Introduction

Primark operates more than 250 stores in Europe. It is planning to venture into the United States, Italy, and Brazil (MarketLine 2013).

The following study is a competitive analysis of Primark in the Italian and Brazilian markets.

A major challenge of businesses today is remaining profitable and competitive (Porter 2004).

Changes in operations, markets of choice, and products or services constitute significant factors with regards to competitiveness.

Theoretical models are used for nation and firm level analyses.

Porter’s diamond model of national competitiveness is used for nation-level analysis.

As a clothing retailer, Primark targets consumers from the low cost end of the market. Primark’s range of products include men and women wear, as well as clothing for newborns and kids (MarketLine 2012). At the national level, Porter’s diamond model of competitiveness is used to analyse the suitability of the Italian and Brazilian markets. According to Porter(2004), competitiveness can be regarded as the ability to attain steadiness and dominance in competition between companies and their competitors. It can be competition between companies on a micro-level or between economies on a macroeconomic level.

Nation-Level Analysis

Primark intends to expand into Italy and Brazil.

Analysis of these markets’ competitiveness is essential, especially in the apparel sector.

Nation-level analysis for each country provides a comprehensive view of these markets.

Attractiveness of the Italian and Brazilian fronts for Primark investment is made apparent.

To determine whether the Italian and Brazilian apparel markets are suitable for Primark to invest in or not, the nation-level analysis of these countries is essential. Primark would be able to determine the profitability, as well the best entry approaches, for these markets.

Porter’s Diamond Model for National Competitiveness

Traditional economic theory advances five factors of comparative advantage for countries or regions.

- The factors include:

- Location.

- Land.

- Natural resources.

- Local population size.

- Labour.

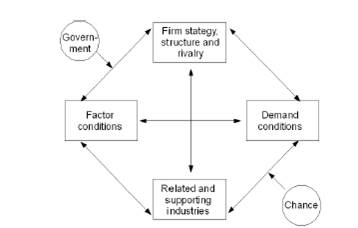

- Porter (2004) advances the ineffectiveness of the economic theory factors.

- The interlinked factors in the model include:

- Firm strategy, structure, and rivalry.

- Related and supporting industries.

- Demand conditions.

- Factor conditions.

Porter (2004) advances that companies can hardly sustain growth on these factors. Their abundance may undermine competitive advantage. Consequently, Porter (2004) developed the diamond model for competitiveness of nations.

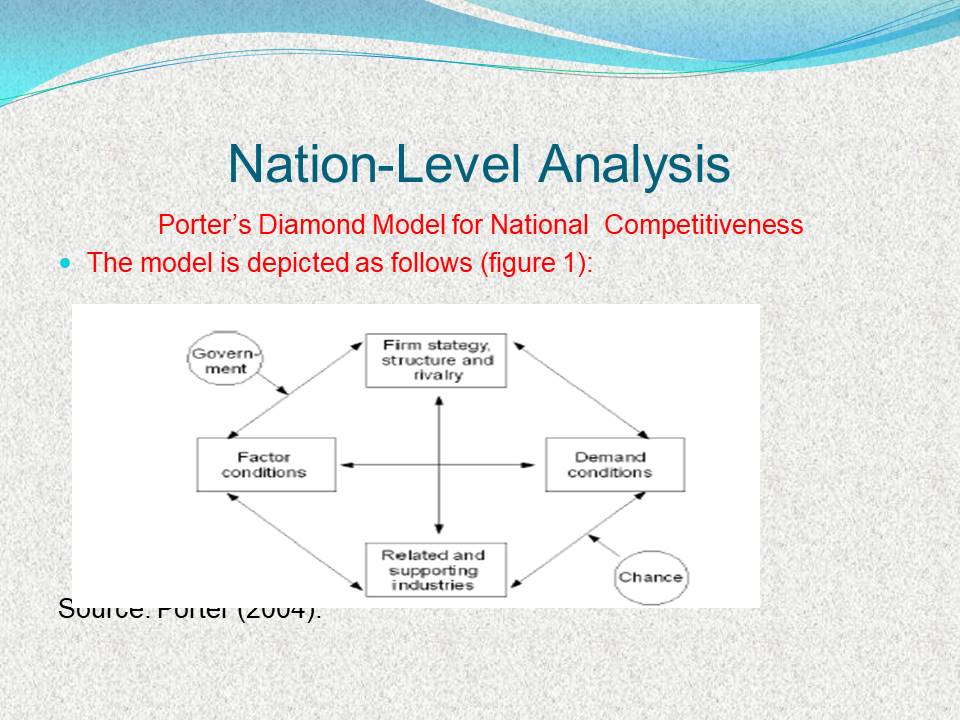

The model postulates that competitive advantage is based on four interlinked activities and factors. The factors from the model can also be influenced by governments to enhance comparative advantages.

The model is depicted as follows (figure 1):

For Primark to gain competitive advantage in any international market, it is important for the management to take into consideration the actors advanced in Porter’s diamond model. The company should explore and develop favourable conditions for optimum outcomes from the interlinked factors in the model. Firm strategy, structure, and rivalry entails the conditionsdetermine the establishment of companies in a given country. The elements also include the organisation and management of domestic competition (Porter 2004).

‘Demand conditions’ entail the nature and extent of demand for services and products in a given country (Porter 2004). Related industries refer to other enterprises that make the given country more competitive internationally. Another factor is related supporting industries. They include industries that define the competition of the country on the global arena. The entities include those operating outside the industry that the firm in question is venturing into (Porter 2004).

Another issue is factor conditions . They include those factors that help the country to remain competitive. They include infrastructure, capital, skilled labour among others (Porter 2004). The government is a key determinant of competitiveness in a country. For instance, in spite of numerous favourable conditions, investment and trade policies, as well as barriers, can make a market unattractive.

Nation-Level Analysis: Italian Market

Overview

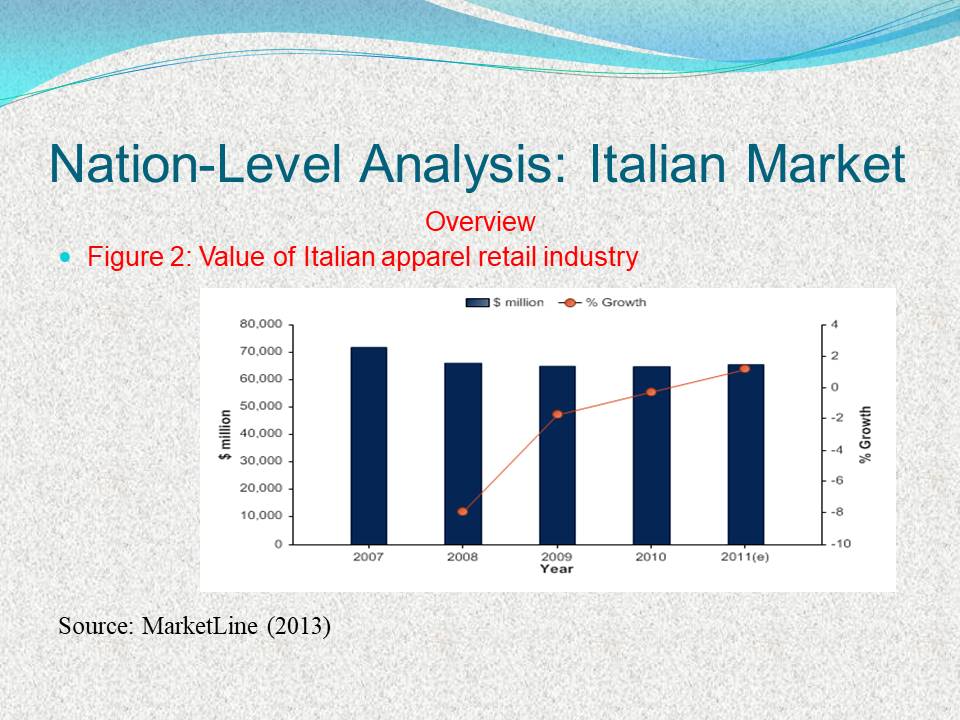

According to MarketLine (2013), the Italian apparel industry accounts for 15.9% of the European retail market.

The country is second to Germany, which has 18.0%.

Women wear accounts for the largest share at 53.5% (MarketLine 2013).

The market is fairly fragmented (MarketLine 2013).

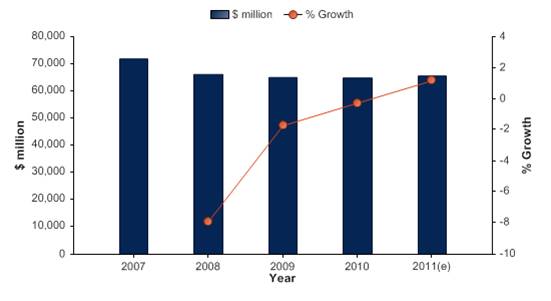

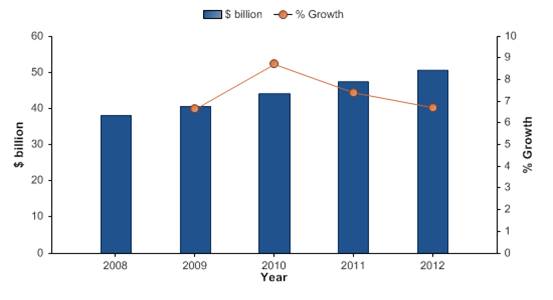

As indicated in figure 2, the Italian apparel market experienced an apparent positive growth between 2008 and 2011. The figure represented a 2% growth. In addition to this development, the market value of the apparel industry grew by more than $50 million. The added value is a very significant to any investor interested in entering into the market.

Five Forces Analysis of the Italian Apparel Retail Market

- Porter’s five forces driving competition model provides a comprehensive view of the Italian apparel retail market.

- The five forces include:

- Buyer power.

- Supplier power.

- Threat of new entrants.

- Threat of substitute products.

- Degree of rivalry (Porter 1990).

An analysis of the Italian and Brazilian markets from the perspective of Porter’s five forces will reveal the strengths, weaknesses, opportunities, and threats for investment in these economies.

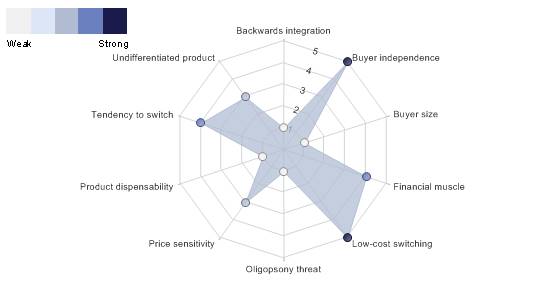

Buyer Power in the Italian Apparel Market

- Overall, buyer power in the Italian market is moderate (MarketLine 2012).

- Brand consciousness is substantial within this market, making it attractive to a strong company like Primark.

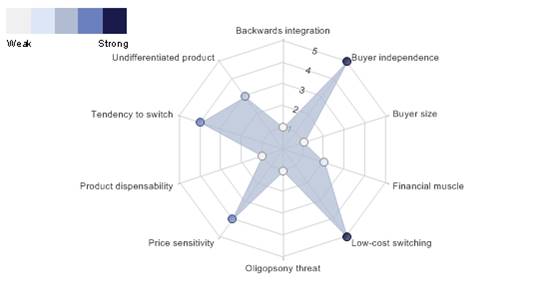

- The drivers of buyer power in Italy apparel market is summed up in figure 3.

According to MarketLine (2012), most of the buyers in the Italian apparel market are individual consumers. The realisation explains the small number of buyers, which weakens their buying power. However, buyer power is enhanced by the high level of choice in the market due to numerous suppliers.

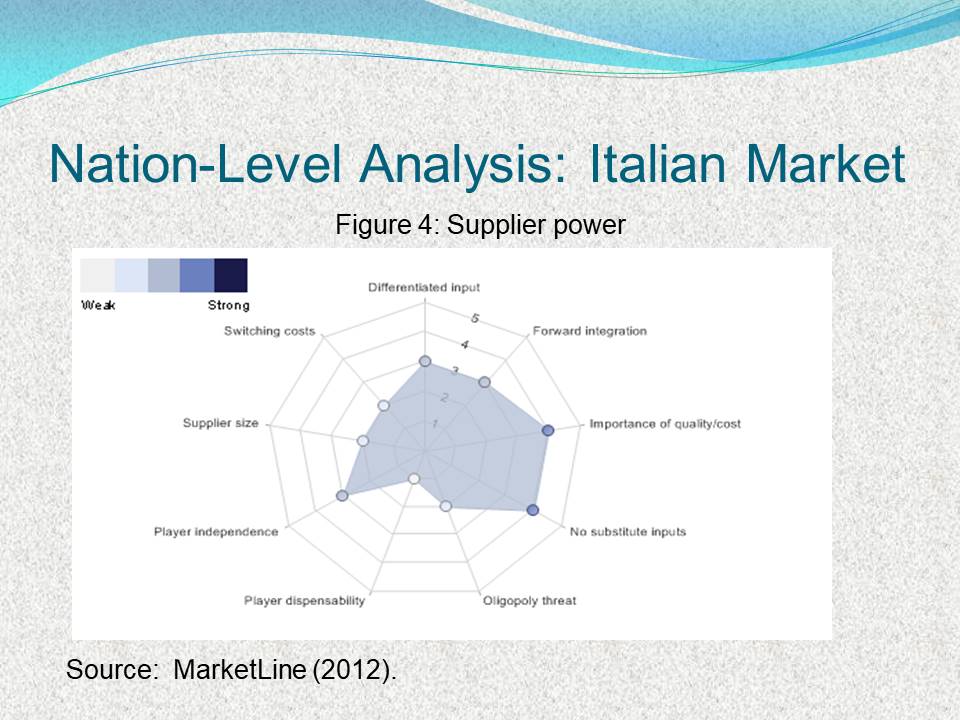

Supplier Power

- Key suppliers in the Italian apparel market are manufacturers and wholesalers of clothing.

- The ability of retailers to source from foreign sources facilitates supplier fragmentation (Porter 1990).

- The power of suppliers in the market is reduced by competition from manufacturers from low-income regions, which include India and China (Porter 1990).

- The suppliers are not diversified. The development negatively impacts on their power.

- The driving forces behind this factor in this market are illustrated in figure 4 below:

The supplier power in the Italian market can be regarded as moderate. Primark will face and compete with diverse suppliers to become established in this market.

Threat of New Entrants

- The decline of the Italian apparel industry in recent years makes it unattractive to new entrants.

- Entry barriers are low. There are also low capital requirements for entry.

- Competition for new entrants is eased by low switching costs for buyers (Ross & Harradine 2010).

- Low level product differentiation also makes it easy for new entrants to compete with existing market players (Ross & Harradine 2010).

- In light of this, it is apparent that the threat of new entrants in this sector is intense.

The ease of entry into the Italian apparel market is an opportunity that Primark can exploit. The company can build its brands in multiple outlets to enhance its establishment in the market.

Threat of Substitute Products

- Apparels have no apparent substitutes.

- However, there may be other alternatives to retail.

- Buying directly from manufacturers and online stores are alternatives to retailing.

- Overall, threat of substitute products in the Italian market is weak (MarketLine 2012).

- However, counterfeits pose a significant threat in the market.

- Primark can exploit alternative supply methods to retailing, in addition to the opening of new stores.

Degree of Rivalry

- Fragmentation in the Italian apparel market is fair. It is characterised by identical retailers operating in large numbers (MarketLine 2012; Ross & Harradine 2010).

- Overall, the rivalry in the Italian apparel market is strong.

- Decline in the performance of the market over the past few years has intensified rivalry.

Strong rivalry in the Italian apparel market is not a good sign for new entrants. However, considering the opportunities and strengths of the market, Primark should consider investing.

Overview of Porter’s Diamond Model Analysis of Italy

- Firm strategy, structure, and rivalry:

- Cut throat competition and rivalry between medium and small sized enterprises.

- The market is largely dominated by medium and small sized enterprises.

- Demand conditions:

- Italian consumer market is highly sophisticated.

- Demand for quality is high.

- There is a lot of pressure from manufacturers and wholesalers.

Porter’s five forces analysis reveals various aspects of the Italian apparel industry. Competition in the country is very high. As such, Primark should get ready to handle the rivalry through intense penetration strategies and product promotion campaigns.

The industry is dominated by numerous medium and small sized enterprises. Such enterprises intensify competition since consumers may be used to them.

Italian market is highly complex, especially due to the high demand for quality. Quality has no substitute. For example, lowering prices cannot compensate for poor quality. Primark’s management should be aware of this fact.

- Related supporting industries:

- Italy’s major economic strength is brought about by processing and manufacturing activities of medium and small enterprises.

- The country is famous for the exportation of fashion apparels.

- It is also a major exporter of machinery.

- Factor conditions:

- Most European countries have suffered from economic downturns in the recent past.

- Italy supports free international trade.

- It is characterised by high infrastructural development.

- Skilled labour is also high.

Italy is one of the leading exporters of machinery and fashion apparel in the world (MarketLine 2013). The development is an indication of booming trade in the country. However, given the status of the country in the apparel export market, investing in this market as a retailer is likely to be affecteed by massive rivalry and competition. It is a fact that Europe has suffered from economic depression and high rates of unemployment in the recent past. However, the effects of these realities in Italy are not very significant. In addition, the country is in a recovering trend (MarketLine 2013). As such, the market provides opportunities for development.

The infrastructure in Italy is also well developed. The trade sector is also highly advanced, a fact that is made apparent in the processing and manufacturing industries.

Nation-Level Analysis: Brazilian Market

Overview

According to MarketLine (2013), Brazil accounts for 11.5% of the total value of the American retail industry . The country stands at position 2 behind the US.

Just like in Italy, women wear accounts for the largest share of the apparel market at 47.5% (MarketLine 2013).

The apparel industry in Brazil is also fairly fragmented.

However, the strong growth in the recent years (2008-2012 period) has lessened the level of rivalry (MarketLine 2013).

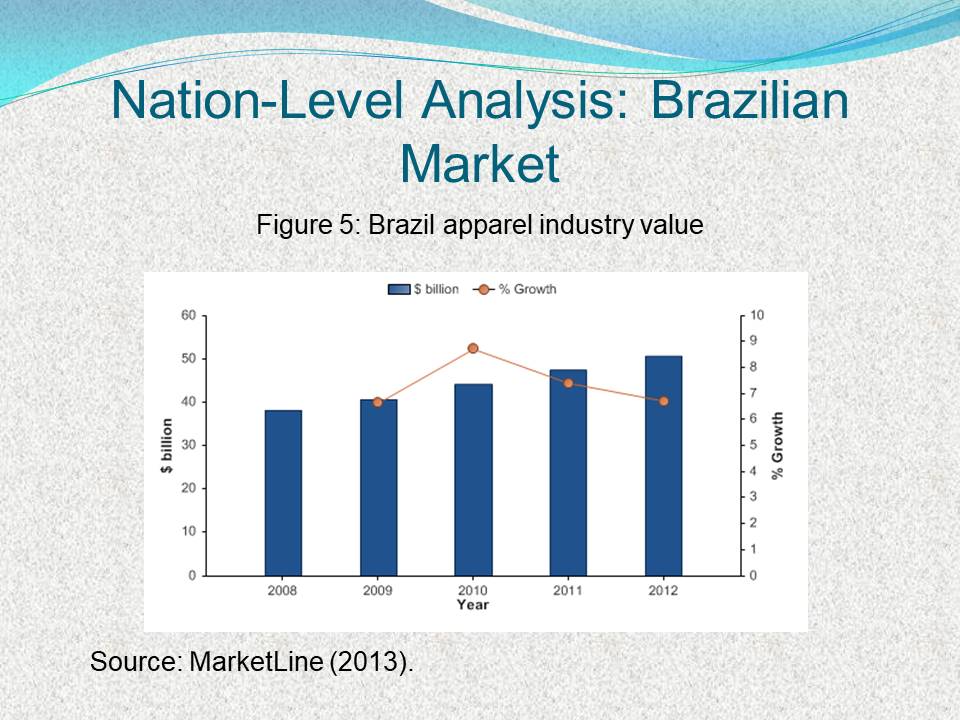

The value of the Brazilian apparel industry between 2000 and 2012 is as shown in figure 5 below:

The Brazilian apparel industry experienced a strong growth in 2012 (6.7%). The trend is expected to continue. The projected positive growth of this market constitutes an opportunity for Primark since the company intends to invest in the region. The market total value in the Americas is also a very significant figure.

Five Forces Analysis of the Brazilian Apparel Industry: Buyer Power

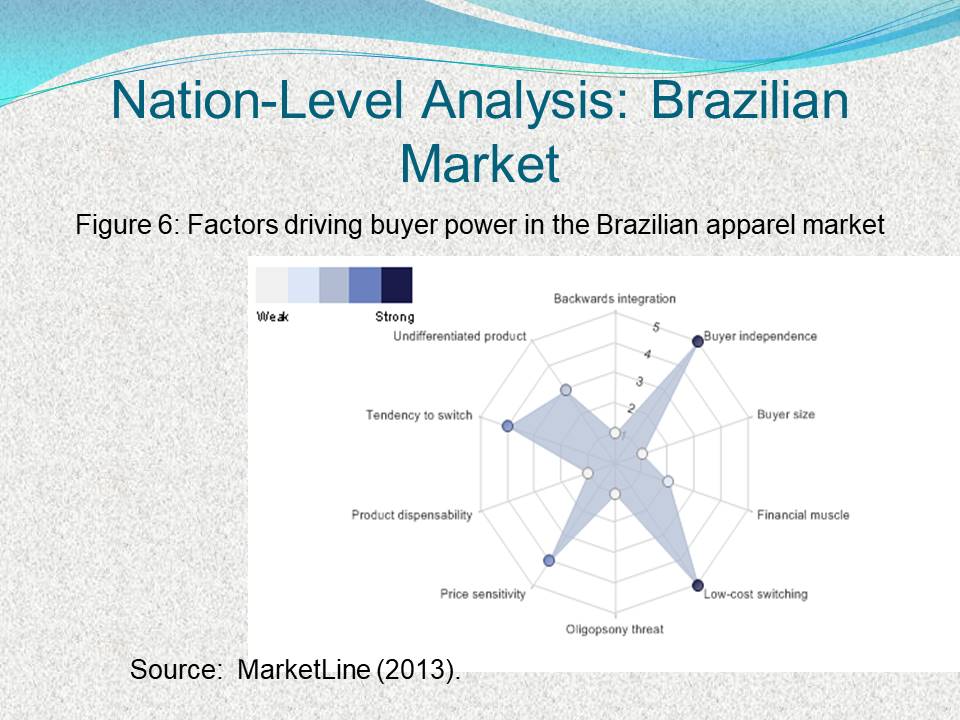

Most buyers are individual consumers. The small size of this segment weakens buyers’ power (Kilduff & Chi 2006).

An analysis of this market reveals that the power held by consumers is moderate.

Price range and different fashions function as differentiating factors for retailers.

The power of Brazilian buyers is highlighted in figure 6 below:

Low buyer power can be a strength for potential investors. The reason is that consumers would not be able to significantly influence market prices. Consequently, Primark can consider this as an opportunity.

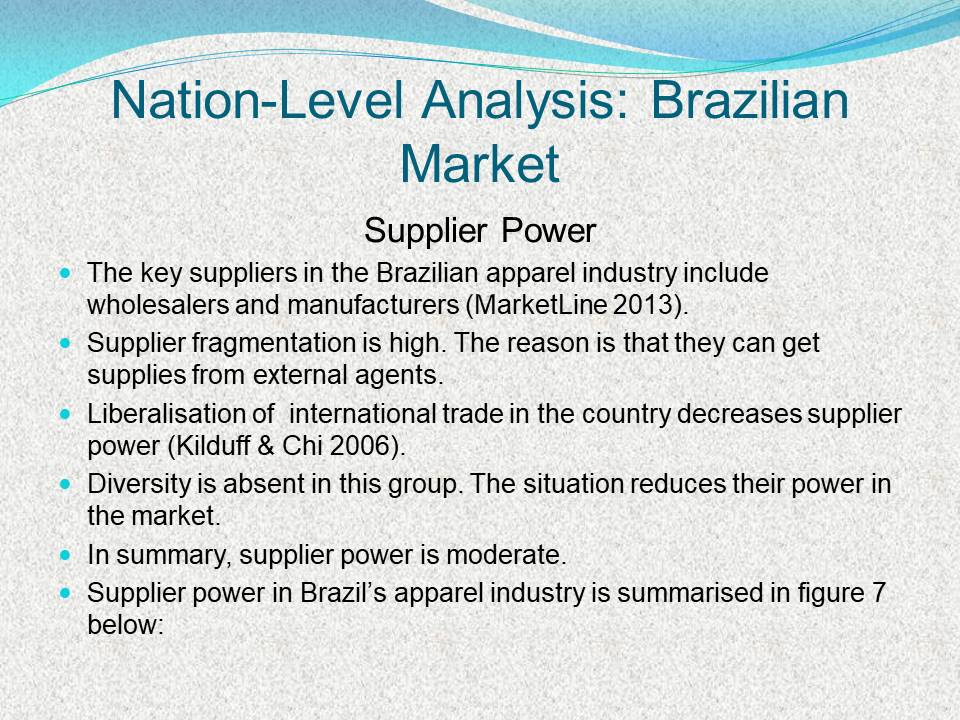

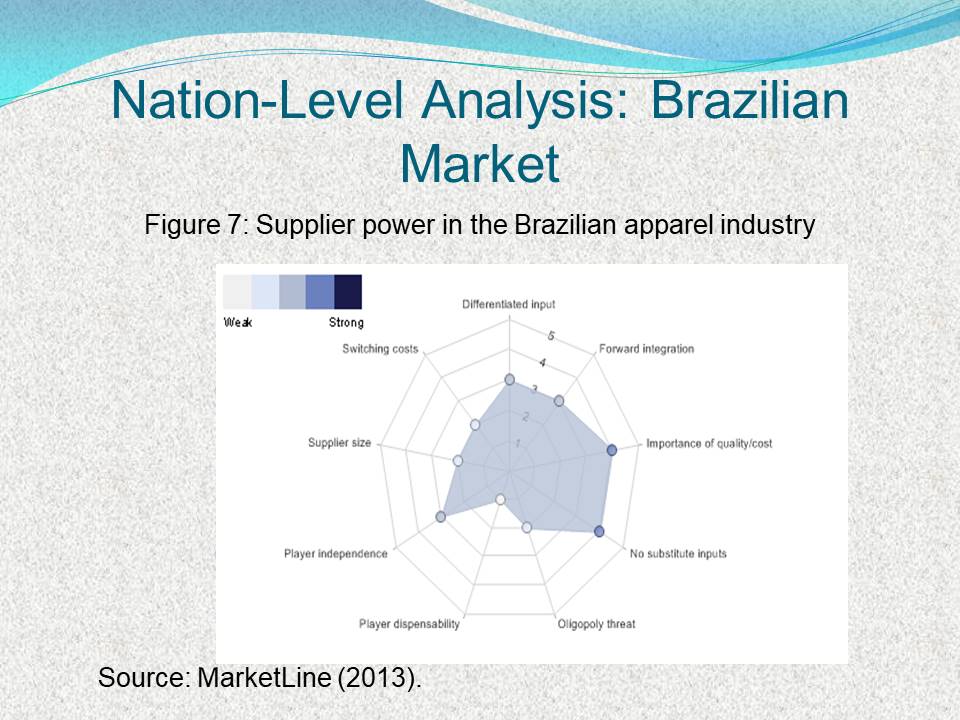

Supplier Power

The key suppliers in the Brazilian apparel industry include wholesalers and manufacturers (MarketLine 2013).

Supplier fragmentation is high. The reason is that they can get supplies from external agents.

Liberalisation of international trade in the country decreases supplier power (Kilduff & Chi 2006).

Diversity is absent in this group. The situation reduces their power in the market.

In summary, supplier power is moderate.

Supplier power in Brazil’s apparel industry is summarised in figure 7 below:

The liberalisation of international trade in Brazil weakens supplier power. Competition with suppliers from low-wage regions (for instance, India and China) is increased. Retailers’ switching costs are not high. However, this switching entails the risk of choosing suppliers with extended supply chains or those who may not be able to cope with sudden demand changes in the market.

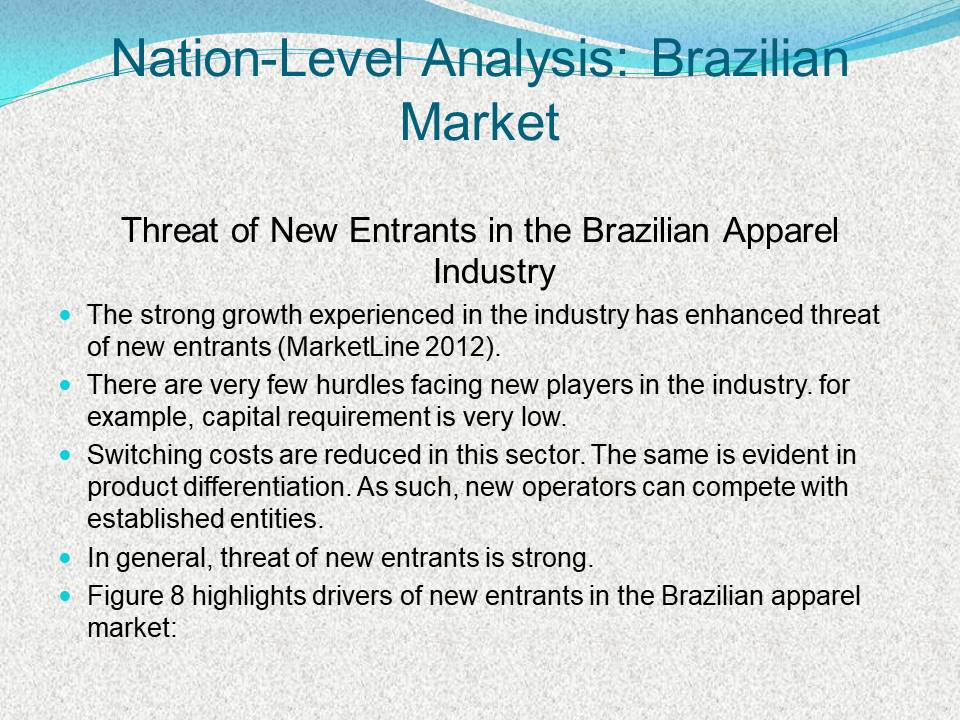

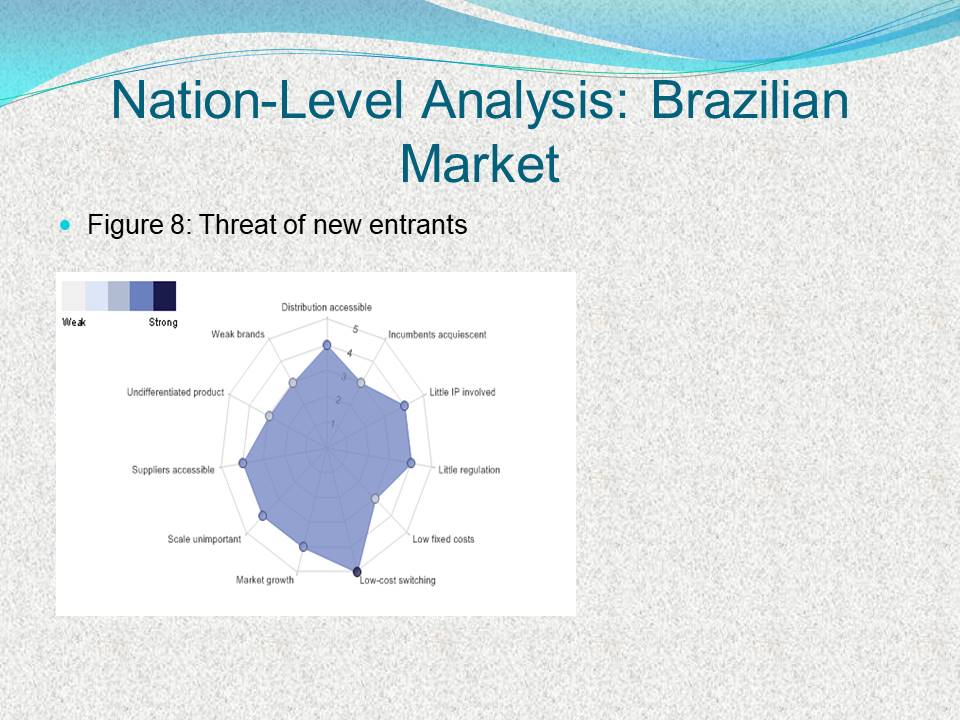

Threat of New Entrants in the Brazilian Apparel Industry

The strong growth experienced in the industry has enhanced threat of new entrants (MarketLine 2012).

There are very few hurdles facing new players in the industry. for example, capital requirement is very low.

Switching costs are reduced in this sector. The same is evident in product differentiation. As such, new operators can compete with established entities.

In general, threat of new entrants is strong.

Figure 8 highlights drivers of new entrants in the Brazilian apparel market:

Given the level of new entrants’ threat in the Brazilian apparel industry, Primark has the opportunity to establish itself in the market. However, the threat of losing market share acquired to new entrants is highly possible.

Threat of Substitute Products in the Brazilian Apparel Industry

There are no substitutes for apparel products.

Growth of online sales is a major substitute for retailers.

Overall, threat of substitute products in the Brazilian apparel industry is weak.

Custom and home made clothing presents alternatives to retailing of ready-made clothes (MarketLine 2013).

Counterfeits pose a significant threat to genuine brands.

Clothing cannot be substituted by other products. However, consumers can purchase these products directly from the manufacturers as opposed from retailers. Companies like Primark need to embrace new distribution channels, such as ecommerce, to optimise their reach to consumers.

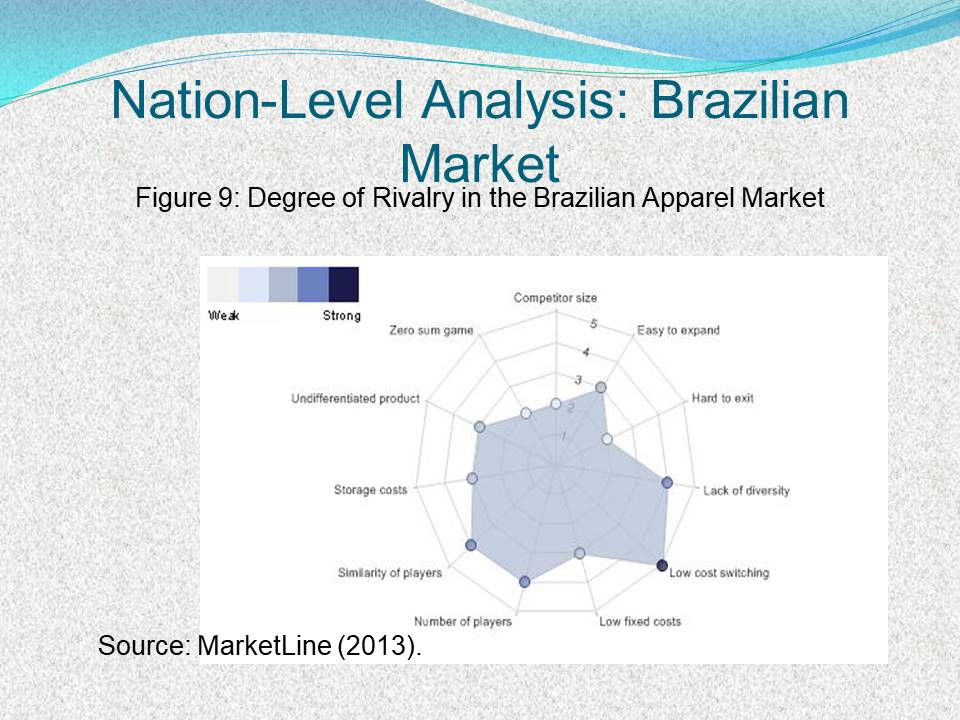

Degree of Rivalry in the Brazilian Apparel Market

The industry is fairly fragmented.

Large number of similar retailers operate in the industry, most of whom are independent (Krugman 1990).

The fast pace of change in fashion has intensified rivalry.

In summary, rivalry is moderate.

The industry still has room for more players.

Rivalry in the Brazilian apparel industry is shown in figure 9 below:

Rivalry in the apparel industry may signify stiff competition. However, it may also indicate an opportunity for establishment in the market. Primark can easily penetrate the Brazilian apparel industry using the appropriate set of strategies.

Overview of Porter’s Diamond Model Analysis of Brazil

- Factor conditions:

- The country is characterised by a massive workforce and large population.

- Technological infrastructure is well developed. However, the physical infrastructure is underdeveloped.

- Labour regulations are relatively inflexible.

- The country experiences substandard levels of skilled labour.

- Demand conditions:

- The country is the tenth largest economy in the world. In addition, it is the most populous country in South American.

- Brazil boasts of a very high level of domestic consumption.

- An increase in the number of middle class consumers is driving consumption.

It is noted that the labor regulations in Brazil are relatively inflexible. However, the high population and positive growth of the economy makes the country very competitive. Skilled labor, on the other hand, is relatively developed, although the apparel industry does not require this extensively.

The physical infrastructure is not well developed. However, other factor conditions increase the competitiveness of the country with regards to investment. Brazil is also heavily investing in infrastructure and education, enhancing its competitive advantage in relation to factor conditions.

- Related and supporting industries:

- Major industries in the country include petrochemicals, steel, and automobiles (MarketLine 2013).

- Extraction of minerals is another booming industry

- Firm strategy, structure, and rivalry:

- Firms are becoming increasingly structured and well informed.

- The country is characterised by a sophisticated and highly advanced service industry.

- It is the second largest industrial sector in America (MarketLine 2013).

Related supporting industries are booming in Brazil. The country is the tenth largest economy in the world. In addition, the companies operating in the country report tremendous growth, making the market very competitive for external investors.

Intense rivalry in the country’s apparel industry is due to the rapid growth of the economy. It is an indication of the fact that there is more room for investors. Fashion is also rapidly changing in Brazil, strengthening the country’s competitive advantage.

Summary of Strengths, Weaknesses, Opportunities, and Threats for Italy

Strengths

- Strong and highly developed economy.

- Free international trade.

- Positive economic growth.

- Highly developed infrastructure.

Weaknesses

- Intense competition in various sectors.

- Slow growth following economic depression in Europe.

- High presence of medium and small scale enterprises.

Opportunities

- The country is recovering from economic depression, signifying opportunity for investments.

- It is the major supplier in the European apparel industry.

- Free international trade policy.

Threats

- Intense competition from other European and global economies.

- ‘Reoccurrence’ of global economic depression.

Summary of Strengths, Weaknesses, Opportunities, and Threats for Brazil

Strengths

- Rapidly developing internal capabilities, such as skilled labour and infrastructure.

- Firms are becoming increasingly structured and highly informed.

- It is one of the highly developing economies in the world.

Weaknesses

- Relatively inflexible labour regulations.

- The threat of future global economic downturns.

Opportunities

- A major economic power in South America.

- Vast natural resources for export.

- Very attractive to international investors.

Threats

- International trade is rigidly regulated.

Justification for Italy and Brazil as the Investment of Choice for Primark

Brazil

- Brazil is a rapidly developing economy. It is characterised by numerous opportunities for development.

- The country’s large population makes it a very attractive market in the apparel industry.

- Country can serve as a strategic location for expansion into other South American economies.

Italy

- Italy, on the other hand, is a major player in the European apparel industry.

- Italy can act as a strategic location for entry into other European apparel markets.

Firm-Level Analysis: Primark Company

Firm level review is conducted using a SWOT analysis.

The model is effective in determining the overall strengths, weaknesses, opportunities, and threats of the organisation.

SWOT analysis is very important. It enables the entity to align its resources with the realities in the market.

Strengths of Primark would enhance its establishment in the new markets.

The weaknesses of this company entail internal factors that need to be addressed to enhance its competitiveness.

Opportunities involve external environment factors. The organisation can exploit these factors to realise its objectives.

Threats are external conditions that unfavourable to the organisation’s operations.

Primark Strengths

The strengths of this company include strong reputation and brand names.

The firm has a well established structure, enabling it to enter new markets.

Primark boasts of a strong supply chain management system.

The firm has capabilities to harness technology to improve its supply chain.

The company has established long term relationships in the market, which are beneficial to trade.

Considering that Primark operates more than 250 stores in different countries, successful strategies in these markets can be customised for application in Italy and Brazil. In addition, apparel consumers in these countries very brand conscious. Consequently, the company can exploit its popular brand name to enhance its image in these markets.

Primark Weaknesses

- The firm records low profit margins in some of the regions it operates in (Krugman 1999).

- The degree of buyer concentration and power is high (Krugman 1999).

Low profits margins are indications of internal weaknesses in relation to operational strategies employed by the company. When faced by high buyer power, the company may end up making very low profits or none at all. It may record insignificant growth in spite of its expanded operations.

Consequently, it is essential for the company to review its operating strategies, if significant growth and profits are to be realised in the targeted markets.

Primark Opportunities

- Low market entry barriers in the targeted economies (Brazil and Italy).

- Increase in disposable incomes in newly industrialised economies, such as Brazil and India.

- Removal of trade barriers in the international arena. The situation is evident in Brazil and Italy.

- Progress in terms of technology. The development is suitable for the improvement of supply chain, for instance, through ecommerce.

- Insatiable consumers in the apparel industry.

Low market barriers in Italy and Brazil are a sign that Primark can penetrate these markets with relative ease. Increased disposable income in these markets imply that consumers are more willing to invest in fashion, presenting a lucrative market in the process. Primark can exploit these markets and attain its objectives.

Threats to Primark

- Globally, environmental and social regulations are increasing, especially in relation to corporate social responsibility.

- The global economic slowdown is a threat to many industries, including those in the apparel sector.

- In some economies, the disposable income of consumers is decreasing.

- Shifting consumer tastes are also a matter of concern.

Corporate social responsibility awareness among consumers has increased in the recent past. As a result, companies that violate these policies and regulations are likely to be regarded negatively by consumers. For instance, a company that uses or sources for materials from other companies utilising child labour have met severe criticism. Such criticisms usually lead to loss of revenue and market share.

Europe has gone through severe economic downturns, which have resulted in frugality among consumers. The trend is improving, although the risk of similar situations occurring in the future cannot be dismissed. As such, Primark should be cautious when investing in Italy, as opposed to Brazil.

Recommendations

The apparel industry has played a significant role in the global integration process (Kilduff & Chi 2006).

Considering the competitive situation in Italy and Brazil, investing in these countries is profitable to Primark.

Businesses that repeatedly attempt to move into new markets have high chances of success (Collins, Kamel & Miller 2006).

Primark should enter new markets close to its core. The markets should be related to the company’s businesses, channels, and geographies.

The opportunities present in the apparel industries in both Italy and Brazil outweigh the threats associated with these markets.

Primark should vary its current cost structures, capabilities, and target consumers in order to appropriately meet the varying market demands.

References

Collins, M, Kamel, M & Miller, K 2006, ‘Beyond the core in retail’, Strategy and Leadership, vol. 34 no. 4, pp. 14-18.

Kilduff, P & Chi, T 2006, ‘Longitudinal patterns of comparative advantage in the textile complex’, Journal of Fashion Marketing and Management, vol. 10 no.2, pp. 134-149.

Krugman, P 1999, ‘The role of geography in development’, International Regional Science Review, vol. 22 no. 2, pp. 12-32.

MarketLine 2013, MarketLine industry profile: apparel retail in Brazil, 2014. Web.

MarketLine 2012, MarketLine industry profile: apparel retail in Italy, 2014. Web.

Porter, M 1990, The competitive advantage of nations, Harvard Business Review, London.

Porter, M 2004, Global competitiveness report 2004-2005, Macmillan, Palgrave.

Ross, J & Harradine, R 2010, ‘Value brands: cheap or trendy?: an investigation into young consumers and supermarket clothing’, Journal of Fashion Marketing and Management, vol. 14 no. 3, pp. 350-366.