Introduction

The decision to invest in a new and foreign market is not easy to make. A number of factors have to be taken into consideration. In spite of this, the decision to expand to foreign markets is not new to Primark. The company has taken these steps a number of times in the past.

For instance, the company operates more than 250 stores in different parts of the world. The existence of these outlets is an indication that Primark has made deliberate steps to enter into new global markets in the past.

A market analysis was conducted to determine the attractiveness of two potential countries that the company wanted to establish its operations in. The two were Brazil and Italy. The analysis revealed a lot about the company and the two countries. Evidently, the two markets have their own potentials for growth, especially in the apparel industry, which Primark specialises in.

The issue of expansion into new markets in other countries is very critical to the operations of Primark. The growth is essential especially taking into consideration the nature of the industry this company operates in. There are numerous reasons why the company should go on with the expansion.

In this executive summary, the justifications for selecting Brazil as the new frontier in Primark’s international venture are provided. The decision to expand to Brazil is supported by facts and figures, including a number of theories touching on international operations.

Proposed Market Entry Strategies and Justification

The proposed market strategy for Primark includes the utilisation of licensing in the first stage of entry. The second stage of expansion should be carried out with the help of complete ownership strategy.

It is important to note that licensing is suitable for Primark since the global apparel industry is currently experiencing intense competition. Complete ownership would afford the company advantages associated with independence, once established in the new market through licensing.

Primark’s Entry Strategy: Recommendations

A number of recommendations are made based on the findings from the market analysis conducted on the two target markets (Italy and Brazil). The recommendations are as follows:

- Brazil is the ideal market for expansion between the two. Expanding to Italy is not a good idea at this stage.

- Two market entry strategies are proposed. They include licensing and total ownership.

- Licensing should be conducted at the first stage of market entry.

- Complete ownership should then follow. It should come after the brand is already established in the new market.

Background

The current case study focused on the assessment of the attractiveness of both Italy and Brazil. The aim was to determine the best market for Primark’s expansion objective. The analysis and evaluation of the target markets revealed that Brazil is more promising compared to Italy.

According to Sako (2006: 500), the motive to expand internationally is informed by the mission and vision statements of the company. In addition to the objective of increasing its profits, it is apparent that Primark aims at offering the customers high quality products. In addition, the company has a reputation of dealing with up-to-date and fashionable apparel.

The products are sold at what can be regarded as affordable prices, which translate to value for customer’s money. The values will inform the entry of this company into the new market. The international ambitions of Primark are made evident by the more than 250 stores it operates in Europe

Primark’s decision to expand internationally can be analysed from the perspective of normative decision’s theory. According to this theoretical framework, the decision to enter into a foreign market should take into consideration the trade-offs between returns and risks (Caves 2007: 21).

Consequently, Primark should go for the entry mode with the highest possibilities for risk-adjustment in relation to returns on investment. The availability of resources, together with the need for control, should also play a key role in the determination of the preferred entry mode.

Dunning (1988:5) highlights the issue of resource availability with regards to international trade. According to Dunning, the concept entails the managerial and financial capabilities of the firm to survive in the given foreign market. Control, on the other hand, implies the need exhibited by the firm to influence systems, decision, and methods of conducting business in that particular market.

The factors enumerated above determine the linkages between the firm-level and the nation-level analyses of international markets. An evaluation of the two markets at the nation level settled on Brazil as the ideal market for Primark to further its expansion objectives.

It is a fact that competition in the Brazilian apparel industry is very high. However, market conditions indicate the availability of opportunities for the establishment of a new company (Artigas and Calicchio 2007: 72). Furthermore, the analysis indicates that the adoption of the appropriate set of entry strategies can help Primark penetrate this market.

The selection of Brazil as the preferred market for Primark is based on various nation-level factors. According to PricewaterhouseCoopers International Limited [PWC] (2013:5), Brazil has recently emerged as a strong and attractive economic player in the world.

The degree of economic diversification in the country is high. In addition, the South American nation has a large domestic consumer market. The financial systems are well regulated, making the country an attractive option for Primark.

According to Dunning (1988: 2), the general framework for determining market-specific and firm-specific factors influencing international expansion is fourfold. The factors of control, resources, risk and returns are essential to the analysis.

The following proposal takes into consideration all these aspects of Primark at the firm level. In addition, the strategies proposed for the market entry appreciate nation-specific factors that will influence Primark’s activities.

Analysis of Market Opportunities in Brazil

Before going international, a firm should conduct an environmental analysis of the target market. The analysis of Brazil as the preferred market was conducted from different perspectives. The impacts of country-specific factors on the operations of the company were reviewed.

There are various classical theories touching on international trade. The theoretical frameworks propose varying elements of comparative advantage, which make some countries more ideal for investment than others (Dunning 1988: 12).

They also advance factor endowments that make a country a preferred international destination. The factors include land, labour, natural resources, and population size (Krugman 1999: 14). Nation-level analysis of Brazil is based on Dunning’s framework for expansion into foreign markets and Porter’s diamond model.

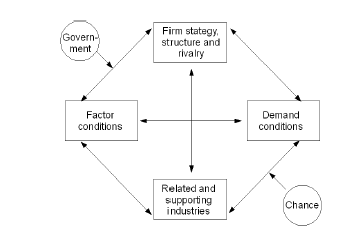

According to Porter (1998:41), nations have the capacity to create new and advanced factor endowments. Factors countries can create include skilled labour, culture, government support, knowledge base, as well as advanced technologies (Porter 1998: 42). Consequently, the diamond model advanced by Porter illustrates the national advantages of Brazil in relation to Primark’s expansion objective.

The individual factors in Porter’s model which constituted a nation’s comparative advantage included factor conditions and demand conditions (Porter 1998: 42).Other factors included related and supporting industries, coupled with firm strategy, structure and rivalry.

Figure 1: Porter’s Diamond Model

Source: Porter (1998: 41).

Factor conditions refer to the situation in the country, with regard to production elements. Production factors include infrastructure, skilled labour, and technological base, among others.

According to PWC (2013: 19), the economy of Brazil is large, and the infrastructure in most parts of the country is well developed. In addition, as an emerging economy, the country is developing very rapidly in relation to skilled labour and technological development (Porter 1998: 44). The apparel industry in Brazil is also fairy established with numerous brands, meaning that skilled labour in this industry is abundant.

Demand conditions aspect of Porter’s diamond model entails the local demand for the products and services the investing company offers (Porter 1998: 44).

According to MarketLine (2013:17), the apparel retail industry in Brazil is experiencing a strong growth. For instance, the value of the industry is forecasted to increase by 39.8% between 2012 and 2017 (MarketLine 2013:12). The growth is based on increasing demand in the apparel industry.

Related and supporting industries in Porter’s diamond model referred to the non-existence or existence of other internationally competitive industries (Porter 1998: 45). According to PWC (2013: 153), Brazil importance in the global economy is attested for by the numerous international organisations based there.

Some of the apparel companies in the country also indicate the level of competitiveness in the industry. The presence of these supporting industries in Brazil indicates that, innovativeness in the industry becomes a necessity. In addition, Primark would be able to enjoy more cost effective inputs.

Firm strategy, structure, and rivalry in Porter’s diamond model referred to the conditions in the country that determine establishment and organisation of companies (Porter 1998: 45). In addition, this aspect of the model determines management of the company. Consequently, these conditions determine the kind of competition in the particular country.

In Brazil, most of the major players in the apparel industry are local firms. According to MarketLine (2013:12) the retail apparel industry is fairly fragmented, although the recent growth of the industry has helped lessen rivalry.

Despite of this rivalry however, Primark would have the relative advantage of offering unique imported products. The role of the government in determining success of enterprises in any country cannot be underestimated. The government ultimately facilitates business environment in the particular country, for instance through policies and regulations.

According to PWC (2013: 72), Brazil is a member of numerous international trade agreements. Some of the agreements include the Free Trade Area of the Americas (FTA), and the Amazon Cooperation Treaty [ACT] (PWC 2013: 73). Other agreements include World Trade Organisation (WTO), International Monetary Fund (IMF), and the Kyoto Protocol on Climate Change (PWC 2013: 73).

Membership to such organisations indicates the country’s openness to international trade, a factor that favours Primark immensely. Labour laws in Brazil are, however, strict. In addition, there are tax regulations and requirements for all foreign companies to register with the Ministry of Development and Foreign Commerce (PWC 2013: 88).

Despite of the political and legal risks involved in Brazil, the returns outweigh them, leaving a country a very ideal market for Primark investment. Usually, many countries will seek to protect local enterprises, due to the uncertainties associated with multinational firms.

Attractiveness of the Country

The nation-level analysis through Porter’s Diamond attests to the potential of Brazil’s apparel industry and the benefits associated with establishing operations here. Below are some of the reasons why the country is attractive for investment:

- Foreign investments are generally welcome in Brazil.

- Brazil is the leading country in Latin America in terms of investment opportunities.

- All major agencies in the world have granted the country Investment Grade rating.

- Local auditing and accounting standards are in line with the International Financial Reporting Standards (IFRS).

- Recent changes in the business culture and the promotion of best practices in corporate governance are favourable to new investors (PWC 2013:31).

However, Primark should be wary of some of the challenges associated with doing business in Brazil. The country is ranked as ‘fair’ with regards to the ease of establishing operations (KPMG 2012: 12).

Figure 2: Ranking of Brazil in terms of ease of doing business

Source: KPMG (2012: 12).

The rising trend in foreign direct investments (FDI) in Brazil further indicates the attractiveness of the country. According to KPMG (2012:9), the country recorded a positive growth in FDI in the period between 2006 and 2011. The trend is expected to persist.

Figure 3: FDI in Brazil

Source: KPMG (2012: 9).

Company’s Situation Analysis

The firm-level analysis conducted on Primark was based the strengths, weaknesses, opportunities and threats (SWOT) framework (Hill and Westbrook 1997: 47). Strengths constitute the internal factors giving Primark an edge over competitors. Weaknesses constitute internal factors resulting to a company being at a disadvantage relative to competitors.

Opportunities constitute the external elements, which an organisation can exploit to its advantage. The business is also faced by a number of threats. They include factors that are external to the entity, and which may derail efforts to achieve business objective.

Some of the key strengths of Primark that can favour it in the intended venture include the positive reputation and popular brand names. In addition, the strong supply chain, and the beneficial trade relations established in the other countries reflect positively for Primark.

The major weakness of the company is however the low margins recorded in some of its branches. In exception of poor business environment conditions, the company might not be ready to expand further due to poor management.

The key opportunities that Primark faces include the highly untapped Brazilian apparel industry, by international retailers. In addition, Brazil has a very large consumer base (Artigas & Calicchio 2007: 76).The only apparent threat to Primark is the global economic depression, whose aftermaths might still be evident in the Brazilian apparel industry.

Readiness to go Overseas

The readiness of Primark to go overseas cannot be denied. The firm-level analysis reveals strengths of the company, which would be very beneficial in overseas ventures. In addition, the company has considerable experience of foreign markets entry from its operations in Europe.

The national-level analysis also indicates immense opportunities for the company in the Brazilian apparel industry. Hence, all indicators point out that Primark is ready for overseas ventures.

Market Entry Strategy

Koch (2001:351) proposes a holistic model for market entry and market selection processes (MEMS). The design of the model takes into account all contexts of the business and the relevant practices. It highlights the external, internal, and mixed category factors that inform the selection of the market. The model is shown below:

Figure 4: Factors influencing market selection

Source: Koch (2001:352).

The factors affecting the selection of mode of market entry are also depicted in Koch’s model as shown below:

Figure 5: Factors influencing market entry mode selection

Source: Koch (2001:353).

Primark can use Koch’s model to select a strategy that is suitable in entering Brazil. Based on the findings made in the nation-level and firm-level analyses, licensing emerges as the preferred entry strategy.

According to Brouthers (2002: 206), licensing entails a firm in one country granting another company in a foreign country to manufacture, process, or use the licensor’s trademark.

The domestic firm apparently enters into licensing contract with the foreign firm, allowing it usage of certain intellectual properties for payment of loyalties or given sales percentage. Intellectual properties licensed can include designs, patents, and name of the firm.

One of the major advantages of licensing is that the strategy has low risks associated with it during expansion internationally, and it is relatively easy and quick (Anderson and Coughlan 1987: 74).

In addition, the licensor (in this case Primark) has the opportunity of capitalising on the licensee’s country specific knowledge. The licensee Primark enter into a licensing agreement with will have better knowledge and experience in relation to Brazilian apparel industry.

Although licensing spreads the risks of entry into new markets to the licensee, the main risk of this strategy is risk to the reputation of the licensor. A licensee with poor reputation will ultimately ruin the reputation of the licensor. Other disadvantages of licensing include very little control to the licensor, and likelihood of the licensee becoming a major competitor.

Wholly owned foreign operations involve the expanding company establishing a complete base of operations in the target market (Brouthers 2002: 207). The strategy is the most extensive, since it would require total involvement by the company.

Fully owned operations have the greatest advantage of total control. However, the disadvantages of this entry strategy are also high. For instance, this method of entry exhibits the highest financial risks. In addition, the company might take relatively longer duration to get established in the market, or even fail altogether.

Implementation of Market Entry Strategy

In the first stage entry level, Primark should use licensing as the market entry strategy. As the brand gains more recognition in the market, the company should then result to total ownership. Initially, Primark should select several leading apparel retailers in the Brazilian market.

After negotiations with these retailers, the company should settle on the one with the most reasonable, attractive, and profitable deal. The licensing should then be entered in, for a specified duration of time.

Primark will have to allow the licensee the permission to use the company’s trademarks, brand, among other intellectual rights. The licensing contract should be projected to a period during which Primark brand should be fairly established in the Brazilian apparel industry. After the contract termination, Primark should then establish wholly owned operations in the Brazilian apparel industry.

Conclusion

The nation-level analysis of Brazil reveals the potential of the market for a foreign international apparel retailer. It is a fact that the country poses some challenges to a new entrant. However, the potential returns outweigh these risks. The firm-level analysis also reveals that Primark is fairly experienced in entering international markets.

The numerous stores the company operates in Europe attest to this. However, the company should approach the Brazilian market cautiously since apparel consumers there have a different view of the industry. The products the company offers in the European markets differ with those demanded by consumers in Brazil.

References

Anderson, E., and Coughlan, A.T. (1987). ‘International market entry and expansion via independent or integrated channels of distribution’. Journal of Marketing, 51 (1), 71-82.

Artigas, M., and Calicchio, N. (2007). ‘How half of the world shops: apparel in Brazil, China, and India’. The McKinsey Quarterly, 1 (4), 68-79.

Brouthers, K. D. (2002). ‘Institutional, cultural and transaction cost influences on entry mode choice and performance’. Journal of International Business Studies, 33 (2), 203-221.

Brouthers, K.D., Brouthers, L.E., and Wilkinson, T.J. (1995). ‘Strategic alliances: choose your partners’. Long Range Planning, 28 (3),18-25.

Caves, R. E. (2007). Multinational enterprise and economic analysis. New York: Cambridge University Press.

Dunning, J. (1988). ‘The eclectic paradigm of international production: a restatement and some possible extensions’. Journal of international Business Studies, 19 (Spring), 1-31.

Hill, T., and Westbrook, R. (1997). ‘SWOT analysis: it’s time for a product recall’. Long Range Planning, 30 (1), 46-52.

Koch, A.J. (2001). ‘Factors influencing market and entry mode selection: developing the MEMS model’. Marketing Intelligence & Planning, 19 (5), 351-361.

KPMG (2012). Investing in Brazil: a land of opportunities. Web.

Krugman, P. (1999). ‘The role of geography in development’. International Regional Science Review, 22 (2), 12-32.

MarketLine. (2013). Marketline industry profile: apparel retail in Brazil. Web.

Porter, M.E. (1998). The competitive advantage of nations, New York: Free Press.

PricewaterhouseCoopers International Limited. (2013). Doing business and investing in Brazil. Web.

Sako, M. (2006). ‘Outsourcing and off-shoring: implications for productivity of business services’. Oxford Review of Economic Policy, 22 (4), 499-512.