Introduction

Companies work within domestic and global economies in order to maintain profit, grow, and bring the necessary goods or services to the public. The way each organization achieves this goal, however, is different. Corporate missions act as a guide and a professional throughline that allows the entire organization to work toward a specific set of goals. They are a crystallization of an organization’s values, both an outward and inward indicator of intent. Therefore, it is necessary for companies to work in accordance with their corporate missions and exercise decision-making that supports its completion. Usually, a corporate mission statement is short and concise, meaning that there can be many ways to interpret it and apply it to practice. However, the importance of a mission statement cannot be overstated, and it should be understood in the context of the company’s operation as a whole, including its financial decisions.

A mission of bringing satisfaction to customers, for example, could be fulfilled both by increasing the available range of products and enhancing product quality. As a result, it becomes necessary to evaluate organizational practices that work to fulfill a corporate mission in order to understand their effectiveness, timeliness, and relevance. For the purposes of this work, financial performance measurements will be accessed as a tool for measuring the company’s adherence to its mission.

The main argument of this work is that financial performance indicators, and financial success, by extension, have a complex relationship with a corporation’s mission, which can either be beneficial or detrimental to either aspect of the organization. Examining the financial stability and well-being of a company can encourage change, altering the way its focus is made within a market and improving financial success. A well-designed and poignant mission statement attracts support to a company, helps to direct its activities, and shapes its public image, supporting the financial efforts of said organization. In addition, it is also a display and consolidation of values and outward priorities (Scales & Biderman-Gross, 2020). Alternatively, financial performance and a company’s mission can come into conflict, where the organization is forced to choose one over the other. In such cases, corporate values may no longer align with the actions of a company or be lost entirely. Even in cases where the organization decides to preserve its mission statement and adhere to it, potential financial gain may be lost.

Approaches to Measuring Financial Performance

In order to understand the success of an organization, it is necessary to understand its financial well-being and success. Almost every measurement is based on KPIs (Key Performance Indicators), which allow managers and other professionals to quickly establish a uniform system for evaluation. Performance analysis can be conducted to understand the financial and non-financial well-being of any given organization (Bénet et al., 2022). With the use of KPI, it becomes easier to understand how any individual part of a company operates, quickly gather data, and perform analysis (Poleski, 2019). According to their name, financial performance measurements exist in order to evaluate the financial success of an organization and its ability to make money or make returns on investments. This process includes assessing different types of KPIs, as well as analyzing a company’s financial statements.

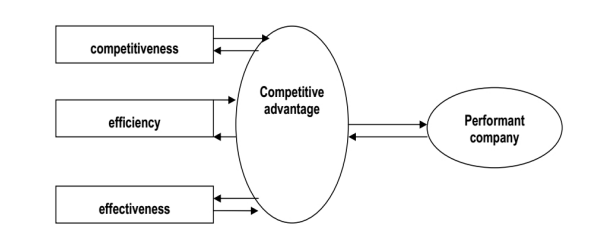

It is difficult to consider all of the primary drivers of financial stability and business success. Each organization interacts with the surrounding economy and other participants in a complex web of interactions, making connections and deriving benefits from them. However, most interaction comes in the form of competition, where companies must outperform others in their sphere in order to retain power or influence. The graph displayed after this paragraph aptly shows the interconnected nature of performance drivers. Production efficiency, competitive edge, and other considerations all have the ability to influence the performance of an organization on the market. Therefore, measuring and evaluating them becomes a key concern in attempting to build or maintain a stable, flourishing business.

Financial statements exist for the explicit purpose of providing more detailed and organized financial information regarding an organization, making them well-suited for performance measurement. In addition, they can also be conducive to better financial returns and profits (Ittner et al., 2003). The statements can include balance sheets, income statements, cash flow statements, and annual reports, all of which discuss different aspects of a company’s financial performance. Aside from using statements or reports, other key performance indicators may also be applicable. For example, gross profit and net profit margins

Importance of Financial Performance Measurement

Financial performance measurements stand as a way to understand whether a company continues developing or working in a sustainable, effective way. Sustainability here is used in the context of corporate longevity, the ability of a given company to maintain its growth throughout the years and cover its expenses. Corporate longevity is often overlooked in favor of short-term profits or revenue, a problem that is being addressed with increasing frequency (Reeves & Whitaker, 2020). According to research, contemporary specialists place increased emphasis on resilience, and sustainable and stable growth, and encourage companies to adopt management practices that support this approach (Cobo-Benita et al., 2020). By analyzing financial statements, discussing various indicators, and making a prediction about the future, organizations gain the capacity to change their approaches in accordance with their own needs and the surrounding economy.

If an organization is underperforming or is unable to cover its expenses, performance measurement can recognize discrepancies and lead to much-needed changes before an organization suffers. In addition, this information can also be used to compare the performance of a company to its past income or estimate how well it compares to the competition. It is a vital indicator for deciding employee wages, risks, and market entrance strategy.

Defining a Corporate Mission

As mentioned previously, a corporate mission is a consolidation of an organization’s aims and goals, a directive for its future growth. A corporate mission can be the inspiration needed to secure investment or an incentive for new clients to come into contact with a given company. A well-supported corporate mission falls in line with all other operations inside a given business and has the capacity to reinforce its financial well-being. According to research, a memorable and well-phrased corporate mission can be vital to the branding and image of a business. It is helpful when other organizations and potential customers need to understand any given business or direct their purchasing decisions (Berbegal-Mirabent et al., 2019). By putting in the time and effort to create, support, and maintain a corporate mission, organizations are able to invest in their long-term success.

This is especially true when an organization needs to communicate with stakeholders on different levels of influence. Their main strength, usually, comes in the form of articulating the business purpose and intended audience, although some mission statements go above and beyond this metric. In such cases, mission statements are able to succinctly differentiate the company from its competition, give a perspective on the value of its work, and affirm its corporate values (Ortiz, 2021). The ability to successfully communicate as many of these qualities as possible within a limited number of words makes a strong mission statement.

Performance Measurements and Corporate Mission

A corporate mission, as any other goal or commitment of an organization, must be supported by other activities to truly be successful. Without being able to support assertions of client-oriented work, success, innovative practices, or good leadership with real results, a company has no way to convince its investors or follow through on existing promises (Alegre & Berbegal-Mirabent, 2018). Analysis by social scientists further shows that a good mission statement and a vision statement have a significant influence on financial performance and success (Sipayung et al., 2019). Therefore, financial performance measurements become the primary tool for accessing a company’s adherence to its mission. With a thought-out, well phrased, and effective mission statement, a company can direct its other activities around it, and create frameworks for asserting its effectiveness.

This is further supported by discussions of corporate responsibility and transparency. A mission statement is one of the ways a company can vocalize its commitment to bettering the world or taking accountability for its actions. A mission statement is a part of being socially responsible, and communicating a business’ commitments to others. According to existing evaluations, corporate social responsibility is directly tied to financial performance, and companies that successfully managed to incorporate CSR ideas into their business model and advertisement saw bigger market success (Platonova et al., 2018). According to modern business trends, it is vital that organizations realize their potential impact on the world around them and take action toward bettering the community.

However, the collaboration between financial performance indicators and corporate mission assumes a positive relationship between the two values. In many cases, an organization may fail to properly align its actions, strategy, or market position with its organizational values, which makes them lose its meaning. Existing research on this trend refers to it as “mission drift” and considers it especially dangerous for smaller businesses. The authors of the paper discussing this trend further connect it with the Hillshade Phenomenon, a tendency of high-earning organizations to drift away from their initial company missions in favor of profitability (Simiao & Shuhuai, 2022). This paper states that ignoring the relationship between mission statements and the financial state of a given business is impossible. The most important takeaway from such research is that financial performance can directly affect the ability of an organization to fulfill its corporate mission. In ideal circumstances, the two work to balance each other, promoting innovation, pointed development, and growth. In real business environments, however, they increasingly come into contention with each other.

Corporate Examples

In order to reinforce this point, it may be productive to examine some of the existing examples of corporations with strong or memorable mission statements. Within the food and services industry, the Starbucks corporation can be noted. As a quickly growing and expanding business, their influence on the coffee shop sphere cannot be understated (Azriuddin et al., 2020). Its mission is to “To inspire and nurture the human spirit – one person, one cup and one neighborhood at a time.” (“Starbucks mission and values,” 2020) This mission statement displays a commitment to supporting the local community, a focus on providing high-quality services, and improving the well-being of individuals. Starbucks considers its coffee and food to be uniquely capable of enhancing the lives of people, and its mission is to foster a fruitful relationship between itself and the society. The idea of a coffee shop as a center of local communities and a place of gathering has been researched previously in a professional capacity (Ferreira et al., 2021). According to studies, locations of consumption can often become centerpieces of smaller communities, drive people together and promote interpersonal interaction.

Starbucks, in this context, is a location separate from both the professional sphere and home life, a mix of private and public. Therefore, the mission statement of Starbucks closely aligns with the public needs and perception, falling in line with the expectations of their customers. The desire to serve the community and foster the gathering of people further bolsters business, giving the corporation an opportunity for growth, profit, and development.

However, the most notable part of Starbucks’ business strategy is its failure to fully adhere to the ideas and values espoused by its own mission statement. For many years, Starbucks has been considered a progressive company, one which offered good employee benefits and treated its workers with due dignity, understanding, and respect. The public image of a community-focused, caring company helped the brand establish its good name and reputation.

In recent years, it has become apparent that Starbucks places a much smaller emphasis on the desires of its lower staff than on profits. Allegations of overworking, and bad workplace conditions during the pandemic have seriously damaged the reputation and the people’s goodwill toward the company. Furthermore, the attempts of workers to unionize and fight for better workplace benefits have been met with harsh resistance, showing an inability to change, care for their staff or listen to their demands (Gruenberg, 2022). As a result of the COVID-19 crisis, and the aforementioned issues, Starbucks has faced significant losses over the last two years, in both staff and revenue. The inability of the chain to maintain its good reputation or sales numbers in the midst of bad publicity shows that adherence to a corporate mission has a large impact on its potential profits.

In cases where the organization fails to properly manage its operation to reflect its mission, the consumers will be less likely to support it with their money. Comparatively, Starbucks has only seen itself recovering financially when it partially gave in to the demands of the employees and introduced much-needed changes to its operation (Gao et al., 2022). An improvement in workplace conditions has lead to better financial success.

Conclusion

In conclusion, financial performance measurements act as a key indicator of corporate wellness. Their existence supports the relationship between companies, investors, and their clients. By analyzing data regarding profits, sales, and expenses, organizations are able to better direct their future efforts to align with the professional mission. These indicators themselves can also serve as a justification of the mission’s effectiveness or a method of its evaluation. If corporate action in service of a company’s mission leads to profit losses, debt, or worse returns on investment, it can signify a need to change the company’s mission for the better.

However, a considerable number of companies also face issues when making mission statements, or trying to align their missions with the pursuit of financial gain. Missions are, in many cases, outwardly focused. They are designed to spread awareness of the business, attract an audience and project a positive image of the company to others. Such statements, however, can easily come into conflict with the internal needs of an organization. Compared to global or long-term goals such as supporting the community or bringing positive change to the lives of individuals, profit motives or the need to stay above the competition fall much more closely in line with what businesses are capable of doing.

With financial performance tools, it is easier to understand, monitor, and change a company’s financial status, compared to more socially-oriented goals. The discrepancy between the two poses a problem for organizations with large public support and important social roles. There is an emergent and important need to combine the practices of staying true to company values while also maintaining its financial success. Some organizations are capable of this task or strive to better achieve it through trial and error. As seen with Starbucks, an inability to adhere to a corporate mission statement can lead an organization to severe financial loss and bad publicity. Taking new insight from their example, it can be asserted that financial evaluation tools and other approaches must be used in service of a broader corporate mission, not just controlling finance. This approach would allow organizations to more easily follow through on their promises, stay true to their missions, and communicate their values in action.

Financial performance measures and mission statements can work together, although it requires significant effort and long-term planning. In this vein, these two indicators are able to work together in improving a company’s service, efficiency, and profitability. It is necessary to conduct a financial performance analysis to fully see the advantages and disadvantages of a given corporate mission.

Reference List

Alegre, I., & Berbegal-Mirabent, J. (2017). The real mission of the mission statement: A systematic review of the literature. Academy of Management Proceedings, 2017(1), 10729. Web.

Azriuddin, M., Kee, D. M., Hafizzudin, M., Fitri, M., Zakwan, M. A., AlSanousi, D., Kelpia, A., & Kurniawan, O. (2020). Becoming an international brand: A case study of Starbucks. Journal of The Community Development in Asia, 3(1), 33-43. Web.

Bénet, N., Deville, A., Raïes, K., & Valette-Florence, P. (2022). Turning non-financial performance measurements into financial performance: The usefulness of front-office staff incentive systems in hotels. Journal of Business Research, 142, 317-327. Web.

Berbegal-Mirabent, J., Mas-Machuca, M., & Guix, P. (2019). Impact of mission statement components on social enterprises’ performance. Review of Managerial Science, 15(3), 705-724. Web.

Cobo-Benita, J. R., Amo, M. H., & Santiuste, A. C. (2020). Rethinking businesses: collaboration, digitalization and sustainability as core pillars for future innovative and resilient companies. ESCP Research Institute of Management (ERIM). Web.

Ferreira, J., Ferreira, C., & Bos, E. (2021). Spaces of consumption, connection, and community: Exploring the role of the coffee shop in urban lives. Geoforum, 119, 21-29. Web.

Gao, J., Li, X., Wang, Z., & Zhang, H. (2022). The Financial Statement Analysis of Starbucks [Paper presentation]. 2022 2nd International Conference on World Trade and Economic Development (WTED 2022).

Gruenberg, M. (2022). Starbucks unionising drive accelerating, as is retaliation. Guardian (Sydney), (1997), 11. Web.

Ittner, C. D., Larcker, D. F., & Randall, T. (2003). Performance implications of strategic performance measurement in financial services firms. SSRN Electronic Journal. Web.

Ortiz, L. (2021). Leveraging the organizational mission statement to communicate identity, distinctiveness and purpose to primary and secondary stakeholders during COVID-19. Journal of Strategy and Management, 15(2), 234-255. Web.

Platonova, E., Asutay, M., Dixon, R., & Mohammad, S. (2018). The impact of corporate social responsibility disclosure on financial performance: Evidence from the GCC Islamic banking sector. Journal of Business Ethics, 151(2), 451-471. Web.

Poleski, D. (2019). Why are key performance indicators important? Business dashboard & analytics software for individuals and teams | Klipfolio. Web.

Reeves, M., & Whitaker, K. (2020). A guide to building a more resilient business. Harvard Business Review. Web.

Scales, D., & Biderman-Gross, F. (2020). How to lead a values-based professional services firm: 3 keys to unlock purpose and profit. John Wiley & Sons.

Simiao, P., & Shuhuai, P. (2022). Hillshade Phenomenon—The delayed impact of corporate mission drift on society. Web.

Sipayung, F., Ginting, L., & Sibarani, M. L. (2019). Vision & Mission, organizational performance and corporate image on consumer goods company. Asia Proceedings of Social Sciences, 4(3), 76-79. Web.

Starbucks mission and values. (2020). Starbucks Stories. Web.

Taouab, O., & Issor, Z. (2019). Firm performance: Definition and measurement models. European Scientific Journal ESJ, 15(1). Web.