Introduction

Setting up an independent practice is challenging for a nurse practitioner, mainly because of legal and financial constraints. Bosse et al. (2017) recommend full practice authority for advanced practice registered nurses to achieve high-quality primary care. Nevertheless, many states do not allow nurse practitioners to practice without a collaborative agreement with a physician (Buppert, 2018).

As shown on the map prepared by the American Association of Nurse Practitioners (AANP, 2018), New Jersey is among the states that set reduced practice authority for nurse practitioners. This means that “state law requires a career-long regulated collaborative agreement with another health provider in order for the NP to provide patient care, or it limits the setting of one or more elements of NP practice” (AANP, 2018, para. 3). This aspect of the legislation might limit the nurse’s capacity to open an independent practice because it creates the need for supervision and prevents nurses from carrying out the full range of duties as care providers.

In states with full practice authority, such as Vermont, Connecticut, or District Columbia, nurses can perform all manipulations required to provide patient care, from patient examinations to prescribing controlled substances (AANP, 2018). This model has a positive influence on primary care quality because it increases the number of independent care providers available and allows nurses to apply all their knowledge and experience to practice without limitations. While setting up an independent practice in one of the full practice states would be more beneficial, the present business plan considers an NP-led clinic in New Jersey.

Business Structure

In order to open an independent practice, it is critical for a nurse practitioner to consider various business structure available today. For a small clinic, there are two key options available: sole proprietorship and partnership. The primary difference between these business structures is the number of owners and their scope of authority and responsibility. Hopson and Hopson (2014) state that sole proprietorship is the easiest form of ownership because it only involves one person who is fully responsible for the business. Partnership, on the other hand, will include two or more owners who may have different responsibilities or authority (Hopson & Hopson, 2014). A partnership can also assist the nurse practitioner with financial concerns since it requires both partners to invest in the business (Hopson & Hopson, 2014). Given that New Jersey laws require nurse practitioners to work with a collaborative agreement, it would be beneficial to consider opening an independent practice in partnership with a physician.

Employee Structure

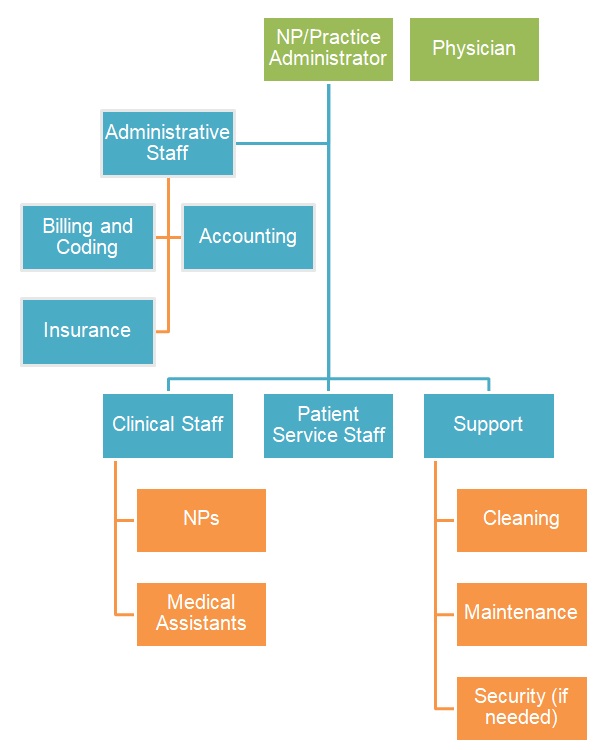

There is a variety of jobs that must be performed in clinical practice, and thus the nurse practitioner will need to recruit at least ten members of staff. As seen in Figure 1, the nurse practitioner/practice administrator and the physician are at the top of the organizational chart because they have the most authority and responsibility (Johnson & Garvin, 2017). Additionally, there is also the administrative, patient service, clinical, and assisting personnel (Johnson & Garvin, 2017). The administrative staff includes billing and coding, accounting, and insurance personnel. The IT function should also be part of the administrative department, but it could be outsourced to control the costs. Employees in patient services include receptionists, who are responsible for meeting patients and creating appointments. The clinical staff involves nurse practitioners and clinical assistants who see patients and render medical care. Lastly, the support staff includes cleaning, maintenance, and security workers, who can either be outsourced as needed or employed full-time. The chosen employee structure will help to control personnel costs while enabling the practice to run smoothly.

Services

The clinic will focus on providing primary care services to the local population. According to research, there is an issue of reduced access to primary care among certain populations, such as elderly persons (Hahn & Cook, 2018). Establishing an NP-led primary care clinic will help to improve access to care in the local community and have a positive influence on population health. The nurses working in the clinic will provide patient assessments, order and interpret diagnostic tests, and prescribe treatments.

Costs

The monthly costs of establishing an independent practice include a variety of expenses required to run this type of business successfully. Monthly costs are usually lower than start-up costs because there is no regular need to lease a new facility or buy new equipment. Table 1 presents an overview of the monthly costs of running an independent nursing practice in New Jersey. However, it is essential to note that these numbers are estimates and might vary from one area to another, as well as among different practices.

Table 1. Estimated monthly expenses.

Projected Monthly Income

In order to calculate the projected monthly income required to support an independent practice, it is essential to combine the total monthly expenses with any loan repayments and taxes. The total estimated monthly expenses for the clinic are $74,500. If the nurse practitioner has taken a $200,000 bank loan for ten years at an interest rate of 7% to start the practice, they would need to include an additional payment of $2,322.17 each month. Finally, the taxes paid by partnerships in New Jersey differ depending on the income but should be no more than 9% of the net income. Hence, the projected monthly income required to support the planned independent practice would be about $85,000.

References

American Association of Nurse Practitioners. (2018). State practice environment.Web.

Bosse, J., Simmonds, K., Hanson, C., Pulcini, J., Dunphy, L., Vanhook, P., & Poghosyan, L. (2017). Position statement: Full practice authority for advanced practice registered nurses is necessary to transform primary care. Nursing outlook, 65(6), 761-765.

Buppert, C. (2018). Nurse practitioner’s business practice and legal guide (6th ed.). Burlington, MA: Jones & Bartlett Learning.

Hahn, J. A., & Cook, W. (2018). Lessons learned from nurse practitioner independent practice: A conversation with a nurse practitioner entrepreneur. Nursing Economics, 36(1), 18-22.

Hopson, J. F., & Hopson, P. D. (2014). Making the right choice of business entity. The CPA Journal, 84(10), 42-47.

Johnson, J. E., & Garvin, W. S. (2017). Advanced practice nurses: Developing a business plan for an independent ambulatory clinical practice. Nursing Economics, 35(3), 126-141.