Intricacy of corporate sponsorship is increasing rapidly. Consequently, corporations wish to replace their chief financial officer (CFO) in the position of chief executive officer (CEO). The task of CFO is to develop the corporation as an extensive financial enterprise while placing as CEO. This is not the foremost factor that the corporation wishes to replace a CFO in the place of CEO.

It is essential for a CFO to have a vast external point of reference. Excluding this company not is in motion and boost the price of the shares depends on the aggregate operating process of the corporation. Above all, it is obviously declared that shareholders are the owners of the company and because of this external point of reference is as important as the internal configuration, overall performance, competitors, products and its performance in the market as well as in the industry.

Combination of both internal and external factors performance of a company impact on the price of the shares in market and also values of shares at shareholders. All of these are recognizable and pay attention regularly both of the CEO and the CFO. A CFO has an opportunity to be CEO and for this finance department can arrange a hospitable environment as follow-

- Awareness of being a chief executive officer (CFO) and opportunities for it plays behind an important role. Though all CFOs are not prospective but most of them are developing to gain the CEO status that place is known as the site of authority.

- Today’s CFOs are involved in strategic planning and also escalating value of the shares where as in past their movements was like a storekeeper. Now the scenario has been changed, their responsibility becomes wider sphere. For instance, cooperate with management board; execute new strategy for the company, impulsive discussion with the CEO and so on.

- In the investor community, they behave more efficiently in analyzing strengths and weaknesses of the company, overall business performance. Moreover, a CFO has the rich knowledge in strategy formulation and application. Finally, in an investor community it is necessary to present two person-one is the CEO and another one is the CFO.

- In a corporation team work is preferable than individual efficiency. But for a CFO it is essential to perform better in external environment as well as in internal responsibilities. For this reason, a CFO has a greater possibility to be a CEO.

- Another important factor is that a CFO has a comprehensible perception of the strategy of the consumer. They also acquainted with the employees prospect while recruiting.

- A CFO would be a well CEO for the reason that they can accurately measure while the organization need change, market performance, internal structure, consumers behave, launching new product in the market, entry in a new market and industry etc.

- For the benefit of the organization consideration of a CFO is the activity of finance. Though there are some barriers to move as CEOs for a CFO it is included that many of the CEO need consultative support from its CFO while risk taking.

Above are the factors for that corporation’s aspiration is that they choose their chief financial officer (CFO) as a chief executive officer (CEO). All of the above describes that a CFO has the competence to keep up the corporation through his internal tasks and also enough efficient to continue external relations that would be benefited the company. Therefore, in the position of CEO, a CFO is one of the best alternative though there might have some difficulties.

Chief Financial Officers would make good Chief Executive Officers (CEOs)

Previous portion of this part describes that what the specialties are the CFO for which he is the best alternative for the company in the place of CEO. Now, this part is for statistical analysis that shows in practice what the successes of CFOs are as a CEO. A short description of the successes of a CFO as a CEO is as bellow:

- With the comparison of last few decades, now a CFO needs to know a lot about production of the company to be a CEO. In 1960, a report stated that about 25% of CFOs are replaced in the place of CEO more than one time.

- Most of the companies recruit a CFO that they would be the CEO of that company. Reason behind for this purpose is- a vast knowledge of key factors that a CFO have to be in case of executive level, competitive attitude for the sound growth of the company, effective strategy formulation.

- In time of the crisis a CFO’s steps are more effective for the organization than a CEO’s. Apart from the internal undertaking a CFO has to keep up a numerous peripheral as a source of finance or investment. This defines that involvement of a CFO as a CEO is profitable for the organization and thus a CFO could be a successful CEO.

- To be a successful CEO a person needs to have a clear impression managerial skill, better communication both with internal and external parties, product’s performance in market, operational movement and vision of the organization. A CFO has all of these desirable qualities that make him successful as a CEO.

- Self education is another phase that makes a CFO a successful CEO. Whenever in the place of CFO people assembles all information of the organization. This enables him to identify the strengths, weakness, opportunity and threats of the company.

- Financing is the factor or key terms through which a company is accomplished to progress forward. A CFO is a coordinator of the factor and also established strategy to execute this that would bring profit for the company.

- For most of the organization CFO is the one alternative for the place of CEO. But in a few cases organizations call for a CFO in the position of CEO. In the period of crisis, top of the organization mostly choose a CFO as a CEO because of the CFO has the experience and efficiency overcome the crisis.

- Establish a new business, risks for it, modernize the organization, enlarge the organization, finding way to fulfill the demand of the employees, market performance of the of their product, reasons of the customers shifting, rapid change of the consumers choice etc. are measured by a CFO. Therefore, these are the factor that enables him a successful CEO.

With managing a lot of barriers a CFO established himself as a successful CEO. Aforementioned are the key success factors of a CFO while he is a CEO. As a result, top of the corporation mostly choose CFO as their CEO. On the other hand, percentage of success of a CFO is greater than any other. Considering all of these it is stated for most of the corporation are-“A CFO is most successful as a CEO in most of the cases.”

Session Long Project: IBM Corp.

Here, selected company is IBM (International Business Machines). For this company calculation of rate of return (% gain or loss) to investors who bought shares of shares of this company a year ago and sold the shares yesterday. This rate of return is known as one-year Holding Period Return or HPR. Here also included most recent price of the shares on the company. Calculation of rate of return (% of gain or loss) is presented as bellow:

From the above calculation, it is estimated that the rate of return of the company is 2.44%, amount of capital gain is $783, 056183 and the recent piece of the share is $81.67.

Case Assignment: Present Value (PV)

Here, given information are as bellow-

In one year worth or face value, (FV) = $7,000.00

Interest or discount rate, i = 8%= 0.08

Again, interest rate or discount rate = 3% = 0.03

Present value (PV) of today’s bank account=? When interest rate or discount rate = 8% or 0.08

When interest rate or discount rate, i = 3% or 0.03, present value (PV) =?

Number of year, n = 1

Therefore, when interest rate, i = 8% or 0.08

Present value (PV) = Face value (FV)/ (1+i) ^n

= 7,000.00/ (1+0.08) ^1 = $6,482 (approximately)

Again, for 3% or 0.03 interest rate present value (PV) = 7,000.00/ (1+0.03) ^1 = $6,796 (approximately).

So, present value (PV) of the bank account is $6,482 (approximately) and $6,796 (approximately) when discounts or interest rates are 8% and 3% respectively.

Calculation for present value (PV)

Calculation for present value of Account-A and Account-B is given in following table-

Calculation and comparison table for the present values of the income stream under the three discount rates

Decision

Above calculation shows that to receive these three payments choosing 8% interest rate is acceptable. Comparison of the present values of the income stream under the three discount rates- 8%, 6% and 4% presents that at 8% discount rate it needs to pay lowest amount to receive these three payments in future.

Session Long Project for Three Companies

Ice Dream

Ice Dream is a beverage company geographical location in El Centro in NAFTA region. Prime product line included Shave Ice with Mexican flavored syrups and other beverage as an ideal business for Southern California. Utilizing one third of capabilities in first year of operation the company generated revenue of US$ 2.4 billion from sales of ice cream. The company has targeted all segments of the citizens like adults, children, and teenagers of El Centro city and surroundings. Its quality moderated pricing covered both the low and middle income level of customers and achieving a quick growth.

RJ Wagner & Associates Realty, Inc

RJ Wagner & Associates Realty, Inc. is a promising player in the Houston real estate market. The company involved to resolute the needs of home buyers and sellers. It provides sophisticated services to the both through its in house agents. Due to growing economy of Houston, the company targeted the Champions area. Its challenging attitude, quick respond to the clients need and dynamic strategy enabled the company’s sales associates to involve themselves in the region that would fit them to earn more within a short period. With excellent marketing practice, individual consulting opportunity and professional feedback, the company has a stable growth of 8.1% per annum.

Interstate Travel Center

Interstate Travel Center operates in Dallas and Texas. The company handles with gas, diesel, restaurant, and other items for the trucking business. The company operates its business in two parts, one is for storage of diesel and gas and the other is restaurant. The internal environment of the company encourages the productivity of employees and value for customers. Trucking business has a 79% share in the US fright market where Interstate Travel Center is a major player. The company has a target to cover its operation within the NAFTA covering new public travel center as well as truck fueling and shopping.

Calculation of risks of these three projects-

Used formulas are as bellow-

Risk = (Actual outcome or return – Expected outcome or return)

Where, Actual return= (Total earnings – Investment)

Or, Actual return= {(Capital gain or loss + Dividend) + Investment}

Calculation table for measuring risk of the three projects is as follow-

In above calculation, each of the three projects has to pay same interest or discount rate- 10%. Their percentages of risks are in consequence as 14.26%, 10.74% and – 4.21%. As a result, this is the ascending order of these projects risk. Therefore, business plan by “Ice Dreams” named “Shaved Ice Beverage Business Plan” has the highest risk.

Case Assignment: Risk Assessment

From the view point of investor’s risks that would be avoided or diversified is the systematic risks. From the given scenarios a large fire severely damages three major U.S cities and a major lawsuit is filed against one large publicly traded corporation is under diversifiable risk. Both of these cases would be avoided through awareness and pre-protection. Following is the formula used in calculation systematic risk

Systematic risk = (r^2); where, r = co-efficient of correlation

On the other hand, risks that could not be diversified are unsystematic risk. Here, a substantial unexpected rise in the price of oil is not diversifiable or unsystematic risk because of it is a case of uncertainty. Any category of pre-protection or awareness can not avoid this. In calculation of unsystematic risk following formula is used-

Unsystematic risk = ; where, r = co-efficient of correlation

Calculation for market portfolio expected rate of return-

According to Capital Asset Pricing Model (CAPM) market portfolio expected rate of return is as bellow-

Ri= Rf + (Rm- Rf) x βi

Where,

Ri = Rate of return on ith assets = 10% = 0.10

Rf = Risk free rate of return = 3% = 0.03

Rm = Market portfolio rate of return =?

Beta or systematic risk on ith asset, βi = 1.5

Therefore, required market portfolio expected rate of return is-

Ri = Rf + (Rm- Rf) x βi

- → 0.10 = 0.03 + (Rm- 0.03) x 1.5

- → (Rm- 0.03) x 1.5 = 0.10-0.03

- → (Rm- 0.03) = 0.07/ 1.5

- → Rm = 0.0467 + 0.03

- → Rm = 0.0767 = 7.67%

So, the required market portfolio expected rate of return, Rm = 7.67%

Calculation for risk-free rate of return under Capital Pricing Asset Model (CAPM)-

Calculation of risk-free rate of return, Rf:

Given data are as follow-

Risk-free rate of return, Rf =?

Expected rate of return on asset “j”, Ri =14%= 0.14

Expected return on market portfolio, Rm = 12%= 0.12

Beta or systematic risk on jth asset, βi = 1.5

Under Capital Asset Pricing Model (CAPM) risk-free rate of return, Rf is-

Rf = Ri – (Rm- Rf) x βi

- → Rf = 0.14 – (0.12- Rf) x 1.5

- → Rf = (0.14 – 0.12×1.5) + 1.5 Rf

- → (Rf -1.5 Rf) = (0.14 – 0.18)

- → -0.5 Rf = – 0.04

- → Rf = (-0.04/ -0.5)

- → Rf = 0.08= 8%

As a result, the required risk-free rate of return, Rf is 8%.

Calculation of beta coefficient-

According to the question,

Expected rate of return on asset “i”, Ri = (10% x 2)= 20%= 0.20

Expected rate of return on asset “j”, Ri = (14% x 2) =28%= 0.28

Risk-free rate of return of asset “i”, Rf = 3% = 0.03

Risk-free rate of return of asset “j”, Rf = 8% = 0.08

Market portfolio expected rate of return of asset “i”, Rm = (7.67% x 2) = 15.34%= 0.1534

Market portfolio expected rate of return of asset “j”, Rm = (12% x 2) = 24%= 0.24

For both cases beta (b) for the portfolio is =?

For asset, “i” beta (b) is

Rf = Ri – (Rm- Rf) x βi

Βi= – (Rf – Ri)/ (Rm- Rf)

= – (0.03 – 0.20)/ (0.1534 – 0.03)

= 1.38

Again beta for asset “j”= – (0.08 – 0.28)/ (0.24 – 0.08)

= 1.25

Calculation for ‘cost of equity’ of the company under Capital Pricing Asset Method (CAPM)

Here, given data are as follow-

Annual yield to maturity, YTM = 4.5% = 0.045

Market risk premium= 6.5% = 0.065

Cost of equity, Ks =?

According to capital pricing asset pricing model (CAPM) equation, cost of equity, Ks

= (Annual yield to maturity, YTM + Market risk premium)

= (0.045 + 0.065)

= 0.11

= 11%

Hence, the required cost of equity under capital pricing asset pricing model (CAPM) equation is 11%.

Again, expected rate of return on this portfolio, Kr= (D1/Po) + g

Under CAPM equation expected rate of return (Kr) is equal to the required rate of return or cost of equity (Ks).

Therefore, Kr= Ks

→ Kr = 11%

Thus, expected rate of return on this portfolio is 11%.

The term investment decision also known as ‘the capital budgeting decision’. From view point of corporation, they wish to invest for a long period and this time duration is not lees than one year. The main ‘message’ of the Capital Asset Pricing Model (CAPM) to corporations is

- Growth- Growth of a company enlarges for a long time on the ground of its investment. In case of short term investment, corporation faced a lot of complexities for a sound growth.

- Risk- Basic criteria of a corporation are structured on the basis of investment attribute. For this reason, for long-term financing considering density of risk is an imperative factor.

- Funding- Acquiring investment for both internal and external is depend on amount of funds so that the corporation could scamper its line up as their wish for a long time.

- Irreversibility- This factor is most important in deciding long term financing in view of the fact that identify right market of the product is strongly linked with irreversibility.

- Complexity- It is difficult for a corporation in terms of investment decision. This decision is depend on future occurrences that are totally uncertain. For more clarification, cash flow of a corporation is depend on-economic, socio-political factors, changes of technology etc.

Investors contemplate while come to a decision to invest and for that they take on numerous aspects. The main ‘message’ of the Capital Asset Pricing Model (CAPM) to investors is as bellow-

- Develop the existing business in a broader form.

- Develop new business so that they can enlarge their business.

- Another important factor is- replacement and modernization. This is for increasing productivity, efficiency and effectiveness.

Case Assignment: Cash Flow

Calculations for Capital Budgeting Practice

Calculation table for net present value discount rates are 0%, 4%, 8% and 10% respectively

Calculation table for internal rate of return, (IRR)

So, for all of the cases the internal rate of return, (IRR) is 18.65%.

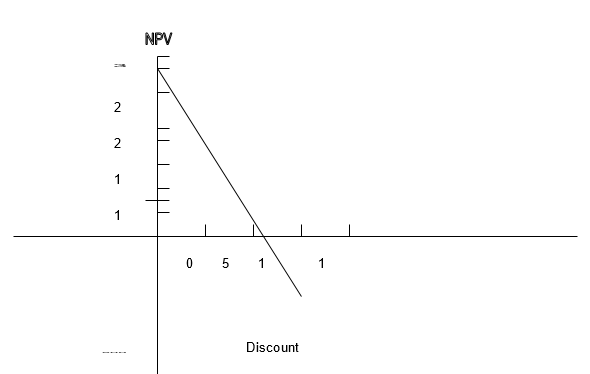

Graphical presentation

Following is the graph of NPV profile where the net present value is plotted in the vertical axis (the “Y” axis) and the discounted rates are in the horizontal axis (the “X” axis).

Calculation table for net present value (NPV) when discount rates are 0%, 4%, 8% and 12% respectively-

Calculation table for internal rate of return, (IRR)

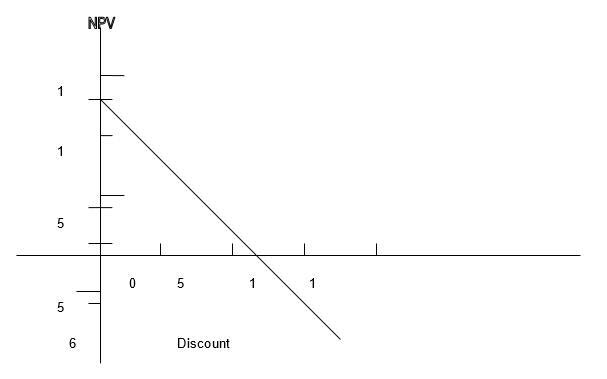

Graphical presentation

Graphical presentation for NPV profile is as follow. In horizontal axis (the “X” axis) discount rates are plotted and in vertical axis (the “Y” axis) net present values are plotted.

Therefore, internal rate of return, (IRR) is 9.86%.

Calculation for net present value

Here given data are as bellow-

Initial investment for the project= $3.2 million

Profitability index (PI) = 0.97

Calculation table for net present value (NPV)-

Therefore, NPV (net present value) for the project is – $ 0.096 (million).

For capital budgeting decision following are the feature of NPV (net present value), IRR (internal rate of return)-

- NPV is a technique of capital budgeting and using this method, time value of money is calculated using a realistic discount factor or interest rate. Internal rate of return is a discount factor for that net present value will become zero.

- A project would be accepted when its NPV shows positive value. And in case of IRR a project will be accepted when its rate of return is lower than its internal rate of return.

- When the value of the NPV is negative, the project must be rejected for its negative figure. Lower IRR than rate of return would the reason of rejecting the project.

- Whenever the NPV of a project is zero the project might be rejected or accepted and for IRR, the rate of return or hurdle rate is equal then the project might be accepted or rejected.

- Not only accept or reject a project NPV and IRR calculation is needed for-time value, measure of true profitability, value-additively, acceptance rules and value of the shareholders.

Considering all of the above features of both net present values (NPV) and internal rate of returns (IRR), it can be easily decide that IRR is better for capital budgeting decision. For more clarification, though both NPV and IRR used same formula in calculating math and also the similar principles but NPV correspond to compute the cost of capital of a company where as IRR presents the rate of return at break-even. As a result, interest or discount rate which is higher than IRR the project should be rejected for its negative NPV and when IRR is greater than interest or discount should be accepted for its positive NPV.

Session Long Project: Tesco PLC

Selected company

Tesco is the selected company to answer this question. In UK, it is the second largest grocer and at world ranking its position is third. Number of its employees is 440,000. It has operated its function in 12 different countries around the world. Tesco serves quality foods at a sound price. In this year earned almost- £128 million and from share capital their earning per share is £26.61. Growth rate of Tesco is 12.9% and profit before tax is £47,298 million.

One new acquisition that the company need

Tesco invests 350 million £ for their new project named “Step Change” in this year. This project is their employees and customer and their aim is to serve quality foods at a sound price as before. For this purpose they opened new sales outlook. Objectives of their “Step Change” project is as bellow-

- Energy saving- their first step is saving energy through their business and understand reasons of increasing utility cost.

- They also make awareness in decreasing consumption.

- At a lower cost introduce new technology in their stores.

- Continuous improvement in automatic merchandising.

- Make awareness in saving supply chain.

- Make easier for both the customer and staff they innovate cost effective technology.

- They have 3,500 employees in Bangalore, India for operating their IT department.

Estimation of initial investment

Calculation table for initial investment.

Annual incremental after-tax cash flow

Calculation table for annual incremental after-tax cash flow.

Problems in getting it funded

- Risk- in doing business risk is essential part. Though Tesco maintained a well management in risk controlling but funding in their non-food business they have faced several challenges. First of all, in implementing their strategy and economical bad circumstance is their challenge. Another internal risk is that for their business survival they need to continuous acquisition. In case of finance, transaction among counterparties, unstable interest rates and foreign currency.

- Cost- in this year their cost of capital is amounted 3.9 billion £ and several times they faced barriers by their counter parties though they have maintain proper audit and make well policies.

- Politics- another problem in funding is political. In different countries they need to maintain different rules, tax payment system, laws, working hour, different culture. As result sometimes these factors are threat for their business.

- Public relations- On of the major threat of investment are media propagation. Investors always try to get the message of an investing company from a third source other then the company itself. Thus media has a tremendous role to uphold or to abolish a company’s investment prospect. Some time bad journalism and adverting allotment affects the Medias view to a particular company.

Case Assignment: Debt and Equity Financing

AMSC produces electronic devices. Their product line includes- superconductor power cables, different devices and grid. These items are bought by China because of their various advantages. Advantages and disadvantages for AMSC to forgo their debt financing and take on equity financing:

- Source of debt financing of the company is numerous. So, debt financing is beneficial for the company. On the other hand, equity financing is depends on the retained earnings. As a result, relation between retained earnings and ratio of total earning is proportional.

- In case of debt financing, cost of debt could be at different percentage. Such as- cost at par value, cost at discounted value and cost at premium. In case of equity, it depends on two factors. One is the future growth of the company and the other is on the decision of dividend per share.

- Percentage of tax is deduced from the cost of debt but in case of unprofitable organization it does not need to pay tax. Where as, external equity of the company depends on the market price of the share.

- AMSC earned more $2.9 million than last year. Last year its expenditure and cash reserves are $48 million and $12.1 million respectively. Where as this year AMSC reserved $15 million but their expenditure is only $13 million. Thus, this is an advantage of equity financing because of the increases of internal financing.

- A disadvantage of AMSC is that it has a crisis of investor and also bank loan. Their top management believes that in this market situation for equity financing their best source is the shareholders.

- AMSC closed their stock at early period whenever, stock market is gained at a large percentage and the percentage is 305.

- By applying their efficient financing strategy AMSC earned two times more than last year and their earning is $50 million though they target is $45 million.

- In debt financing the tax-free cost of debt is used because the company’s target is to maximize is value and stock. For this reason, it is advantageous for AMSC to use debt financing.

- A disadvantage of equity financing is it involves in floatation costs which is one type of expenses. As a result, the amount of fund from that this costs is deducted and amount of investment is reduced.

- The term cost of debt is referred the interest rate on new debt or the marginal cost of debt and this is helpful for required capital budgeting decisions.

Aforementioned are the advantages and disadvantages of American Superconductor for their debt financing and take on equity financing. Though they have faced a numerous difficulties but they enjoy a mixture of benefits that helps to increase their annual reserves and decrease their expenditures.

Session Long Projects “X” and “Y”

In order to examine the structure and activities of an organization here identified two projects-“X and Y” and both of these have need of investment. Between these “X” is the current project and “Y” is the long-term investment project. For planning and controlling financial management is a set of managerial activities. The scope of these activities is as bellow-

- Production.

- Marketing.

- Finance.

In this paper, for both of the projects or events require identifying preferable source of funding. The step of funding the projects “X” and “Y” can be termed as-

- Short-term asset-mix or liquidity decision- An organization’s profitability and liquidity depend on the investment in current assets. An important part of financial function is managing current assets that have an effect on the organization’s liquidity. So, managing current assets should be on such a way that would overcome the risk of liquidity. There always exists a conflict between profitability and liquidity. Lack of sufficient funds in current assets is the cause of profitability, illiquid and high risk and an idle current asset is not capable to earn anything. Managers should be efficient to continue a sound trade-off between liquidity and profitability. As a result, financial functions are manipulated the organization’s productions and marketing. Consequently, it affects the organization’s size, growth, profitability, risk and at last value of the firm.

- Long-term asset mix or investment decision- For an organization, investment decisions engrosses capital expenditures and hence it meets to the capital budgeting decisions. Long-term asset mix also engage in allocation of funds that would enlarge the future cash-flows. From view point of investors there are two important points in making decision. That can be describe as follow-

- Measuring discount rate or cut-off rate and compare this with the new investments that would bring a forthcoming profitability.

- Measuring both expected return and risk. Changing or replacing decision is depending on expected return and risk of the project.

To put into operation a project has an extensive arrangement for accurate required rate of return or discount rate or hurdle rate on investments that would considered as the cost of capital. An investor’s probable earn is depend on the opportunity cost of capital or the expected rate of return. And hence, a manger has to be efficient in allocation of fund. In case of long-term project following objectives should be considered by a manager-

- Size of the organization and growth rate.

- Formation of assets.

- Ways to increase funds of the organization.

- Understanding capital markets.

For the preferable source of funding excluding the above criteria following are the important activities that an investment and financial management engaged-

- Forecasting and planning- this step is needed for the company’s future position and the organization if proper plan cloud be designed.

- Major investment and financing decisions- a company could be successful if it would have rapid growth in sales, equipment, plant investment and inventory. The financial manager have to help measuring maximum sales growth rate, definite assets to get hold of and in a efficient way finance them. For this reason, the company could sell equity share or raise its funds through borrowing debt. In case of debt financing plan of investment or project should be long-term.

- Coordination and control- this step is for organization’s internal management department. Thus the company could reach its targeted position. Interaction among all departments such as marketing, finance, human resource affects the investment requirements and hence the decision making. For investment decision marketing affected some factors as- inventory policies, deployment of plant capacity and availability of funds.

- Dealing with the financial markets- it is step that deals money and capital markets by the financial manager. Every firm is affected by the firm’s securities are traded, funds are raised by the general financial markets and at last the investors of the firm either rewarded or reprimanded.

Abovementioned discussions are for preferable investment in both long-term project and current project. For both of this debt financing is helpful than equity financing because of its uncertain market condition. And for this financial managers take decisions in favor of asset attain and the financing way for this assets and also for the existing resources. Consequently all of these could help the organization to increase its values and also increase long-term welfare.

Bibliography

Bplans. Shaved Ice Beverage Business Plan, Ice Dreams, 2008. Web.

Bplans. Truck Stop Business Plan: Interstate Travel Center. 2008. Web.

Scott Besley and Eugene F. Brigham, Essentials of managerial finance, 13th edition., 2007, Thomson south—western. Web.

Besley, S. & Brigham, F. E., Essentials of Managerial Finance, 13th ed., Thomson South Western, Singapore. Web.

Block, B. S. & Hirt, G. A. (2005), Foundations of Financial Management, 11th edition, McGraw hill Irwin, Boston. Web.

Bodie, Z. Kane, A. and Marcus A. J., Investments, 5th Edition, Tata McGraw-hill publishing company limited, New Delhi. Web.

Brigham, E. & F., & Houston, J., Fundamentals of financial management, 4th edition. 2004, pp. 117-124. Web.

Brealey A Richard & Myers, Stewart, Fundamentals of Corporate Finance, New York: McGraw Hill. 2007, pp. 433-467, 465-85. Web.

Brealey, A. Richard & Myers, Stewart, Financing and risk management, New York: McGraw-Hill. 4th editions. Web.

Brigham, E. F., and Houseton, J. F. (2004), Fundamentals of Financial Management, 10th Edition, Thomson south-western, Singapore. Web.

Holt, H. H., (2002), Entrepreneurship New Venture Creation, 6th Edition, Prentice- Hall of India Private Limited, New Delhi. Web.

Jensen, M. C and Meckling, W. H., Theory of the firm: Managerial behaviour, Agency Costs and ownership Structure, Journal of Financial Economics, 1976.

Mao, James C. T., Quantitative Analysis of Financial Decision, Prentice Hall. Web.

Pandey, I. M. Financial Management, 9th Edition, Vikas publishing house Ltd: New Delhi, 2007. Web.

Picker, Ida., Do CFOs Really Make Good CEOs? Institutional Investor; 1989; 23, 9; ABI/INFORM Global, pg. 47.

PCQUOTE (2008), International Business Machs (IBM). Web.

Ross A, Wererfield R, Jaffe J., Corporate finance, 8th edition. McGraw-Hill, 2006. Web.

Solomon, Ezra, The Theory of Financial Management, Colombia University Press, 1963.

Tesco , More than the weekly shop, Annual Report and Financial Statements 2008. Web.

Walter, James E, “Dividend Policy: Its Influence on the Value of the enterprise”, The American Finance Association, Journal of Finance, 1963, Volume – 18, Issue: 2.

Wagner RJ and Realty Assoc, Real Estate Brokerage Business Plan. Web.