Situation

Gloria Londoño is the founder of a group of nursing homes for the elderly in Spain, called Calidad de Vida. She has built this nationwide venture on the bedrock of basic values such as honesty, transparency, enthusiasm and community welfare. The Calidad de Vida brand has 12 franchisees all over Spain, each being independently run by experienced doctors and other health care experts. In order to support her expansion plans well into the future, Gloria is facing the current need for an Angel investor to fuel strategic growth.

She is well aware that it was actually her initial drive for expansion that took Calidad de Vida up from one clinic to twelve. Simply by pursuing future growth, she would be able to carry on about her vision of building a stronger alternative to the traditional daycare centre, a place which can nurture the elderly with intensive care. Indeed, there are several theories which suggest no shrewd businessperson can afford to end their business growth ambitions due to cost-constraints because it usually leads to stagnation in the long run.

Besides this, Gloria is fed up with her existing chain of nationwide franchises. Most seem to have forgotten the core values and vision which had defined Calidad de Vida’s basic identity all these years. In order to enforce best practices across the board, she feels the immediate need to gain greater control of these franchises and run them on a corporate platform, that too in a better-organized fashion. To fulfil this aim, she requires access to funds, from any source possible. At the same time, being a small-time businessperson, she doesn’t want to cede her majority stake (67%) in the company.

To address her problem, Gloria has already had a few rounds of meeting with Victor Sema, an entrepreneur with extensive experience of being an Angel investor, mostly for start-ups in health care. Victor is known for his ruthless efficiency and demanding his pound of flesh when he deigns to fund any new venture. He believes in having all his demands met at any cost, which can push him to unreasonable extremities when contracting new companies. Victor doesn’t go easy on Gloria either: he offers her 3 million Euros in exchange for 25% stake in Calidad de Vida, voting privileges on all strategic decisions, and the rights to sell the company’s assets after 5 years, if he wants to, at the drop of a hat.

Victor gives Gloria some time to ponder over his offer. She consults her CFO, Daniel, and deputy director, Diana, on the issue of whether such a move would serve the company’s best interests. Daniel advises her to ahead with the strategic alliance as this would enable the company to get rid of its cash crunch worries, and undo the inherent disadvantages of the franchise model that has been plaguing the balance sheets. Daniel is a pragmatist whose line of thought is somewhat close to what a CFO would think, in such situations.

In contrast to Daniel, Diana shares Gloria’s concerns on Victor’s bullying tactics and the fact that he has absolutely no respect for one of the founding principles of Calidad de Vida: transparency. She feels that given the right opportunity, Victor may use his undue influence to make more unreasonable demands which can prove detrimental to the very survival of Calidad de Vida. While Daniel continues to press for a speedy resolution to the cash-flow problem, Gloria is in two minds over her next course of action. Any decision she takes now will have lasting, long-term significance.

Task

In order to carefully weigh Gloria’s predicament, one will need to assess the extent to which things can go wrong, the worst possible consequences that could happen, and from there, try and identify the best course of action suitable to all stakeholders. It is amply clear from the case study that the mission values of Calidad de Vida are in fact, very close to Gloria’s heart. She does not want to compromise on them even though she shares the same passion for health care as Victor does.

Several authors have agreed that the corporate code of ethics is at the heart of everything that is done in order to sustain a company over a long period of time. By compromising on its core values, an organization becomes a plastic entity devoid of vitality, energy and a positive climate of growth. To make their transformation turn up at a new level, organizations cannot afford to betray their foundation values which had caused the huge growth in the first place.

Clearly, Gloria’s heart and mind are in the right place when she disagrees with Victor’s notions of total control and other dictatorial terms. They have no place in an organization which prides itself for its transparency and reputation. The notion of transparency has its roots in most forms of corporate governing ethics which mandate a top-down process that will ensure the organization, and its employees remain committed to predefined values which reflect their collective identity. No organization can hope to survive without these values.

Apart from transparency issues, there are other considerations which have to be borne in mind by Gloria. By the description of Victor, he comes across as a ruthless entrepreneur with no consideration for the human element in the companies that he has been handling. He makes it clear in no equivocal terms, that as and when needed, he wouldn’t really mind liquidating his assets of Calidad de Vida. This is again in conflict with Gloria’s own vision for the company.

She had started her business five years ago as an occupational therapist. Since then, the only thing that got her so far ahead was her steadfast commitment to elderly clients – she had envisioned a company which would go out of its way to make elderly patients feel at home, and make their therapeutic experience as pain-free as possible. These mission values are in sharp contrast to Victor’s own approach towards the bottomline, which neglects the human element.

Gloria has to calculate the human cost of closing down on even one Calidad de Vida centre: apart from employees losing their jobs, she would also be doing a grave injustice to large numbers of elderly clients who have been depending on her centres for their long-term treatment. The fact that Gloria has been running these centres despite operating on a very thin margin suggests her love and attachment to the patients.

Many authors agree that human welfare should be at the focal centre of an organization’s corporate ethics policy; an organization is built from scratch by its people, the human resources. Consequently, it is important for organizations not to betray the interests of those very people for whom it’s been striving so hard. It is clear that from the very outset, Gloria does not want to allow such negative consequences and in order to ensure Victor does not cross the line, she should be able to dictate a few of her own terms. While it’s all right for her to heed Daniel’s advice as far as the finances go, she needs to do in-depth research on Victor to check his track record with previous start-ups, and the human cost.

The task lying ahead for Gloria is to go through Victor’s 4-page contract and come with her own suggestions for changes. Even though Victor appears uncompromising and someone who is far too busy for Gloria, she should decide not to allow such pressure tactics to work on her. Last but not least, Gloria needs to listen to her employees and patients who are clearly quite close to her success in business. She wouldn’t be able to permanently live with the decision to abandon them in their hour of need.

Action

In all due probability, Gloria will have to square off with Victor over the future prospect of Calidad de Vida. His blunt refusal could put an end to her temporary vision of resurrecting the health care chain. However, it is important for her not to feel intimidated by such tactics, and stand her ground even though the answer could mean failure of her objectives. While it is true that she needs Victor in order to fund future operations and growth for Calidad de Vida, she doesn’t exactly have to approach him with a begging bowl. It is absolutely within her means to dictate a few terms and conditions of her own, especially after going through contract details.

She should initially focus on the common grounds and from there, work her way up into the finer details of the contract. She should concentrate on preparing a task list of common ground items and approach Victor with her agreement for the same. She can later justify them as a means to approach the continued negotiations in good faith. There are indeed a few areas where she may not want to compromise.

Gloria has every right as the continued majority shareholder (51%) to gain a veto privilege on Victor’s ability to interfere in everyday corporate decisions. This would give her the necessary upper hand so that she gains the ability to control any excesses of the Angel investor, any possible abuse of power. To put forward this important demand, Gloria needs to remind Victor that even though he may not have the right authority which he thought he deserved, he still stands to gain 25% per year from the amount of investment made on Calidad de Vida.

Given that Gloria’s company has been doing good business over the years, especially with the arrival of latest expertise from all walks of life, Victor should be able to recoup his investment in no time – in short, Gloria should be able to convince him about the clear advantages of such a deal. Victor, in his turn, could be made to shift from his uncompromising position to a more amenable one.

Gloria also needs to present Victor with a 5 or 6-point action plan which contains a list of principles that have summarised the guiding philosophy of Calidad de Vida. She should also pursue a written agreement so that Victor abides by the terms of this philosophy. Despite some potential misgivings, Victor might be forced to come around and allow some concessions. If he doesn’t swallow the bait, the deal is over. But, Gloria will still have saved her organization from any future hostile takeover or liquidation attempts. All businesses exist for the reason of profit alone, and Victor cannot be expected to behave any differently.

However, it is well within Gloria’s rights to make him agree to finite demands which have basic relevance to corporate ethics. Victor cannot be allowed to push them aside and keep dictating his own terms which are against the transparency principles of Calidad de Vida. Gloria has every right to demand equal respect as a partner.

In the event, Victor does not agree to any of these demands, it should be clear as day that he doesn’t share the ethos and values that Gloria wants to nurture in Calidad de Vida. He only cares about the bottomline, which is not in sync with what Gloria wants. In the event the negotiations come to a standstill, Gloria should conditionally withdraw from the offer and politely inform Victor that she might think of considering it at a later stage, hoping he may change his mind.

Result

Moving on from Victor, the next best option for Gloria is to keep on looking for Angel investors who might consider filing her proposal. Her discussions with the CFO, Daniel, suggest that the company has been recently discussing how to acquire new franchisees in Portugal and other countries. Perhaps, it would be a prudent move to consider strategic tie-ups with investors in other countries, including Germany, UK and France. As most EU countries have common health care laws, it wouldn’t be difficult for investors in one country to consider a business proposal in the other, since all laws are effectively the same everywhere.

At the same time, Gloria may consider plugging holes in the existing franchisee model of Calidad de Vida, which could be suffering from the lack of a proper business strategy. While the existing franchisee model may have worked during the initial growth of the company, it’s quite possible that the situation is very different.

In the light of changing circumstances, Gloria should envision a future roadmap where the franchisees are made accountable for everything they do and the fact that they start adhering more strongly to the corporate philosophy and core values of Calidad de Vida. Perhaps, she can start new incentives and revenue-sharing models which will force the franchisee to attract more business. The franchisee may be encouraged to do everything they can to pursue the best interests of Calidad de Vida.

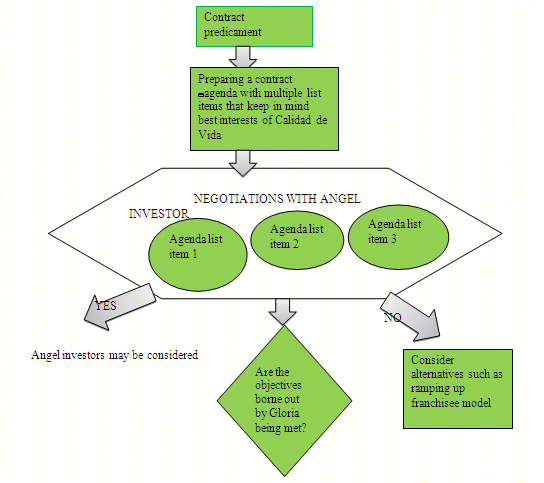

In summary, the handling of the given situation by Gloria can be summarised by the given flowchart. It conveys her ability to withstand the given situation in the company of Victor to its maximum limit. As such, this may lead to future growth prospects for Calidad de Vida, provided they are able to gain strategic depth in their expansion moves. By all means, it would be unfeasible for Calidad de Vida to hold on to its ethical values while negotiating an alliance with an entity that goes against these values.

References

- Herzlinger, Regina E., and Munoz Seca, Beatriz, “HBR Case Study: An Angel Investor with an Agenda,” Harvard Business Review. Web.

- Mognetti, Jean-Frederic, Organic Growth: Cost-effective Business Expansion from Within. New York: John Wiley & Sons, 2002.

- Weeks, William A., and Nantel, Jacques, “Corporate Code of Ethics and SalesForce Behavior: a Case Study,” Journal of Business Ethics 11, no.10 (1992): 753-760.

- Henn, Stephen K., Business Ethics: A Case Study Approach. New York: John Wiley & Sons, 1992.

- Sujansky, Joanne G., and Ferri-Reed, Jan, Keeping the Millenials: Why Companies in Billions are Losing Turnover to this Generation – and what to do about it. New York: John Wiley & Sons, 2007.

- Christensen, Lars Thoger, “Corporate Communications: the Challenge of Transparency,” Corporate Communications: An International Journal 7, no.3 (1996): 162-168.

- Bushman, R.M., and Piotroski, J.D., “What determines Corporate Transparency,” Journal of Accounting Research 42, no.2 (2004): 207-252.

- Flynn, Gabriel, Leadership and Business Ethics. New York: Springer, 2008.

- Ferrell, O.C., Fraedrich, John, and Ferrell, Linda, Business Ethics: Ethical Decision-Making and Cases, New York: Cengage Learning, 2010.

- Steele, Paul, and Beasor, Tom, Business Negotiation: A Practical Workbook. London: Gower Publishing, 1999.

- Cohen, Steven, Negotiation Skills for Managers, London: McGraw Hill Professional, 2002.

- Bebchuk, Lucian Arye, “The Case against Board Veto in Corporate Takeovers,” The University of Chicago Law Review 69 (2002): 973-1035.