Introduction

Greece is one of the countries in the world that enjoys a substantial amount of wind resources, especially in the Aegean Sea Islands and on the mountain ridges on the mainland. Due to this, the government has given the first indication to investors concerning the size of the initial phase of offshore wind power plant deployment (Kardakaris, Boufidi and Soukissian, 2021). Therefore, Greek and foreign companies will start battling for market share immediately after legislative and regulatory structure is presented. In addition, individual investors will start scrambling for an opportunity to invest in the offshore business. The main question arising is the possibility of investing in offshore wind power in Greece, which has been answered in this report.

Analysis

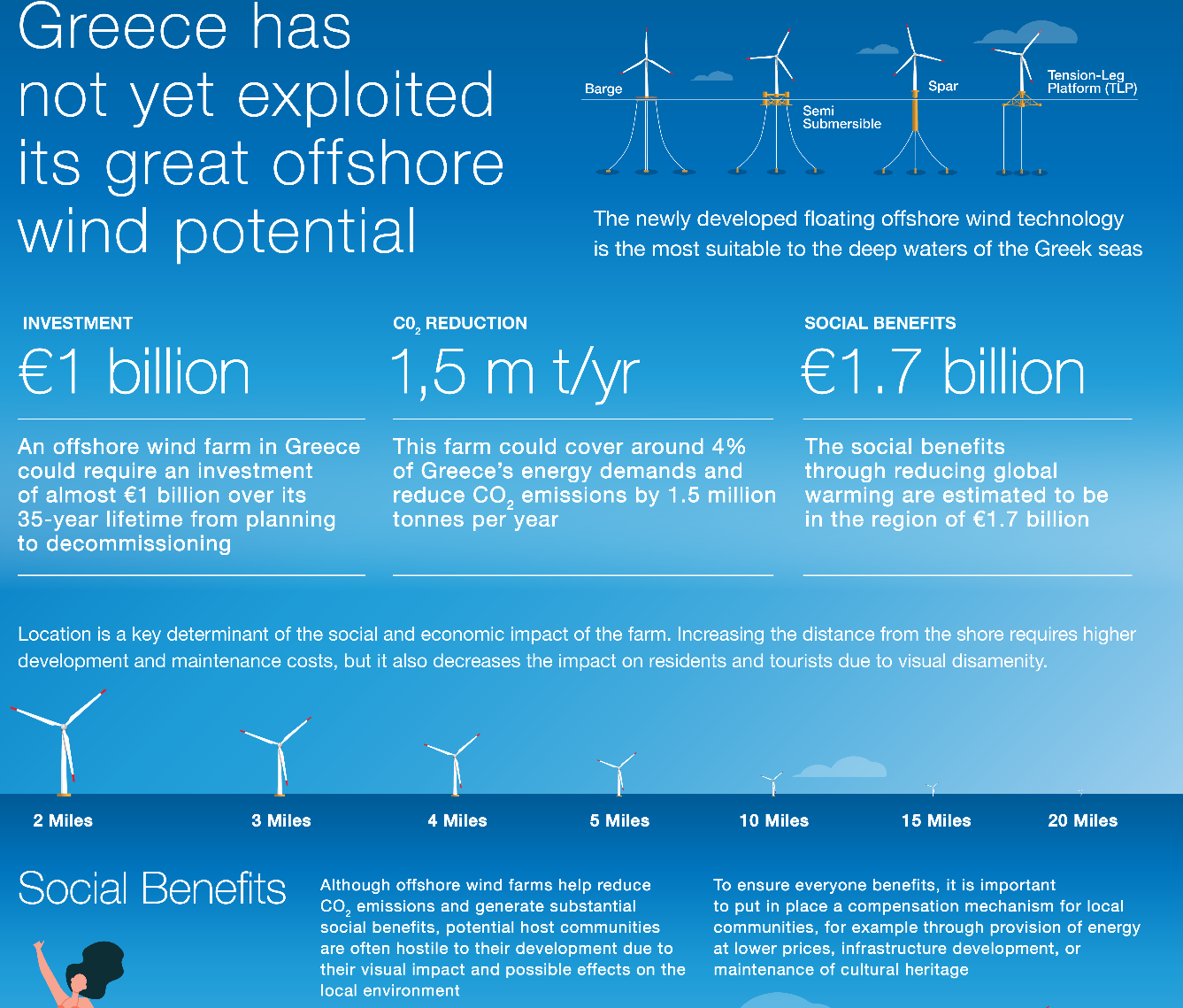

Greece’s 2050 target is to have zero carbon emissions, and investing in renewable energy is critical to achieving the country’s target. This has led to discussions on exploiting the country’s offshore wind through a relevant legislative structure that will promote investment in offshore wind energy in Greece (Spyridonidou and Vagiona, 2020). New floating offshore wind technology has been developed, and it is most appropriate for the deep waters of the Greek seas. For instance, a floating offshore wind farm of 500MW energy capacity at an average 12 kilometers (km) distance away from the shore and 300 meters (m) depth. In addition, the floating offshore has a likelihood of requiring an investment of about $1.34 billion over its lifetime (Pires et al., 2021). Further on, the farm can produce 3 million MWh yearly for more than 30 years. This will cater to 6% of the country’s energy and reduce carbon emissions by 2 million tons.

The analysis above quantifies the social impact of offshore wind farms. Further on, developing a cost-benefit analysis (CBA) structure connects investment costs to offshore wind power’s social, environmental, and economic benefits. The CBA structure focuses on the benefits of the national and global level and local community and visitors to places where farms will be located (Spyridonidou, Vagiona and Loukogeorgaki, 2020). It is crucial to identify that investment in offshore wind power in Greece will create a significant global gain by reducing carbon emissions and replacing them with energy from conventional sources.

The offshore wind power plant can also benefit local communities when the Greek government develops appropriate compensation. On the other hand, it can hinder development because it is associated with visual disamenity (Vourdoubas, 2021). A good estimation structure can be developed by estimating annual welfare loss, the approximate amount per resident. The best form of compensation is private compensation, which provides energy at lower prices to the residents (Wang, Nguyen and Dang, 2022). Another compensation can be providing local public goods such as maintaining cultural heritage or developing local infrastructures. Using either of the two compensation methods will ensure significant benefits to the residents where a farm will be built.

Results and Findings

The study was conducted to answer issues concerning investing in an offshore wind power plant in Greece. In the study, 15 participants were used, and the method used was administering questionnaires. To analyze the data collected from the participants, IBM SPSS was used. The null hypothesis of the study was that the variables compared in the analysis were independent, while the alternative hypothesis was that the variables compared were dependent on each other. The summary from the statistical software was created using a crosstabs table and correlation, and the results acquired are further interpreted in this section.

The first test is cross-tabulation of how well the participants were informed regarding offshore wind power by how much they believe that wind energy has the potential to total revenue (tr). The results reveal that six out of 15 were somewhat well-informed about offshore wind power. In addition, three out of six who were somewhat well informed believed that wind power would affect the total revenue by 4%, and the rest believed that wind power would affect total revenue by 5%. Further on, seven respondents believed that wind power would increase the total revenue by 5% regardless of their knowledge about wind power plants.

From another perspective looking at both the crosstabs table and the chi-square test results (How well informed are you regarding offshore wind power * How much do you believe that wind energy has the potential to tr Crosstabulation) were consistent with the data. Most of the participants believed that wind energy would increase the total revenue by 5%, followed by 4% and the last was 3%. In addition, the value of chi-square statistics is 8.762, and the p-value is.363. Since the p-value is greater than the significant level of.05, the alternative hypothesis is rejected to conclude that the two variables in the study are independent.

The second cross-tabulation for the study are the feasibility of investing in an offshore wind power plant and would the participant consider Greece an attractive location to invest in. The crosstabs table shows that the chi-square is consistent with the data. The feasibility of the participant in the test was divided into three: short-term, medium-term, and long-term profitability. The expected answers were; maybe, no, and yes. 6 out of 15 participants replied that investing in an offshore wind power plant will have long-term profitability. This shows that most participants were unsure of the feasibility, but they suspected it could have long-term profitability. In addition, most of the participants revealed that they were sure that investing in wind energy cannot have short-term profitability.

The chi-statistics of the feasibility and location test is 5.044, while the p-value is.282. The p-value of the test is greater than the significant level of.05. Therefore, the null hypothesis should be accepted to conclude that the variables in the study are independent. In addition, this has revealed that the answers provided by the participants concerning feasibility were not affected by the location of the power plant. Therefore, there is a probability that the participants responded to the test depending on their knowledge of wind power plants instead of the location.

The third cross-tabulation was testing if the proposed research is related to the investment resource by what are the main limitations of such an investment. The proposed research was divided into change management, investment, leadership, and resource limitation. On the other hand, the main limitations were: bureaucracy and financial and geographical. Further on, the results in the cross table and the chi-square were consistent with the participant’s data. Eight out of 15 participant respondents said that financial limitation is the main limitation to investing in wind power plants. This shows that the proposed research does not significantly impact investing in wind energy.

On the other hand, the chi-statistics of the proposed research and preliminary limitation test is 13.281, while the p-value is.150. In the study, the p-value is less than the significant value of.05. Therefore, the alternative hypothesis should be rejected to accept the null hypothesis and conclude that this test’s two variables are independent. This shows that the answers provided by the participants did not depend on the primary limitations; instead, they responded depending on what they felt closely related to the investment and resources.

The final test on the cross-tabulation was how much participants believed that the geographical location within Greece is important by feasibility, in the end, to invest at all in Greece. In this test, the geographical location was divided from 1 to 5. On the other hand, the feasibility of investing was divided into two, maybe and yes. The crosstab revealed that one value was, but this did not affect the consistency in the chi-square test results. The crosstabs results revealed that most participants were unsure if the geographical location is essential for locating the power plant. In addition, the chi-square statistic was 3.111, while the p-value was.539. Since the p>.05, the null hypothesis will be accepted to conclude that the two variables in the study were independent. Therefore, the answers provided by the respondents were not determined by the feasibility of investment.

Spearman’s rank was computed to assess the relationship between how much you believe that wind energy has: the potential for the total revenue and the geographical location within Greece is essential. The results revealed a positive correlation between the two variables, r (14), p=.432. Since the p-value is greater than the significant value of.05, the alternative hypothesis is accepted to conclude that the two variables are independent. In addition, the Person correlation revealed there is a positive correlation between the two variables, r (14), p=.510. Therefore, both Pearson and Spearman correlations show positive correlations and accept null hypotheses.

Discussion and Conclusion

Most people do not know much about wind power energy and its benefits in a country. Still, despite the little knowledge they have about it, they believe that it has the capability of significantly increasing the total revenue. For instance, the data collected in this study has revealed that people believe that wind power has the potential to increase the total revenue by either 3, 4, or 5% (Wu et al., 2020). Therefore, more public education should show the benefits and negative impacts of wind energy before another study is conducted. In addition, this will ensure more accuracy in the study conducted because people will not guess; they will give their opinions depending on what they know.

Wind power has the feasibility of long-term profitability because it focuses more on business planning and less on asset sales. Due to this, wind power plants can survive eventually without breakdown. The study revealed that most participants are not sure but believe that wind power will have long-term profitability. Therefore, the Greek government should consider these participants’ belief responses since they support it regardless of knowing less about wind power (Cheng and Wu, 2021). In addition, the financial limitation is the main issue affecting investing in wind power plants. Although proposed research on change management, investment, leadership, and resource limitation tampers with investing in wind power, it does not significantly impact financial limitation (Ziemba, 2022). Due to financial constraints attached to investing in wind power, the Greek government should determine if the project will be funded by the federal government or privatized.

The wind power plant’s geographical location is crucial because wind turbines should be located within a wind plant area to maximize annual energy production. Since the Aegean Sea receives heavy air, it will be the perfect location for placing wind turbines and power plants (Loukogeorgaki, Vagiona and Lioliou, 2022). After selecting the place, a compensation plan should ensure that the local community benefits more from the project. For the perfect compensation plan, public participation is crucial to avoid the distress that might lead to the project’s failure. Therefore, ensuring that the project is located at the appropriate place and an appropriate compensation plan for the residents will assist the wind power plant’s success.

In conclusion, investing in wind power plants has numerous advantages for Greece. First, it will increase the country’s total revenue by 3 to 5%. Secondly, if appropriate compensation is selected, the power plant revenues will ensure local infrastructure development where the project is located. Thirdly, it will reduce carbon emissions because wind power does not produce carbon. Finally, it will reduce the power shortage that the country is facing due to the current power supplier. Although investing in the wind power plant is expensive, the government has many methods of funding its methods; hence it will use those means to fund the project and ensure it becomes a success.

Reference List

Cheng, M. and Wu, Y. (2021) ‘Investment evaluation and partnership selection model in the offshore wind power underwater foundations industry’, Journal of Marine Science and Engineering, 9(12), p.1371.

Kardakaris, K., Boufidi, I. and Soukissian, T. (2021) ‘Offshore wind and wave Energy complementarity in the Greek seas based on ERA5 data’, Atmosphere, 12(10), p.1360.

Loukogeorgaki, E., Vagiona, D. and Lioliou, A. (2022) ‘Incorporating public participation in offshore wind farm siting in Greece’, Wind, 2(1), pp.1-16.

Pires, A., Rotella Junior, P., Morioka, S., Rocha, L. and Bolis, I. (2021) ‘Main trends and criteria adopted in economic feasibility studies of offshore wind energy: a systematic literature review’, Energies, 15(1), p.12.

Spyridonidou, S. and Vagiona, D. (2020) ‘Systematic review of site-selection processes in onshore and offshore wind energy research’, Energies, 13(22), p.5906.

Spyridonidou, S., Vagiona, D. and Loukogeorgaki, E. (2020) ‘Strategic planning of offshore wind farms in Greece’, Sustainability, 12(3), p.905.

Vourdoubas, J. (2021) ‘Islands with zero net carbon footprint due to electricity use. The case of Crete, Greece ‘, European Journal of Environment and Earth Sciences, 2(1), pp.37-43.

Wang, C., Nguyen, N. and Dang, T. (2022) ‘Offshore wind power station (OWPS) site selection using a two-stage MCDM-based spherical fuzzy set approach’, Scientific Reports, 12(1).

Wu, Y., Tao, Y., Zhang, B., Wang, S., Xu, C. and Zhou, J. (2020) ‘A decision framework of offshore wind power station site selection using a PROMETHEE method under intuitionistic fuzzy environment: A case in China’, Ocean & Coastal Management, 184, p.105016.

Ziemba, P. (2022) ‘Uncertain multi-criteria analysis of offshore wind farms projects investments – case study of the Polish economic zone of the Baltic Sea’, Applied Energy, 309, p.118232.