Executive summary

The Australian tourism and hospitality industry has continued to grow tremendously. Currently, the sector contributes significantly to the country’s GDP. Despite global threats such as terrorism and economic depression, the sector has continued to bolster impressive results.

However, with the growing competition from other countries such as South Africa, USA, and China, many factors need to be considered to gain a competitive edge. Price and quantity demanded are the principal guidelines to setting prices of facilities in this sector. As such, the country should endeavour to provide competitive prices as well as the right quantity to its domestic and international tourists.

Price and Quantity Adjustments for Australian Tourism and Hospitality Products

The impact on the market for Australian tourism products of a decrease in the price of tourism products in the United States.

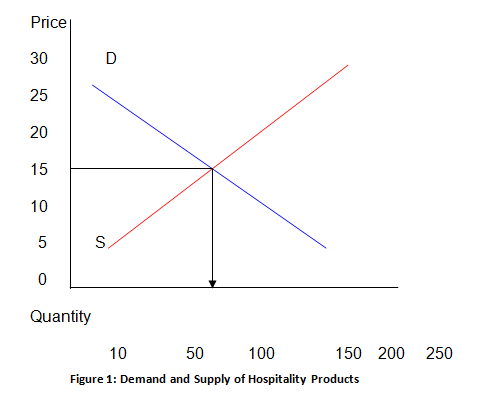

A decrease in the price of United States tourism products will have a significant effect on the demand for Australian tourism products. This will affect the demand curve of Australian tourism products. This phenomenon can be best explained using the traditional demand and supply curve.

Assuming the graph is representative of the current Australian tourism demand and supply trend, we can conclude that the quantity demanded of hospitality products is 100 units at a price of 15. This is, therefore, our Australian market equilibrium.

However, it is generally accepted that marketing, technological advancements, and pricing policies of competitors can easily destabilise market equilibrium. Nada and Sarath notes that since the United States and Australian tourism industry share a lot, any changes in market activities in one region, easily affect the other party. By reducing the prices of its products, the United States will attract more tourist, local, and international, to use its affordable facilities. This will consequently reduce the demand for Australian tourism products, which will be viewed by many tourists as too expensive. In this case, services become substitutes for one another.

Since the effect is price motivated, there will be a movement along the demand curve, but not a shift of the demand curve. The quantity demanded would thus, drop from 100 units to say 50 units. This drop will represent a downward movement along the demand curve.

These changes will influence quantity exchanged and price differently. To retain its tourism market, the Australian marketing authority may step in to reduce prices of its facilities. According to Singh, Australia being “one of the leading tourist destinations,” this option presents a good opportunity for curbing loss of market. Otherwise, the Australian quantity will reduce. However, according to Tourism Australia, the reduction will not be very significant considering that international tourism only represents 27% of the country’s tourism earnings.

The impact on the market for hotel rooms if the price of airline flights increases

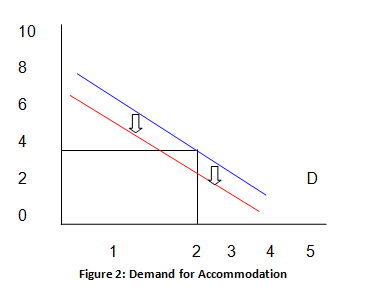

Increase in flight prices affects the demand for travel negatively. Many people, even those who had planned for their trips, find it easy cancelling them when travel prices go up. In fact, air travel and accommodation demands are complimentary goods. Any change in the price of such a good affects the price of its complimentary good.

Increase in the cost of flight will affect the demand curve; it will shift to the left. As shown in figure 2, an increase in the cost of air travel leads to a decrease in the demand for accommodation. Dwyer & Forsyth claim, “…Arise in the price of air travel to a destination resulting in less visitation may lead to a fall in the demand for hotel accommodation in that destination.”

This change may result in reduced prices for accommodation facilities to attract more guests and to compensate for extra money paid for air travel. Since most facilities will not be occupied, this is a probable resolute for many facility owners. However, if the situation remains as it is, most facilities will be vacant due to reduced number of visitors.

The impact on the market for restaurant meals if the government imposes a service tax of 20% of the price of each meal

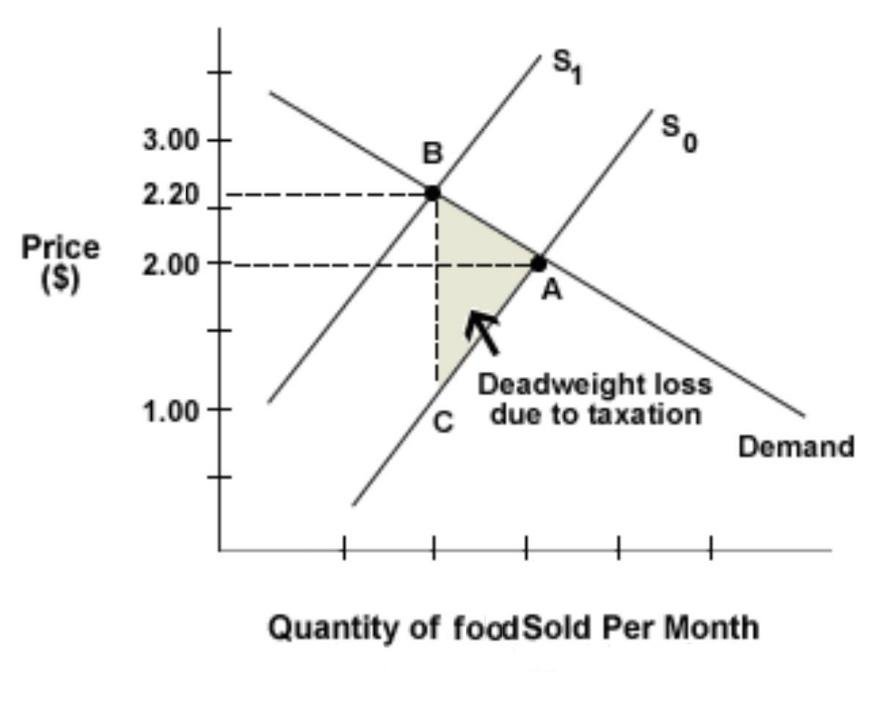

By imposing a service tax on a particular product, the government reduces both the supply and demand of that product. This intern drives equilibrium price higher than it was before the imposition of the tax. The equilibrium quantity also drops as traders deliver less. This creates a complex scenario where a new demand and supply curve is created.

Every move by the authorities to impose, lower, or increase taxes is aimed at either the consumers or the sellers. In most cases, however, both parties share the tax burden. The principle governing the tax-sharing ration between these two parties is called tax incidence.

If the government imposes a service tax of 20% on restaurant meals, there will be a shift in the supply curve upwards to the left as illustrated in figure 3.

As shown in the figure, the original price for meals was $2. However, after government’s taxation, the supply curve has shifted upwards to the left. Consumers then pay extra $0.2 above $2.0 they paid before the 20% tax increment. In this case, sellers receive a payment of $2.2 per meal, but remits $0.2 to the taxman.

This scenario creates the region marked “deadweight loss due to taxation.” This results from a significant reduction in the number of mutually beneficial exchanges between the two trading parties, hotel owners and the customers.

The concept of price elasticity of demand

The demand for many products is often affected by changes in its price. In fact, a decrease in the price a product almost, always results in an increase in demand for the product. This is the basic rule of demand. In most cases, the changes in price do not lead to a proportional change in demand for a product.

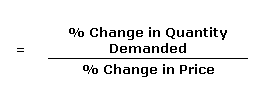

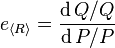

This is where price elasticity of demand comes in. Mankiw states “Price elasticity of demand for any good measures how willing consumers are to buy less of the good as its price rises.” He further states that price elasticity of demand is “computed as the percentage change in quantity demanded divided by the percentage change in price”.

The diagram shown below better explains this, where P2 and Qd2 were the original price and quantity, and P1 and Qd1 are the resultant price and quantity after increase respectively. In this case, the change in price is P1-P2, while the change in quantity is Qd1-Qd2.

The results from these manipulations may yield any of the following situations: elastic, inelastic, and unit elastic demand.

50 Quantity

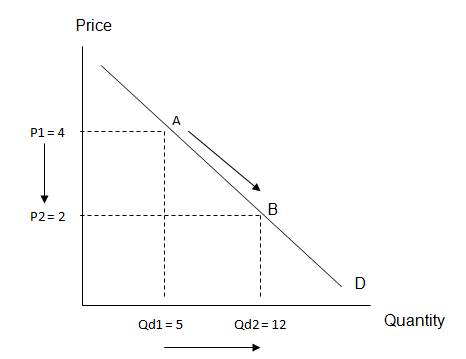

Commodities whose demand is significantly affected by price changes are said to have elastic demand. The demand for such commodities is said to be sensitive to price changes. For instance, if an increase in the price of such a commodity is affected by taxation, seasonality, scarcity, or hoarding, less of that commodity will be sold. On the other hand, a decrease in the price of the commodity will lead to increased demand for the commodity.

As illustrated in figure 5, consumers demand 50 units of product X at $20 per unit. However, increasing the price to $30 significantly reduces the quantity demanded to 10 units only. In fact, in a case of perfectly elastic demand, as illustrated in figure 4, increase in price results in a complete shift in demand as consumers take to other products or abandon the use of the product all together.

Elastic demand acts as a guide to producers in pricing their products. A producer who fails to incorporate elasticity of the demand of his/her goods is prone to fail. Price sensitive goods can only be sold in large numbers when consumers consider them fairly priced.

Elastic demand significantly affects producers’ revenue. This is because an increase in price will lead to a fall in demand, which intern reduces earnings. However, if a producer chooses to reduce prices to avoid loss of customers, he/she will still be cutting on his/her income. Either way, elastic demand’s effect on revenue is negative.

Many factors determine the elasticity of demand. However, the principal determinant of consumers’ continued use of a product after price change is the willingness and ability of the consumers. There are many other factors determining elasticity of demand.

To begin with, we will discuss the effect of availability of substitutes on elasticity of demand. When a product has close substitutes, its ability to have highly elastic demand is greatly enhanced. This is because consumers can easily switch to their substitutes in case of a price increase.

In fact, even a minor price change can upset the demand for such products highly. For instance, butter and margarine are substitutes. When the price of butter is increased, many consumers would opt to buy margarine instead. Thus, the demand for butter will significantly drop.

The second factor is the high percentage of income. The cost of a product plays a significant role in influencing a consumer to purchase. Cost, in this case, affects different income groups differently.

When a product’s price represents a huge chunk of an individual’s income, the individuals tend to give it much though before committing to purchase. For instance, a middle-income earner tends to give little attention to small price changes on cheap products such as milk.

However, changes in the prices of products such as cars, which represent a high percentage of their income, may affect their purchasing decisions. As such, the demand for products representing high percentage of an individual’s income is elastic to price changes.

Another factor is necessity. Consumers tend to give first priority to products they consider very necessary. Such products are purchased regardless of their prices. However, products and services, which are not very necessary such as swimming pool and massage, have elastic demand as they can be easily discarded if their prices go up.

Inelastic Demand

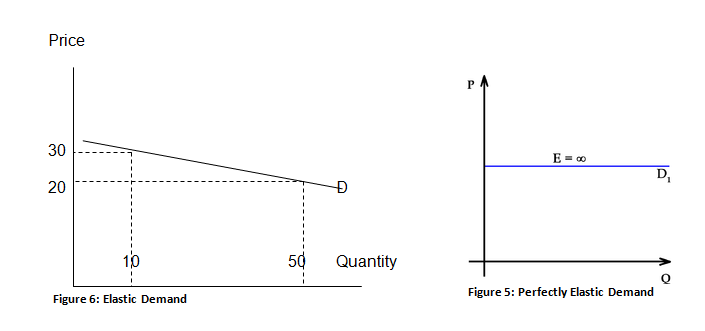

Whenever there is a price change, the quantity demanded by consumers must change. This change varies as it at times fall or rise in relation to price changes. In inelastic demand, however, this change does not correspond to changes in price. A fall or increase in product prices affects consumer’s demand, but not in correspondence to the price changes.

As illustrated in figure 7, changes in price have a minimal effect on the quantity of goods demanded. At a price of $30, 3 units are demanded; while at a double price of $60, 2 units are demanded. Despite doubled prices, quantity of goods demanded has dropped insignificantly. This is the case with inelastic demand; consumers’ consumption pattern is not highly affected by prices.

Figure 6, which represents a perfectly inelastic demand, shows a slightly different pattern. Here, regardless of price changes, the quantity demanded remains the same. In the short run, a few products exhibit this kind of a pattern, for instance, gasoline and food. Gasoline has become extremely important in the world today.

Taylor believes that barely all economic activities are driven using gasoline. As such, a rise in the price of gasoline may not affect its consumption in the short run, as people will still fuel their cars and machines. In the long run, however, many people may shift to alternative means such as using public transport, which will render the demand for gasoline imperfectly inelastic.

In elastic demand does not affect producers significantly. This is because their products will still be sold despite price increment. Their revenues, therefore, remain stable and predictable. However, in the end, products with inelastic demand may be affected as consumers, realizing that the price increment is not going down, may seeking alternatives.

Inelastic demand can arise due to several factors. The first being consumer brand loyalty. Consumers tend to develop attachment to products or companies, which is at times hard to break.

Hoyer & Deborah asserts, “Brand loyalty occurs when consumers make a conscious evaluation that a brand or service satisfies their needs to a greater extent than others do and decide to buy the same brand repeatedly for that reason.” Consumers who are loyal to a specific brand may not be easily swayed by price changes. Such consumers tend to exhibit inelastic demand trends.

Another factor that causes inelastic demand is the necessity of the product. When a product is very essential to buyers as food is, buyers will still purchase regardless of price changes. People must eat regardless of the cost of foodstuff.

Therefore, increasing the price of foodstuff does not lead to a complete withdrawal from consumption, but a small reduction in quantity consumed by those who cannot afford. Another example is insulin. The sick who need insulin must buy it regardless of price because they cannot do without it; failure to buy may be fatal.

Lack of substitute products also causes inelastic demand. Whenever there is a price increment, consumers naturally move to seek substitute products to satisfy their needs. For instance, when the price of bread increases, consumers may consider buying cakes or flakes to grace the breakfast table.

However, in a case where no substitute products exist, consumers have to buy regardless of price increment. In some cases, substitutes may be available, but are too expensive to shift to; a good example is fuel.

When fuel prices go up, many people may consider shifting to alternative fuels or using hybrid cars, but harnessing alternative fuels and buying hybrid cars is so expensive in the short run. In this regard, consumers are forced to continue using fuel.

Another probable cause of inelastic demand is the price of a commodity in relation to consumers’ income. Increase in prices of products considered very cheap by consumers may not affect the customers’ decision to purchase or continue using the product. A good example is packaged salt.

Globally, salt has remained one the most readily available and affordable kitchen products according to Preedy. In fact, most families do no budget for salt. An increase in the price of salt, therefore, may be insignificant to most families, which will intern not affect its consumption.

Consumers at times do not bear the cost of the products they purchase or consume. For instance, CEOs of leading corporations, company executives, and other cooperate expense account holders, do not bear the cost of their purchases. Such costs are directly transferred to the companies they work for.

In such a case, increase in price of commodities does not affect purchases or consumption in any way, since the companies concerned will meets the costs. Consumers only move to cut cost if they will feel the pinch personally. This is not the case with corporate accounts.

Unit Elastic

Occurs where e(R)=1

Unit elasticity occurs when changes in the price of a commodity is directly proportional to changes in quantity demanded of that commodity.

Unitary elasticity does not affect the revenue of producers in any way. By charging high prices, few products will be consumed, but to the ratio that compensates for lost sales volume. For instance, if a product X is sold at $10, 1000 units will be sold and the producer will earn $10,000.

However, if the producer increases the price to $20, there will be a drop in sales. Interestingly this drop will only go down up to the extent of gapping the income lost. As such, 500 units will be sold at the new price of $20 generating $10,000 as it was before the price increment. In the case of a price drop, vice versa will be the case.

As illustrated in figure 8, any percentage change in price of the commodity is matched by percentage change in quantity equaling the change. Key to this observation is the fact that at high prices, the slope is very steep while registering low quantities; for large quantities, it is flat registering low prices.

Bibliography

Dwyer L & W Forsyth, Tourism economics and policy, Channel View Publications, Bristol, 2010.

Hoyer W & J Deborah, Consumer behavior, 5th edn, Cengage Learning, Australia, 2010.

Mankiw N, Principles of economics, 6th edn, Cengage Learning, Mason, OH, 2012, p. 91.

Nada K & D Sarath, “Measuring the Economic Impact of Australian Tourism Marketing” Tourism Economics, vol. 13, no. 2, 2007, pp. 261-274.

Preedy R, Comprehensive Handbook of Iodine Nutritional, Biochemical, Pathological and Therapeutic Aspects, Academic Press, London, 2009, p.1231.

Singh S, Tourism in destination communities, CABI, Wallingford, 2003, p. 27

Taylor J, Economics, 6th edn, Houghton Mifflin, Boston, 2008, p.32.

Tourism Australia, essential news for the tourism industry, Australia, 2009. Web.