Executive Summary

The scope of this report is to review strategic marketing internationalization options for Progressive Corporation to enter and penetrate the Belgium insurance industry. The study aims at examining different marketing mixes that might facilitate sustainable business activities in the dynamic and conservative Belgium market. Therefore, the topic of the proposed report is strategic internalization product marketing strategies that might guarantee the success of Progressive Corporation’s intention to move into the Belgium market. The selected organization might benefit from the findings of this report is the successful American-based Progressive Corporation. This company has been in the US market for more than six decades and has established a successful brand image within the local market and beyond. The rationale for selecting this company is its expansive market coverage, innovative approach to product branding, and intentions to move into new international markets. Moreover, the company has a strong and stable market capitalization. Also, Progressive Corporation has had consistent positive performance in the last three decades.

The researcher used a qualitative research design to collect and analyze secondary data from Progressive Corporation’s performance report, Deloitte’s 2018 market overview of the Belgium insurance industry, and FitchSolutions’ global overview of the insurance industry. The researcher also integrated reputable journal articles and books to capture a wider insight into the scope of the report. Data analysis involved an institutional theoretical framework to examine the internal and external market environment of Progressive Corporation’s marketing successes. These strengths were related to the marketing situation in Belgium in terms of target customers, unique selling points, distribution plan, pricing and positioning, special offers, marketing materials, promotion, online marketing, conversion, joint venture, retention, increasing transaction prices, barriers to market entry in Belgium and competitor analysis. The findings indicated that Progressive Corporation has strong international marketing strategies that might foster a smooth and effective market entry into the Belgium market. To guarantee sustainable business activities in the new market, Progressive Corporation should consider improving market targeting, promotion, and publicity strategies.

Scope, Aim, and Topic of the Report

This report examines the potential international marketing strategies that Progressive Corporation should integrate into its planned entry and penetration of the Belgium market as an international insurance services provider. The scope of the report focuses on the international marketing approach to be implemented in the Belgium market for the American-based Progressive Corporation. The report is centered on the insurance industry and how Progressive Corporation might be positioned to effectively penetrate the foreign market. This study aims to examine potential international marketing strategies that might foster smooth and suitable entry into the Belgium insurance industry for Progressive Corporation. The topic of this report is internationalization marketing strategies to guarantee proactive and effective market entry for the American-based Progressive Corporation. These aspects are discussed below.

Scope of the Report

This international marketing report is created to offer strategies that the Progressive Corporation might integrate into its current marketing strategies to effectively enter and penetrate the expansive and complex Belgian insurance industry. The report is focused on the insurance industry since Progressive Corporation is one of the leading automobile insurance providers in the US and plans to move into new international markets. This means that the report will examine the Belgian insurance industry by reviewing the micro and macro market environment about Progressive Corporation’s business model (Zhang 2015). The rationale for selecting Progressive Corporation was informed by its intentions to expand into the international market, especially with its successful technology-based automobile insurance policy product. The report will examine the entire Belgium insurance market, with more attention given to the automobile insurance sector.

Aim of the Report

This marketing project aims to examine potential international marketing strategies that might foster smooth and suitable entry into the Belgium insurance industry for Progressive Corporation. Specifically, the report is created to present adequate and practical marketing schemes that are aligned to the micro and micro business environment dynamics in Belgium. This means that the study will present best practices for a sustainable internationalized marketing for a foreign-based company intending to enter a new market (Strom, Sears & Kelly 2013). In this case, Progressive Corporation will be presented with the best marketing tactics and plan to increase its probability of successful entry and penetration of the Belgian insurance industry as a major player.

The topic of the Report

The topic of this report is the internalization of marketing strategies for Progressive Corporation to guarantee effective entry and sustainable operation within the Belgian insurance industry as an automobile insurance policy provider. The proposed marketing strategies will be aligned to cultural and other market dynamics that might increase the probability of successful business activities for Progressive Corporation in the Belgium insurance industry. Determining the right mix of international marketing strategies in the Belgian insurance industry for Progressive Corporation is a prerequisite for successful entry and quick control of this conservative market (Sostrin 2013). The reason for selecting international marketing strategies is to provide Progressive Corporation the right marketing mix since it plans to move into the Belgian market.

This means that managers and other stakeholders of Progressive Corporation will be in a position to understand the Belgian market and make an informed decision on the best marketing mix before moving into this foreign region (Solomon 2013). Moreover, the stakeholders will have a blueprint and a mind map of what to expect in the Belgium market and how to effectively react to avoid failed entry or penetration. A lot of literature suggests that the Belgium insurance industry is conservative with many bottlenecks that might not be accommodative to an international company (2018 insurance industry outlook 2018; Belgium insurance report 2018). For instance, Simha (2014) notes that tough business regulations might slowdown market penetration. Moreover, Singh and Singh (2014) established that the Belgian insurance market is highly stratified and extremely sensitive, in terms of customer preferences. Therefore, this report will attempt to address these challenges by offering the right marketing mix that can function in the Belgium insurance industry.

International Business Selection

Progressive Corporation is one of the leading insurance companies in the US. Established in 1937, the company has grown and created a stable market niche through its unique automobile cover. From 1956 to 1987, the firm expanded its market capitalization to $1 billion following a series of expansionary business strategies. In the last two decades, the company has remained consistent in recording positive growth. By the end of the last financial year, Progressive Corporation had premiums valued at over $20 billion. At present, this firm is the most innovative insurance provider in the US market through the integration of technology, which enables clients to purchase insurance covers online. At present, the company has fully embraced modern business practices in managing its product brands via mobile apps, browsers, and an active 24/7 claim reporting and processing system (Core values 2017).

As a one-stop provider of comprehensive insurance cover, Progressive Corporation has expanded throughout the US and is currently among the top ten most profitable insurance firms. The current business lines for Progressive Corporation include insuring commercial vehicles home, boats, RVs, Other-Indemnity, and personal policy. The products are segmented into Personal Line, Commercial Auto, and Other-Indemnity. The rationale for selecting Progressive Corporation is its strong market capitalization, stable brand image, and prolonged market experience in the insurance industry (see table 1 and 2). This means that the company has enough financial, management, logistics, and marketing capabilities for entering a new international market.

Table 1. Financial standing of Progressive Corporation (values in $, 000). Source: PGR company financials 2018.

Table 2: Financial performance in comparison to competitors in Belgium. Source: PGR company financials 2018.

Progressive Corporation currently does business in the US, Canada, Mexico, and most parts of South America. As at the end of the 2016 to 2017 financial year, the company had an active presence in 12 countries (Core values 2017). The mission of this firm is the provision of excellent, cost effective, and innovative insurance policy services. The vision is to become the first choice for clients interested in insurance policy products. At present, the vision and mission of Progressive Corporation are embedded in the core values of golden rule excellence, objectives, integrity, and profit (Core values 2017). The company has consistently used the focused operational modeling to enter foreign markets by integrating a three-item marketing mix consisting of efficiency, reliability, and dependability. As a result, Progressive Corporation has managed to use a quality-based and diversified entry strategy to not only penetrate foreign markets but also sustain operations (Shende 2014).

Data Collection Sources and Analytical Methods

The research project was carried out through qualitative design using secondary data from Progressive Corporation annual reports, reputable marketing journals, books, and dedicated market analysis websites. To ensure that the findings are dependable and representational of the actual situation, the researcher focused the secondary collection on reliable and verifiable sources as discussed in the next section.

Utilized Sources of Secondary Data and their Justification

The primary source of secondary data was from Progressive Corporation’s annual report for the 2016-2017 financial year. This report captures financial standing, marking activities, market niche, operational strategies, and future market forecast. This source is reliable since it is produced by the company under investigation. The second secondary source was the report on the 2018 Belgium insurance industry outlook by Deloitte. This source is reliable because Deloitte is an accredited and reputable audit firm that has been carrying out market research for several decades. Moreover, the creators of this report are experienced professionals who have expansive knowledge about the Belgium insurance industry. The third secondary source selected by the researcher was the Belgium insurance report done by FitchSolutions, which is an accredited marketing analysis website covering the entire European continent.

This source was selected because it provides an extensive overview of the market trends within the Belgium insurance industry. The fourth secondary source is a 2017 report on global insurance industry insights created by McKinsey & Company. This source is reliable since the creator of this report is an experienced insurance industry audit firm. The researcher also referred to several empirical journal articles on marketing and international business strategies within the insurance industry. These sources are appropriate for the selected topic because they touch on the marketing dynamics, industry trends, unique customer niches, micro- and macro-environment analysis, and general performance of Progressive Corporation. As captured in table 3, the sources and rationale for their selection were comparatively examined.

Table 3. Summary of secondary sources and rationale for selection.

Employed Analytical Techniques and their Justification

The researcher employed the institutional theoretical framework to examine the internal and external market enlivenment for Progressive Corporation. The framework then related these parameters to the proposed new international market in Belgium. Moreover, the researcher performed a stakeholder analysis to understand the current trends in the local and potential international market in Belgium. The theoretical frameworks were supported by a systematic qualitative data analysis using thematic inference. The rationale for focusing on qualitative data analysis using a thematic approach was informed by the need to examine a wide range of international marketing parameters and relate them to potential successful market entry and penetration for Progressive Corporation into the Belgium insurance industry. For instance, the use of thematic analysis will enable the researcher to capture industry, marketing strategies, and internal business environment insights of Progressive Corporation within the new foreign market.

Findings

Results of the Analysis

The institutional theoretical framework analysis focused on target customers, unique selling points, distribution plan, pricing and positioning, special offers, marketing materials, promotion, online marketing, conversion, joint venture, retention, increasing transaction prices, barriers to market entry in Belgium, and competitor analysis to understand the current position of Progressive Corporation as discussed below.

Target Customers

The customer segments are divided into corporate and private individuals. Corporate customers are commercial automobile owners. The private customer is anybody who owns an automobile. This means that the product does not discriminate against the customers in terms of gender or age (Searcy & Buslovich 2014). The psychographic profile of the targeted customers is driven by the latest trend is an affordable, effective, and automated automobile insurance policy. The market segments are further divided from business to business (B2B) and business to customer (B2C) (Rashid & Naeem 2017). The B2B segment consists of vehicle owners who will acquire the rights to cover their automobile against uncertainty. The B2C segmentation involves direct selling of the insurance cover product through third-party brokers. The product targets car owners, especially the youthful population who quickly embrace new technology and for people who care about a comprehensive insurance cover.

Unique Selling Proposition (USP)

The digitized automobile insurance product is a unique technologically advanced policy cover created to guarantee convenience in automobile usage since it protects users from uncertainty (Osterwalder & Pigneur 2013). As the first of its kind, this product is designed to give customers easy access to insurance through payment by installments in addition to shorter claim processing time.

Pricing and Positioning Strategy

The digitized automobile insurance coverage is positioned as the first of its kind in the US market to offer unique automated application, verification, and claim to report. Progressive Corporation has adopted the penetration pricing strategy consist of a discounted introduction price in foreign markets after which it is adjusted once the product is embraced by the targeted market (Oakland 2014).

Distribution Plan

Since the digitized automobile insurance cover product is focused on a single usage, that is, in vehicles, it is sold through several traditional and online stores in addition to the company website. The company has contracted private online stores and insurance brokers to retail the product at a discount of the units sold. The company also distributes the product to commercial vehicle companies through direct selling or subcontracting a sales agency (Nasrinsulthana & Hyder 2015).

Special Offers

Progressive Corporation offers free claim processing, especially for individual customers who are not technologically literate. The business also has created a user-friendly website with self-explanatory videos that are made in different languages to meet the needs of each customer. The company has established a toll-free 24/7 support line for customers. Periodically, the business implements short- and long-term promotional activities such as price discounts (Myerson 2015).

Marketing Materials

To promote the impact detection and remediation system product, the business has created a discount page on the main product website. This button automatically calculates the discount a customer will get from purchasing a specified unit of the product (Muthuraman & Mohandoss 2016). Moreover, in the introduction manual booklet, the many problems occurring in automobiles are highlighted followed by a strong commitment to 99% successful claim processing in the event of an accident. The booklet comes with a persuasive statement giving customers assurance that the product will give them a head start in automobile insurance. Since the product is designed on the pillar of convenience, the policy statements are written in a simple language (Global insurance industry insights: an in-depth perspective 2018). However, there is a need for the business to modify the product website to allow for direct buying to avoid overdependence on the online stores.

Promotions Strategy

The promotional strategy for the digitized automobile insurance cover product is carried out via traditional and modern media channels. The main traditional media channels are print newspapers and billboards. The modern media channels are television, radio, and online ads (Karimi 2013). The advertisement messages about the product are aired through these channels to reach as many customers as possible.

Online Marketing Strategy

The keywords optimized on the business website are convenience, flexibility, and affordability. The website’s algorithms are often revised by the installation of Google optimizers to ensure that search results related to the product appear at the top when browsing. The business use this strategy via the YouTube channel to allow the product message and an accompanying short video to be automatically viewed by a visitor for about 10 seconds for the embedded visual and audio files (Global insurance industry insights: an in-depth perspective 2018). The business uses social media pages such as Facebook and Twitter to advertise the product and create a fun base.

Conversion Strategy

To turn the prospective clients to paying customers, the first conventional strategy by Progressive Corporation is giving a coupon to a customer who buys the product. The coupon contains a serial number and a person who gets it is guaranteed a discount of 10%. Another conventional strategy is the use of social media strategy through an online promo link. Any customer who visits the website through this link is awarded points that are redeemable at the point of product purchase (Martelo, Barroso & Cepeda 2013). Moreover, customers are allowed to post reviews or view the previous rating on the website.

Joint Ventures and Partnerships

Since the digitized automobile insurance cover product requires a simple business platform, the company uses the business to the business model to form alliances with automobile insurance brokers to maximize sales and guarantee long-term gains. The business has also considered partnering with sales agencies to increase product visibility in the targeted markets (Mangan, Lalwani & Lalwani 2016).

Strategy for Increasing Transaction Prices

To increase the transaction price, the digitized automobile insurance cover product is sold as a bundle consisting of the insurance sticker, claim processing form, and good driving habits detectors. However, customers are allowed to buy the product alone (Lohdi & Naz 2016). This strategy has created the perception that is cheaper to buy the product as a bundle, thus increase the sales at $500 per transaction (Kotler et al. 2013).

Retention Strategy

The business runs a loyalty program through redeemable service points for every purchase of the digitized automobile insurance cover. These service points are categorized as platinum for customers frequently buying many units and regular for customers purchasing a few units consistently (Kotler & Keller 2016). The number of service points is determined by the percentage discount for a new purchase.

Competitor Analysis

The primary competitors of Progressive Corporation in the Belgium market are ING Belgium and Belfius. ING Belgium has more than 700 products within the insurance industry. The company has a strong brand image besides having been in the market for more than three decades (Kiran 2016). Moreover, the firm offers a product similar to Progressive Corporation’s digitalized automobile insurance cover. On the other hand, Belfius is a government-owned insurance company in Belgium. This means that the firm has an access to unlimited funding and government protection (Kajalo & Lindblom 2015). Belfius also has a competitive advantage as the only authorized insurers of all state-owned vehicles in Belgium. As captured in table 4, the competitor analysis suggests that Progressive Corporation will face strong competition in Belgium.

Table 4. Competitor analysis and market share. (Source: PGR company financials 2018).

Belfius serves the high-end customer segment within the local market. This business has capitalized on government endorsement to market its products. Moreover, the business has created multiple products. Also, the company has had a series of successful promotional strategies such as discounts, redeemable reward points for loyal customers, and active advertisement. As a result, Belfius is the current market leader (2018 insurance industry outlook 2018). ING Belgium has concentrated on affordable pricing as the main market penetration strategy in retailing different insurance policy cover products in Belgium. This means that the business has wide market coverage since its appeal to low and middle-income customers. Specifically, the business has also capitalized on mega sales to promote its diverse products. During these mega sale campaigns, the company offers as high as a 20% discount on assorted private and commercial insurance covers (2018 insurance industry outlook 2018). As a result, the company has carved a unique market niche consisting of the loyal customer within the local market (Monks & Minow 2014).

Barriers to Market Entry in Belgium

The main barriers to market entry are product differentiation, capital requirements, switching costs, and limited economies of scale. Since the Belgian insurance industry is dynamic and multifaceted, it is difficult for a new service provider to gain from economies of scale since the current players have built absolute volumes of trade (Hyland, Lee & Mills 2015). This means that when Progressive Corporation enters big, it might face the risk of strong reactions from the incumbent brands (Homburg, Jozic & Kuehnl 2017). Another barrier is the aspect of product differentiation. The incumbent brands have developed strong customer loyalty networks in addition to strong brand recognition. This means that Progressive Corporation will have to invest heavily to capture a share of the market. The last barrier is the capital requirement (Holt 2015). The insurance industry requires substantial capital to start and operate, especially in the stratified and conservative Belgium market.

Interpretation of the Findings

Reflectively, a well-designed international marketing strategy for Progressive Corporation will facilitate the success of its proposed entry and penetration of the conservative Belgium insurance industry. To increase the aspects of professionalism and creditability, the international marketing plan should integrate bomb channels to reach customers in a tailored manner (Harrison & Wicks 2013). The customization process may involve the inclusion of unique features and processes that flawlessly ensure a lifetime association between the clients and the business since there are competitors who have strong product brands. Before rolling out an international marketing plan, it is necessary to establish the behavior of the targeted clients to select the appropriate promotion channel.

In the ideal, effective channel selection has the potential of reducing the negative impacts of product rejection in the highly stratified Belgium market. In the case of Progressive Corporation, product branding could be angled on a functional idea that can appeal to the desires of the potential clients (Habib et al. 2014). For example, the integration of an involuntary, flexible, and quantifiable measure for customer perception will make the marketing strategies successful in Belgium. Thus, the internationalization marketing plan may involve using advertisement campaigns that appeal to different market segments and are focused on peculiar customer behavior for each segment (Guiso, Sapienza & Zingales 2015). This strategy has the potential of creating a long-term customer loyalty base. Moreover, it will improve the company’s visibility within the targeted market and beyond.

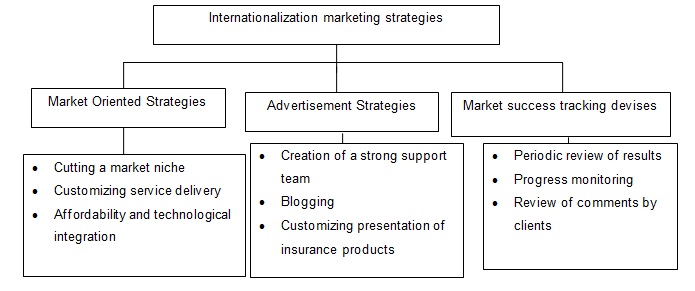

Customer relationship management is a significant internationalization marketing strategy, especially for the proposed entry of Progressive Corporation into the Belgium market. In the business environment, effective customer care has the potential of improving product visibility from a series of positive feedbacks. Therefore, Progressive Corporation might use its strong customer relationship management strategies in the US market to review the current push and pull factors that would influence the visibility in the Belgium market (Belgium insurance report 2018). As capture in figure 1, strong internationalization marketing strategies are necessary for the creation of a strong and self-sustaining mind map that can appeal to the desires and expectations of the potential clients in Belgium.

Recommendations

Target Marketing

Since the proposed digitalized automobile insurance policy cover will be launched as a premium and affordable product in the Belgium market, targeted markets will consist of middle and high-income customer segments. This means that the business will target customers willing to spend between $500 and $1,000 on automobile insurance per annum (Fill 2013). Fortunately, the target market is well spread across Belgium and beyond and currently consists of 20% of the households (2018 insurance industry outlook 2018). The ideal customer for the proposed market entry into the Belgium insurance industry is any individual who owns a car and wants affordable and reliable insurance policy cover. The ideal customer should fall within the socio-economic status of D to B+ and above; low, middle to high-income brackets.

The ideal customer should not be discriminated against on the ground of education level as long as he or she can afford to purchase the products for Progressive Corporation to succeed in Belgium (Eman, Ayman & El-Nahas 2013). The firm should also target customers of all religious, social, and political affiliations. Since the entire business is should be based on an online platform in the Belgium market, the location of a customer will not matter. However, the business will have to concentrate on the urban regions within the first year of operations to gain from easy access to customers. The insurance business segment is very dynamic and characterized by the presence of many competitors and perfect substitute products in Belgium (Daft & Marcic 2016). This means that the tastes and preferences of customers are constantly changing according to the latest trends in insurance products. Therefore, the proposed entry plan will have to conform to these changes to ensure that customers’ demand for high quality, affordable, and flexible insurance covers are met.

Advertising and Promotional Campaigns

The advertising and promotional campaigns for Progressive Corporation’s proposed entry into the Belgium insurance industry will involve different activities, objectives, and strategies. Since the entire business will be based on an online platform, the promotional and advertising campaigns will be modeled to appeal to the social media community (2018 insurance industry outlook 2018). The proposed advertisement and promotion campaigns will be done through online and offline channels. The primary online channels include social media pages such as Facebook and Twitter. The offline media will be a print and audiovisual medium. The print media will include local daily newspapers to reach customers who have access to print media, especially the middle-aged customers (Cravens & Piercy 2013). The audiovisual media will include television, radio, and digital billboard advertisements.

The adverts will be packaged to reach different customer segments at the same time. For instance, television advertisements will be done at the prime time to optimize its coverage for middle-aged clients (Clow & Baack 2014). The radio advertisements will be done at least five times in the popular local stations to reach as many potential customers as possible. The radio adverts will be made simple through the use of a catchy phrase to optimize its impact on youthful customers (Chaffey & Smith, 2013). Lastly, the digital billboards will be placed in strategic roads and streets to ensure that the advert messages reach the youthful and middle-aged customers. For instance, the business will consider placing a digital advert on the main city highway and next to public parks to reach as many potential clients as possible (Elder & Krishna 2013). The strategy for using offline and online media platforms is aimed at targeting all customer segments, irrespective of the age of online literacy level.

Plans for Generating Publicity in Belgium Market

Since social media, especially Twitter, Facebook, Linkedin, and Google have gained popularity over the years, the plans for generating publicity will be angled on online platform pages in Belgium (Ang 2014). The rationale for picking social media is because of its dominance in the communication environment, especially for an online-based business. Specifically, about Progressive Corporation’s advertisement in the new market, Facebook, Twitter, and other online pages will be ideal tools for building community following and branding through capitalizing on location, interest, and need to meet the desires of the targeted customers (Battor & Battour 2013). Through tweets and likes, the business will be in a position to expand its market coverage. For instance, social media platforms will be used to build healthy and friendly partnerships with targeted clients to improve on the probability of product acceptance (Belch & Belch 2013). The success of this publicity platform will be deeply entrenched on the principles of quality, affordability, and reliability as reputation builders. Therefore, the use of Twitter, Facebook, and Google will ensure that Progressive Corporation’s visibility is increased within the targeted market region and beyond (Cole 2015).

Conclusion

From the international marketing strategy plan analysis, it is apparent that the objective of Progressive Corporation to enter and penetrate the Belgium market is achievable. Since the proposed automobile insurance policy product is entirely based on the online platform, the advertisement and promotional strategies should be tailored to reach different customer segments in Belgium. The proposed advertisement platforms included online and offline media such as print, television, radio, and social media. The suggested publicity plans revolve around the use of social media to cue the behavior of targeted customers in addition to improving website visibility. Specifically, search engine optimization and the use of different social media pages were recommended to ensure that the marketing plan covers a wide market.

Reference List

2018 insurance industry outlook. 2018. Web.

Ang, L 2014, Integrated marketing communications: a focus on new technologies and advanced theories, Cambridge University Press, Cambridge.

Battor, M & Battour, M 2013, ‘Can organisational learning foster customer relationships? Implications for performance’, The Learning Organisation, vol. 20, no. 5, pp. 279-290.

Belch, E & Belch, A 2013, Advertising and promotion, an integrated marketing communications perspective, 9th edn, McGraw-Hill Higher Education, New York, NY.

Belgium insurance report. 2018. Web.

Chaffey, D & Smith, P 2013, Digital marketing excellence, planning, optimizing and integrating online marketing, 5th edn, Routledge, London.

Clow, E & Baack D 2014, Integrated advertising, promotion, and marketing communications, 6th edn, Pearson Higher Education, New York, NY.

Cole A 2015, The implications of consumer behaviour for marketing, Anchor academic publishing, London.

Core values. 2017. Web.

Cravens, D & Piercy, N 2013, Strategic marketing, 10th edn, McGraw-Hill, New York, NY.

Daft, R & Marcic, D 2016, Understanding management, 10th edn, Cengage Learning, London.

Elder, R & Krishna, A 2013, ‘The visual depiction effect in advertising: Facilitating embodied mental simulation through product orientation’, Journal of Consumer Research, vol. 38, no. 6, pp. 988-1003.

Eman, M, Ayman, Y & El-Nahas, T 2013, ‘The impact of corporate image and reputation on service quality, customer satisfaction and customer loyalty: testing the mediating role: case analysis in an international service company’, Journal of Business and Retail Management Research, vol. 8, no. 1, pp. 12-33.

Fill, C 2013, Marketing communications: brands, experiences and participation, 6th edn, Pearson Higher Education, New York, NY.

Global insurance industry insights: an in-depth perspective. 2018. Web.

Guiso, L, Sapienza, P & Zingales, L 2015, ‘The value of corporate culture’, Journal of Financial Economics, vol. 117, no. 1, pp. 60-76.

Habib, S, Aslam, S, Hussain, A, Yasmeen, S & Ibrahim, M 2014, ‘The impact of organizational culture on job satisfaction, employee commitment and turnover intention’, Advances in Economics and Business, vol. 2, no. 6, pp. 215-222.

Harrison, J & Wicks, A 2013, ‘Stakeholder theory, value, and firm performance’, Business Ethics Quarterly, vol. 23, no. 1, pp. 97-124.

Holt, D 2015, Brands and branding: cultural strategy group. Web.

Homburg, C, Jozic, D & Kuehnl, C 2017, ‘Customer experience management: toward implementing an evolving marketing concept’, Journal of the Academy of Marketing Science, vol. 45, no. 3, pp. 377-401.

Hyland, P, Lee, A & Mills, M 2015, ‘Mindfulness at work: a new approach to improving individual and organizational performance’, Industrial and Organizational Psychology, vol. 8, no. 4, pp. 576-602.

Kajalo, S & Lindblom, A 2015,’Market orientation, entrepreneurial orientation and business performance among small retailers’, International Journal of Retail & Distribution Management, vol. 43, no. 7, pp. 580-596.

Karimi, S 2013, ‘A purchase decision making process model of online consumer and its influential factor a cross sector analysis’, Phd Thesis, Manchester Business School, London.

Kiran, D 2016, Total quality management: key concepts and case studies, Elsevier Science, New York, NY.

Kotler, P & Keller, K 2016, Marketing management, 15th edn, Pearson Prentice Hall, New York, NY.

Kotler, P, Keller, L, Koshy, A & Jha, M 2013, Marketing management: a South Asian perspective, 14th edn, Imprint Pearson Education, New York, NY.

Lohdi, S & Naz, U 2016, ‘Impact of customer self concept and life style on luxury goods purchases: a case of females of Karachi’, Arabian Journal of Business Management Review, vol. 6, no. 192, pp. 56-67.

Mangan, J, Lalwani, C & Lalwani, C 2016, Global logistics and supply chain management, John Wiley & Sons, New York, NY.

Martelo, S, Barroso, C & Cepeda, G 2013, ‘The use of organizational capabilities to increase customer value’, Journal of Business Research, vol. 66, no.10, pp. 2042-2050.

Monks, R & Minow, N 2014, Corporate governance, John Wiley & Sons, New York, NY.

Muthuraman, B & Mohandoss, K 2016, ‘Impact of customer based brand equity of Toyota cars in Oman’, International Journal of Applied Sciences and Management, vol. 2, no. 1, pp. 219-225.

Myerson, P 2015, Supply chain and logistics management made easy: methods and applications for planning, operations, integration, control and improvement, and network design, FT Press, New York, NY.

Nasrinsulthana, M & Hyder, S 2015, ‘Brand preference among customer using Toyota car in Oman’, Intercontinental Journal of Marketing Research Review, vol. 3, no. 10, pp. 62-67.

Oakland, JS 2014, Total quality management and operational excellence: text with cases, 4th edn, Routledge, London.

Osterwalder, A & Pigneur, Y 2013, Business model generation: a handbook for visionaries, game changers, and challengers, John Wiley & Sons, New York, NY.

PGR company financials. 2018. Web.

Rashid, A & Naeem, N 2017, ‘Effects of mergers on corporate performance: an empirical evaluation using OLC and the empirical Bayesian method’, Borsa Istanbul Review, vol. 17, no. 1, pp. 10-24.

Searcy, C & Buslovich, R 2014, ‘Corporate perspectives on the development and use of sustainability reports’, Journal of Business Ethics, vol. 121, no. 2, pp. 149-169.

Shende, W 2014, ‘Analysis of research in consumer behaviour of automobile passenger car customer’, International Journal of Scientific and research Publications, vol. 4, no. 2, pp.1-8.

Simha, S 2014, ‘Identifying the preferences and brand choices of female customers for cars: A study conducted in Muscat region, of Sultanate of Oman’, International Journal of Science and Research, vol. 9, no. 2, pp. 312-320.

Singh, H & Singh, B 2014, ‘Total quality management: today’s business excellence strategy’, International Letters of Social and Humanistic Sciences, vol. 12, no. 32, pp. 188-196.

Solomon, M 2013, Consumer behaviour: Buying, having, and being, 10th edn, Pearson Education, London.

Sostrin, J 2013, Beyond the job description: how managers and employees can navigate the true demands of the job, Palgrave Macmillan, London.

Strom, D, Sears, K & Kelly, K 2013, ‘Work engagement: the role of organizational justice and leadership style in predicting engagement among employees’, Journal of Leadership & Organizational Studies, vol. 2, no. 1, pp. 71-82.

Zhang, Y 2015, ‘The impact of brand image on consumer behaviour: A literature review’, Open Journal of Business and Management, vol. 2, no. 3, pp. 58-62.