Strategy Implementation

Companies Objectives

There are several actionable steps that Polaris Industries Inc. could take to implement the chosen strategies of product and market development to expand its geographical presence across the globe. In relation to geographical expansion, the company seeks to expand its presence by 20% over the next three years. The steps to achieve this goal will include conducting market research to identify potential grounds for expansion, creating clear product distribution channels, and implementing targeted marketing campaigns focusing on individuals in particular regions.

On product development, the company will set a goal of launching at least three new innovative and innovative products over the next three years. The approach to accomplishing this objective are creating a skilled R&D team, properly financing the team, and trying mergers and acquisitions should the first option fail.

Concerning market development, the company will seek to expand its market share in the existing regions by 20%. To achieve this penetration, the company needs to create good relationships with various vehicle dealers who play a pivotal role in the distribution of vehicles. Polaris should strive to have repeat customers by offering after-sale services. This would align with the literature, which reveals that organizations that offer after-purchase services have more clients than those that do not (Hride, 2022). The company could also enhance market development by offering customer loyalty points where rewards can be provided for repeat customers. Since this practice is not common in the industry, it could result in market differentiation for the company.

Based on the insights of the IFEM analysis, the company has challenges with its operational costs, especially in its internal environment. To address this problem, the company will set an objective of streamlining all its internal processes to ensure that they are optimal and reduce production costs by 10%. To achieve this objective, the company should first conduct an operational audit, which refers to examining organizational processes to ensure they are efficient, effective, and in line with the company’s and external regulations (Chen et al., 2020). An audit into the preventable losses that the company causes when manufacturing vehicles would help guide the management on the areas that need to be re-examined and adjusted. Either internal or external auditors could conduct the internal audits for this company. These steps will give Polaris Industries a competitive edge as it will avoid losses that its competitors have to bear.

Organizational Chart

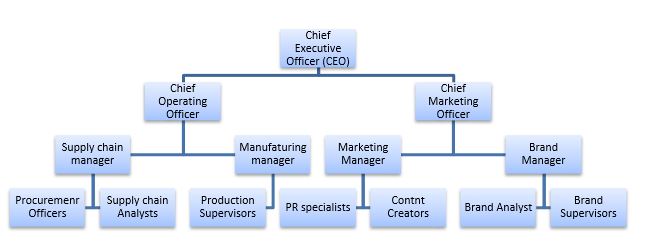

To support the implementation of the proposed changes, a revision of the Polaris organizational structure is needed. The current structure that the organization uses, as shown below in Figure 1.

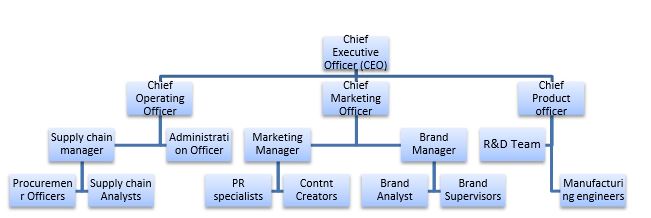

The rationalization for this new structure is that it creates a new department under the chief product officer focused on product development. Regarding market development, the current organization structure is acceptable, and the marketing managers need to align their objectives to diversify into new geographic regions. To move the organization into the new structure, employees and managers must be trained to follow the new mission and vision and understand the company’s need to diversify into new organizational regions. There should be clear communication in the organizational structure change and the formation of a new department with a senior manager. The company’s chief operations manager and marketing manager must view the chief product manager as equal.

Product Positioning Map

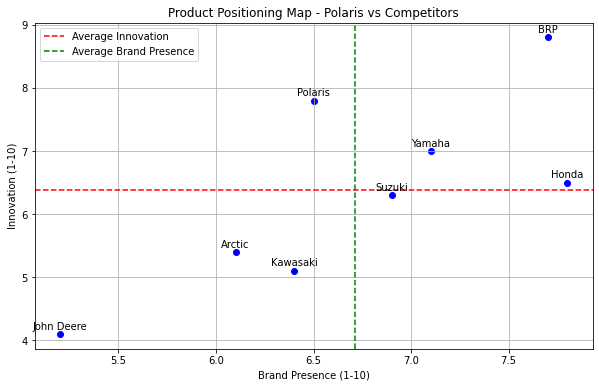

The product positioning map for Polaris shows that it is below the average brand presence compared to its competitors but above the average in terms of innovation. Adopting the recommended geographical expansion strategy will raise the company’s brand presence and innovation, thus gaining a competitive advantage.

Polaris Industries Projected Balance Sheet

The figures in Table 1 below show the projected income statement once the strategy for product and market development is initialized and how the company will continue to be profitable. The balance sheet shows that the proposed changes will not lead to immediate results since this shall be a long-term project.

Table 1: Polaris Industries Projected Balance Sheet.

Impacts of the Strategy on Polaris Value

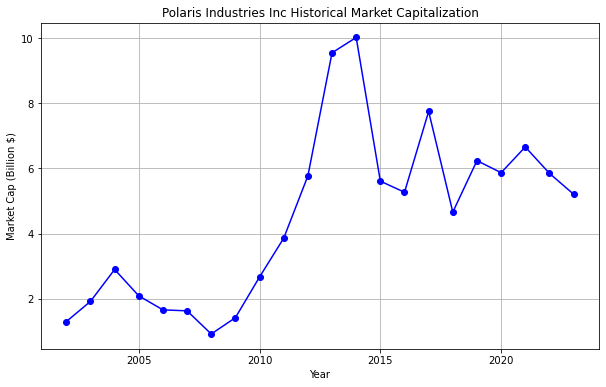

The company under analysis has been declining in value, and implementing the policy will likely change the trajectory. Polaris Industries Inc. is valued at $5.21 billion by market capitalization (Companiesmarketcap.com, 2023). Since 2014, the company’s market capitalization has been decreasing, as shown in Figure 3 below. Implementing the proposed product and market development strategies will result in a change of trajectory, giving the company a value of over $10.00 billion by market capitalization, as was in the case of 2015.

Strategy Evaluation Draft

Balanced Scorecard

A balanced scorecard is used to measure a company’s performance using various indicators, many of which cannot be reflected in a company’s financial statements. The indicators could include the loyalty of an organization’s partners, the employees’ skills, or the goodwill of a company’s brand. Developed by Kaplan and Norton, the balanced scorecard places the company’s vision and strategy at the center. It is surrounded by measures based on four perspectives: financial, customer, internal business processes, and learning and growth (Oyewo et al., 2022). Table 2 shows a balanced scorecard for Polaris Industries, showing how the outlined objectives and strategies will be achieved over the next three years.

Table 2: Polaris Balanced Score Card.

Contingency Plan for Addressing the Unforeseen Changes

Market challenges could arise related to obstacles limiting the market research for expansion into new geographical regions. Such unplanned problems are common within organizations, necessitating contingency plans (Niemimaa et al., 2019). If this problem occurs, the best contingency plan will be leveraging third-party organizations to conduct the research on behalf of the company.

Additionally, the management is responsible for creating a team of experts who will explore alternative research methods. The strategic plan holds that the company will seek to be innovative and release three disruptive products into the market within the next three years. Should this fail due to the inability of the R&D team to come up with such a project and lack of financing, the company will seek to collaborate with external companies or seek mergers and acquisitions with promising companies. To address this unforeseen need, a team will be dedicated to exploring external organizations and identifying those that offer promising solutions for acquisition.

Challenges could arise in the internal audits conducted within the organization, especially when the results are not good. This is a common problem many organizations face concerning their internal audit teams (Li et al., 2020). Should the question of untransparent auditing arise, a contingency plan of leveraging external auditors will be explored. A dedicated workforce of open internal auditors shall be established to prevent this challenge.

The proposed strategy needs the organization to restructure its current administrative hierarchy and have a new product development department. However, there is a risk that some employees could resist this change. Should this occur, the organization must provide clear communication on the reasons for change before its implementation. The management is responsible for addressing employee concerns, training the workers on the new structure, and ensuring transparent communication within the organization.

References

Chen, Y., Lin, B., Lu, L., & Zhou, G. (2020). Can internal audit functions improve firm operational efficiency? Evidence from China. Managerial Auditing Journal, 35(8), 1167–1188. Web.

CompaniesMarketCap (2023). Market Capitalization of Polaris (PII). Web.

Comparably. (2023). Polaris Inc. Competitors. Web.

Hride, F. T., Ferdousi, F., & Jasimuddin, S. M. (2022). Linking perceived price fairness, customer satisfaction, trust, and loyalty: A structural equation modelling of Facebook‐based e‐commerce in Bangladesh. Global Business and Organizational Excellence, 41(3), 41–54. Web.

Li, Y., Li, X., Xiang, E., & Djajadikerta, H. G. (2020). Financial distress, internal control, and earnings management: Evidence from China. Journal of Contemporary Accounting & Economics, 16(3). Web.

Niemimaa, M., Järveläinen, J., Heikkilä, M., & Heikkilä, J. (2019). Business continuity of business models: Evaluating the resilience of business models for contingencies. International Journal of Information Management, 49, 208-216. Web.

Oyewo, B., Moses, O., & Erin, O. (2022). Balanced scorecard usage and organizational effectiveness: Evidence from the manufacturing sector. Measuring Business Excellence, 26(4), 558–582. Web.