Introduction

Procter & Gamble [P&G] is a public limited company that was established in 1837 in Cincinnati, Ohio, US. The firm operates in the consumer goods industry and has managed to venture into the global market. The firm operates five main segments, which include Family Care and Baby Care, Health Care, Grooming, Beauty, Home Care and Fabric Care.

The firm has over 121,000 employees (P&G 2013). In the course of its operation, P&G has managed to develop a strong market position both in the local and the international market. The firm’s success can be explained by the effective management and marketing practices that have been integrated. Moreover, the firm has adopted optimal business models, which ensure that its products are aligned with the prevailing customer needs and wants. Consequently, its products have gained substantial market acceptability (P&G 2013).

Vision and mission statement

P&G intends to position itself as the global leader with regard to consumer products and services. Moreover, the firm is committed towards providing customers with high quality products and services.

Values and principles

The firm has adopted a number of values and principle. Some of its core values and principles include trust, leadership and integrity.

Objectives

P&G is focused towards achieving the following objectives

- To develop a strong customer base and ensure that its brands achieve market leadership.

- To transform its existing businesses into market leaders.

- To regain market leadership and growth momentum in Western Europe region.

In addition to meeting the customers’ needs, P&G is focused towards delivering high value to shareholders’ by maximising their wealth. Over the 175 years it has been in existence, P&G has managed to survive challenging economic situations such as economic downturns and other changes emanating from the external and internal business environments.

The firm cannot rule out the likelihood of such occurrences in the future considering the fact that it does not operate in isolation. Consequently, the firm may experience challenges in its quest to achieve the aforementioned objectives.

Aim

This report is aimed at conducting a comprehensive situational analysis of P&G. This is achieved by evaluating the challenges that the firm faces and the strategies that the management team should integrate in order to enhance the firm’s competitiveness and future success. The report mainly focuses on the strategies that the firm can adopt in order to develop a high competitive advantage.

Situational analysis

Businesses operate in an environment that is characterised by a high rate of dynamism. One of the elements that characterise the modern business environment is hyper-competition. Lancaster (2005) is of the opinion that it imperative for firms’ management teams to continuously monitor the external business environment in order to adjust their firms’ competitive strategies.

Ferrell & Hartline (2013) are of the opinion that “a thorough situation analysis empowers the marketing manager because it encourages both analysis and synthesis of information” (p.56). Firms do have control of the external business environment. Therefore, failure to understand the external business environment may adversely affect the organisations’ competitiveness.

To understand the external business environment, it is imperative for P&G’s management team to take into account the cultural, economic, social, political, legal and demographic variables. This can be achieved by integrating the PESTLE and the SWOT models as illustrated below (Hiebing & Cooper 2004).

PESTLE Analysis

SWOT and TOWs matrix

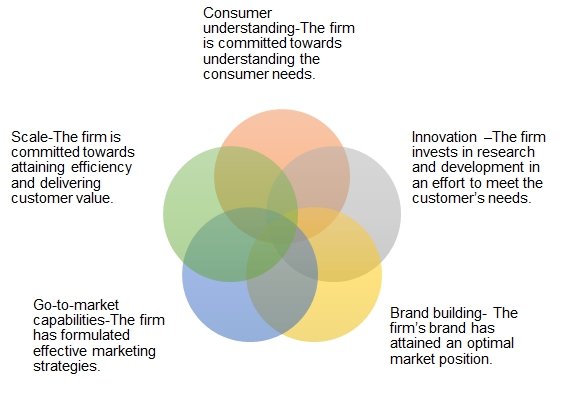

Core competencies

According Boone (Kurtz & Boone 2013), core competencies are critical in an organisation’s marketing practises because they enable an organisation to optimally position itself. P &G’s success is based on a number of core competencies, which include.

Source: (P&G 2013)

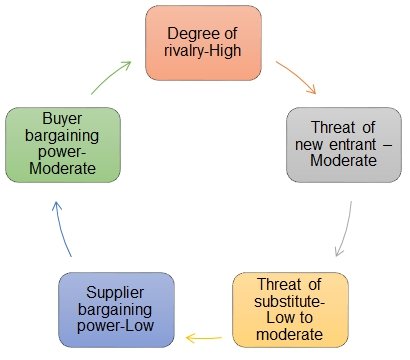

Porters’ five forces

According Stonehouse and Snowdon (2007), the five forces model enables a firm’s management team to determine the attractiveness of a particular market and hence the potential of attaining its desired level of profitability. The degree of industry attractiveness varies from one industry to another.

The Porter’s model is comprised of five main dimensions, which include the threat of new entrant, buyer and seller bargaining power, degree of rivalry and threat of substitute. Below is an analysis of the Porter’s five forces with specific reference to P&G Group.

Degree of rivalry-High

The firm operates in an environment that is characterised by a high degree of rivalry (P&G 2013). Yannapoulos (2011) is of the opinion that “competition forces companies to constantly engage in offensive and defensive marketing strategies” (p.1).

The rivalry emanates from the regional, local and global firms that have established operations in the industry. P&G competes against organisations that deal with private labels and branded products. The firm’s main competitors include Colgate-Palmolive, Revlon, Kimberly-Clark Johnson & Johnson and Unilever.

The large number of competitors gives consumers a wide range of options to select from (Drummond & Ensor 2009). Consumers select products on the basis of their price, quality, and the strength of the brand amongst other factors. P&G Group is experiencing an increment in competition emanating from non-branded products, which are sold at a lower price. Thus, low-income consumers can afford diverse health and wellness products (Rehtmeyer 2010).

Threat of new entrants-moderate

According to Rehtmeyer (2010), the consumer goods industry is characterised by a low threat of entry. New entrants do not have the capability to rival big and well established entities such as P&G, which are adequately capitalised.

Another factor that acts as a barrier to entry relates to the high cost of research and development that the firms are required to undertake (Rehtmeyer 2010). New entrants must ensure that their products are effectively differentiated. The industry is in its mature stage thus making it less attractive to new entrants (Doole & Lowe 2012).

Threat of substitute-Low to moderate

The consumer goods industry is characterised by a low threat of substitute products. According to Rehtmeyer (2010), most firms in the industry deal with necessities, which do not have perfect substitutes.

Supplier bargaining power- low

P&G derives its competitiveness from partnerships and joint venture. Consequently, the firm is able to invest in research and development (Rehtmeyer 2010). Moreover, the firm has the capacity to control its suppliers because of its large size. Consequently, the firm sets standards, which suppliers are required to adhere to in the course of supplying the raw materials (Serena 2013).

Buyer bargaining power-moderate

P&G mainly depend on Wal-Mart and other business affiliates in its quest to generate revenue. It is estimated that 15% of the firm’s sales originate from Wal-Mart. Organisational consumers such as Wal-Mart have a relatively low buyer bargaining power compared individual consumers who have the option of selecting competing products. Therefore, the industry’s has a moderate buyer bargaining power.

Source: (Rehtmeyer 2010)

Market commoditisation and innovation

According to Ferrell and Hartline (2013), the consumer goods industry is increasingly becoming commoditised. Most of the products offered by competing firms are similar.

For example, the products have similar features and they have minimal price differences. Ferrell and Hartline (2013) postulates that “commoditisation is a consequence of mature industries where slowing innovation, extensive product assortment, excess supply and frugal consumers force margins to the floor” (p.2).

According to the company’s Chief Executive Officer, Mr. Lafley, it is imperative for the firm to review its product differentiation strategy. This will ensure that the firm’s products remain unique and relevant to the consumers (Jopson 2013).

Commoditisation of an industry presents a major challenge to industry players. This arises from the fact that the competing firms have to ensure that they adopt effective differentiation strategies in order to be competitive.

The consumer goods industry in the US is experiencing a high rate of commoditisation as a result of its lucrative nature, which is increasing the intensity of competition. More firms are venturing into the industry in an effort to exploit the industry’s profitability. Consequently, it has become difficult for firm’s such as P&G to successfully differential itself (Pulendran, Speed & Widing 2002).

In order to survive in such an industry, it is imperative for industry players such as P&G to formulate strategies that will attract and retain customers. This calls for organisations to be innovative. One of the ways through which the firms can achieve this is by investing in value-added strategies.

The firm’s management team should conduct a comprehensive consumer market research in order to determine what the consumers’ needs and wants. Secondly, the firm’s research and development department should be adequately innovative in order to develop products that are customised.

Such a strategy will improve the effectiveness and efficiency with which the firm addresses the customers’ value. Such an analysis will enable P&G respond to the consumers’ unarticulated needs hence improving their level of loyalty.

Customising its products will also enhance the firm’s capacity to survive in a market that is mature. Alternatively, P&G can also consider integrating the concept of targeted extension, which entails adding value to the firm’s core products and marketing them to specific market segments in order to meet the desired market needs (Wierenga 2008).

Developing competitive advantage

In order to remain competitive, it is imperative for P &G Group to consider improving its competitive advantage. According to Davidson and Keegan (2004) “competitive advantage is achieved whenever your company does something better than competitors” (p. 167). Thus, it is fundamental for P&G to develop it competitive advantage in order to survive in the long term. P&G can develop its competitiveness by adopting the strategies proposed by the Ansoff Matrix. The advantages of these strategies are discussed herein.

Market development

P&G should consider investing in market development strategies. According to McDonald, Brian & Ward (2007), market development strategies entail marketing existing products to new markets. This entails identifying a new customer group to whom a firm markets its product to. P&G mainly markets its products to female consumers. However, it is imperative for the firm’s management team to consider marketing its products to men. Moreover, the firm can achieve market development by identifying potential markets that it can enter.

To achieve this, P&G should focus on entering the emerging and developing markets. Consequently, the firm should abolish its centralised operational strategy (Jopson 2013). Some of the markets that the firm should consider include Brazil, China, Russia and India. Prior to entering new markets, P&G should conduct a comprehensive market research in order to determine the prevailing market potential.

According to Jopson (2013), consumers in the developing economies are increasing consumption of household and personal consumer products despite the poor economic performance. P&G should also ensure that it develops a comprehensive understanding of the target markets’ culture, and consumption behaviour. This will improve the likelihood of its products gaining sufficient market penetration.

Product diversification

Currently, P&G specialises in five main market segments, which include Family Care and Baby Care, Health Care, Grooming, Beauty, Home Care and Fabric Care. It is essential for the firm’s management team to consider diversifying its product portfolio. This will improve the likelihood of the firm attracting a new customer group.

In its product diversification strategy, P&G should focus on Fast-Moving-Consumer Goods [FMCG]. This will minimise the need of the firm to develop new capabilities and resources.

Currently, the firm specialises in producing high-end products. To increase its customer base, it is imperative for the firm’s management team to consider targeting low-income consumers. This will enable the firm increase its sales revenue. Furthermore, product diversification will caution the firm against macro-environmental changes hence enhancing its financial sustainability.

Product development

Firms in the consumer goods industry are experiencing a challenge arising from change in consumer behaviour. The consumers’ product tastes and preferences are changing at an alarming rate.

According to Wright (2006), firms that specialise in production of consumer goods are experiencing an increment in pressure to ensure that their products are innovative and are aligned to their needs and wants. Wright (2006) further opines that “failure to address the consumers’ needs and wants may lead to loss of sales and to a complete demise of an organisation” (p.14).

To survive in such an environment, it is imperative for the firms’ management team to increase its investment in research and development. The research and development will enable P&G to undertake continuous and new product development. In its product development efforts, the firm should consider enhancing the content of its products.

Furthermore, P&G should improve its product packaging. According to Wright (2006), product packaging plays a critical role in enhancing the attractiveness of a product, which is a quintessential element in an organisation’s effort to build its brand. Investment in new and continuous product innovation will contribute towards improvement in the firm’s ability to attract and retain customers.

According to Jopson (2013), it is important for the firm to ensure that the new products are successfully launched in the market. Previously, P&G has experienced botched product launches, for example the Pamper Dry Max. Furthermore, the firm experienced a challenge in its quest to launch the Tide Pods laundry (Jopson 2013).

Market penetration

McDonald, Brian & Ward (2007) posit that market penetration entails marketing an existing product or service to an existing market. One of the strategies that the firm can adopt in its quest to achieve sufficient market penetration entails targeting the competitors’ customers. Adopting market penetration strategies will contribute towards improvement in the firm’s market share.

Despite these benefits, there are a number of challenges associated with market penetration. First, targeting the competitors’ customers will increase the degree of rivalry between P&G and its competitors, which might culminate in price wars hence leading to a decline in the industry’s profitability.

Conclusion and recommendations

The report shows P&G operates in an environment that is very dynamic. Despite the challenges faced, P&G has managed to survive the transformations emanating from the external business environment. One of the challenges faced by the firm relates to increment in the intensity of competition.

Some of its main competitors include Kimberly-Clark, Colgate Palmolive and Johnson & Johnson. Most of the industry players have adopted aggressive operational and competitive strategies such as continuous product improvement and new product development in an effort to meet the consumers’ needs.

Consequently, the industry has become commoditised. Moreover, the industry’s transformation also emanates from the change in consumer behaviour. To survive in such an industry, it is essential for P&G’s management team adopt effective growth strategies. Some of the strategies that the firm should consider are outlined below.

- The firm should consider expanding its market by venturing into the developing and emerging markets. Some of the markets that the firm should focus include Russia, Brazil, India and China. Market expansion will enable the firm maximise its sales revenue. Moreover, the firm will be able to achieve economies of scale.

- P&G should also consider integrating the concept of product diversification. However, the firm should focus on fast-moving consumer goods in order to successfully exploit its capabilities and core competences. This strategy will enable P&G to attract new customer groups.

- It is also important for the firm to consider developing products and services that are aligned with the consumers’ needs and wants. The firm can achieve this by conducting a comprehensive consumer market research. As a result, the firm will be able to deliver high value to consumers. Moreover, P&G will be able to differentiate its products.

Reference List

Bohlen, B., Carlotti, S. & Mihas, L. 2010, How the recession has changed US consumer behaviour. Web.

CISCO: Intelligent innovation in the consumer packaged goods industry; faster, cheaper, local 2012. Web.

Cooper, L. 2000, ‘Strategic marketing planning for radically new products’, Journal of Marketing, vol. 64 no.1, pp. 1-16.

Davidson, H. & Keegan, W. 2004, Offensive marketing; an action guide to gaining competitive advantage, Routledge, New York.

Doole, I. & Lowe, R. 2012, CIM coursebook 08/09; strategic marketing decision, Routledge, New York.

Drummond, G. & Ensor, J. 2009, Introduction to marketing concepts, Routledge, New York.

Ferrell, O. & Hartline, M. 2013, Marketing strategy; text and cases, Cengage, Mason, Ohio.

Hiebing, R. & Cooper, S. 2004, The one day marketing plan; organising and completing a plan that works, McGraw-Hill, New York.

Hattingh, D., Russo, B., Basorun, A. & Wamelen, A. 2012. Web.

Jopson, B. 2013, Procter and Gamble; time to freshen up. Web.

Kurtz, D. & Boone, L. 2013, Boone and Kurtz contemporary marketing, Cengage, Mason, Ohio.

Lancaster, G 2005, Management of marketing, Routledge, New York.

McDonald, M., Smith, B. & Ward, K. 2007, Marketing due diligence; reconnecting strategy to share price, Butterworth, Boston.

P&G: Core strengths 2013. Web.

P&G: Pampers and UNICEF; working together for healthy babies 2013. Web.

P&G: Supplier engagement 2013. Web.

Pulendran, S., Speed, R. & Widing, R. 2002, ‘Marketing planning, market orientation and business performance’, European Journal of Marketing, vol. 37 no. 3, pp. 476-497.

Rehtmeyer, J. 2010, The Procter and Gamble company, M.J Neeley School of Business, New York.

Serena, N. 2013, P&G, big companies pinch suppliers on payments. Web.

Stonehouse, G. & Snowdon, B. 2007, ‘Competitive advantage revisited’, Journal of Management Inquiry, vol. 16, pp. 256-275.

Wierenga, B. 2008, Handbook of marketing models, RSM Erasmus University, Rotterdam.

Wright, R. 2006, Consumer behaviour, Cengage Learning, New York.

Yannopoulos, P. 2011, ‘Defensive and offensive strategies for market success’, International Journal of Business and Social Science, vol. 2, no. 13, pp. 1-12.