Introduction

The success and failure of any business entity is determined by the strategies adopted. It is the wish of every organization to be successful in business so that the goals of the stakeholders can be achieved. The goals can be achieved by establishing the strategies which are suitable to place the organization in a competitive position. Managers have an obligation to develop strategies which will make the company successful (Jones, 2009).

Product diversification

Product diversification has been found to improve the performance of a company. The companies with higher levels of product diversification have more total sales and total assets. This can be explained from the understanding that companies with a wide variety of products provides consumers with the ability to choose.

Therefore, consumers can buy products which they need because they have supply of all the kinds of products required to satisfy their needs. Companies with few or no diversification end up losing customers especially when the consumers lack products which satisfy their needs.

The companies with a high product diversification end up making more sales compared to those with no or lesser levels of diversification. This is the argument which helps us to understand why the companies with high levels of diversification have more assets and make more sales (Jones, 2009).

However, companies which specialize in the production and marketing of a particular product are able to capture the particular needs of each customer and this helps improve their performance compared to diversified companies. As such, these companies can satisfy the needs of a particular niche of customers.

These companies generate more sales and accumulate more assets because they are able to get extra advantages in the sale of their products. In the modern day business environment it has been observed that companies develop better strategies when they specialize in one product.

Product diversification has been found to make companies make lower levels of profits. The asset base of a company is determined by the amount of sales made in a particular period of time. Thus, when companies specialize in production of certain products they have added advantages in that they can maintain a higher profile of customers (Jones, 2009).

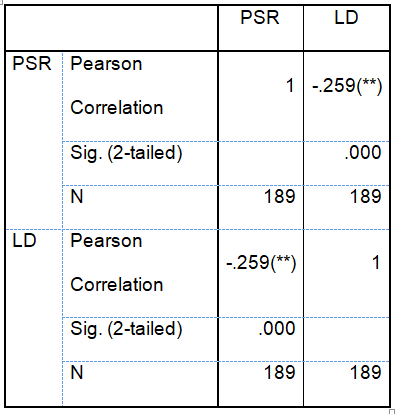

** Correlation is significant at the 0.01 level (2-tailed).

From table 1 it is evident that the correlation between the level of diversification and the percentage sales ratio is significant. It is observed that there is a negative correlation between the level of diversification and the percentage of sales ratio (Field, 2009).

This implies that the higher the level of diversification the lesser the sales are made per unit of the products. This is explained by the fact that when a company has many products to sell a few units of each unit are sold compared to the total sales volume.

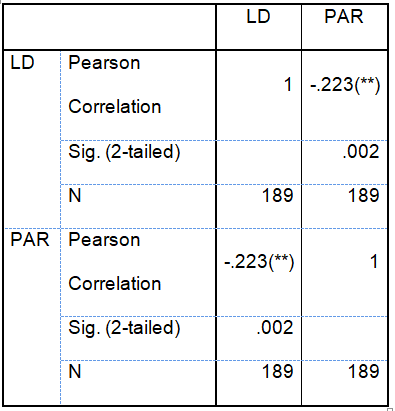

Table 2 indicates that there is a significant relationship between the level of diversification and the percentage asset ratio. On the other hand, there is a negative relationship between the level of diversification and the percentage asset ratio (Field, 2009).

** Correlation is significant at the 0.01 level (2-tailed).

This indicates that as an organization continues to diversify its products it is unable to purchase more assets to cater for each of the product category. Companies manufacturing a single product are able to develop a large number of assets in the product category which they choose.

Internationalization

Internationalization helps companies to venture into more countries to market their products. As companies sell their products to more countries they are able to get more customers and this helps improve the sales as well as the assets accumulated.

Internationalization helps companies to expand the market share and the level of competition is increased. When companies increase the numbers of countries they serve with their products this helps create more opportunities to establish new customers. The sales volume of an organization increases when the number of customers served increases. The ability to purchase new assets is determined by the profitability of the businesses conducted by the company (Jones, 2009).

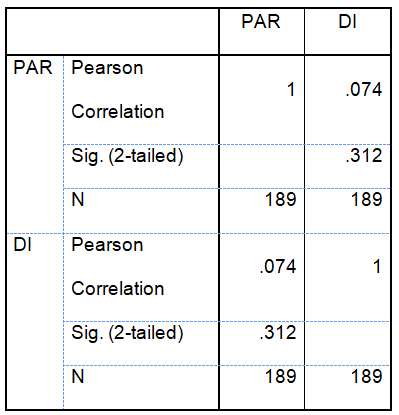

From Table 3 it is evident that there is no significant relationship between the percentage asset ratio and the degree of internationalization. In addition, it is observed that there is a positive relationship between the two elements (Field, 2009). This explains the hypothesis that the higher the level of internationalization the larger the amount of assets accumulated.

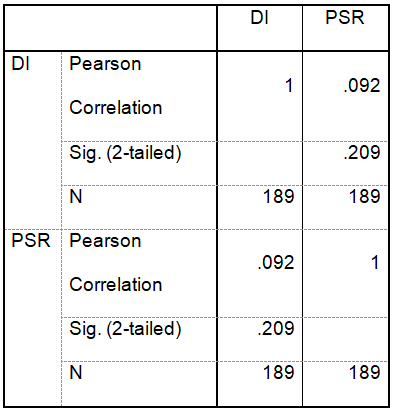

From Table 4 it is observed that there is no significant relationship between the level of internationalization and the percentage sales ratio. In addition, there is a positive relationship between the degree of internationalization and the percentage sales ratio of the company (Field, 2009).

This is an indication that when companies expand their operation to the global markets they get more market share and the sales increases. It is also important to identify that when companies venture into new global markets more products are sold and this increases the sales volume.

Conclusion

From the above findings it can be concluded that product diversification and internationalization of market activities of a company help improve the performance. It is evident that the sales volume increases when companies diversify in the production and marketing systems.

In addition, it is also evident that the amount of assets accumulated is higher when a company operates in many countries. Therefore, diversification and internationalization are important factors in improving the profitability, market share and the asset base of a company.

References

Field, A. (2009). Discovering Statistics Using SPSS, 3rd edition, New York: NY, Sage.

Jones, M. (2009). Internationalization, entrepreneurship and the smaller firm: evidence from around the world. Cheltenham, Edward Elgar Publishing.