After accumulating many years of experience your colleagues Ghofran, Leena, Alham, Rawan & Elham decided to start their own business, Glare Investment Corporation. Their plan is to develop a toys factory focused on the boys’ segment. The company will develop three main products: the Remote Electric car, the Remote Electric Helicopter and the star product of the company: the GLARE Robot.

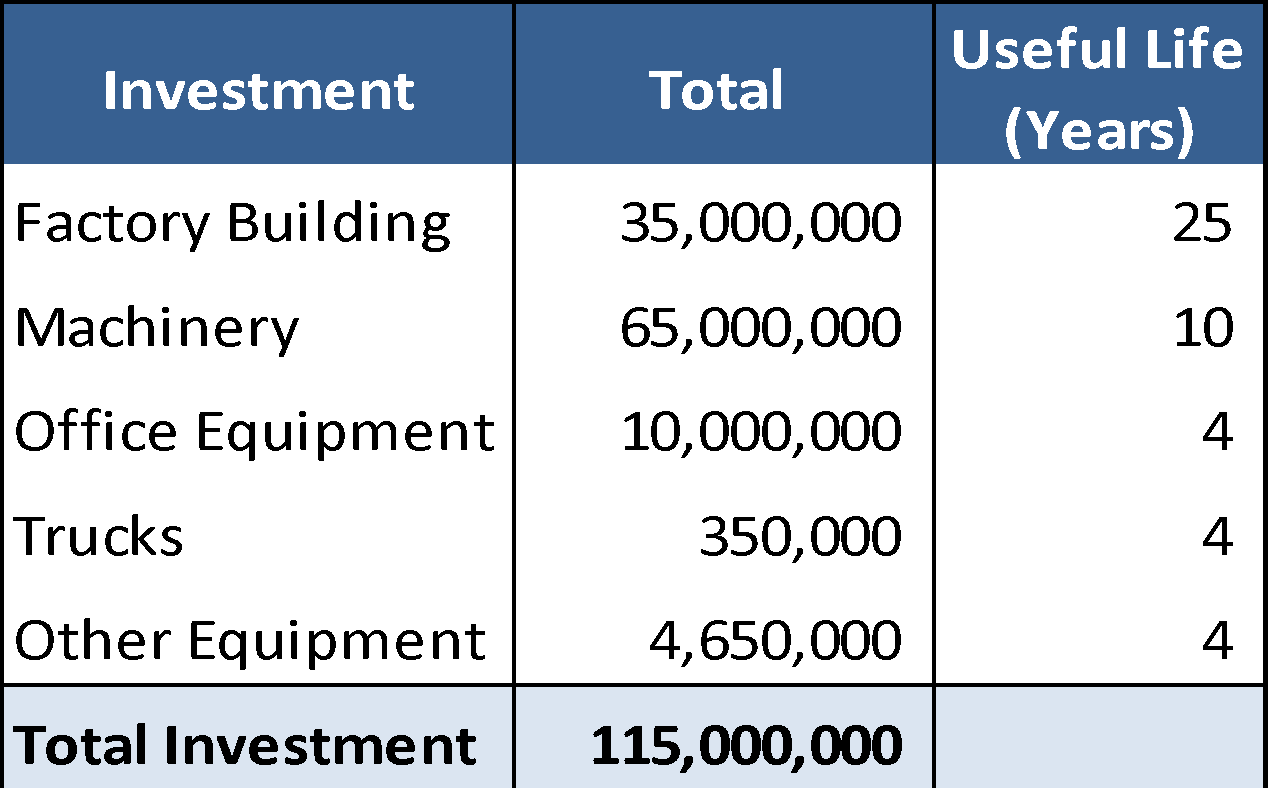

The initial investment is around SR 115 million which is comprised by the building of the factory, the specialized machinery, the office equipment, 2 trucks (SR 175,000 each) to distribute their product to the toys stores across the city, and other minor equipment. The details of the major investment are detailed below:

The production manager and the construction team estimate that the factory will be set up and fully operational in one year.

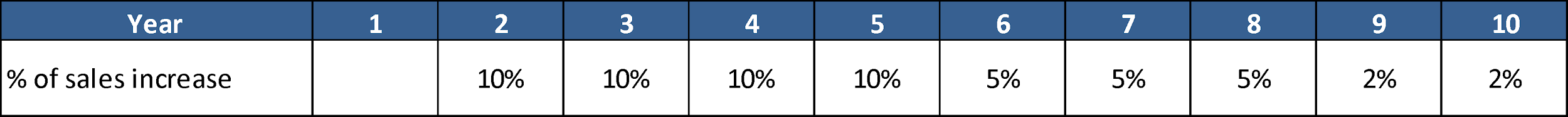

The marketing department projects sales of 120,000 units for each product for the first year of the operation, increasing in the following years as indicated below:

According to their marketing study the following sale prices are adequate to capture the target customers, then the sale price would increase at a fixed rate of +3% which is similar to the inflation expected for the next 10 years.

Electric remote car: SR 150 per unit.

Electric remote helicopter: SR 250 per unit.

GLARE Robot: SR 350 per unit.

Meanwhile, the finance department considers that the production cost per unit for each one of the products will be as follows:

Electric remote car: 30% of the unitary sale price.

Electric remote helicopter: 35% of the unitary sale price.

GLARE Robot: 40% of the unitary sale price.

The administration cost is considered as 20% of the total sales revenue of every year.

Toys stores are well known in the market and the competition is fierce, the finance department estimates that GLARE should have a credit policy for all its customers equivalent to 90 days of their operating revenue. Meanwhile to respond quickly to demand they will have an inventory of raw materials equivalent to 30 days of its production cost. In addition, they will keep the credit with their main suppliers estimated 60 days of their production cost. (Assume 360 days per year)

They should not forget to pay their income taxes of 40%.

Currently, banks are very cautious and are not possible to get a loan to execute the idea. Our proud entrepreneurs estimate that an annual opportunity cost of 25% is an acceptable yield for their investment.

Finally, due to the substantial drop in the projected sales in Year 10, our investors assumed that they will liquidate the company at the end of that year. The finance department projects a market value at the moment of its liquidation for the factory building of SR 35 million; all the other assets have zero liquidation value.

- Should they go ahead with this investment? (assume the straight-line method for depreciation)

- What is the payback of the project? Do you consider it is appropriate to go ahead with the project with the estimated payback? What is the minimum IRR acceptable for this project?

- What happens if the sale volumes for the electric remote car remain flat after the first year of the opening? Should they go ahead with the project anyway?

- Due to the fierce competition, the marketing department considers pertinent to prepare a sensitivity analysis keeping the prices flat for the 3 products along the horizon period? Should they go ahead with the investment anyway?

- What happens if we assume an A/R of 120 days of the total sales revenue instead of the initial 90 days? What’s the new NPV, should they accept the project or not? Why the increase on A/R impacts the project’s NPV in such a way?

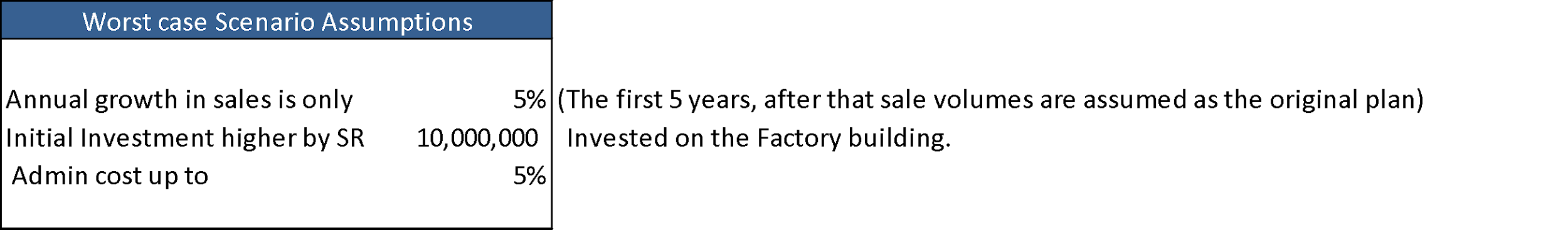

- In order to be prudent and avoid the loss of all their savings, our investors developed a “Worst Case Scenario” to evaluate their project. The main assumptions of the Worst Case Scenario are as follows: (all the other variables remain unchanged; assume the straight-line method for depreciation)

- What is the Worst case scenario NPV, should they accept the project? Please interpret the results.

- Which assumption of the Worst Case Scenario is having the highest impact of the NPV of the project? Why?

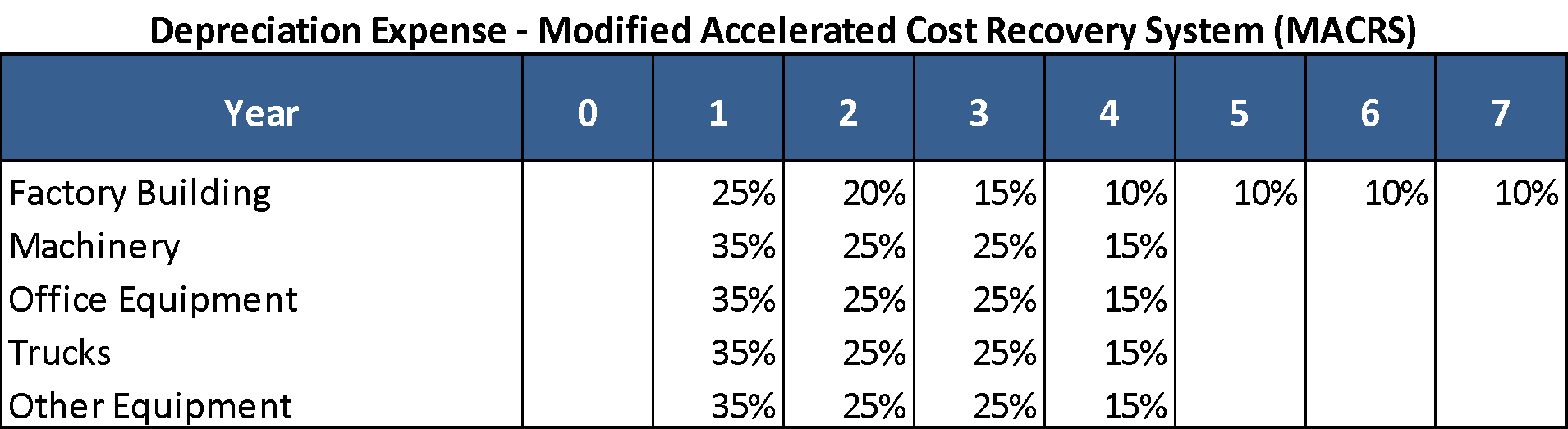

- One of our proud entrepreneurs contacted a potential investor that would like to participate in the project, in order to impress the investor they decided to adapt the Modified Accelerated Cost Recovery System (MACRS) for the calculation of the depreciation expenses using the following depreciation schedule:

(All the variables of the base case scenario remain unchanged).

How the use of the MACRS method is impacting the project’s value?. Please interpret your findings.