Executive Summary

As the Marketing Manager of WM Morrison Supermarkets, it essential to critically review the current marketing and promotion policies of the company regarding its existing product line in order to ensure flawless operations and efficient performance of the relevant responsibilities of a manager. The purpose of this report is to prepare a marketing plan to amend, improve, and extend the existing policies and practices of Morrison Supermarkets and develop a promotional policy in due course; so, the report first outlines a brief company overview, reviews the current operational model, identifies the key problem of the business, and analyses the strategic report.

Subsequently, the report prepares justification for launching the new product and extending the product range and assesses the major marketing opportunities for the new product, whilst generating a marketing plan by constructing industry and market analysis, external macro analysis, and competitive analysis, and evaluating Porter’s five forces model and the key marketing objectives.

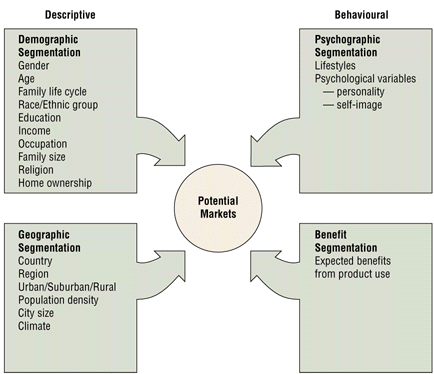

In addition, the paper also considers the segmentation, targeting, and positioning of the new products, whilst assessing the demographic, psychographic, and geographic segmentation, and appraising the benefits of such segmentations; conversely, in order to better understand the market, this paper also prepares a consumer profile and formulates the marketing strategy, product positioning, and perceptual mapping, and delineates the BCG matrix. The report also defines the adoption placement, FAB marketing, marketing communications process, marketing mix variables, promotional strategy, costs and marketing budgets, and contingency considerations for Morrisons Company.

Introduction

Being the fourth biggest retail chain, Morrisons competes aggressively in the UK’s retail industry, which is chiefly characterized as an oligopolistic market; in March 2004, the company took over Safeway (a major retail chain with 479 stores), and in June 2015, it ensured a market share of eleven percent; moreover, it generated a revenue of £16,317 million until January 2017.

Company Brief

Morrisons was established in 1899 by William Morrison, with headquarter in Bradford, West Yorkshire; today, it is a major retail supermarket chain in the United Kingdom and its product range includes Morrisons-branded chicken, eggs, pork, milk, beef, and flowers; in addition, the company possesses food-producing facilities for bringing fresh bakery, deli, lamb, fruit, fish, and vegetables to the stores. There are about five hundred outlets by which Morrisons serves the consumers throughout the UK, and the organization has also developed corporate websites for offering e-commerce facilities and online home delivery services; in addition, it runs more than ten production plants throughout Britain along with seven local distribution centers and a national center for assisting the major supermarkets (Reuters 2017).

Overview of Current Operational Model

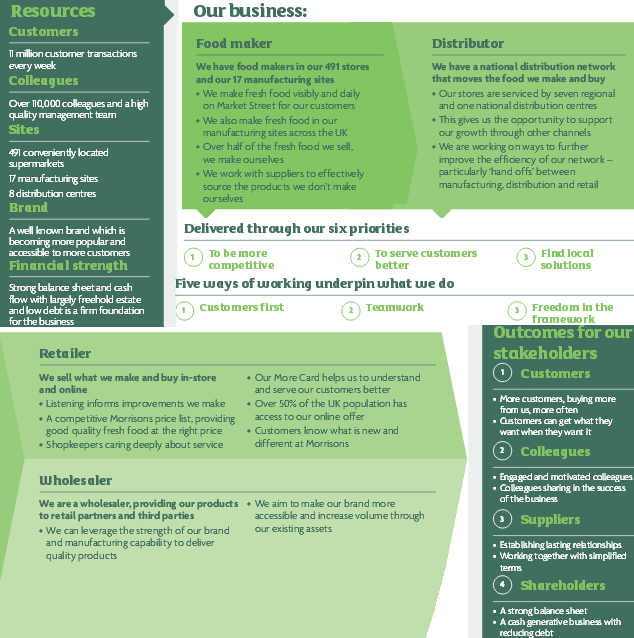

The company has designed its current operational model by categorizing its activities in four distinct levels; firstly, it works as a food producer to make fresh foods visible to the final customers; secondly, it serves as a distributor of the products from the manufacturing plants to the retail outlets to ensure the efficiency of the network (Morrisons 2017). Morrisons also emphasizes on two other roles it plays in the industry, which includes the most crucial role of a retailer (selling products from the outlets or via the eCommerce sites), and working as a wholesaler (for delivering its branded items to its retail collaborators and third parties upon relevant request); the following figure briefly illustrates its current operational model:

The Problem

The most critical problem of the company is that Tesco is its biggest competitor having a huge market share. Therefore, Morrisons must constantly seek new ways to grasp a bigger share of the market either by expanding its presence within the UK or by extending its current product line and launching new or innovative products in its portfolio, so that a greater consumer base can be ensured. However, there are some other internal corporate problems as well; for example, the business has lost the connection with its roots, disrupted its pricing policy, and created some customer dissatisfactions, whilst making a delay in entering the convenience market and online selling system (SkyUK 2017).

Strategic Report

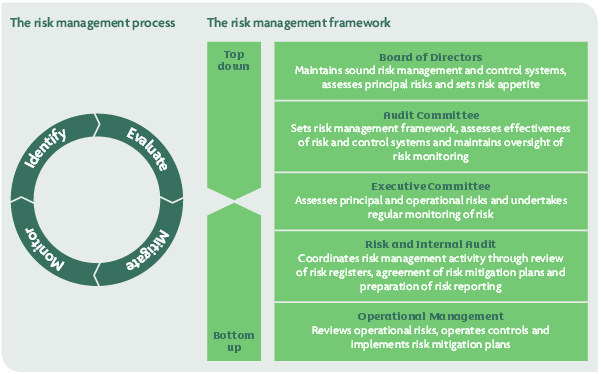

The strategic report of Morrisons published earlier this year suggests that there are a number of strategies the company shall adopt from now on; for example, it should be more competitive in the market, and should better serve its consumers through numerous policies, whilst emphasizing on identifying local solutions, building teams, ensuring freedom and democracy, and controlling costs:

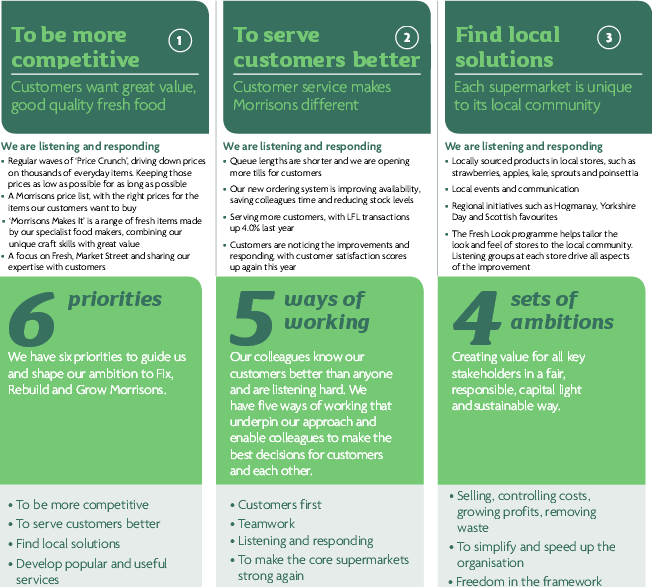

The company has also undertaken risk management strategies to boost its internal capabilities to make better ‘risk-informed’ decisions; the key elements of the risk management framework have been demonstrated in the figure below:

Justification for Launching the New Product and Extending the Product Range

The UK’s grocery and retail industry are highly competitive, even though it consists of only a handful of market players (such as Tesco, ASDA, Sainsbury’s, Aldi, Lidl, and Waitrose); as a result, it is particularly essential for Morrisons to find new strategies not just to sustain in the market, but also to create a stronger customer base and larger market share.

This is the justification for Morrisons to launch, amend, improve, and extend its existing product line – in fact, according to the latest annual report of the company, this year; it is looking forward to launching new products like Free From, vegan, and low-sugar products for health-conscious consumer groups (Morrisons 2017).

Major Marketing Opportunities for the New Product

Morrisons would be launching new products like Free From, vegan, and low-sugar items in order to extend and improve its product ranges, and amend its existing product line with more organic items – this indeed poses great marketing opportunities for the company, since the number of health-conscious people in Britain is increasing rapidly in recent years. It has been reported that in last ten years, over 360% people in the United Kingdom has chosen a fully vegetarian diet, mainly due to the recent scientific indications supporting the idea that vegetarian lifestyles can have a substantial range of advantages on human health over the longer term (Quinn 2016).

On the other hand, whilst the demands for these kinds of products are high, their availabilities in the nearby supermarkets are comparatively lower in the downtown neighborhood stores. As a result, Morrisons can get a huge marketing opportunity for the new products, and effectively monetize the market prospects in order to generate higher revenues and greater market share.

Marketing Plan

The marketing plan for the forthcoming launching of the new products by Morrisons, and the extension, amendment, and improvement of its product portfolio has been put forward in the following subsections:

Industry and Market Analysis

The industry is highly competitive and Morrisons seem to be strong enough to retain its position in the sector; on the other hand, Tesco is strategically well equipped to keep hold of its position as the market leader (Agriculture and Agri-Food Canada 2016). Morrisons’ goal for the new product development and the extension, amendment, and improvement of its product line is to make sure that it can get hold of a greater share of the market and compete more aggressively with Tesco and Sainsbury; therefore, a detailed industry and market analysis of the retail sector has been outlined in the table below:

Table 1: Industry and market analysis (Agriculture and Agri-Food Canada 2016).

External Macro Analysis

Table 2: External macro analysis for Morrisons.

Competitive Analysis

The industry is fairly competitive and the rivalry is the highest amongst Tesco, Sainsbury, Asda, and Morrisons; a forecast of the potential sales of these retailers until 2020 has been outlined in the table below:

Table 3: Competitive analysis until 2020 (Agriculture and Agri-Food Canada 2016).

Five Forces Model

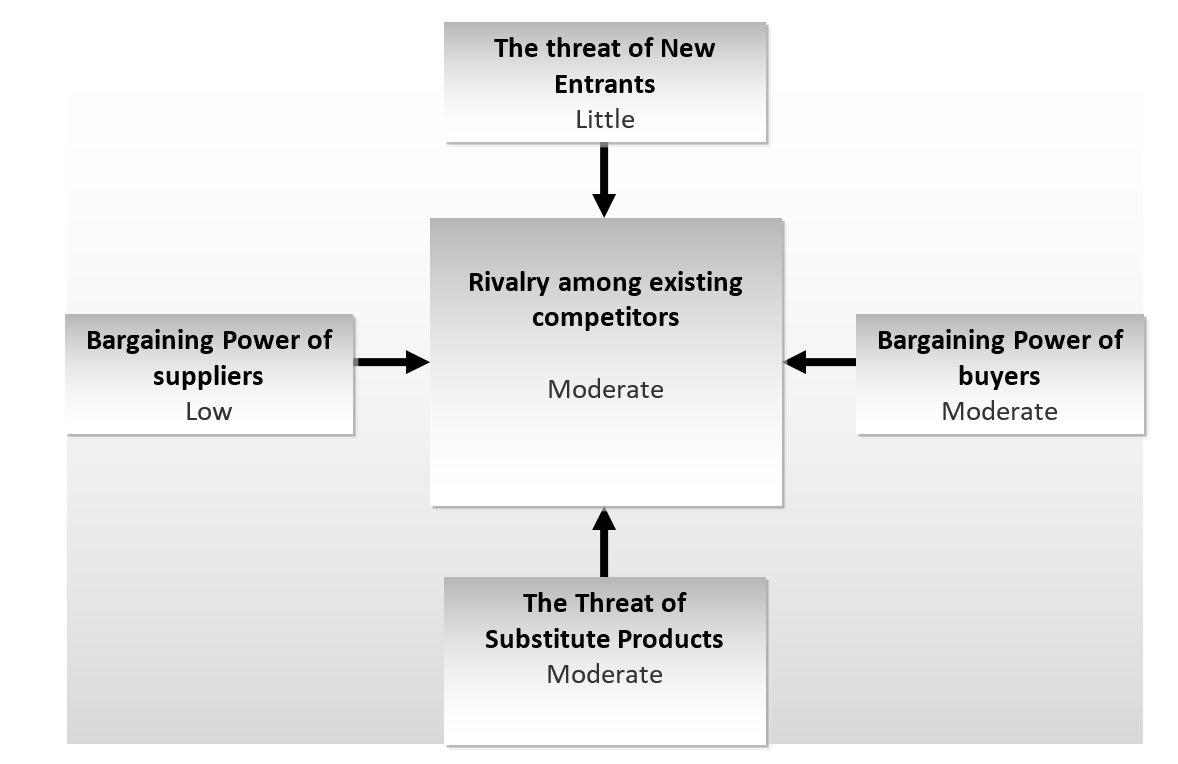

Five Forces Analysis

Table 4: Porter’s five forces analysis of competition for Morrisons’.

Marketing Objectives

The key marketing objectives for the new product development and the renovation of the existing product line are:

- To reach the niche market of vegan foods, which is growing gradually;

- To create more choices for the customers;

- To utilize the diversification strategy and gain a competitive advantage;

- To increase the average annual revenues;

- To grasp a higher market share;

- To make sure that there is a constant flow of demands even during recessionary periods.

Segmentation, Targeting, and Positioning

The following subsections of the paper assess the recommended marketing strategy for the new products of Morrisons based upon segmentation, targeting, and positioning strategies; therefore, the following segmentation techniques would be used in this research:

Segmentation – Demographic

Table 5: Demographic segmentation of the UK.

Segmentation – Psychographic

Over the last four decades, the United Kingdom has turned into a hub for people from numerous nationalities and ethnicities across the globe; as a result, the attitudes, lifestyles, values, personalities, opinions, and interests of the UK population are extremely diverse (McDonald 2012). Consequently, it is not feasible for the business to segment the market using the psychographic tool, since this would create too many micro-groups making it difficult for the business to operate effectively (Maciel & Wallendorf 2017).

Segmentation – Geographic

The existing outlets of Morrisons are densely located across all areas of the country. In addition, the targeted customer groups (that is health-conscious consumers and online shoppers) are present throughout the country, and there is no evidence supporting the idea that the above-stated target groups live in any particular geographical location – thus, Morrisons does not have a reason to segment the market geographically.

Benefit Segmentation

The annual report of the company suggests that Morrisons has created the operational units across the country based on benefit segmentation, and it would use its existing segments to launch the new products as well. This is because the current benefit segmentation has proved to be effective enough to control the markets, and at least for the next five years since the product launch, this model would be used.

Targeting

The health-conscious consumers are the major target groups for the new products of Morrisons, as the country’s vegetarian population grew by 360% in the last ten years. However, online shoppers would be another big target group, since it has turned into a highly prospective market in recent years (Dholakia & Chiang 2013).

Consumer Profile

It can be deduced from the consumer profile of the UK that the demands for the offered new products would be high due to the consumers’ behavioral and spending patterns; as a result, the company’s sales targets would be met easily:

Table 6: Consumer profile of the UK (Metzger 2014).

Positioning

The positioning has been conducted cautiously using the marketing mix variables as an indicator; it shows that the target market is a niche, but the promotional activities should be comprehensive enough to engage an increasing number of consumers.

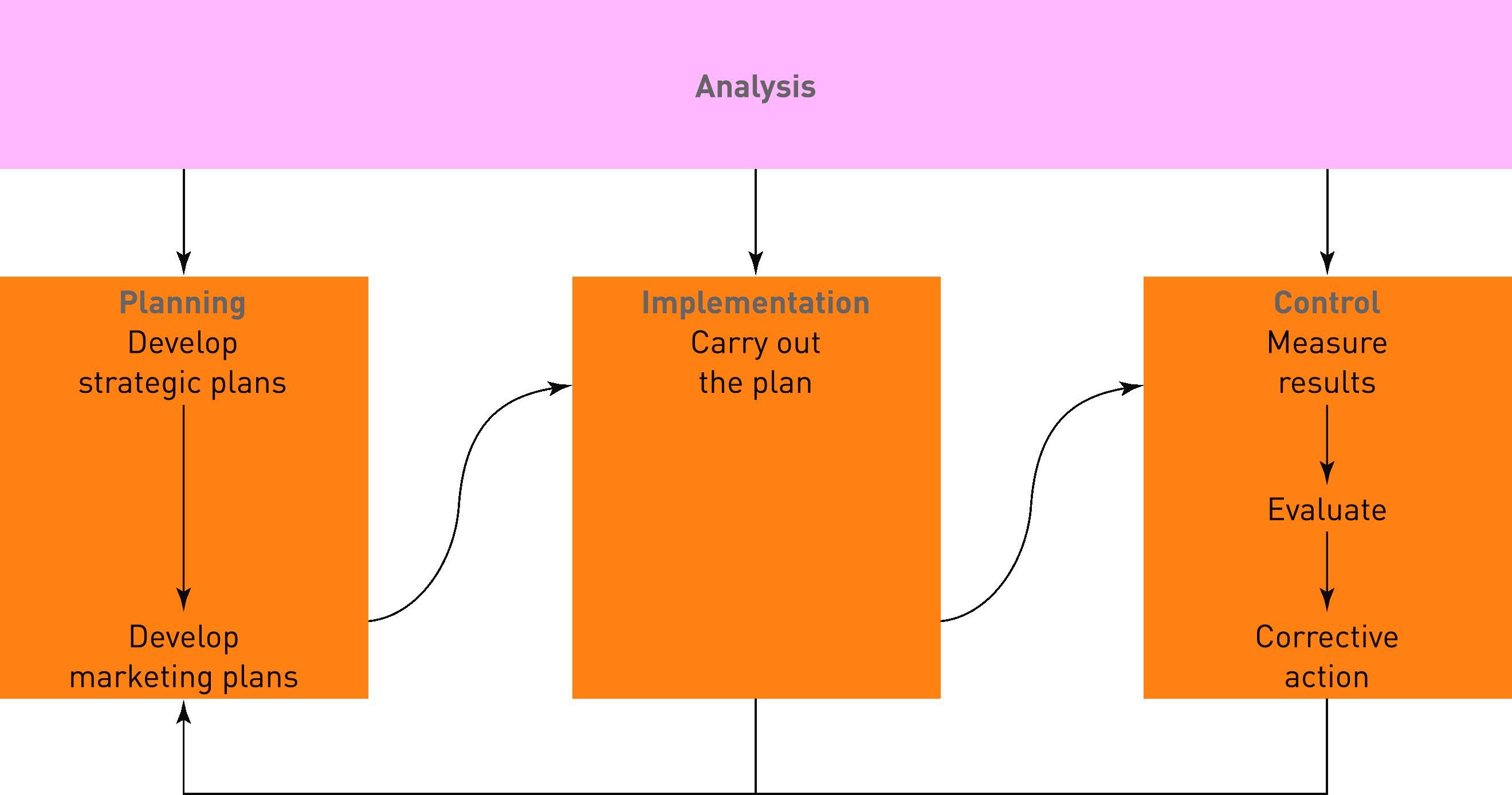

Marketing Strategy Formulation

The marketing strategy for the new vegan products has been formulated in several stages; first, Morrisons came up with apt market analysis, and then it developed the strategic plan and carried out the annual and long-range plan. Afterward, it developed growth strategies and measured the results to take corrective actions to make the marketing strategy flawless:

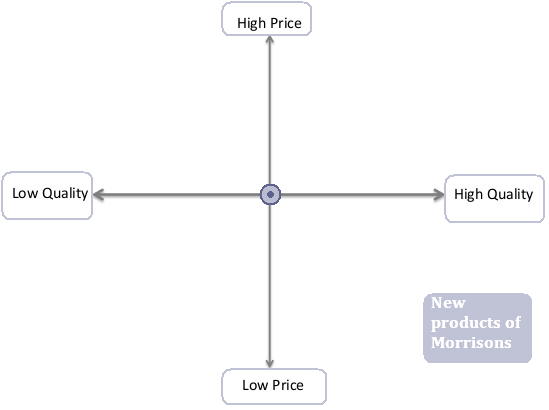

Product Positioning and Perceptual Mapping

The following product positioning and perceptual mapping show that the new products of Morrisons would have high quality, but lower prices in order to be more competitive in the market:

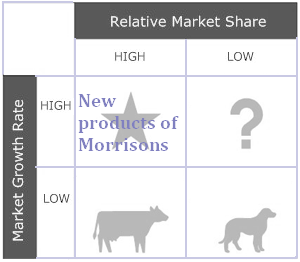

BCG Matrix of Product Function and Overall Strategy

Using the BCG matrix of product function and overall strategy, it can be argued that the new products of Morrisons would have a high market growth rate and high relative market share due to the latent opportunities. As a result, it would occupy the ‘star’ position, as shown in the figure below:

Adoption Placement

The company is not willing to adopt any new placement strategies for marketing the new products; rather, it aims to use the existing distribution channels and outlets to broaden its product line.

FABs Marketing

The company would be using FABs marketing techniques in order to create a high level of consumer awareness. This technique would make sure that the key messages on the features, advantages, and benefits of the products are quickly and effectively disseminated to a large group of customers at the same time.

FAB Messages for Use in MCP

Table 7: FAB messages for use in MCP.

Marketing Communications Process

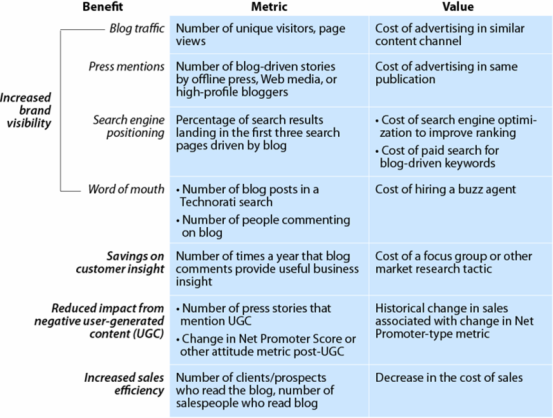

The company is willing to adopt online marketing communication procedures because this is the most promising medium at the moment – therefore, the key methods would be online advertising, which includes promotion on social networking sites, blogs, interactive marketing communications, search engine optimization, mobile marketing, emails, and app development (Lobschat, Osinga & Reinartz 2017). The key benefits of this kind of marketing communication procedures are demonstrated in the following figure:

Marketing Mix and Promotional Strategy

The marketing mix variables and the detailed promotional strategy are considered in the following subsections:

Marketing Mix Variables

Table 8: The marketing mix.

Promotional Strategy

The key promotional plan is to advertise the products through TV, newspapers, the internet, public relations, and outdoor advertisements; however, the company will also attempt to upgrade its brand loyalty through attractive packaging and seasonal discounts. The following figure shows the promotional mix for the company’s new products:

Costs and Budgeting

A summarised budget detailing the categories of expenditures and an estimated financial profile of the contributions that would be made by the new products to the annual turnovers are demonstrated below:

Table 9: Costs, budgeting, and revenues from the new product development.

Marketing Budget

A detailed breakdown of the forecasted budget for the marketing and promotional activities of the new product is outlined in the table below:

Table 10: Marketing budget.

Contingency Considerations

There are a number of uncontrollable factors that might disrupt the operations of Morrisons, which, for example, include natural disasters, hacks or cyberattacks, shoplifting, political turmoil, product recall, etc; as a result, the company has allocated back-up funds in order to confront and manage these potential risks and make sure that the new product development remains to be successful.

Conclusions

Morrisons is operating in a highly competitive market, and thus, constant adoption of apt marketing strategies is essential to sustain over the longer term. The company has selected a highly prospective target market to bring about its new range of products. The numbers of vegetarian individuals are increasing in the UK and are likely to grow in the upcoming years as well; consequently, the company has carried out relevant marketing research to make this project successful. The company aims to attain its projected sales objectives via the implementation of its dynamic promotional plan.

Reference List

Agriculture and Agri-Food Canada, 2016, Grocery retail trends in the United Kingdom. Web.

Bloomberg, 2017, WM Morrison supermarkets plc. Web.

Dholakia, R & Chiang, K 2013, ‘Shoppers in cyberspace: are they from venus or mars and does it matter’, Journal of Consumer Psychology, vol. 13, no. 1, pp. 171-176.

Higginson, A 2017, Strategic report and supplementary material 2016/17. Web.

Ilyuk, V & Block, L 2016, ‘The effects of single-serve packaging on consumption closure and judgments of product efficacy’, Journal of Consumer Research, vol. 42, no. 6, pp. 858-878.

Lobschat, L, Osinga, E & Reinartz, W 2017, ‘What happens online stays online? Segment specific online and offline effects of banner advertisements’, Journal of Marketing Research, vol. 2, no. 1, pp. 1-87.

Maciel, A & Wallendorf, M 2017, ‘Taste engineering: an extended consumer model of cultural competence constitution’, Journal of Consumer Research, vol. 43, no. 5, pp. 726-746.

McDonald, M 2012, Market segmentation: how to do it and how to profit from it, Wiley, New Jersey.

Metzger, A 2014, Business analysis of UK supermarket industry, GRIN Publishing, Munich.

Morrisons, 2017, WM Morrison supermarkets plc annual report and financial statements 2016/17. Web.

Ngwe, D 2016, ‘Why outlet stores exist: averting cannibalization in product line extensions’, Harvard Business Review, vol. 2, no. 1, pp. 1-47.

Quinn, S 2016, ‘Number of vegans in Britain rises by 360% in 10 years’, The Telegraph. Web.

Reuters, 2017, WM Morrison supermarkets plc (MRW.L). Web.

SkyUK, 2017, Morrisons: five mistakes behind its troubles. Web.