Draw and label a theoretical diagram outlining the process of “securitization” in creating financial assets described as “mortgage backed securities”

Securitization

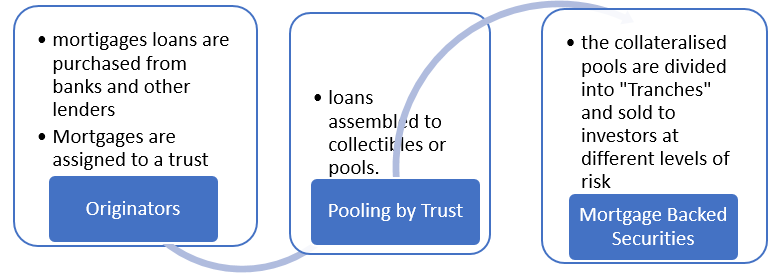

The process theoretically involves three processes. There is the purchasing of mortgage loans also referred to as mortgage notes from banks and other accredited lenders. The loans are then assigned to a trust. The second process involves the assembling of the loans as collections or pools by the trust. Finally, there is securitization of the pools or collections which are then issued as mortgage backed securities to investors.

Using your diagram as a guide, explain the function of mortgage securitization in more detail (i.e. what is it designed to do)

Functions of Securitization

The functions of securitization are more or less the advantages or merits of the process to its consumers (Besley 2001, p. 81). At the first stage, there is sufficient liquidity that offers originators enough capital to avail more loans to consumers. The availability of credit due to sufficient liquidity is made possible through the third process where investors buy MBS in the form of tranches or derivatives. From the second stage as shown above, there is a reallocation of the risk through shifting of the credit risk that is associated by the securiti9ese assets held by investors. That way the originators who mainly are the financial institutions have their risk reduced through sharing.

What is the difference between a Mortgage Backed Security (MBS) and a Collateralized Debt Obligation (CDO)?

Collateralized Debt Obligation (CDO) and Mortgage Backed Security

According to Wiedeman (2009, p. 49), CDO’s add to the aggregation of the existing securities. The main difference between CDO’s is that CDO’s have a very unique and differentiated financial structure from mortgage securities. The main differences between CDO’s and MBS can be seen through the funding structures of both processes. According to nnn, CDO’s are different and unique from MBS in six different ways.

Mortgage Backed Securities are supported by brain dead pools of underlying assets while Collateralized Debt Obligation is managed (Wiedeman 2009, p. 51). It therefore implies that the asset portfolio of the CDO’s is likely to change drastically during the life of a CDO transaction. Stativity of MBS on the other hand ensures that their portfolios undergo minimum change during the life of the transaction.

Another difference that distinguishes CDO’s from MBS is that CDO transactions may close before the full formation of the underling pool of assets (Wiedeman 2009, p. 53). To investors this may be advantageous o disadvantageous. This aspect offers advantage because it makes it easy for the investment manager to include in the pool a wide range of collateral cutting across the industry from credit, industry and vintage. There is a demerit however in that investors are not sure if the investment manager will act or not according to the customer intentions.

Another distinguishing feature between MBS and CDO’s is the status of granularity (Besley & Brigham 2008, p. 69). The granularity of CDO’s is heterogeneous. In some cases some CDO’s have few underlying assets numbering as little as twenty while others may have several hundreds or thousands. It’s important to note that big number assets in a portfolio do not necessarily mean the pool is diversified. The methods of actuarial loss that are traditionally applied to MBS and ABS do not apply in the contemporalised CDO approaches.

Volatility of ratings is another difference that exists between CDO’s and MBS (Besley & Brigham 2008, p. 73). In essence, CDO’s exhibit more volatility in ratings compared to MBS and sometimes ABS. this is brought about by the migration of ratings on the CDO’s underlying collateral or manager trading (Besley & Brigham 2008, p. 67).

According to (Wiedeman 2009, p. 55), the heterogeneity of CDO pools helps in diversifying pool performance. However, the diversification is not possible in MBS simply because they lack the heterogeneity that CDO’s have. Additionally, the heterogeneity of CDO’s adds to the opacity of investors, an advantage when looked at objectively.

Finally, there are limitations in the secondary market trading in CDO’s trading because the CDO market is still young (Wiedeman 2009, p. 57). The heterogeneity of CDO’s that is sometimes regarded as an advantage is a demerit here in that its existence between underwriters, collateral managers and asset types has hampered the development of secondary market trading like it is in MBS.

Explain the term “Subprime mortgages” (or Alt –A /Tranche Z Mortgages)?

Subprime Mortgages

Subprime mortgages are loans given to individuals with an inconsistent credit history (Nanto 2010, p. 123). Subprime mortgages are part of a large lending scheme of subprime lending that advances credit to people who are likely to experience difficulty in repaying the loans they are given. The individuals involved in subprime mortgage lending have a history of failing to maintain the repayment schedule of loans and other credit facilities extended to them.

The individuals normally have a credit score or histories of below 600. Because of the risk involved in lending to subprime borrowers, financial institutions involved charge very interest rates which normally range above the prime lending rate. Subprime mortgages operate on a very complicated structure that includes the Adjustable Rate Mortgage (ARM) which is the most common. Some of the ARM’s commonly offered in the market include 3/27 and 3/28. ARM’s initially charge fixed interest rates which may at later stages be converted to floating rates depending on indices like LIBOR.

One of the main undoing of subprime mortgages was the low interest rates charged at the beginning only to increase once the interest rates increased to higher rates (UN, & Velloso 2009, p. 53). The variable rate mortgage repayments always led to a sharp increase in the repayments that subprime borrowers made.

Describe the importance of mortgage securitization from a United States (USA) historical perspective

Importance of securitization

The Great Depression necessitated the need for more security in credit lending. In 1934 through the National Housing Act of 1934, the US government of the US created the Federal Housing Administration (Scott 2009, p. 48). FHA concentrated on creating a fixed mortgage rate that would stabilize the housing market. The Federal National Housing Corporation was created in 1938 purposely to create liquidity in the market so that loan originators can easily be freed to issue more loans.

The origination role that the FNMA was supposed was through buying mortgages issued by FHA. Essentially, the federal government had opened the way for mortgage securitization by the creation of the above bodies. Loan originators could fall back on FNMA in case they run into liquidity problems. By buying the mortgages issued by FHA, FNMA in effect guaranteed loan originators by taking the risk. In other words, the risk is spread and shared significantly reducing the chances of failure.

The Government National Mortgage Association (GNMA) was formed. GNMA’s principle role was to give support to all mortgages issued by the FHA, the veterans’ administration and the Farmers Home Administration. The GNMA operates with the full faith and credit of the government of the US. Securitization was broadened in 1970 when the government allowed FNMA to buy private mortgages going beyond its initial mandate of buying mortgages only issued by the FHA. At the same time the federal government created the Federal Home Loan Mortgage Corporation (FHLMC) which performs the sale role as FNMA (Berlatsky 2010, p. 78).

The first time GNMA guaranteed the first mortgage pass-through of an approved lender was in 1968 while FNMA issued pass-through in the form of a participation certificate in 1971. Ten years later in 1981 FNMA issued a mortgage pass-through referred to as a mortgage-backed security. FNMA would also issue the country’s first ever collateralized mortgage obligation (Goldsmith 2009, p. 36).

Throughout the issuance of the above securities to mortgage owners, the government institutions were guaranteeing loan originators of a fallback plan in case the loans went toxic. It’s important to note that only government institutions played the critical role in the securitization process. Thus through securitization, the federal government is able to reduce the risk that originators bear besides ensuring more people access credit through the assets they hold.

Explain in general terms “systemic” and “non systemic” risk in relation to financial securities/assets?

Systemic and non systemic risks

Financial securities are types of investments. While these risks can be averted or reduced through various avenues, some of them have to be accepted and planned for in securities investment. These risks can be analyzed through both macro and micro levels.

Macro risks are large scale and include systemic and non systemic risks. In systematic risks, the risk on securities cannot be easily predicted, reduced. Furthermore, it’s impossible to predict it and the existing protection is minimal. These risks affect the entire system and no one part can claim to be immune from the. They include for instance interest rate increases by reserve banks or various legislations by governments.

Non-systemic risk on the other hand is one that is particular to securities and is easily eliminated through diversification. Some of these risks include employee strikes and go slows and management decisions that affect particular business operations and not entire industrial sectors.

List and describe the various systemic and non systemic risk factors likely to influence “subprime” mortgage backed securities

Systemic and non systemic risk factors influencing subprime mortgage backed securities

There is no doubt that flaws present in the subprime mortgage financing system led to the collapse of the world financial system (Forster 2009, p. 57). The systemic failure was caused by failed linkages throughout the system. The risk was as a result of the interaction of banking practices that were not very sound and investment decisions that were made with scant information on the part of investors. There was also an excessive reliance on the market by major players as well as market malfunctioning.

It’s important to note that the genesis of the GFC was multifaceted. Defaults resulting from subprime mortgages were one of them. Therefore the analysis below on the risks that led to the meltdown specifically aims at explaining the circumstances that led to the defaults.

There was excessive leverage and maturity transformation in real estate finance based on mortgage backed securities (Taylor & Clarida 2010, p. 104). The financial institutions took major risks by operating on high leverage of the conduits and investiments vehicles which averaged at almost 100% instead of the normal 50%. Additionally, the institution involved invested in long-term securities while refinancing themselves through the issuance of asset backed commercial papers. Such refinancing was short term generating the need for constant refinancing. The end result was the breakdown of the maturity transformation of conduits and SIV’s.

Market malfunctioning was another risk factor that is likely to affect subprime mortgage backed securities. In the financial crisis for instance, the breakdown of the maturity transformation of conduits and SIV’s led to the adjustment of the markets. Security prices were driven down because most investors were asking for high risk premia so as they can hold on to the assets that could no longer be financed by the conduits and SIV’s.

The uncertainty due to the adjustment of the prices of securities led to the withdrawal of funding by investors while insisting for large discounts on assets whose value was unknown. Such reasoning was fronted by risk averse investors who required higher expected rates of return for taking higher levels of risk. That set the stage for market malfunctioning that followed the crisis.

The overdependence on markets by financial institutions presents another risk factor to the subprime mortgage backed securities (Berlatsky 2010, p. 78). This brings in the element of the role that fair value accounting plays in the market. Through the mark to market system, the financial institutions have exposed themselves to the influence of market events. For instance banks had valued the subprime mortgage backed assets they were holding at the prices they could have sold them immediately if need arose. A market crisis in the magnitude of GFC therefore resulted into substantial undervaluation of the subprime mortgage backed securities.

Market malfunctioning and fair value accounting’s procyclical effects can be escalated by insufficient equity buffers in financial institutions (Scott 2009, p. 51). Some of the first causalities are subprime mortgage backed securities. Because the banks were operating on little or no buffers, absorbing the shock of the financial a crisis was a bit difficult.

There is also the systemic risk that is associated with the prudential regulation (Savona et al. 2009, p. 90). The capital adequacy requirements that are set by central banks including the Fed are highly procyclical. The system allows banks to expand in good times while contracting in bad times characterized by crises like the GFC. There is a result fluctuation in the entire financial and economic system which gives rise to a ripple effect. Such behavior led to the contraction and eventual collapse of many banking institutions that could not support the subprime mortgage backed security portfolios they were holding.

All the above scenarios were created after the busting of the housing bubble. Rising interest rates and falling home prices meant financial institutions could not meet their projections in terms of returns. Subprime mortgage loanees in return could not afford refinancing leading to defaults that crippled these financial institutions.

In relation to your answer in G) above explain why Freddie Mac and Fannie May, large Wall St Financial Institutions (such as Lehman Brothers and Merrill Lynch) and other investors in collateralized debt‐Mortgage Backed Securities may have failed to adequately asses, or mispriced these risks associated with subprime mortgages

Assessment Failure by Wall street Financial Institutions

It’s important to note that as much banks need to do their own assessment on the products they offered and market prevailing market trends; they also rely on credit rating agencies for direction (Steger & Roy 2010, p. 110). On this part alone, credit agencies failed to foresee the problem and its magnitude effectively keeping the financial system in ignorance. However, there was also lack of adequate assessment by WallStreet financial institutions that resulted in flaws and biases of internal controls as well as lack of market discipline.

Many financial institutions held on to the subprime mortgage backed securities they had created for additional returns (Committee on Capital Markets Regulation 2009, p. 240). There was acute underestimation of the risks of holding on to the securities by the institutions.

Many financial institutions hedged the securities through insurance arrangements. However unrealistic optimism coupled by overreliance on credit agency ratings led to the gross underinsurance of the securities leaving a bog portion of them exposed to risk. Moreover, the banks failed to adequately assess and acknowledge the systemic risk posed by the possibility of counterparties to the hedges falling into financial trouble.

Many institutions were on pursuit of big returns with complete ignorance of the risks the ventures involved. WallStreet institutions treated risk management and control as a matter of routine (Wiedemann, 2009, p. 67). In the pursuit of the returns, the institutions introduced the use of incentive schemes that only focused on the short-term gains with little or no adjustment to risk with little thought given to the survival of the institutions and the system. Additionally, there was asymmetrical flow of information purposely or otherwise on subprime mortgage securities. It’s clear many investors did not have a clue what they were getting into. Though banks didn’t hold information, they did not care to make a case for investors to understand the risks involved.

Categorise and explain any applications of the key principles of finance learnt in this course may havehelped participants (especially investors) recognize the risks involved in the securitization of subprime mortgages, and which might also have provided guidance to government or regulatory decision makers in US financial markets in preventing events that triggered the Global Financial Crisis (GFC)

Principles of Finance in the recognition and prevention of the GFC

There is a need for a redefinition or reorganization of financial principles, as they are known today (Committee on Capital Markets Regulation 2009, p. 253).

The existing conceptual framework operates on principles such as self stability of markets. Regulators therefore rarely intervene in markets opting to stay out of their developments by imposing minimum barriers. The existing concept also assumes that corporate governance ensures enough discipline in the market. Additionally, the concept assumes that market gate keepers are people of high integrity who can be relied on by investors and regulators to keep the market stable and out of trouble.

Furthermore the concept advocates for the interconnectivity between markets so as to increase welfare (Taylor & Weerapana 2009, p. 89). During the global financial crisis, systemic risk played an important role in the collapse of the global financial system. The complexity of the financial transactions involved convinced investors that the risk was spread while in fact it was hidden. Because there was little that could be done, systemic risk that started at Lehman Brothers spread throughout the entire financial system leading to big loses to investors. Interconnectivity coupled with systemic risk, could have been addressed by a law that could have regulated risk taking in the trading of products like MBS (Munchau, 2009. p 23).

A major restructuring of the concept had taken place in some situations like in Australia and Canada, which protected investors and helped save financial institutions. The successful policies that authorities may have pursued could have been based on improved versions of the financial principles discussed above.

Many financial experts agree that financial reform should take into account the issue of efficient market theory. In the heart of this is the definition of market risk. The assumption by this principle that markets tend to equilibrium in a random fashion and that they are supposed to operate devoid of any discontinuity in the sequence of prices. The fact however is that markets are subjected to imbalances means that regulators cannot ignore them. There is a potential for a systemic risk of market collapse because too many participants are on the same side which warrants liquidation from government without causing a discontinuity.

Securitization of mortgages especially subprime mortgages created an agency problem that contrary to what its designers though, increased risk instead of diversifying it. Financial institutions were only interested in making more profits and cared less about protecting investors. The hypothesis aided financial dealers to chronically underestimate the possibility and effects of asset bubbles. That is the critical area where regulation must address.

There is need to create laws and regulations that guide corporate governance to check against self-interest, complexity and work pressures. According to the fisher theorem, every corporation’s objective is the maximization of the present value even if it means going against the preferences of the shareholders. Management opportunities and market opportunities are clearly separated (Calhoun & Derluguian, 2011, p.45). It therefore means that the investment decisions that organizations make are independent of the owners’ preferences and the financing decision. Additionally, the value of the investment does not depend on any method that is used to finance the project.

The above tools and the positive principles between return and risk may have together with others like efficient market hypotheses aided in risky decision making by corporate executives. The repackaging and reselling of MBS especially subprime mortgages by financial institutions should have been regulated more closely to control and oversee the kind of products the institutions rolled out.

References

Besley, S. & Brigham, F.E. (2008) Principles of Finance. NY: John Willey & sons.

Besley, S. (2001) Principles of finance. NY: Routledge.

Berlatsky, N. (2010) The Global Financial Crisis. London: Macmillan Publishers.

Calhoun, C. & Derluguian, G. (2011) Aftermath: A New Global Economic Order?. London: Longhorn Publishers.

Committee on Capital Markets Regulation. (2009) The global financial crisis: a plan for regulatory reform. Washington: Committee on Capital Markets Regulation.

Forster, J. (2009) The Global Financial Crisis: Implications for Australasian Business. NY: Cengage Learning.

Goldsmith, B. (2009) Handbook for Surviving the Global Financial Crisis. NY: Springer.

Munchau, W. (2009) The meltdown years: the unfolding of the global economic crisis. London: Sage Publications.

Nanto, D.K. (2010) Global Financial Crisis: Analysis and Policy Implications. London: Sage Publishers.

Steger, B. M. & Roy, R. K. (2010) Neoliberalism: a very short introduction. NJ: InfoBase Publishers.

Scott, S.H. (2009) The global financial crisis. London: Sage Publishers.

Savona, P. et al. (2009) Global Financial Crisis: Global Impact and Solutions. NJ: Thompsons Learning.

Taylor, P. M. & Clarida, R. (2010) The Global Financial Crisis. Berlin: Springer Verlag.

Taylor & Weerapana, A. (2009) Principles of macroeconomics: global financial crisis edition. NY: Routledge.

UN, & Velloso, H. (2009) The Global Financial Crisis: What Happened and What’s Next. Washington: United Nations.

Wiedemann, L. (2009). Principles of Finance Management. NJ: Infobase Publishers.