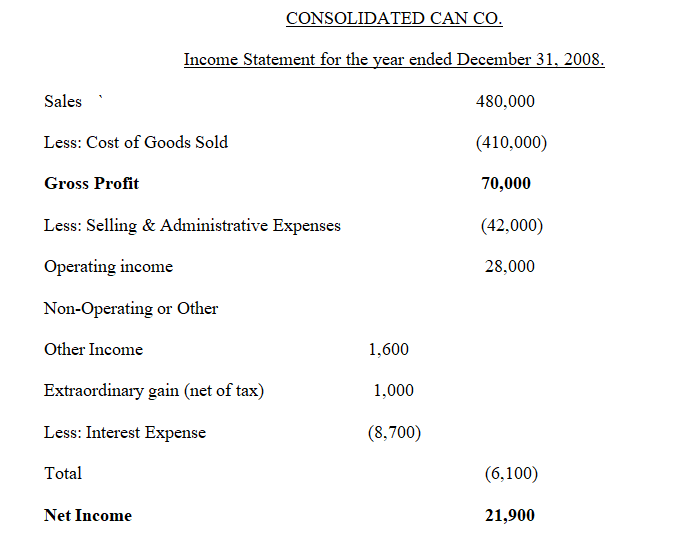

The accounting information for consolidated Can for a period ended December 31, 2008, was as follows. Cost of Products Sold $410,000,Dividends $3, 000, Extraordinary gain (net of tax) $1,000,Income taxes $9, 300, Interest expense $8, 700, Other Income $1,600,Retained Earnings – Jan 1, 2008 $270, 000, Sales $480, 000, Selling and administrative expense $42,000. To prepare an income statement and statement of retained earnings, a multistep approach was followed.

Multistep income and retained earning a statement is an accounting approach used in determining the financial performance of a business enterprise. It involves a number of additions and deductions in order to determine net income and retained earnings. In addition, the method involves the separation of operating income and expenses from non-operating income and losses. The stages involved are the calculation of gross profit by subtracting the cost of sales from total sales, calculating operating income by subtracting operating expenses from the gross profit, and finally, obtaining net income or loss by adding non-operating profit or losses(Gibson,2011).

For the year ending 31st December 2008, the company realized a gross profit of $70,000 which was obtained after subtracting cost of goods sold($410,000) from sales($480,000). Operating income realized was $28,000. When all other expenses were subtracted from the operating income, Consolidated Can realized a net income of $21,900 (Lewis, 2008).

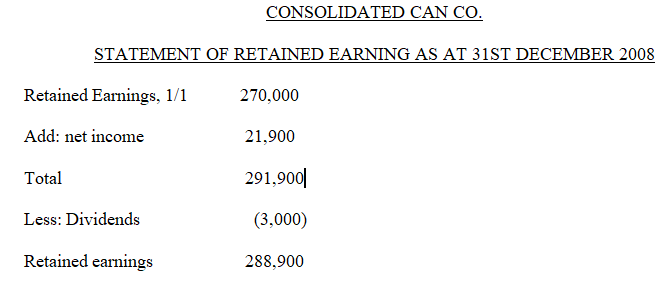

Retained earnings are the net income that is left after withdrawal by owner or payment of dividends to shareholders. Retained earnings are recorded in the statement of retained earnings. The formulae for retained earning is beginning retained earnings, add income earning and less withdrawal by owners or dividends. Basing on retained earning formulae, the key elements in retained earnings statement are withdrawal by owners or dividend, tax effects and correction of past errors, net income, and beginning balance for retained earnings.

When dividends for a specified period are declared, they must be deducted in the statement whether their payment has been effected or not (Lewis, 2008). The retained earnings from the previous operating period were $270,000.This amount was added to the net income of $ 21,900, which was derived from income statement. This gives a total of $291,900.

Dividends payable in the current operating period had to be subtracted from the total earnings to arrive at the new figure of retained earnings which is $288,900 from the statement of retained earnings. Thus, it is evident that Consolidated Can realized a positive growth in its retained earnings from the previous period. The retained earnings grew by $18,900 from the figure realized in the previous accounting period (Gibson, 2011).

In conclusion, multiple approaches offer an excellent way in determining net income and retained earnings. From the two financial statements, statement of retained earnings and income statement, the performance of the company is good as retained earnings and total income have positive figures. The company offers a positive prospect for investment.

References

Gibson, C. H. (2011). Financial reporting and analysis: Using financial accounting Information. Mason, OH: South-Western Cengage Learning.

Lewis J. (2008). Financial statement analysis: University of Scranton press.