies (Baumol & Alan 2007, 16). The Estate is headed by well capable leaders who are able to see that the vision of the company is achieved and this is why the company has been growing rapidly since 1995 and has expanded its business to other industries such as the restaurant and beer industry in order to tap into the market that exists in Australia (Moorilla 2011).

Moorilla Estate has sufficient human resources and uses conventional recruitment strategies to acquire highly talented individuals who will assist the organisation in all the businesses that it pursues, especially when it comes to wine making the chief wine maker, Van Dar Reest makes sure that the company gets enough skilled man power who will assist the company to produce the best vintage wine through ensuring that the company adheres to the latest production technologies available in the market to mature and even package their wine.

The current number of permanent employees who have experience in dealing with wine stands at over 20 while the company also has temporary staff of over 50 employees who occasionally tend to the vineyards and assist in the process of placing wine in casks for maturation (Moorilla 2011). The company’s culture has gone a long way in ensuring that a high degree of professionalism and quality standards are adhered to.

External Analysis

General environment

With Australia being the fourth-largest producer of wine-producing slightly over 750 million litres of Wine the countries wine industry is characterised by and superior wine manufacturing techniques that make the industry a competitive participant that makes over $ 5.5 billion annually from the sales of branded and premium wine (Winebiz 2011).

According to the ABS, total Australian domestic sales, including imported wines, went up by over 4.7% during 2010 to 535 million litres. The domestic sales of wine within the borders of Australia went up by 4.66% and 470 million litres were sold and consumed by consumers within Australia (Winebiz 2011). The bad news is that the market share of domestic wines relatively reduced as compared to imported wines which increased their market share in Australia.

In this period the total percentage of market share that went to domestic wines was 88% while imported wine 12% unlike previously where domestic wines enjoyed a market share of over 90%, this fact can be attributed to the aggressive marketing nature of foreign wine companies (Winebiz 2011).

The Sales of Australian-produced fortified wines did not register any growth, but the sales of red together with white table wine and sparkling wines also went up, this fact has been attributed to the fact that these wines go better with meals and social occasions thus triggering high demand rates.

The Australian wine industry also experienced significant growth in the vermouth, carbonated wines and flavoured wines including cocktails wines, un alcoholic wines, and low alcohol content wine. This class improved by 33.9% in 2010 and thus represents approximately 4% of the total wine sales in Australia (Winebiz 2011).

The Australian wine market is, therefore, a good industry that has most of its wine subcategories still growing with the exception of fortified wine. Growing companies which like Moorilla estate can, therefore, be assured that there exists a good market within and outside Australia and those strategies must be developed to gain market share.

Competition

The level of competition within in the Australian industry is quite stiff with only a few companies taking up a massive part of the markets share this may be due to the fact that these companies come from a lineage of winemakers who have been in this business for decades and possible centuries.

These companies that have operated in the industry for so long have to build up names and trust among the indigenous Australian market and international community overshadowing upcoming companies thus making it hard for these companies to be able to penetrate the market (Trott, 2008, p.144; Porter, 1990, p.81).

There are over 2,477 wine-producing companies which commercially operate in Australia with the number of producers and participants increasing by 2.4% annually. The number of companies existing in the Australian wine market usually doubles up every decade. Accolade Wines, Treasury Wine Estates and Casella Wines are accountable for approximately 75% of exported Australian wine by volume.

Accolade wines have taken the spot that was previously occupied by treasury wine estates in exporting branded wines while Warburn Estate is one of the few companies that has managed to penetrate the export market and is thus coming up quickly and gaining market share despite accolade wines leading in volume of exports. Treasury wines still boast of being on top of the list of largest exporters in terms of value.

Moorilla Estate is not among the top ten companies in terms of value and volumes due to the fact that the company has been in the wine industry for a shorter period and hasn’t created brands that can be equalled to those of companies such as Accolade and Treasury wine estates (Winebiz 2011).

According to wine biz 2010 the largest producers for domestic and export market wine in Australia are Accolade Wines, Treasury Wine Estates, Casella Wines, Pernod Ricard Pacific, Australian Vintage, De Bortoli Wines, and McWilliam’s Wines Group, Andrew Peace Wines, Warburn Estate, Kingston Estate Wines, Nugan Estate, The Yalumba Wine Company, Peter Lehmann Wines, Littore Family Wines, Angove Family Winemakers, Brown Brothers, The Tahbilk Group, Wingara Wine Group, Grant Burge Wines, and Tyrrell’s Vineyards.

One characteristic of these companies is the fact that these companies are very aggressive in terms of marketing and that they produce high quality elegant tasting wine, thus giving them some degree of competitive advantage over other companies.

The Customer Environment

The proposed chateau targets high-end customers who are rich, college-educated babyboomers. These ideal consumers have wine as part of their everyday lives and enjoy going out, and often entertain friends or business partners. Customers naturally become wine educated through classes, literature, and just by taking wine. The company’s second customer target is made up of business individuals and entities; far most wholesalers and distributors.

Wholesalers act as middlemen for distributing wine to leading restaurants and wine shops situated all over Australia. The second business category the winey is targeting is in-state restaurants executives and sommeliers. The third business category is in-state speciality wine shops, which focus on carrying first-class wine.

Demographic trends

Australian wine industry specialists explain that the tremendous growth in the high-end wine market is due to the ageing babyboomers. Baby boomers are heading towards their prime drinking age and this class of customers is predicted to raise high-end wine consumption for a period of time.

Each day in Australia, close to 50,000 individuals celebrate their fiftieth birthday and 50 to 59-year-olds take 16.5 bottles of wine each year as compared to 6.8 bottles each year for the 21 to 29-year-olds. Majority of these babyboomers are wealthy and can comfortably spend luxuries, such as high-wine wines.

The important players in the purchase process for the firm’s products are; Purchasers/distributors (actual act of purchase), users (actual product user), influencers (influence the decision and make recommendations). The purchase or distribution channel has a significant influence on the price the company will receive for its products.

Wholesalers and distributors discounts are clearly stated, and these discounts greatly reduce the winery’s profit margins. Tasting room and in-state direct mail sales are the only ways through which the producer sells directly to wine users and charges retail price. Direct sales to eateries and wine shop owners are made at wholesale prices that are two-thirds of the retail prices.

The winery mainly targets high-end consumers and this might fail to go along way with low-end consumers. The target consumers are wealthy sophisticated individuals and the winery needs to build a brand name within the target consumers, it has to sell its products at a premium to enable the high-end identify themselves with the product.

The winery’s products are of top-notch quality and that is why they are charged at a premium and the company cannot compromise the quality of its products or brand name at the expense of attracting non-customers. The competing products are a big challenge to the winey to penetrate. However, majority are able to keep the market share considering that they have been in the industry some even for a century.

Also, some offer low-end products and since that is not our market niche, they hold the winery’s non-customers. Majority of wine consumers in Australia prefer fortified wines red wine, white table wine, sparkling wines, flavoured wine and low alcohol wine and non-alcoholic wines. Due to the social nature of Australians than the country’s premium branded wine market is constantly on the growth rate and consumers spend close between $ 20 and $60 per bottle depending on occasions on wine (Winebiz 2011).

The Australia adult population also consumes a lot of red and white wine after meals, thus prompting winemakers to market wine on this platform. The premium wine market is thus becoming a very important business for wine producers and these companies are dedicating a lot of effort and manufacturing the best branded and tasting wines and introducing them to the market (Johnson, Scholes & Whittington 2008, 43).

The levels of disposable income amongst Australians is high thus meaning that Australia is the type of market which consumers can indulge in the purchase of luxury goods thus getting a share of it is a quite an attractive business segment for all the winemakers in Australia.

Although premium wine is meant for a targeted group of consumers more and more consumers within the Australian market are indulging in drinking premium wine due to the fact that they are attracted to the high quality of wine that premium brands are known to offer to the market such wines come in brands such as Pinot, Syrah, Chardonnay, Brut and Rose which are among the highest consumed brands of wine amongst the customers in Australia.

Core Business

Drinking wine is part of the culture of people of Australia thus making the wine business quite an attractive market, especially owing to the fact that the country in 2009-2010, calendar purchased and consumed well over 500 million litres of wine. The premium wine market is expanding within Australia and internationally and it presents a lot of business opportunities in both the domestic and export market.

Moorilla estate thus intends to operate successfully within this portion of the industry and cash on the opportunity by manufacturing, branding and selling elegant premium wine brands. The company possesses the muse and praxis series of wine which has been developed using the latest conventional bio-dynamic strategies making their wine highly superior in terms of taste and quality. It is thus the aim of Moorilla estate to cater to the needs of consumers who desire to have high-quality premium wine in Australia.

Swot analysis

Internal Environment

The internal analysis of a company basically focuses on the strength and weaknesses of the organisation itself, and how they impact the total business scenario of the concern and company strategies (Wheelen and Hunger 2002). In this aspect, one thing is very important, what can be determined as strength can change into the weakness in another aspect.

There are factors like finance, marketing, and the service providing capabilities, the macroeconomic factors, the technological changes and most importantly the different legal matters that come with the maintenance of the properties (Campbell, D., et al, 2002.p.64)

Strengths

A key strength of the Moorilla is expected to come from the highly experienced Chief winemaker Van Dar Reest and his team of winemakers who have the necessary skill and knowledge together with bio-dynamic technologies to make superior wine. The winemaker is expected to import their wide variety of knowledge that he has gathered over the years and apply it into wine business to make Moorilla estate become successful.

The current organisational culture of Moorilla estate is very suitable for their business mission, vision and strategic goals, the company’s top management has built his business on the platform of delivering highly differentiated products and premium wine thus this platform will assist the company to create a favourable brand image.

The fact that the company has its own vineyards and enough human resources to nature a wide variety of vintage and youthful grapes and other fruits which are used to make their wine is also strength of the company (Moorilla 2011). The fact that the company has a wide variety of selection under their muse series and praxis series together with vintage collection ultimately serves as strength to the company.

Weaknesses

Constraint financial resource may limit the level of growth that Moorilla may intend to achieve during its operations, since other competitors such as Accolade and Treasury and Casella wine estates are able to operate with a more aggressive business model giving these companies a competitive age (Winebiz 2011).

The current marketing strategy of the company and wine manufacturing facilities are not large enough to increase the revenue and volume of wine sales, thus reducing the activities of Moorilla estate to the Tasmanian region. The company also does not have a superior distribution strategy, thus having a limited distribution capability as compared to the top 20 wine-producing and selling companies which operate in Australia.

External environment

Strategic planning be it short or long term is done in the light of company’s strength, weaknesses, opportunities and threats (Sinkovics & Ghauri, 2009, p.177). A company’s strengths and weaknesses take a critical look into internal factors such as company resources, culture and structure while on the other hand opportunities and threats take a look at a company’s external environment.

Opportunities

The Australia wine industry is worth over $5 billion, thus making the industry quite attractive if a company uses the right approach, then it will most likely step upon its activities. Due to the company’s limited resource situation, the company can enter into contractual agreements with other well-established companies locally within Australia or even internationally this way the company can be able to increase the volume of sales.

The current marketing weaknesses of the company can offer a platform of improving their business only if the company invites independent marketing firms to audit their current systems and suggest a complete overhaul of their marketing strategy (Lancaster & Withey 2006 p.43-32).

Threats

The increasing level of competition within the Australian wine industry can threaten the strategic path of Moorilla estates, it is thus up to the companies not to let competition within the industry get out of hand, and this can be achieved by competing cautiously. Foreign brands also pose a threat to the business of Moorilla and thus effective marketing strategies should be used to counter the moves made by these foreign brands ( Hedley, 2002,p.16-19).

Objectives and goals

The first and main goal of Moorilla Estate is by 2014 to be enlisted among the top twenty wineries companies in the Australian market by increasing its wine production volumes and sales values. This can be attainable by adopting a more proactive business model that will allow the company to be more vigorous.

The current business model limits the company’s business to Tasmania but the company needs to form partnerships with other companies in order to increase the sales of the company over a period of 3 years. The company with therefore need to invest more in marketing communication in order to create a suitable brand image that will make the company’s wide product range more known to the public.

Considering the tremendous reception of the winery’s products in the Australian market, with more aggressive and proactive marketing strategies the company can go far. The second goal is to grow its brand recognition among its potential consumers and make Moorilla Estate a household name. The brand value associated with the muse series and the praxis series brands is quite low as compared to that of leading competitors within the industry.

The management of Moorilla Estate aims to ensure that the brand is among the top 20 brands within the Australian wine market. The management believes that if this is attained then the level of brand association between the company and its brands will automatically increase the demand levels of all their brands within the Australian domestic and the export market.

This can thus be achieved by massive promotion campaigns and partnerships such as sponsorship of events that will create massive awareness that is good for the strategic goals of Moorilla. Many successful organisations often have cost management strategies that are very suitable for their organisations making it quite easy for the company to reduce costs and maximise income.

Moorilla Estate third goal aims at keeping its costs low by eliminating any unnecessary costs, this way the company can make more money and these funds may be used to invest in research and development of wine and expanding their business model.

This can be attained by operating using budgets and focused planning techniques that will allow the company to optimise their resources and working with a trimmed staff that will assist the company fro spending a lot of unnecessary labour costs. Cost utilisation can be measured by the profit margin and the returns on capital of the company.

Proposed Marketing Mix

Pricing

A penetration and Skimming policy could be implemented by the management of Moorilla estate to price their premium wine products in order to gain ground fast in the market while at the same time maximise revenue streams at the higher end of their premium products ( Bennet,2006,p.80-87).

Some of the high end premium products that sell for over $40 per bottle include Muse series’ Brut, Rose, Chardonnay, Pinot Noir, Syrah, while those premium products on the lower end which can be priced using price penetration strategy include Gewürztraminer, Pinot Gris, Rieslin and Praxis series’ Riesling, Sauvignon blank, Chardonnay, Vintage Riesling Brut.

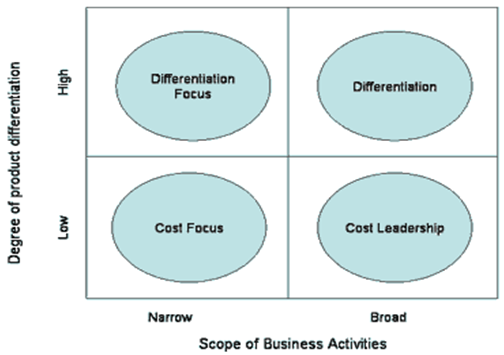

This pricing strategy is intended to undercut the price offered by competitors for similar products but ensuring that quality of wine is not compromised. This pricing approach will allow Moorilla to have a competitive advantage by selling premium products and competing using both a differentiation and cost focus at the same time by selling high-quality brands which have respect and a good name it the market.

Thus when consumers have more money to spend on a single purchase of wine they can purchase the higher end of premium wine offerings but once they are tight on cash, the consumers can henceforth purchase those products that are on the lower end of the premium offering of the Muse and Praxis series.

Product

Moorilla marketing department has ensured that superiorly designed bottles are used to package their wine products. Considering that packaging plays a very big role towards ensuring that consumers attention is captured then the wide variety of brands under Moorilla are well designed to ensure that their products have the right appeal as compared to offerings of competitors ( Brassington, & Pettitt, 2006,p.65)

The packaging used it Moorilla estate variety of wins are not a danger to consumers and to the products inside the bottles the products can be even bought and stored for years in order to become vintage wine. The company currently bottles their wine in 750ml and 1litre bottles.

Promotion

Promotions a very important part of commercial success and therefore, Moorilla Estate must invest enough resources to ensure that Promotions run properly and all brands under Moorilla get the right amount of exposure. A good promotional mix should always target the consumers and resellers (Holm, 2006, p 69).

Consumer promotional activities encourage consumers to buy more of the product. It is thus necessary that most of marketing communication effort be directed to the right audience through the mass media and the marketing portals, with more information being displayed and exposure being repeated then the brands belonging to Moorilla estate well be better known and then chances of their sales going up will be increased ( Heding, Charlotte & Mogens, 2009,p.67-71).

With social marketing becoming more and more famous the internet through blog sites, Facebook and Twitter is also a reliable source for customer information that is more likely to spread credible information about the brands belonging to the company and thus increase consumer traffic in local stores and on the online purchase centres (Balmer & Greyser, 2006, p. 736; Brown, 2006, p.23).

Seasonal discounts and offers are also a very important part of promotion, hotels are a very important part of the supply chain of premium wine and thus Moorilla estate should work in partnership with the biggest hotels and approach customers with discount rates this way those consumers who will purchase their brands are more likely to notify their friends by word of mouth if they are impressed by the elegant taste of the muse and praxis series.

Place/distribution

The volume of sales is often influenced distribution networks that companies have developed over the years, if a company does not use the right channels to distribute their product then a company is most likely not to optimise their sales (Goodstein, et al. 1993,p.153) The fastest-moving places for wine are hotels, supermarkets and liquor stores it is thus the duty of the marketing department get in partnership with the most respected retailers and wholesalers such as supermarkets, hotels and liquor stores in order to ensure that products belonging to Moorilla estate are repeatedly exposed in areas that are open to the to higher numbers of consumer traffic.

Besides using stores, Moorilla also uses direct marketing techniques that allow consumers to order their products directly from their website and have their orders delivered to the door step this way the company can make sales without the help of other middlemen and other institutions ( Kotler & Keller, 2006, p.279-282). It is thus the intention of Moorilla estate management to ensure that the company is able to use all the available channels of distribution because this way the company will be able to maximise the total volume of products and brands belonging to their Estate in the market.

Process

The production process that go min developing wine is very particular and goes a long way into defining the taste and flavour of wine. Many consumers of wine are very particular and are more likely to be annoyed or highly dissatisfied if their favourite brand of wine taste different just because the due process of manufacturing their wine was not followed (Charles, W. et al. 200, p 211-213).

It is thus very important for wine manufacturers put in place the right mechanisms to ensure quality standards are followed and that consistency manufacturing is assured (Balmer & Greyser, 2006, p. 734-738). This is thus why Moorilla estate ensured that it acquired on of the best winemakers Van Der Reest to lead their wine production process.

Experienced winemakers such as Van Der Reest use analytical chemistry techniques such as titration and measurement of PH levels to group wine while still in casks. Labelling of casks and grouping them according to time to maturity and fermentation together with ingredients and clear documentation and techniques are very important part of ensuring that the final products elegant and of precise taste.

Failure to ensure that the right process are followed before the product hits the market then the final product is more likely to fail in the market because consumers will be displeased by it due to the fact that the taste/flavour may not meet their expectations.

Implementation

The entire marketing program is to be monitored every year and the full results are expected to see after three years, during this period of implementation the Moorilla estate should put in place an implementation committee that will be used to monitor the implementation process closely with the aim of putting the entire process on track. The implementation process usually requires a company to provide enough resources in order to ensure that strategy implementation is successful.

The top management understands that implementation of strategy is often met with resistance and thus the first step of the implementation stage is to encourage organisational personnel to embrace change by sensitising them on the need of the change and giving them positive attributes that are to arise put of the change this is because human resource is the most important resource of the organisation and thus when they are ready to embrace the change, then the chance of success is more ( Felkins et al. 1993,p.55).

The goal, in this case, is objective of the marketing department and management in Moorilla estate is to make the company a common name within the wine industry of Australia by building the brand value of Moorilla estate wine brands. If the company is to achieve its first goal, which is to be among the top 20 wine producers in Australia, then it needs to dedicate significant resources that will see the success of the strategy.

The company will need to develop a competitive intelligence unit that will be given the sole responsibility of conducting continuous research and forwarding relevant information to the implementation committee of the company. The establishment of this committee will, therefore, require financial and human resources together with procedures detailing how they are to work (Brigham & Houston 2009, 91-93).

Additionally, marketing communication activities often demand that a company develops a public relations office and thus it is important the company hires or creates and internal public relation office that will be in charge of publicising the company through the various media especially the social media and cheaper avenues of gaining publicity.

While the responsibility of creating publicity will be assigned between the competitive intelligence department, the marketing department and the newly formed PR department, It is up to the management to keep a close eye on the activities and ensure that incremental processes that are consistent to the goals are carried out in due time.

Those responsible of achieving the various goals are supposed to use findings of their research that they may have gathered from published sources and credible competitors due develop tactics that they will use to ensure that the company increases its brand value steadily.

Although the long term goal is building brand value and make Moorilla estate brands popular, it is only logical for those implementing the strategy that they need to use incremental steps in order to achieve the long term goal and this can be achieved by increasing the amount of media coverage and hits that the company has on their websites (Kotler 2003, 278).

The company can also sponsor large events or local sports teams, and trade exhibitions and billboards to create curiosity among the community and especially Australia and this way the company can start gaining exposure and building their brand value slowly one stem at a time. The important thing is that managers use controls that will assist the company operate with a high level of consistency increasing repeated exposures.

At the same time, the company should develop good channels of communication that will assist the managers to communicate the progress of the implementation to the employees and to ensure that every member who is part of the team and workforce plays his part towards achieving the goal. If communication is poor, then a company may often delink itself from its corporate strategic goals, therefore, injuring the performance of the company both financially and non-financially goals (Wheelen & Hunger 2002, 221).

Moorilla estates should ensure that the company develops a direct means of communication where the company that will link those responsible of decision making with the employees who interact day-in-day-out with the customers and other industry participants. The progress of strategic goals can thus be measured by using a balanced scorecard approach. By comparing targeted goals and actual performance at specific periods i.e. (Q1.Q2.Q3.Q4) the implementation committee can evaluate strategy with the aim of initiating change.

Evaluation and control

Morilla Estate will adopt a balanced scorecard approach to evaluate, monitor and justify any corrections in strategy within organisations (Wheelen & Hunger 2002, 303). The main advantage of a balanced scorecard approach is that it uses both a financial and non-financial approach to measure strategic success of an organisation, by comparing input of various processes and outputs.

Since Moorilla estates aims to gain brand recognition and increase its brand value hoping to trigger associative purchases to its brands, it is thus the duty of the implementation committee to measure the actual results of their strategic efforts quarterly per year and if the actual outcomes surpass the targeted outcome then there will be no need to carry out any strategic changes but if the actual outcome falls below the actual planned performance then there will be needed to change or alter the strategy (Frey 2008, 32).

BSC is a highly effective strategic performance management tool that enables managers to take a critical look on how appropriate the marketing strategies that will be put in place by Moorilla estate management is to achieving their goals. The BSC approach allows managers to review strategy by taking an in-depth look at how the organisation performed especially when it comes to financial parameters, customer parameters; Internal business processes parameters and learning and growth parameters of the organisation.

If the brand value of this brand goes up, then there will be financial consequences, customer consequences and other consequences and this can be used as the key indicators that can be used to evaluate if the strategy that was put in place was effective and good enough to help the company realise its goals. This is the approach that will be used by management within Moorilla estate to control and evaluate how the organisation performed strategically.

Assuming that all goes well then the company will be pushed into a better financial position and thus the company will realise a growth in sales and revenues because of increased customer traffic but if the opposite happens then this will mean the there is something wrong with the strategy that aims to increase brand value of wine products belonging Muse and Praxis series to Moorilla estate.

The same applies to the customer aspect of the BSC if Moorilla is able to meet its brand value objectives customers are more likely to be satisfied and there will be less customer complaints, the results of such a phase will include high customer rates and low customer defection rates and hence if the latter happens the company is most likely to blame the current strategic regime for the failure in achieving targets (Steiner 1997, 77).

The outcome of the BSC process is used by management in Moorilla estate to justify the need of carrying out any strategic changes in the company within the marketing strategy (Koontz & Weihrich 2009, 132).

A table representing some of the BSC parameters that are used by Moorilla estate to evaluate and control strategy.

References

Balmer, J.T.M., & Greyser, A.S., 2006. Corporate Marketing; Integrating Corporate Identity, Corporate Branding, Corporate Communications, Corporate Image And Corporate Reputation. European journal of marketing, vol 40 issue: 7/8 pp. 730-741.

Baumol, W.J. & Alan, S.B., 2007. Economics: Principles and Policy. New York, NY: Cengage Learning.

Bennet P., 2006. Marketing Management and Strategy, 4th edn. New York, NY: Prentice Hall.

Brassington, F. & Pettitt, S., 2006. Principles of Marketing, 4th edn. New York, NY: Prentice Hall.

Brigham, E.F. & Houston J.F., 2009. Fundamentals of Financial Management. New York, NY: Cengage Learning.

Brown, B.C., 2006. How to use thee Internet to advertise, promote and market your business or website—with little or no money. New York, NY: Atlantic Publishing Company.

Campbell, D., et al, 2002. Business Strategy an Introduction, 2 edn, Banbury Rd, Butterworth-Heinemann.

Charles, W. et al. 2002.Essentials of Marketing, Natorp Boulevard, South Western Cengage Learning.

Felkins, et al. 1993. Change Management: A Model for Effective Organizational Performance, Quality Resources. New York, NY: White Plains.

Frey, R.S., 2008. Successful strategies for Small Businesses: using product knowledge, 5 edn, Norwood, Artech House Inc.

Goodstein, et al. 1993. Applied strategic planning: a comprehensive guide. New York, NY: McGraw-Hill Professional.

Heding, T., Charlotte K.F. & Mogens B., 2009. Brand management: research, theory and practice. New York, NY: Taylor & Francis.

Hedley, B., 2002. A fundamental approach to strategy development. Long Range Planning Vol. 9, no. 6 pp. 2-11.

Holm, O., 2006. Intergraded marketing communication: from tactics to strategy corporate communication objectives. An international journal, vol11, iss 1 pp. 22-33, emerald publishing group.

Johnson, G., Scholes, K. & Whittington, R., 2008. Exploring corporate strategy: texts and cases, 8th edn. Boston, MA: Pearson Education Limited.

Kitchen, P.J., 2005. A reader in marketing communication. London: Routledge.

Koontz, H. & Weihrich, H., 2009. Essence of Management an International Perspective. New Delhi: Tata McGraw Hill.

Kotler, P., & Keller, K., 2006. Marketing Management, 13th edn. New York, NY: Prentice Hall.

Kotler, P., 2003. Marketing Insights from A to Z: 80 concepts every manager needs to know, New Jersey: John Wiley & Sons Inc.

Kourdi, J., 2009.Business Strategy: A Guide to Effective Decision Making, 2 edn, New York: Economist books.

Lancaster, G. & Withey, F., 2006. Marketing Fundamentals: CIM Course book, London: Butterworth-Heimann.

McDonald, M., 2003. Marketing plans: how to prepare them, how to use them, 5th edn. Oxford: Butterworth-Heinemann.

Moorilla. Web.

Porter, M.E., 1990. Competitive advantage, illustrated edn, Northampton, MA: Free Press.

Ring, P. & Perry, J., 1985. Strategic management in public and private organizations: implications and distinctive contexts and constraints. Academy of Management Review Vol 10, pp. 276-286.

Sinkovics, R. & Ghauri N.P., 2009. New Challenges to International Marketing. London: Emerald Group Publishing.

Steiner, G., 1997. Strategic planning: what every manager must know. New York, NY: Simon and Schuster.

Trott. P., 2008. Innovation Management and New Product Development, 4th edn. London: Pearson.

Wheelen, T.L., & Hunger J.D., 2002. Strategic Management and Business Policy. New Jersey: Prentice Hall.

Winebiz. Web.