Although traditionally considered beyond profitable, the oil and gas industry requires substantial costs and often demands that immediate decisions should be made regarding a specific issue (Daly, 2013). The process of oil extraction is often fraught with numerous problems, the tools being either extraordinarily expensive or dismissed by EPA as environmentally inappropriate (Suslick, Schiozer, and Rodriguez, 2009).

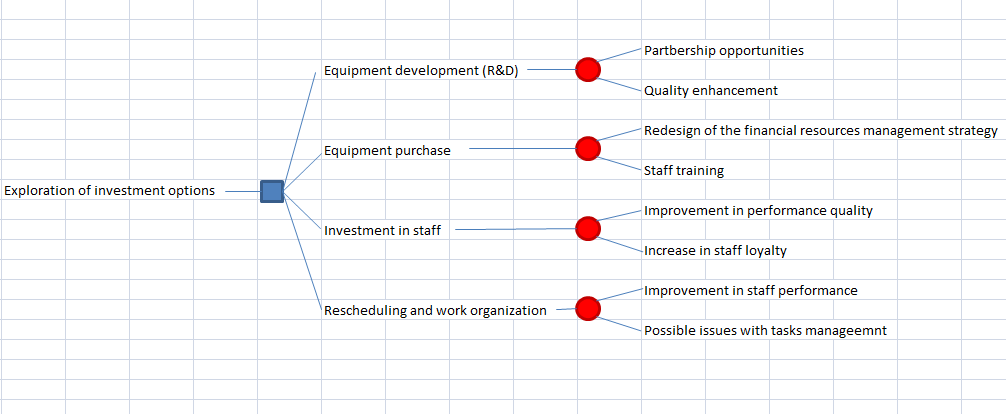

In his choice between marketing natural gas, considering the purchase of expensive inventory for working in the Prudhoe Bay, producing condensates, and resorting to gas recycling, the owner of the project chose the latter option, yet it required a substantial amount of resources (Finch, Macmillan and Simpson, 2002). Although the opportunities for further progress that the project has now seem equally important, it is crucial at present to focus on investing in the equipment development so that the industry infrastructure could be built to an even greater degree (Bradner, 2015). Thus, entrepreneurship will be able to grow and provide premises for other organizations to create partnerships with it.

The ample opportunities that the focus on investing in building the necessary tools implies are not to be underrated (EY, 2014). Specifically, the pipeline that the company has designed and that is bound to become a groundbreaking innovation in improving the extraction of oil needs to be created further (Bradner, 2015).

Indeed, according to the existing description of the industry, the lack of appropriate devices may have dire consequences on the success of the entrepreneurship: “For example, inefficient processes, lack of automation, and poor services support can lead to workforce inefficiency” (Inkpen and Moffett, 2011, p. 190). A tighter supervision of the identified issues, however, is likely to contribute to a consistent rise in the employees’ satisfaction rates because of the properly functioning equipment and the overall success of the operational processes. Therefore, the performance quality is going to rise (EY, 2015).

As stressed above, investing in the employees is another important issue that the organization should focus on. By purchasing the tools that will make the process of oil extraction easier, as well as investing in the staff’s training to use the machinery accordingly, the organization will be able to save on hiring a qualified workforce (Galli, Armstrong and Jehl, 1999). Furthermore, the premises for building a team of loyal employees will be created.

The rest of the options that the company has are nonetheless crucial for its further progress, yet they can be viewed as the next steps to complete and the issues of lower priority than the one related to the equipment design and its further usage. For instance, purchasing the necessary tools could be viewed as an alternative to inventing the instruments and making it the company’s selling point.

However, the acquisition of the required resources may mean that the full potential of Point Thompson may never be revealed (Bradner, 2015). Indeed, these are the devices produced by the company that will provide the chance to reach the oil deposits and extract oil without affecting the environment negatively and at the same time spare the staff members several complicated and potentially dangerous tasks.

Therefore investing in the company’s R&D processes, particularly, the design of the related instruments is the issue of the highest priority at present. Affecting a range of the firm’s processes positively, it will serve as the means of taking a niche in the target environment. Therefore, Point Thompson must be headed toward R&D and a technological update.

References

Bradner, M. (2015). Extending industry infrastructure on the North Slope. Web.

Daly, M. (2013) Future trends in global oil and gas exploration.

EY. (2014) Global oil and gas tax guide 2014. Web.

EY. (2015) Global oil and gas tax guide 2015. Web.

Finch, J. F., Macmillan, F. E. and Simpson, G. S. (2002) ‘On the diffusion of probabilistic investment appraisal and decision-making procedures in the UK’s upstream oil and gas industry’, Research Policy, 31(6), pp. 969–988.

Galli, G., Armstrong, M. and Jehl, B. (1999) ‘Comparison of three methods for evaluating oil projects’, JPT, 51(10), pp. 44-49.

Inkpen, A. and Moffett, M. H. (2011) The global oil & gas industry: management. strategy and finance, Sheridan Road Tulsa, OK: PennWell Corp.

Suslick, S. B., Schiozer, D. and Rodriguez, R. (2009) ‘Uncertainty and risk analysis in petroleum exploration and production’, Terrae, 6(1), pp. 30-41.