Introduction

Porsche Automobile Holding SE is a German company that holds most of its investments in automobile industry. Ferdinand Porsche founded the company in 1931 by the name of “Dr. Ing. h. c. F. Porsche GmbH.” It is headquartered in Zuffenhausen, Stuttgart, in Germany.

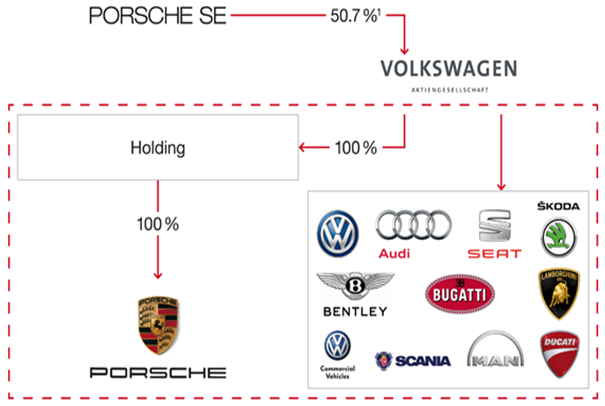

The company from its inception in 1931 was owned by Dr. Ing h.c. F. Porsche AG. In 2007, it became a holding company with 50.1 percent stake in Porsche Zwischenholding GnbH. In 2009, Porsche Ag became a joint venture between Volkswagen AG and Porsche SE. the present ownership model is presented in the figure below (see Figure 1).

Porsche belongs to the automobile sector. More specifically, it concentrates in the luxury automobile industry. The global automobile industry has been undergoing recession in 2010-11. However, in 2012 the industry has experienced increase in demand that varied with regions. The demand of automobile in Europe and China has been weakening and is expected to reduce even in 2013.

Further, with rising fuel prices and depleting natural gas resources, there has been increasing pressure on automobile companies for making fuel-efficient vehicles. The automobile industry faced an auto sales growth of 4.4 percent in 2012 and is expected to decline to 2.9 percent in 2013. In such a sluggishly growing market, Porsche ahs a niche position in the luxury automobile market.

Presently, Porsche makes cars in four distinct categories. First are the consumer models that are directly targeted for sale. The second type is the racing cars, and the third are the prototype or concept cars and the fourth are tractors. Porsche also makes hybrid cars and engines for aircrafts. According to the company website, Porsche makes the following models of cars – 911, Boxter/Caman, Cayenne, and Panamera.

In the following report, we will further discuss the business and growth of Porsche. We will study the business growth and try to capture financial overview of the company. The in the end the paper will try to gather information regarding the demand for products sold by Porsche.

Business Growth

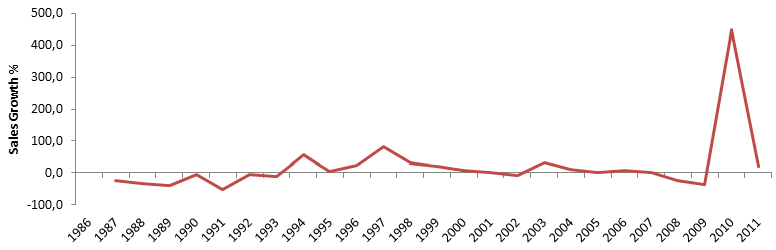

The company has been undergoing tremendous growth. Though the sales figures for early years are not available, the sales figures of Porsche cars since 1987 are available and are presented below.

Figure 2: Growth statistics of Porsche

Figure 2 shows the growth statistics of Porsche from 2002 through 2010. The data demonstrates that the revenue and profit has undergone negative growth in 2009 and 2010 when the production, sales, and revenue fell drastically. This was due to the sluggish demand of luxury cars in the developed countries. As sales fell, the revenue as well as the profit also reduced substantially.

In Northern America, the sales of Porsche cars is available from 1987 through 2011, which is shown in, figure 3.

Figure 3 shows the sales growth rate in North America for Porsche. This shows that the sales figures have been declining in 1988 and have remained negative in 1987 through 1992. The reason for such a decline in sales in late 1980s was sue to the devaluation of dollar against deutsche that increased the prices of Porsche and therefore reduced demand.

In the 1990s, a recession hit sales. In 1992 the company had faced losses of $150 million. This resulted in change in the CEO of the organization in 1992. The focus of the company was shifted from consumer orientation to a purely sports car company. With the restructuring brought forth by Wendelin Wiedeking the pre-tax profit kept on rising for the company and it can be observed in figure 3 that there was always positive sales growth post 1992.

In 2002, there was again a minor restructuring of the company with Porsche going into a joint venture with Volkswagen and began its sports/utility car segment. This move was beneficial for the company as the sales growth was in double digits and the pre-tax profit increased by 22 percent.

In 2009, Porsche increased its stake in Volkswagen by 50.76 percent. There were talks of possible merger between the two companies. However, in the process of uncertainty in 2007 when the takeover bid was initially triggered under German law, there was a decline in the sales.

In 2009, the two companies agreed to create a merged entity wherein Volkswagen will initially take a stake of 49.9 percent in Porsche and buy it back at a later date. Since 2008, the sales growth of the company has been negative. The pre-tax profit growth had initially declined and then splurged into negative growth in 2009 and 2010 only recovering in 2011. In 2012, Volkswagen declared to take total control over Porsche.

Financial Overview

Figure 4: Consolidated Financial Performance of Porsche

Figure 4 presents the consolidated financial performance of Porsche since 2005. The figure shows that the financial performance of Porsche has been changing from moderately good in 2005 to very high increase in earnings per share (EPS) in 2006 to €23.6. However, since 2007 EPS has declined considerably and have been negative in 2008 and 2009.

It has started recovering since 2010 through 2011. The net income of Porsche has increased from 2005 through 2007, however, has declined to negative value in 2008 and 2009. The reason for such bad performance for Porsche in these two years was due to the merger and acquisition between Volkswagen and Porsche. The gross margin has declined from 54.04% in 2005 to 40.82% in 2008.

Operating margin of the company too has declined from 25.72% in 2005 to -6.4% in 2008. In terms of financial health the total current assets as a percentage of total assets has decreased from 45.56% in 2005 to 2.14% in 2011. Total liabilities of the company have gone down from 2005 to 2011. The quick ratio of the company has increased from 0.95 in 2005 to 1.61 in 2011 indicating that the company has greater liquidity.

Demand for product

Figure 5: Demand for Porsche

Figure 5 presents a sales and production analysis of the Porsche products that actually indicates the demand for the Porsche products. This provides a segregation of the product wise production and sales of the company. Porsche makes four products – 911, Boxter/Cayman, Cayenna, and Panamera. The sales and production figures of each brand are provided in figure 4.

The figure shows that overall; in 2010, there was higher demand for the product than supply by 909 units. However, in 2011, the demand for the product fell and there was greater supply of the product creating an excess supply of more than ten thousand products. In 2011, the demand for all the products declined substantially that resulted in the huge excess supply of Porsche cars in the market.

The demand for Cayenne is high, for which the production of the SUV had been increased in 2011 as demonstrated in the figure. However, due to the recession, the overall global demand for automobiles has been low. Demand for sports car and Cayenne has been high in the USA with increase in demand by 15%. The sale of 911 and Boxter/Cayman showed a sale of 9166 in the US.

In the UK, the demand showed a spurt with changes in the model design of Boxter/Cayman. Demand in Asian countries like Japan and China has been encouraging despite difficult economic conditions. Demand in Middle East and Africa continued to grow with 7945 Porsches selling in the area. In Asia-Pacific, the company posted a sales figure of 3930 in 2011 showing a growing demand.

Reference List

Global Credit Research, Global auto industry likely to see reduced demand growth in 2013, Moody’s Investors Service. Web.

Morningstar, Porsche Automobile Holding SE ADR. Web.

Porsche SE, Facts and Figures, Porsche SE. Web.

Porsche SE, Porsche Automobile Holding SE, Porsche SE. Web.

Vettraino, J. P., Porsche at 60: The little sports-car company that could, Autoweek. Web.