Executive Summary

This report discusses the use of project teams in achieving objectives of a given project in an organization. In this case, the report discusses the use of project team in a merger between Hewlett-Packard (HP) and Compaq companies in the computer industry.

The merger was important in trying to solve the crisis facing both companies. Although the management of these two companies enabled the companies to grow significantly, they failed in achieving set targets of their respective companies. These crises with both companies were accelerated by high competition in the computer industry. This led to an agreement between the CEOs of both companies to merger them.

The process of a merger between these two companies meant changes in human resource, communication and management. The report thus discusses how teams are used in the merger project to ensure its success. The merger starts with approval by stakeholders of both companies after a hard convincing by management.

The teams called clean teams are formed from employees of both companies. The clean teams adopted different strategies to create a unified culture out of the different cultures of the two companies. The team members carry out different responsibilities but reporting to two team leaders selected from both companies.

These clean teams are faced with conflicts regarding which aspects to adopt and which to drop from both companies. The aspects and products which are more advantageous are chosen while others are dropped. Those employees whose products are dropped lose their jobs but are compensated or taken in other jobs.

The management communicates either good or bad news to employees to gain their trust and reduce their resistance. The merger thus succeeds through use of clean teams to implement the project.

Introduction

Organizations in the same industry normally compete against each other in the same market as they sell the same products. When the individual organization’s internal strategies fail to enable them meet targets, they face a great risk of failure. In the many options of trying to avoid failure organization in the same industry can merger to form one company which will succeed and compete efficiently in that industry.

This report discusses the merger between Hewlett-Packard (HP) and Compaq companies in the computer industry. This report analyses different aspects of the merger with emphasis on human resource, communication and integration of management (Piven 2001).

Merger Background

In 1999, HP chose Fiorina as its CEO, who worked hard to transform the company old culture and structure as a way of improving it. Her work of pushing for more focus in services led to an increase of the company’s stock from $54.43 to $74.48 (Carleton, and Lineberry, 2004).

Though this was a great success to her, the company failed to meet its targets. The company started to cut down on jobs but with no success with its stock value declining significantly. The company’s internal strategies were not working anymore. Fiorina came up with the idea of merger between HP and Compaq through buying of stock (Williams 2001, 3).

Merger context

The merger was to happen in 2001 with Carly Fiorina planning to acquire Compaq through buying of its stock. Fiorina wanted to acquire stock worth $25 billion from Compaq (Clegg et.al. 2009). Through this stock HP was to own 64 percent while Compaq would be left with a share of 36 percent.

This merger was expected to be completed by the first half of 2002 with the two companies becoming one. The merger was faced with opposition not only from investors but also the workers of both companies (Clegg, Kornberger and Pitsis 2009, 51). They criticized that the merger would not solve the individual company’s problems but would create a bigger unified problem for both.

Exhibit 1: Merger Summary

Source: Press Release issued on September 3, 2001.

Stakeholders

The merger stakeholders were HP and Compaq with the management representing them in the process. The shareholders of HP were represented by their CEO Fiorina who initiated the idea of a merger between the two companies. On the other hand the Compaq company shareholders were represented by their chairman and CEO, Capellas.

Hp Company was begun in 1938 by two electrical engineering graduates named William Hewlett and David Packard (Hoopes, 2001).

The company was named after their names gaining the short form of HP. HP shareholding is thus centered on the family of these two founders as even Fiorina was the first CEO outside the family ties. On the other hand Compaq started by two senior mangers as a computer company in 1982 (Levine, 2005).

The two CEO from both companies started the idea to merge the two companies with a phone call conversation. During this time both companies were suffering from competitive prices in the industry.

These two managers eventually meet but first with the idea of coming up with competitive strategies which would enable both companies to meet their targets. Fiorina during this meeting came up with the idea to merger both companies through buying of stock. The two CEO came into an agreement of merger as it would prevent the two companies from failure.

The two parties having come into an agreement went to represent the idea to their board of directors respectively. Fiorina was faced with opposition from the stakeholders who saw the idea as a creation of a bigger problem (Williams, 2001). The stakeholders believed the merger would lead to loss of consumer loyalty with the new formed company.

But on the other had the CEOs of both companies saw it as the only way to cut the rivalry in conditions of expenses. Fiorina though faced with this opposition from stakeholders managed to convince them on how the merger would not only reduce competition but also cut down on production expenses.

Fiorina been a CEO was thus able to influence the stakeholders to accept the idea of a merger even though it was thought to create a big problem. She argued on the basis of reasons for merger stating that the merger was meant for consolidation and not diversification.

Both the CEOs confirmed to the stakeholders the advantages they were to derive from the merger. The merger would create a stronger company which would mean increase in profitability through development. The merger would also enhance the ability to execute with integration of both management and strengths of both companies.

The stakeholders having agreed to the idea left their representation to carry out the management of the merger process. The integration of both management and cultures was used as the strategy to enhance the merger.

Organizational structure

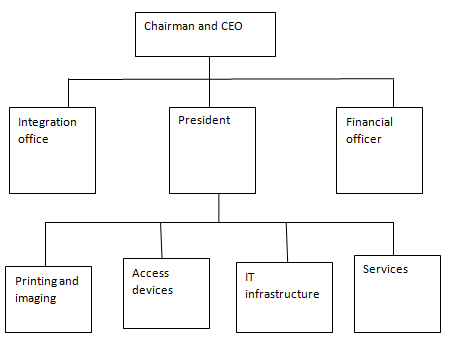

The organizational structure of both companies was to change to pave way for the merger and formation of an entirely new company. The roles of the managers and supervisors were to change in many ways with more and complex responsibilities emerging. The new structure was based on the four major operating groups to be formed.

The four major operating groups included; services, imaging and printing, access devices, and information technology infrastructure (LaPlante, 2007). This new integration meant a reduction in the workforce which meant retrenchment of employees. Fiorina was elected as the chairman and CEO and with her experience in restructuring, she advocated for discipline and inspection in the integration process.

The organizational structure formed had included the integration office which was occupied by two integration managers selected from each company (Resnick, 2010). These managers created teams from other managers and employees from both companies known as clean teams.

These teams were to research on the culture and management styles of both companies and come up with ideas on her to merge them as one. The first thing carried out by these teams was assessing the cultural differences between the two companies.

HP culture was viewed as a culture where consideration, thoughtfulness and planning were applied (Fiorina, 2002). On the other hand Compaq culture was viewed to be ready to act. The employees of Compaq were seen to act fast after little debate and consideration.

Those employees which were experts in different departments of both companies were selected to form the integration team (Koontz, and Weihrich, 2006). Fiorina selected McKinney, who had served for long in HP in running worldwide sales and marketing, to be an integration manager.

His experience would were be applied in managing the integration process. On the other side of Compaq, Capellas selected Clarke who was the chief financial officer during this time, as Compaq’s integration manager. These two integration mangers came up with different ideas from their application of experiences with their companies.

These managers contributed greatly to the integration process by been part of the integration teams. McKinney identified that the companies’ strategies were similar and thus required no significant changes. Both companies applied same strategy from product point of view and to move to industry standards.

Through these similar strategies the team advocated for the need of one CEO and one country manager (Lee, 2004). On the other hand Clarke also made significant contribution through the clean team. Clarke advocated for the “adoption” strategy among senior managers which applied a buddy systems staffing plan.

Team responsibilities and roles in integration management

This clean team applied the many strategies in the process of integrating both companies. The teams were referred to as the clean teams as members could meet in clean rooms away from their workmates they were used to. The teams could adopt different strategies in their responsibility of integrating both teams.

The strategy which was highly applied by the clean team was the adopt-and-go method (DePamphilis, 2009). The clean team could go into the field and carry out necessary research to make recommendations. These recommendations were based on a two way decagons, that is, the clean team could decide on which products to keep and which to eliminate.

The recommendations were made after the clean team evaluates the product, asset or internal system. The evaluation was meant to show which of company used a better version than the other. The better product, asset or internal system was kept while the other was done away with. This strategy allowed for faster integration process as it was faced with no resistance.

The employees whose product line was eliminated lost their jobs but were given chance for other jobs within the new company (Piven, 2001). The decisions made in the clean rooms by integration team were final and did not allow for further discussion.

In the integration role of the team members, adoption of the launch-and-learn strategy was adopted. With the clean teams having less time to carry out the integration process, the launch and learn approach saved time to wait and see the outcomes of decisions made.

The clean team also applied the use of launch-and-moose strategy in their responsibility to merger HP and Compaq (Gaughan, 2010). This approach was initiated to prevent as well as help solve the conflicts that emerged among the clean team.

Conflicts and differences were common in the clean team as it was formed by employees from different companies with different cultures. This approach enabled the tabling of differences and then the team could decide how to deal with them. This helped the clean team to reduce and avoid conflicts.

The clean team also applied the approach of watch-out-for-icebergs. Icebergs though seen above the surface of water, their bigger part is hidden underwater and not easily seen. This was the case for the integration process with many problems hidden from the visibility of the clean team.

Some issues in the merger were not well visible and could lead to its failure if not attended to like; leadership, governance, retention, and communications. With these invisible problems posing threat to the integration process, a Cultural Integration Team (CIT) was formed. This team was formed within the clean team itself (Federico, 2003).

The CIT introduced the “Fast Start” program which was to enable workshops for individual employee teams. These workshops were meant to help employees known each other, familiarize themselves with both companies and solve conflicts among themselves. This use of the CIT enabled employees from both HP and Compaq to adapt with working horizontally across the post-merger HP (Hill, and Jones, 2009).

The clean team selected from both companies used the horizontal reporting relationship among members. This was because the clean team did not consider nor apply the former roles and position of the team members.

The team members though having authority and responsibility differences before merger, were now equal and at same level. The leadership of the clean team was only exercised by the two integration managers selected by both CEOs from the two companies.

Merger development and conflict

The clean team by now had developed and included many members from both companies. The integration process had now advanced that it was time to name the team which would form the new company’s leadership. This was a difficult task for the clean team to select which executives from HP or Compaq would occupy the top management.

In a four business group, HP now the new company announced the names of 150 senior managers to lead the organization across the world. This meant the company had done away with some managers and employees. To this effect the company human resource management offered retention bonuses to these managers and employees although most of them preferred to stay (Cumming, and Worley, 2009).

The clean team had to consider many aspects in selecting the merger team members and establishing their roles. First the clean team used the strategy of adopt-and-go approach to eliminate some managers and employees.

Those managers and employees whose product line or internal systems were eliminated were less considered than those whose were chosen. This was on the basis of who?, among both companies’ managers and employees were better experienced and qualified to run different aspects of the new HP.

The developed team to manage the new HP Company was likely to encounter conflicts due to culture differences of the employees from HP and Compaq. Thus their main challenge was to develop a human resource strategy that would maintain the standards both companies had before while allowing for cultural change.

The new HP had to create new unified culture among the employees to avoid conflict issue. The HP’s human resource manager saw the need to use good communication as a way to incorporate both companies’ cultures among employees. In the issue of eliminating about 10 percent of the combined workforce, this HR manager saw it essential to communicate these to the team members (Baque, 2003).

On the other hand the Compaq HR manager saw it inappropriate to communicate to the employees about the expected retrenchment due to restructuring of both companies. This conflicting issue made it hard to integrate both cultures in the shortest time.

The use of good communication was adopted after discussion by the clean team as the best strategy to avoid cultural differences. The employees of the new HP were thus given all the information regarding expected changes whether good or bad. This aided the employees to gain trust of the newly formed HP.

Conclusion

The merger between HP and Compaq was a big challenge for both companies. Though a difficult strategy to adopt, the merger would enable both companies to solve the problem of not meeting their internal targets. The merger would also enable the companies to compete effective in the industry irrespective of the price challenges experienced at the time.

Though the merger had these advantages, it was faced with great opposition from both stakeholders and traders of both companies (Aqrawal, 2010).

The merge to them was expected to create bigger problems for both companies rather than solving current problems. This was a challenge for the management of both companies who saw the merger as the only way to solve their problems. The management argued the benefits of the merger and convinced stakeholders to allow it.

The merger was a big step for both companies and required discipline and massive inspection to integrate both companies. The use of a team combining employees from both companies allowed for a faster integration. The merger was faced with the threat of integrating both cultures of both companies into one.

In the integration process, culture differences led to conflicts between team members regarding different decisions to be made. Though the existence of conflicts the integration became a success.

Recommendations

In a merger between two companies, the advantages and disadvantages of the merger should be clearly known by both companies. The effects of the merger to the two companies should be well explained to their respective shareholders to avoid their resistance and gain their support. The two companies should create a team from employees of each to carry out the process of integration.

The team members selected to drop their authority and responsibility from their respective companies to allow for a horizontal relationship between the team. The team should apply the approach of adopt-and-go in the integration process to make it quick and without conflicts.

Companies undergoing a merger face the great challenge of incorporating their respective cultures to one. These companies should use good communication among employees as the best tool to integrate both their cultures into one. The companies’ integration team should inform employees of both companies regarding expected changes whether bad and good.

References

Aqrawal, R., 2010. Mergers and Acquisition – A Case Study and Analysis of HP-Compaq Merger. Ezine articles. Web.

Baque, H., 2003. Managing a successful integration, lessons learned from the HP/Compaq merger. Scribd. Web.

Carleton, J. R. and Lineberry, C. S., 2004. Achieving Post-Merger Success. A Stakeholder’s Guide to Culture Due Diligence, Assessment, and Integration. New York: Pfeiffer.

Clegg, S., Kornberger, M. and Pitsis, T., 2009. Managing & Organisations: An Introduction to Theory & Practice. New York: SAGE Publications.

Cumming, T. and Worley, C., 2009. Organization development and change. New York: Cengage Learning.

DePamphilis, D., 2009. Mergers, Acquisitions, and Other Restructuring Activities: An Integrated Approach to Process, Tools, Cases, and Solutions. Burlington: Academic Press.

Federico, G., 2003. Carly Fiorina: Is she Helping or Hurting HP. Keeeez.com. Web.

Fiorina, C., 2002. The Case for the Merger. Hp. Web.

Gaughan, P., 2010. Mergers, Acquisitions, and Corporate Restructurings. New York: John Wiley & Sons.

Hill, C. and Jones, G., 2009. Strategic Management Theory: An Integrated Approach. New York: Cengage Learning

Hoopes, L., 2001. A case study on business communication. Awpage Society. Web.

Koontz, H. and Weihrich, H., 2006. Essentials of Management. New Delhi: Tata McGraw-Hill Education.

LaPlante, A., 2007. Compaq and HP: Urge to Merge Was Right? Stanford BusinessMagazine. Web.

Lee, X., 2004. The Secrets of our happy union. Human resource online. Web.

Levine, H., 2005. Project portfolio management: a practical guide to selecting projects, managing, and maximizing benefits. New York: John Wiley & Sons.

Piven, J., 2001. HP-Compaq: A technology giant born of industry weakness. All Business. Web.

Resnick, S., 2010. Organisational Change Management Process. Work systems. Web.

Williams, M., 2001. HP’s Deal for Compaq Has Doubters as Value of Plan Falls to$20.52Billion. The Wall Street Journal, p. A3.