Background

The process of identifying risks and searching for the tools that will help mitigate them successfully is crucial for an organization operating in the environment of the global economy. Therefore, it is crucial to spot the threats that the oil project will be exposed to in Sudan, including environmental, economic, political, social, and financial factors. By creating a sustainable approach toward cost management and taking the political threats into account, the managers will be able to make entrepreneurship a success.

Operational Uncertainties

Among all operational uncertainties that the organization is likely to face in the context of the target market, the oil supply needs to be listed as the issue that is likely to be of the greatest concern (Leiras, Rebas, and Hamacher 2013). The available capacity of the process units is another operational uncertainty that needs to be addressed to facilitate the smooth management of the related processes. Indeed, the cracking and coking capacities, which are currently viewed as the primary target of investors, restrict the firm’s operations to a significant degree (Addressing uncertainty in oil and natural gas industry greenhouse gas inventories 2015).

It should be noted, though, that the emphasis on the identified capacities has affected the oil market somewhat negatively over the past few years: “Instead of closing refineries in the OECD, however, companies have invested in more complex cracking and coking capacities, exacerbating the surplus of petroleum products in export markets” (Doshi 2015, para. 5). In other words, by improving the tools worldwide, investors have created the situation, in which the supply rates may exceed the demand levels (International Energy Outlook 2016). As a result, the organizations that have not established a strong presence in the target market yet may be ousted from the economic environment by the enterprises that have already become household names in the oil industry.

In light of the investment issues mentioned above, it will be reasonable to assume that the current supply rates are going to rise consistently, therefore, leading to the necessity to reduce prices. The identified step, in its turn, will imply that the project in question will need a reduction of expenses; otherwise, it will not be viable in the target environment. For these purposes, the principles of sustainable use of resources will have to be included in the organization’s system.

Risks

Environmental

The environmental impacts of oil production are, perhaps, among the most dubious aspects of the industry’s existence. Unless the project is located in a remote, deserted area, its threats to the wellbeing of the people living in the vicinity, as well as the unique habitat and its endemics, will be immediately confirmed.

The environmental uncertainties mentioned above are linked directly to the operational ones, such as the emissions inventory uncertainty. Even though oil sites are not typically viewed as a source of large emissions, the degree to which they pollute the environment still needs to be assessed, while the uncertainty levels most certainly pose a significant obstacle to the process.

Political

Although Sudan seems to provide an auspicious environment for an oil project, one must bear in mind that the state is facing political issues. Although the military confrontations between Sudan and South Sudan seem to have been de-escalated, armed conflicts remain a tangible threat (Cukier 2013). Also, the tension between Sudan and its enclave defines the security – or, to be more accurate, the lack thereof – of the organizations operating in the environment of the state. For instance, in case the oilfield is located near South Sudan, debates regarding the location and ownership of the resource are likely to be spawned.

Financial

The fiscal uncertainty in which Sudan has recently found itself is likely to be the key impediment to the successful implementation of the project. According to the warning of EV (2014), companies must develop flexibility and resistance to the financial issues in the environment of other states: “Oil and gas companies must adapt to the fiscal regime in force. However, fiscal uncertainty clauses are included in oil and gas transportation contracts” (EV 2014, p. 181). With the information above in mind, one should address the recent financial crisis in the contract so that the organization could ensure its safety in case of an emergency (Foreign and Commonwealth Office 2016).

Economic

A drop in supply is likely to affect the viability of the project to a considerable extent since the company will not be able to retrieve the profit that will be enough to cover the expenses. The problem may occur due to warm winters in the next few years. The low demand may require the necessity to reduce the oil prices to the point where the project cannot be sustained anymore.

The same concerns the supply rates; without the required materials supplied by the partners, the project will not be sustainable. Furthermore, apart from the lack of the necessary tools and materials, the possibility of the scenario in which the prices for the items in question will be too high for the company to afford may be possible. At present, several companies provide the related services and equipment, yet the risk of facing a shortage of supplies is still relatively high.

The risks listed above are likely to have a significant impact on the stakeholders. The gravity of the effects that the threats mentioned above have on the project and, therefore, on its investors, is quite high. Thus, the people supporting the project financially may lose their money.

Credit Rating

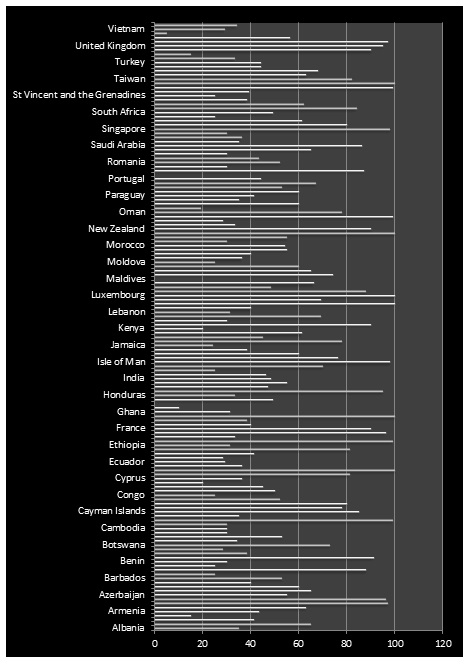

The current credit rating of Sudan seems to be quite small, which can be explained by the lack of political stability in the state. As the diagram below shows, there is no agreement among states about the credibility of Sudan’s economy; as a result, the ratings lack homogeneity, scaling from 0 (Puerto-Rico) to 100 (Netherlands). A closer look at the rating system will show that the countries with the highest potential and the highest economic growth tend to be more loyal toward Sudan, The same tendency is expected in the nearest future given the lack of stability in the political environment of the state. Nevertheless, the chances of producing oil successfully and gaining revenues within a relatively short amount of time are rather high (Trading Economics 2016).

Ownership

As stressed above, the lack of clarity about the administrative and territorial division of the state (particularly, the existence of South Sudan and the areas that its government claims as its) may hinder the project. Another impediment on the way to implementing the project successfully, the fact that Sudan’s ownership of its oil deposits ends in 2016 needs to be listed among the primary reasons for concern (Patey 2014). According to the recent report by Makkawi Mohamed Awad, the Sudanese oil minister, the agreement with China about giving Khartoum the full ownership of the oil pipeline will not be signed until the end of 20916:

Sudanese oil minister Makkawi Mohamed Awad announced on Monday that an agreement will be signed with several Chinese companies by which Khartoum will assume full ownership of the oil pipeline that extends to the South by the end of 2016. (‘Sudan to assume full ownership of oil pipelines by end of 2016: minister’ 2014)

Although the time for signing the contract is approaching fast, the fact that there is still an ownership uncertainty makes the situation dubious. Nevertheless, the fact that the agreement is going to be signed any day now serves as the reason for deeming the project as viable. By creating the environment in which collaboration between the Chinese suppliers and the Sudanese oil companies will become a possibility, the state government will pave the way to the state’s rapid economic growth, as well as the overall increase in the oil industry rates.

Financing Configurations

The choice of the hard currency loan over the domestic one, which is currently the option generally preferred by investors (Asiedu, Dzigbede, and Nti-Addae 2015) can be considered a source of minor risks for the project as well. Although Sudan has been experiencing economic growth, the rates thereof are not quite consistent (Asiedu 2013). As a result, a drop in the exchange rates will inevitably lead to a significant loss for the entrepreneurship. Thus, it will be a sensible step to suggest that the home currency loan should be viewed as an opportunity for the investors and the organization in question. By using the home currency loan, the organization members will not expose themselves to the threats that lurk in the target environment.

Reference List

Addressing uncertainty in oil and natural gas industry greenhouse gas inventories(2015). Web.

Asiedu, E. (2013)Foreign direct investment, natural resources and institutions.Web.

Asiedu, E., Dzigbede, K., and Nti-Addae, A. (2015) ‘Foreign direct investment, natural resources, and employment in sub-Saharan Africa’, in Africa at a fork in the road: taking off or disappointment once again? New Haven, CT: Bett House, pp. 395-414.

Cukier, A. (2013) Political risks and the Chinese oil supply after the split of Sudan and South Sudan. Web.

Doshi, V. (2015) As complexity grows, oil and gas companies must focus on capabilities and flexibility. Web.

EV. (2014) Global oil and gas tax guide. Web.

Foreign and Commonwealth Office (2016) Overseas business risk – Sudan.Web.

International Energy Outlook (2016) Chapter 2. Petroleum and other liquid fuels. Web.

Leiras, A., Rebas, G., and Hamacher, S. (2013) ‘Tactical and operational planning of multirefinery networks under uncertainty: an iterative integration approach’, Industrial and Engineering Chemistry Research, 52(25), pp. 8507-8517.

Patey, L. (2014) New kings of crude: China, India, and the global struggle for oil In Sudan and South Sudan. India, New Delhi: HarperCollins Publishers.

Sudan to assume full ownership of oil pipelines by end of 2016: minister (2016). Web.

Trading Economics (2016) Sudan: credit rating. Web.