Introduction

Privatization as an economic concept became popular around the world in the 20th and early 21st centuries. A study by Nowak found that many government-owned corporations were not efficient, and as a consequence, competitive enough to be profitable (46). Because of this, they often had to rely upon government bailouts after suffering significant losses. As globalization was taking shape in the 1970s, 1980s, and 1990s, most of these companies could no longer compete with the more efficient and highly profitable multinational corporations (Rose-Ackerman et al. 54).

In Latin America, Brazil was one of the first countries to embrace the concept of privatizing state-owned enterprises. The Brazilian government determined that this was the best way of ensuring that these companies could continue in operation without having to rely on taxpayer subsidies. Privatization provided a unique development strategy for the government, leading to the creation of jobs and assuring the government of continued revenue through taxation, in addition to reducing or eliminating the need for costly government bailouts in the operation of these companies.

The Political Economy of Brazil’s Development and Underdevelopment

Brazil is the most populous nation in Latin America and has a rapidly developing economy. Unlike the United States and Canada, the economy of this country had long stagnated due to a number of factors, including political instability. As Le Fraga explains, the country fell under military rule after a coup d’état in 1964 and it took 21 years for the reins of the country to return to civilian rule, which finally occurred in 1985 (67). These events led to political instability and tension, which slowed economic growth as the political environment was unfavorable for the development of both local and foreign companies.

Brazil’s long period of developmental stagnation was partly caused by the economic drag of its numerous underperforming government-owned companies. The government was forced to inject large amounts of cash into these institutions just to keep them running and most of them still continued to operate at a loss (Melnik and Miryakov (49). Corruption was another constant drain on the well-being of the economy. In a display of blatant nepotism, unethical government officials would appoint their close friends and family members as a reward for their loyalty, regardless of their qualifications or professional competencies. This unscrupulous practice created a culture of mediocrity, not to mention the outright theft and wastage of public resources, leading to significant losses at these institutions.

When the civilian rule was restored to the country in 1985, there was massive pressure on the new public leadership to redefine the economy. Rampant unemployment, for example, was a major problem throughout the country due to the mismanagement of public institutions across the board (Morady et al 32). It was thus necessary to find a way of making these institutions profitable once again to help bolster tax revenue for the government and generate more employment opportunities for the population at large. It was during this period that the concept of privatization began taking shape in Latin America and around the world as it was becoming increasingly evident that the culture of theft, incompetency and wastefulness could be eliminated if these institutions were run by private citizens as opposed to the government.

In April 1990, President Fernando Collor de Mello initiated a policy known as Programa Nacional de Desestatização, a massive privatization program meant to stimulate the country’s flagging economy (Rose-Ackerman et al. 64). The resolution targeted the transport, telecommunication, energy, sanitation and water supply sectors. It was a deliberate effort to ensure that these important industries would begin to experience rapid growth. The government sold off many government entities within these sectors to private players, which then resulted in a more conducive environment for the companies to grow in.

Theoretical Perspective

privatization has since remained an important and viable economic strategy that facilitates desirable growth in Latin America. In order to better understand why this has been the case, it is important to acknowledge the relationship between a policymaker’s economic paradigms and his or her developmental policies. As Nowak explains, government leaders tend to embrace certain fiscal paradigms because of their effectiveness in promoting economic development (78). Focusing more attention on the needs of the state apparatus versus caring for the needs of the people at large is one aspect of such a paradigm.

At the time that Brazil gained its independence, a prevailing economic principle in effect was the importance of helping empower its citizens by creating an environment wherein the people could achieve their career and financial dreams without undue control or restraints from the government (Aspalter 32). Developmental policies at the time emphasized the importance of providing for the socio-economic needs of the people, including proper medical care, educational opportunities, gainful employment, and the like. There was a major paradigm shift, however, when the country fell under the control of the military junta. Suppression of political views, economic sabotage, and close governmental surveillance became increasingly common and widespread. However, there was also a series of positive changes that came about in the country after democracy was restored. To better understand the evolution of economic thought over the past decades that eventually led to privatization in Brazil, it will be necessary to more closely examine various theoretical concepts underpinning the country’s political/economic structure during those time periods.

Socialism

Socialism was a theory that emerged in Europe and gained popularity in Latin America soon after the period of independence. It is a socio-economic and political philosophy that emphasizes the self-management of workers and the social ownership of the means of production (Rose-Ackerman et al. 90). It also emphasizes the decentralization of economic activities and control as a means of empowering the masses. It also seeks to promote a participatory process in the planning of the major socio-economic facets of a country. Instead of a few political elites making all of these decisions from the top-down, socialism seeks to encourage citizens at even the lowest echelons of society to participate in the decision-making process.

Socialism gained popularity in 21st century Brazil as the best way of fighting a whole host of societal ills including the exploitation of workers, poverty, hunger, racism, sexism, economic oppression, and the destruction of natural resources (Melnik and Miryakov 48). Brazil’s civilian government realized the importance of empowering its citizens by giving them a voice in the formulation of new policies. One of the most important concepts promoted in Brazil at that time was the creation of free markets. The government realized that it had to promote an environment in which private sector businesses could thrive and this led to the privatization of companies that had previously belonged to the government.

Neoliberalism

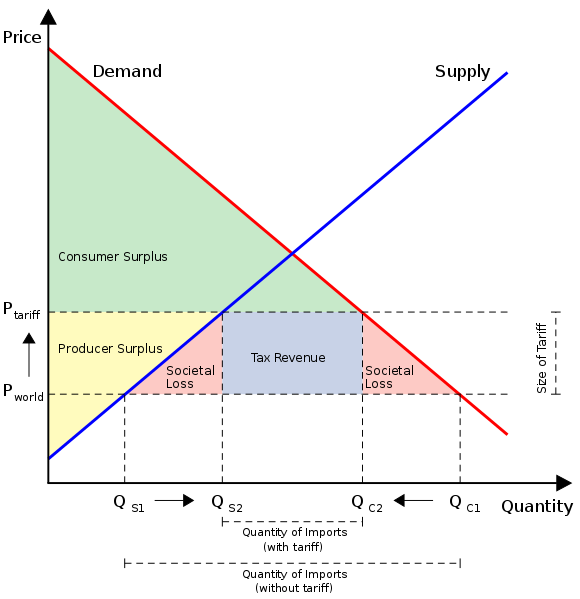

The concept of neoliberalism emerged in the 20th century as a resurgence of 19th-century liberal economic theory and eventually gained widespread acceptance. As pointed out by Ndimande and Lubienski, neoliberalism promotes free-market capitalism and economic liberation (63). The theory emphasizes the significance of deregulation, privatization, free trade, austerity, globalization and reduced government expenditure as a way of promoting the private sector. As Nowak observes, proponents of neoliberalism believe that the primary role of the government is to create an enabling environment for private sector entities to flourish without the state bureaucracy itself getting unnecessarily involved (86). Neoliberals would stress that such a strategy could potentially reduce social loss, provide more revenue to the government through taxation and stabilize the markets as shown in Figure 1 below.

Neoliberalism as a socio-political and economic paradigm has been one of the forces that led to privatization in Latin America. In Brazil, the government was keen on finding an effective way of ensuring that large companies not only remained operational to protect jobs but become more profitable as well. Most of them were inefficient and a burden to taxpayers, however. privatization was viewed as the best way of eliminating this burden, ensuring employment security, and creating revenue for the government through taxation (Jacobs and Laybourn-Langton 116). The government created an environment that not only attracted local investors but foreign ones as well, especially from Europe and North America.

Your stated goal was to explain both theoretically and in a tangible concrete way what privatization is, how it developed, its effect on the people, government, and economy of Brazil as a case study, and to make an assessment of the practice in your opinion, based upon actual facts rather than just vague assessments. I think you did a better job of handling the theoretical side and gave a fairly good introductory overview of the practical side. However, it may be good to include more concreteness by, for example, giving some sort of actual financial numbers, possibly giving a before and after comparison of privatization in Brazil to support your assessments. Also, it may be a good idea to offer examples of one or two particular critical infrastructure companies that became privatized and offer concrete numbers showing that privatization sort of “saved the day” for that particular company.

Privatization Program’s Implementation

Usimec and Usiminas (steel companies) situated in the Minas Gerais state became the first Brazilian privatized companies in history. It happened approximately eighteen months since the first law on privatization enactment in 1990. In the next year six more enterprises have been privatized. Then, additional 44 companies come into the hands of private owners from 1991 to 2006. However, it feels unconvincing in comparison to 57 privatizations conducted by the Plan Ministry in 2018, which is more than the total number of privatizations before (Dias, Teles, and Pilatti 34). This initiative also included the largest Brazilian electric power industry named Eletrobras. The essential firms privatized are Companhia Siderurgica Nacional (1993), Embraer (1994), Companhia Vale do Rio Doce (1997), and Telebra (1998).

The main objectives of the first law were to transfer state-exploited activities to the private sector, reduce the public debt, modernize the entire economy, and attract more FDI and capital. Next laws added state public financial institutions to the privatization list, while law Law 13.360 (2016) improved the public auction process. Nevertheless, the golden share veto power was preserved by the BFG. For instance, this practice saw Embraer, the Brazilian aerospace conglomerate, unable to improve the company’s logo or name, be involved in third-party training for military programs, and transfer the control of the company.

The Benefits of Selling Off National Assets

The sale of national assets to private enterprises became a popular practice in Brazil in the early 1990s as the government focused more attention on promoting economic growth and development. The government realized that the best way of creating employment, eliminating public waste, and promoting overall economic growth was to empower the private sector better. The following are some benefits that the strategy of privatization has bestowed upon this country.

Elimination of Economic Burden

The Brazilian government was spending too much of its resources on running these institutions before privatization emerged as a major trend. It was very costly to run the companies because they were inefficiently managed and consequently not profitable. As Aspalter observes, managers’ main motivation for overseeing these institutions was to protect their own financial well-being and reward political cronies and family members (55).

When the government made the decision to sell off many of these companies, especially the least profitable ones, it was a huge economic relief for taxpayers. Money that had once been used to fund the companies’ operations could now be directed toward other economic projects. The government no longer had to bear the financial loss brought about by inefficiency, waste, and outright graft. Executives of a for-profit company are forced to look to the well-being of the company itself rather than their own personal interests.

Improved Efficiency of the Corporations

The large government-owned corporations of Brazil were so inefficient in their operations that it became virtually impossible for them to turn profits. This was partly because many of them were managed by individuals who lacked academic qualifications or the experience needed for their success (Morady et al. 58). Some Brazilian global corporations such as Petrobras, Vale, and Embraer became excellent examples of privatization success. As pointed out by Cassiolato, Bernardes, and Lastres, the changes brought by significant structural changes helped the company to avoid bankruptcy in the 1990s (19). The gross revenue of the company in 1994 dropped to $ 177 million compared to $ 582 million spotted in 1990. Nevertheless, by 1999 Embraer reached 3.379 USD dollars of gross revenue and already held 41% of the world market share. privatization opened the way for more essential strategies resulting in a competitive advantage over Bombardier.

Protection of Employment

One of the main reasons cited by the Brazilian government for the continued operation of these companies at a loss was to address the problem of unemployment in the country. Governmental leaders ostensibly felt that by maintaining the status quo, they would be able to protect the existing employees’ jobs. Regardless of how altruistic these intentions may or may not have been, privatization was able to solve the problem of unemployment in a more effective manner.

At the time that privatization was coming of age, competition from multinational corporations was becoming increasingly stiff (Ndimande and Lubienski 78). It was no longer viable for the government to continue running these companies because of the massive financial losses they were experiencing. However, privatization caused these firms to be much more efficient and made them more competitive than ever. The implementation of the privatization program that started in the 1990s made some positive contributions to the improvement of the Brazilian unemployment rate (Dias, Teles, and Pilatti 36). For instance, the peak of unemployment in Brazil was seen in 1998 (15%). Nevertheless, the more intensified neoliberal period of privatization coincided with a gradual unemployment rate decrease, reaching 6,8% in 2014, the lowest index of the last three decades.

Revenues through the Sale and Taxation

The Brazilian government was forfeiting much of its revenue through the financial underwriting of failing companies. Most of the cost to do so came from Brazil’s repressive taxation regime and constant borrowing from the international community (Melnik and Miryakov 44). privatization led to massive revenue streams being generated through the sale of government-owned companies and the subsequent taxation of the newly privatized enterprises. This income was then able to be directed towards various developmental projects or the paying down of debt.

Empowering the Private Sector

The policy of selling off national assets to individual and corporate investors was seen as a strategic move that empowered the private sector. According to Nowak, private companies often feel intimidated to competing against government-owned firms (93). Through privatization, the Brazilian government was passing a message on to the private sector that it now wished to create an environment for its businesses to flourish without the fear of interference or competition from the government. The private sector enjoyed government support not only by purchasing these assets in the first place but also by enjoying a business environment that was now supportive of private enterprise despite continuing competition from foreign firms.

Costs of Selling off National Assets

Although the privatization of government companies created numerous benefits, it is important to appreciate the fact that there were also some costs that the government incurred in doing so. In this case, the focus was to assess the opportunity cost of the government selling its assets to private investors after holding on to these companies for several decades. The following points represent the downsides of the strategy.

Reduced Capacity for the Government to Control the Sector

When the government sold off its publicly held businesses, it lost its capacity to direct its business operations in the manner it had done previously. The government’s role was now restricted to that of a regulator that simply defined the overall policies that the players in each respective industry had to observe. A further downside of this was that these private companies were now at liberty to hire foreign executives and managers instead of Brazilian citizens to lead their companies. Before the sales, however, the government was keen on ensuring that these firms were headed by Brazilians only (Chong and Lopez-de-Silanes 41). The power to make such decisions had now been forfeited. As long as these now privately held companies were operating within the law, the government’s involvement in their operations had been highly constrained if not outright eliminated.

Fear of Job Losses as Firms Downsize

It is a self-evident fact that privately-owned companies need to remain profitable in order to be sustainable. Le Fraga explains that the need to turn a profit forces such companies to maximize efficiency and maintain a lean workforce capable of delivering the expected outcomes at a minimal amount of expenditure (56). Downsizing is a common practice that companies use to eliminate waste and improve profitability. They will then regularly evaluate their workforces to assess the productivity of their employees. When redundancy and inefficiency are detected, management may choose to reduce the overall number of workers. They may also choose to replace Brazilian employees with foreign nationals whom they feel have better skills and credentials to improve the overall performance of the company. Hiring foreigners of course, however, tends to reduce employment opportunities for the citizens of the country in question.

Negative Impact on Workers

Although privatization preserved many work opportunities that could be lost, the wage of Brazilian employees continues to decrease. Arnold found that people who had been working in privatized state-owned enterprises for ten years after privatization saw their wages falling by 30 log points (25). Such drastic wage loss can be explained by structural changes (people were transferred to lower-paying establishments) and changes in compensation policies. The researcher also highlights that labor markets that are more affected by privatization tend to decrease wages more often than ones less exposed to the process. In general, the privatization program deteriorated the aggregated salary in the country by about 5 log points (direct impact on privatized workers and spillovers).

Lost Profits for the Government

A final downside of the privatization movement in Latin America, especially in Brazil, involves the potential loss of revenue to the government when a government-owned business is sold, but was already performing very well. Although most of Brazil’s government-owned companies were poorly run, some were still, in fact, earning profit for the government. In the energy sector, for example, the government had been enjoying meaningful profit from a number of its companies. When these firms were sold off to private investors, the profit that the government had been earning was subsequently lost. From then on, the government’s only revenue stream was from taxes charged on the gross profits that these firms made; the companies’ lucrative profit thus benefitted only the new private owners and/or shareholders.

Conclusion

privatization has become one of the most successful strategies for strengthening the economy and political landscape of Latin America. Brazil, in particular, has embraced this strategy as a means of strengthening its previously faltering economy. When the military handed the reins of the country back to its civilian leadership base, some of the more pressing issues that had to be addressed included a growing public wage bill, rampant unemployment, and underperforming government corporations. Government leaders eventually determined that by dealing with the poorly run governmental companies, they were also addressing the problem of excessive government expenditures and weak employment.

It was clear that governmentally owned companies in Brazil were facing stiff competition from their more efficiently run multinational counterparts in North America, Europe, and parts of Asia. The privatization process offered a solution for improving the performance of these companies, making them efficient enough to compete. The government also needed to implement an import substitution policy, and privatization provided the best platform to achieve that goal.

Unlike before, when they were governmentally run and operating at a loss, the privatization strategy forced these companies to eliminate waste and ensure profitability. One thing they did to accomplish this goal was to redefine their policies and focus on improving the performance of individual employees. The outcome was impressive as they were able to achieve industry best practices. Although there were some costs associated with this strategy as discussed above, privatization has helped in strengthening the economy of Brazil in an assortment of ways.

Works Cited

Arnold, David. The Impact of privatization of State-Owned Enterprises on Workers, Working paper #625, Princeton University, 2019.

Aspalter, Christian. The Routledge International Handbook to Welfare State Systems. Taylor & Francis, 2017.

Berti, Suman. The Human Right to Water in Latin America: Challenges to Implementation and Contribution to the Concept. Brill, 2018.

Cassiolato, Jose, Roberto Bernardes and Helena Lastres. Transfer of Technology for Successful Integration into the Global Economy: A case study of Embraer in Brazil. United Nations, 2003.

Chong, Alberto, and Florencio Lopez-de-Silanes. “privatization in Latin America: What Does the Evidence Say?” Economía, vol. 4, no. 2, 2004, pp. 37-111.

Dias, Murillo, Andre Teles, and Keli Pilatti. “The Future of privatization in Brazil: Regulatory and Political Challenges”. Global Journal of Politics and Law Research, vol. 6, no. 2, 2018, pp. 32-42.

Jacobs, Michael, and Laurie Laybourn-Langton. “Paradigm Shifts in Economic Theory and Policy.” Intereconomics: Review of European Economic Policy, vol. 53, no. 3, pp. 113-118.

Le Fraga, Victoria, “The Impacts of Pension Privatization in Latin American: A Cross-Country Comparison of Pension Reforms and the Introduction of Individual Accounts. An analysis Modeled After the Six Guiding Core Principles of Social Security.” (2017). Senior Projects, vol. 34, no. 1, 2017, pp. 8-112.

Melnik Denis, and Mikhail Miryakov. “privatization of Pension System in Chile and Formation of New Pension Orthodoxy.” Voprosy Ekonomiki, vol. 9, no. 1, 2019, pp. 40-54.

Morady, Farhang, et al., editors, Development & Growth: Economic Impacts of Globalization. IJOPEC Publication, 2016.

Ndimande, Bekisizwe, and Christopher Lubienski. “privatization and the Education of Marginalised Children: Policies, Impacts and Global Lessons.” Taylor & Francis, 2017.

Nowak, Manfred. Human Rights or Global Capitalism: The Limits of privatization. University of Pennsylvania Press, 2017.

Rose-Ackerman, Susan, et al, editors. Comparative Administrative Law. Edward Elgar Publishing Limited, 2017.

Sandberg, Claudia, and Carolina Rocha, editors. Contemporary Latin American Cinema: Resisting Neoliberalism? Palgrave Macmillan, 2018.