Executive Summary

The report presents the business expansion plan of Design Studio to develop and operate a 386,000 sq ft of a manufacturing facility in Huizhou, Guangdong Province, China named Design Studio (Huizhou) Home Furnishing Co., Ltd. Scheduled to be operational by 2nd half 2012, it will be the Group’s state-of-the-art manufacturing facility, equipped with some of the latest computerized machinery and production lines from Europe. Based on the objective of the project, this report discusses the financial implications using discounted cash flow techniques and the worthiness of the project by risk evaluation methods. The success of the study leads to better implementation and investment of the company’s vision. The report forms the basis of the company’s investment in the coming expansion.

Introduction

Design Studio Furniture Manufacturer Limited a leading premier furniture manufacturer, product and interior fitting-out specialist has earned a reputation since 1992 for offering superior quality products, professional workmanship, and services. Design Studio manufactures, supplies, and installs paneling products for residential property developments. The Company also provides interior fitting-out services for residential, commercial, retail properties. Design Studio is a distributor of the imported brands of complementary products and exports its products to overseas markets.

Being close to the market and understanding its expectations has always been an important operating philosophy for Design Studio, this will put us in a strong position to meet the demands for interior contracting services across the hospitality, commercial and retail segments in China. With China’s rising urbanization and strong economic growth having translated into increasing consumerism and demand for housing and lifestyles choices, the board decided which to open up promising developments across all sectors in China which will further strengthen our business models.

Discussion of Options

There is a potential in approaching the Chinese market from the retail business model, a fully furnished showrooms in key cities such as Shanghai, Beijing, Tianjin and Nanjing which will offer a complete range of furniture & furnishing products for discerning mid/high-income home owners across these major cities to one-stop service of interior service for residential and commercial projects.

The business development unit came up with three business models and would like to explore the possibility of implementing it. The Retail, Residential Projects and Hospitality and Commercial Projects.

- Option 1: The Retail segment sells as retails basics to all consumers. Understanding the consumer behaviors is also a key focus in adding our strategic and design skills to create a retail environment that reflects the identity and qualities of the brand.

- Option 2: The Residential Projects segment provide interior fitting-out services, manufactures various paneling products, including kitchen and vanity cabinets, wardrobes, doors and doorframes, and furniture components. Each home is an inspirational statement in individual design and deserves full attention and looking its best.

- Option 3: The Hospitality and Commercial Projects segment to provide interior fitting-out services on a turnkey basis and structural works for hospitality, commercial, and retail properties, such as hotels, resorts, offices, shops, and bank branches.

Description of the Cost and Benefits of the Project

Manufacturing is the principal activity of Design Studio. Encompassing a wide range of paneling products including kitchens and vanity cabinets, wardrobes, doors and doorframes, our customized creations has adorned many prestigious residential and hotel property developments.

- Option 1 – The Retail: The initial cost involves manufacturing facility and fully furnished showrooms. Incorporating the cost of making products, the cost of materials, labor, marketing and other resources. With promising prospects and China’s opening-up in its retail market is in line with WTO rules, and offers unprecedented preferential policies to overseas investors.

- Option 2 – The Residential Projects: The initial cost involves manufacturing facility and corporate office. Incorporating the cost of making products, the cost of materials, specialized personnel, marketing and other resources. A major benefit of this alternative is the development of the property market has given vitality to the interior design sector. The interior decoration industry developed rapidly in the 1990s as living standards improved and China began its housing reform.

- Option 3 – The Hospitality and Commercial Projects: The initial cost involves manufacturing facility and corporate office. Incorporating the cost of making products, the cost of materials, specialized personnel, software, marketing and other resources. With a growing number of the city’s companies are realizing the importance of making the workplace more of a “home away from home”. Cutting edge office design, focusing on employee comfort as well as ergonomic functionality, is now seen by many businesses as the key to retaining quality personnel, increasing productivity, maintaining a competitive edge and having the right corporate image.

Cost of Capital Assumptions and Calculations

By using a weighted average cost of capital (WACC) of comparable companies that are similar in risk and within the furniture retailer industry it produces an accurate estimate for long term.

- Haverty Furniture 7%

- Herman Miller 9%

- Steelcase 9%

- OfficeMax 13%

An average from the 4 companies of 9.5% is taken for the WACC.

Evaluation of the Project

Both NPV and IRR can be reliably used for as long as the prescribed conditions are met. In comparison using NPV, the choice of discount rate is based on the perceived risks against the particular project. At times the projects are discounted at different rates. This occurs when one project is considered more risky than the other. It must be stressed that the reliability of NPV in project evaluation is as good as the choice of discounted rate. It’s important to note that NPV is only reliable and dependable if the chosen discounted rate is reasonable and practicable. Values that are impracticable and Unrealistic provide baseless and inapplicable decisions. When using IRR, project acceptance is must not be primarily based on how high or low a respective IRR is. The practicality of maintaining such an IRR must be considered based on past, current and future expected changes within the corporations operations. This should help in assessing whether or not reinvesting opportunities based on such an IRR is realistic and hence practicable. A project’s IRR is only accepted if the value is considered practicable and realistic for application by the firm. Otherwise, a re-evaluation is undertaken and a more realistic discounted rate adopted.

*For calculations refer Appendix 1

Present Value is calculated with the formula; Profit of that year / (1+r) ^n

r = discounting rate, WACC in ratio per 100 & n= future year of cash flow

Internal Rate of Return, IRR

Evaluation of the Risk of the Project

As with any opportunity, there is a wide range of risks in China’s business environment, Common risk by any of the options includes:

- Increase in corporate taxes, value added tax and etc.

- Economic risk based on assumption that the city will grow providing the projected demand.

- Foreign exchange risk as the manufacturing facility was initially funded in Singapore Dollars and the returns will be in the local currency.

- Recruitment, development, and retention of talented employees and willingness of management from the headquarters to work in China.

- Competitors setting up similar operations interfering in the demand and supply.

- Sourcing risks, including supply-chain and business interruption issues.

- Insurance market, the lack of insurance management gives rise to substantial risk, especially when they award contract to less capitalized contractor.

- Product safety is now one of the most prominent sourcing risks resulting from manufacturing in China, and it poses a significant risk to any company’s brand and reputation.

- Disaster Preparedness, to have contingency plan in the event of a natural disaster affecting one of their key facilities or supplier.

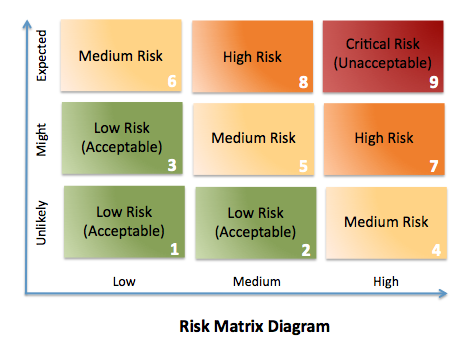

A simple way to quantify risk of subjective matters to assist management in their decision-making has been proposed below. By taking in account of an issue that may probably poses a risk and the impact on the project.

Option 1 – The Retail Projects

- Construction, completion and operation of the manufacturing facility. (5)

- Construction, completion and operation of the showrooms. (5)

- Setting up the equipments, machinery and production lines. (6)

- The cost of materials and making product. (3)

- More display space, more rental cost. (7)

- Getting good sales people to promote and sell the furniture. (7)

- Totally dependent on “foot traffic” for sales. (9)

- Operate from locations with high foot traffic like shopping malls. (8)

- Manage during retail hours, stretching into long days and weekends. (3)

Total Risk Rating: 53

Option 2 – The Residential Projects

- Construction, completion and operation of the manufacturing facility. (5)

- Construction, completion and operation of the corporate office. (4)

- Setting up the equipments, machinery and production lines. (6)

- The cost of materials and making product. (3)

- Recruitment of Designer specialised in Residential project. (7)

- Dependent on walk-in customer, referral and tendering of project. (7)

Total Risk Rating: 32

Option 3 – The Hospitality and Commercial Projects

- Construction, completion and operation of the manufacturing facility. (5)

- Construction, completion and operation of the corporate office. (4)

- Setting up the equipments, machinery and production lines. (6)

- The cost of materials and making product. (3)

- Recruitment of Designer specialised in Commercial project. (7)

- Investment of software for more complex project. (8)

- Dependent on tendering of project only. (9)

Total Risk Rating: 42

Recommendations

The choice of investment option is not limited to financial analysis only. China remains one of the largest manufacturing countries across the globe and competition is stiff. While the company aims to adopt a measure that will ensure maximum possible returns, it will also focus on less risky measures which will not compromise its productivity or existence. Reaching out to clients in a market that is largely filled with many manufacturing entities is of crucial importance. Its important that the corporations realize the stage of development in China is rather developmental than mature and as such many potential challenges exist. This can be more pronounced for corporations that are not familiar with the country. The need for trusted advisors, in formation of risk mitigation can therefore not be underestimated.

Despite having a much larger present value, Option 3 has an IRR value less that investment the discount rate of 10% and is therefore not a good choice for investment. Option 2 on the other hand has a high IRR value and additionally has the most positive NPV value and is therefore the best investment alternative [9]. If capital is not an issue, all three options should consider implementation that might increase the returns more than expected.

Bibliography

Lee, S P. (2011). The Chinese University of Hong Kong. Weighted Average Cost of Capital. Web.

Wiki Wealth. (2011). WACC Discount Rate Analysis – Haverty Furniture (HVT) Stock Research, Investment News & SWOT Analysis. Web.

Wiki Wealth. (2011). Herman Miller (MLHR) Stock Research, Investment News & SWOT Analysis. Web.

Wiki Wealth. (2011). Steelcase (SCS) Stock Research, Investment News & SWOT Analysis. Web.

Wiki Wealth. (2011). OfficeMax (OMX) Stock Research, Investment News & SWOT Analysis. Web.

Atrill et al. (2002). Accounting: an introduction. 4th edition. French Forest: Pearson Education Australia.

Wanaby, R. (2009). Appraising investments. London: McGraw Hill Publishers.

Claire, R. (2007). Discounted cash flow in financial analysis. Management Journal, 14(4), p 345-356.

Brealey, R. (2005). Principles of Corporate Finance. London: McGraw-Hill.

Guerrero, R. (2007). The Case for Real Options Made Simple. The Journal of Applied Corporate Finance, 45(15), pp. 56-89.