Background

The paper will focus on constructing a personal financial plan. The plan will create a picture of the current financial status and plans. Further, it is worth mentioning that the market and economic outlook are quite uncertain. Thus, when creating the plan, assumptions will be made about the future. Besides, the plan will look at the different insurance covers that the client may require before the end of its life expectancy. Finally, a net worth statement of the client will be drawn at the end of the analysis.

The current situation

- The current total assets amount to $30,000.

- There are no liabilities.

- The net worth of the client is also estimated at $30,000.

- There are no working assets.

The objectives and goals

- The client intends to retire at the age of 60 years.

- The annual income after tax is estimated at $2,000.

- The life expectancy of the client is estimated at 90 years. Besides, the client will need income until the last year of life expectancy.

- To become financially independent.

- Minimize the tax liability.

- Maintain the current standard of living in case of an eventuality.

- Maintain a standard of living during retirement.

- Plan and stay ahead of changes in the economy such as inflation.

- Maximize returns and minimize risks of the investments.

Analysis details

- The client is risk-averse, therefore will prefer assets that have low risk.

- The client does not have a living will.

- The client does not have health care powers of attorney.

- The client does not have a will.

- The client does not have durable powers of attorney.

- There are no long-term care assets at risk.

- Finally, the client does not have a Net Estimated Life Insurance Needs Shortage.

- There are no planned educational goals.

Assumption

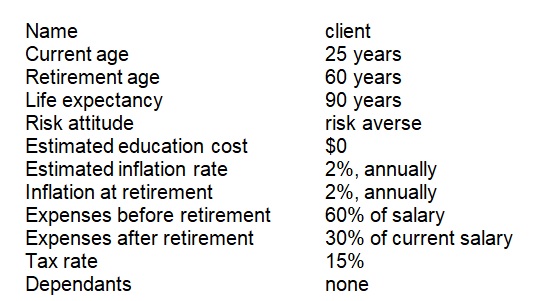

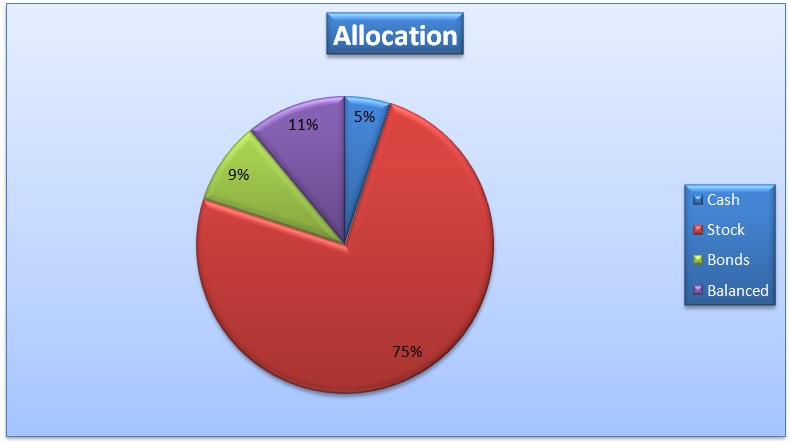

The assumptions on the client’s information, various rates, allocation of assets, expenses, and inflation are summarized below.

Cash flow

Table 1: Cash flow statement. The table shows the income and expenses of the client. It also gives information on the net income.

In the table, 44% of the income is spent on housing followed by food & clothing, then health care. At the moment, the client does not have investments and loans. So there are no returns from investment and there are no loan and mortgage repayments. Further, the client has $30,000 to invest. This will be distributed across various assets. The investment will be made in a way that incorporates the risk attitude of the client.

Asset allocation

As indicated above, the client has an annual income amounting to $2,000 and $30,000 in cash. Therefore, asset allocation will focus on investing the amount available in a way that maximizes returns and minimizes risks. The cash will be allocated in the three broad categories of assets. These are cash, stock, bonds, and balanced assets. It is worth mentioning that asset allocation will have a significant impact on investment returns. Further, since the economic and market conditions keep on changing, the client needs to come up with a tactical asset allocation plan that will be responsive to these changes. Therefore, the allocations should not be rigid. Otherwise, the customer may lose on opportunities. Therefore, the $30,000 will be allocated using the proportions shown below.

Table 2: Allocations. The table gives proportions of how the client should invest the $30,000.

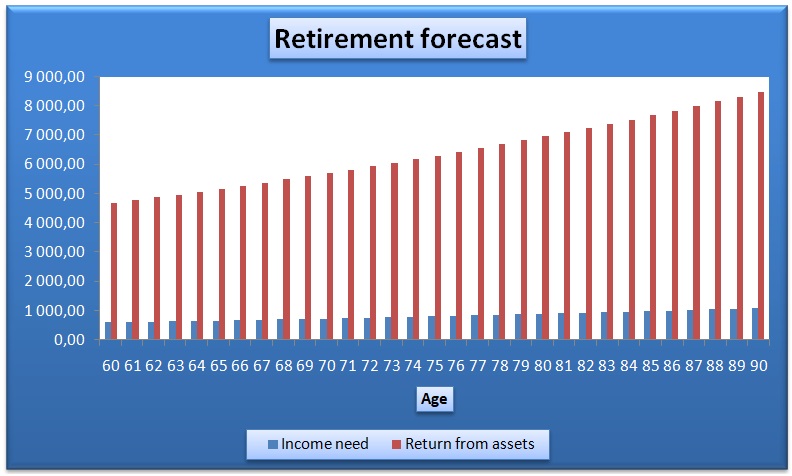

Retirement evaluation

At the moment, the client does not have a retirement plan. One of the goals indicated above is to plan for retirement because the plan will cover life expectancy. The retirement plan will look at tax advantages, taxable investments, Social Security benefits, and other defined benefit pensions. The current income of the client may not reach the intended retirement goals. Therefore, the client may need to increase savings and invest in assets that offer high returns to increase the chances of attaining the retirement target.

The planning for retirement requires a trade-off between current and future spending. The amount required for retirement depends on when income, savings levels, return on investment, government pension, and year of retirement among others. The break-down for retirement is summarized below.

Income required during retirement (30% * 2,000 * 30 years * 2%) = $25,427.66

Income during retirement, ($4,689 * 2% * 30%) = $198,717.20

Income shortage = $0

The calculation above indicates that the revenue that the customer will earn after retirement exceeds the total retirement expenses. Therefore, if the investment is properly done, then there will be no shortage. Besides, there will be no need for having additional assets to fund the retirement. The client can consider taking early retirement, increasing the retirement expenses, buying a home after retirement, or taking more vacations during retirement so that the income can be fully utilized before the lapse of the life expectancy period. The retirement schedule is summarized below.

Table 3: Retirement schedule. The chart shows the expenses and expected income during the retirement period.

Survivor needs analysis

The analysis is based on the assumption that the client will not have a family or other dependants. Despite not having dependants, the client still needs life insurance to take care of final and funeral expenses. Therefore, the client should consider taking a term life insurance cover. This will just cater to temporary needs that cover only for a specific period. Thus, the cash needs for the life insurance cover is estimated at $1,710.

Long-term care

During old age especially after retirement, the client may require additional custodial or medical care. This can be provided at home, in a nursing home, or at a hospital. Some of the activities that are offered under this care are dressing, bathing, toileting, and eating among others. The client needs to take insurance that will cover costs that are associated with long-term care. The need estimate for the long-term care is shown below.

Estimated annual care cost $500

Approximated years of care 5

Inflation rate 2%

Total $2,602.02

The client needs to take this insurance as soon as possible to reduce future expenses. If the client waits then takes the over at a later date, then it will attract more costs.

Disability insurance

This insurance will be important because it offers protection if the client is unable to meet financial commitments due to an accident or sickness. Thus, it protects the earnings and the assets of the client. Without this insurance, the client might need to find other sources of income that may substitute earnings that might be lost in the event an eventuality occurs. Unfortunately, it may not be possible to find such kind of income that cannot be worn out swiftly. This makes the disability insurance a sure bet for the client. The estimation of income need during a disability is summarized below. The calculations are based on the assumption that the client will be disabled at least five times before 65 years. The disability may last for about 3 months.

Annual income source $5,861.25

Annual expenses $2,287.50

Income surplus $3,573.75

Discussion

The analysis above covers most of the financial aspects of the plan. It covers asset allocation, retirement, life insurance, long-term, and disability insurance. Apart from the financial aspect, the client also needs to plan for the non-financial aspects. For instance, the client needs to plan for the assets and returns in such a way that they minimize tax liability and maximize any tax benefit that may arise. Also, the client needs to carry out estate planning. This will ensure that the assets of the client are distributed according to their wish. It will also minimize tax expenses. Thirdly, the client may also need to plan for further education. This may increase the chances of earning more income in the future. Based on the discussion above, the insurance needs for the client total $32,027.18. The balance sheet (net worth) statement for the client is shown below.

Balance sheet statement (net worth)

As of April 2017.

Table 4: The balance sheet. It gives information on the assets and the liabilities of the client.

The table above shows that the net worth of the client stands at $30,000. The amount is invested in the four categories of assets as indicated above. The client will start earning income from the investment and grow the asset.