Introduction

In the growing debate over globalisation and free trade, it is difficult to focus on real policies under discussion. There are varied issues that focus on environmental destruction, markets, and exploitation among others, but one must relate globalisation to free trade in order to understand global trade policies.

Globalisation reflects the adoption of free trade policies for international markets by liberalisation of policies (Bhagwati, 2004). On this regard, countries liberalise their trade policies with other countries through elimination of policies that could deter trade or act as trade barriers.

Some elements of trade barriers include “tariffs (high taxes on imported goods, which make them expensive) and subsidies from governments to domestic firms” (Spruiell, 2006). Both policies inhibit foreign firms from selling their products and services in local markets because of high prices (Friedman, 2000).

The concept of trade policy is easy to grasp. That is, it reflects subsidies or tariffs, which governments adopt to protect foreign firms from selling in their countries. There are also other approaches to trade barriers, such as expensive trade license for foreigners, quotas, and a total ban on foreign goods among others.

Protectionism refers to policy agendas, which aim to increase the number of tariffs and subsidies that governments use to prevent or minimise trades or exploitation that result from free trade in the international market. This essay focuses on protectionist measures, major arguments used by countries to justify protectionist measures, and challenges and opportunities protectionism presents to companies that wish to expand to foreign markets.

Major arguments used by countries to justify protectionist measures

Governments use several arguments to justify their protectionist policies. First, infant industries require government subsidies and strong protectionist laws to protect them from fierce competition from well-established firms in the global market (Bhagwati, 1988). Such budding firms may not be strong enough to endure challenges posed by competitors. Therefore, by protecting such domestic firms from external competition, the government allows them to thrive in the domestic market.

Second, dumping also has facilitated the increment in protectionist laws. Dumping takes place when imported goods have significantly lower prices in foreign markets than the normal price in the country of origin.

Antidumping policies protect domestic market prices by ensuring that imports do not have ‘too low’ prices below the cost of production or have fair market prices. The US has used antidumping policies to protect domestic markets from cheap imports from China. Free trade could facilitate dumping, particularly in non-industrialised countries.

Third, in some instances, governments have introduced protectionist laws because of national security issues. Such governments aim to reduce reliance on other countries to supply critical resources and services, which may not be available in periods of dispute. Although it is difficult to identify all industries that are vital for national security of a country, some governments aim to protect their IT and energy firms from foreign ownership.

Fourth, some countries have relative cheap labour. Consequently, they produce goods at low costs, which result in lower prices in the international market. Such countries may create unfair competition in the market. However, countries with cheap labour like China have attracted investments than those with high costs of labour. Consumers want cheap products. Thus, if a country has expensive products because of labour cost, the domestic firms will lose market share to foreign firms.

Fifth, some governments argue that protectionist laws enhance equality in income through protection of local jobs. These are the essence of high tariffs and subsidies for the domestic firms. From this argument, one can deduce that the US, which has an expensive steel industry, may not compete against the steel industry of Brazil, which is relative cheap. In such situations, the US steel industry may lay off workers in order to cut costs and remain competitive. Consequently, workers who depend on the industry will slip into poverty.

From such competition, the steel industry in the US may collapse altogether after several years. Consequently, the US will rely on foreign suppliers of steel. If the US engages in diplomatic disputes or wars with Brazil or other countries with steel firms, it may not be able to get that vital resource for its domestic operation. Thus, the result could be devastating to the US economy.

Another different reason for protectionism bears no economic advantages to any country. In this argument, countries note that their protectionist laws should reciprocate laws of their peers. That is, trade barriers should be high to reflect practices by other countries.

China has applied this theory against the US in which it uses subsidies and tariffs as bargaining chip when negotiating international contracts. The bargaining chip theory does not support or oppose trade, but it considers protectionist law as a two-way approach. For instance, the US may lower steel tariffs for Brazil only if the latter agrees to lower its tariffs on other exports from the US.

Countries that use the bargaining chip approach focus on enhancing trade opportunities, but strive to protect their domestic markets as much as possible. Hence, they maximise exports and reduce harmful imports (Spruiell, 2006).

Challenges and opportunities protectionism presents to companies that wish to expand to international markets

Although the arguments for protectionism are compelling, trade protection could hurt economies of countries, which impose them too. Some countries are fond of retaliation. For instance, some reports had indicated that there were many discriminatory trade policies than liberalising ones (Miller, 2009).

Miller notes “governments are applying protectionist measures at the rate of 60 per quarter, and more than 90% of goods traded in the world have been affected by some kind of protectionist measures” (Miller, 2009). Trade policies could result into few goods and high prices, which hurt economies and consumers. This may not be suitable for any firm that intends to expand in countries, which tend to retaliate against trade policies.

Foreign firms may not be able to compete against inefficient protected domestic firms. Governments that impose tariffs in order to protect their emerging firms create unfair competition in free trade. However, consumers will face higher prices and poor quality of services and products. In other words, firms with quality products may not expand to countries with high tariffs and subsidies because of possible unfair competition or expensive trade licence.

Protectionist policies lower efficiency. Some economists claim that free trade may lead to loss of jobs in the importing country. However, economists have argued that competition created by foreign firms could enhance efficiency of local industries, quality of goods, and lead to sales growth and employment.

Arguments for protectionist laws are compelling, particularly in saving domestic jobs. A government may be right in protecting local jobs in a local steel industry, preventing the industry from bankruptcy and mismanagement by imposing relatively higher tariffs on imports (Griswold, 2001).

On the other hand, a government may fail to account for individuals who work in other firms supported by steel products. Other foreign factories can buy steel at world prices and manufacture steel products lower costs. Consumers will buy such products from other foreign countries with lower prices.

This implies that American firms, which manufacture steel products, will experience declines in sales and may lay off a significant number of employees. They may also go out of business or seek for additional capital from investors. This was the case when President Bush enacted high tariffs on steel in the year 2002.

On this note, one must ask whether it is important to save some jobs at the expense of others or government should leave economic forces and efficiency to control markets.

This point illustrates that protectionist policies have costs to the imposing country. In most cases, one may fail to notice such costs associated with protectionist measures. This happens because one can observe any changes in a given industry, but fail to notice the overall impacts because such impacts are widely distributed, affect many industries and customers.

Countries argue in favour of protectionist measures to protect domestic firms and avoid relying on foreign industries. Thus, if a country leaves its industries unprotected from global forces, they may collapse and cause reliance on foreign products. However, this situation may not be bad because free trade does not operate in that manner for both developed and emerging economies.

For developed economies, competition from foreign firms should allow domestic firms to re-examine and re-engineer their processes and enact the needed reforms so that they can become stronger and compete effectively with foreign firms. Moreover, it is also unlikely that domestic firms can lose all capacity to manufacture products for the local market.

It is also imperative to understand whether industries in emerging economies require protection. Many emerging economies believe that they require protection from well-established multinational firms. However, this is a folly argument. Since some countries gained their independence from former colonial masters, they considered any imports as “other forms of colonialism and dependence on former masters” (Spruiell, 2006).

Consequently, many countries adopted import substitution policies. Under the import substitution policy, governments controlled how their countries utilised available resources in attempts to manufacture all products they previously imported. This strategy did not lead to any economic growth. Instead, a number of emerging economies fell into deep debt crises while struggling to manufacture all products.

On the contrary, East Asia has shown that developing countries can “export all products they can easily and cheaply manufacture and import products they cannot produce locally without high economic costs” (Spruiell, 2006).

Globalisation has improved because many countries have noted that it is sound to maximise the production and export of products and services they can produce cheaply and easily. On the other hand, such countries also maximise importation of products they cannot manufacture. This results into a rapid economic growth.

In this manner, countries rely on their comparative advantages and strategies to create value in the global market. According to Spruiell, “the principle of comparative advantage means that every nation, no matter how undeveloped or poor, has a comparative advantage in producing some goods” (Spruiell, 2006).

However, many countries may not adopt open market policies because protectionism is a ‘bargaining chip’. Hence, the argument for protectionism under this theory still holds because nations may only reduce their trade barriers and tariffs if they can get some values from other countries. Otherwise, they claim that domestic firms will have to compete in the global market against other firms, which have protection and government subsidies.

Proponents of protectionist measures and bargaining chip strategy question why a domestic industry should face competition from other industries, which get subsidies from their governments. Government subsidies allow industries to produce and sell products at lower costs than costs of production. Thus, proponents of protectionism justify their position as attempts to eliminate unfair competition.

However, when one focuses on comparative advantages, they must recognise that the concept requires countries to open their domestic markets and focus on exports to boost their economies. Protectionist laws deny consumers to buy cheap products. Moreover, such laws only protect a few selected business interests to the detriment of the entire economy.

Foreign firms may find it difficult to establish their operations in countries, which protect their domestic industries from competition. Generally, countries experience economic growth when they are free to trade with other countries without many trade barriers. Countries with open borders are likely to facilitate foreign investments and trade as investors will find few trade barriers while consumers will buy products at lower prices.

Thus, even subsidies may only favour open market countries because producers are likely to export their products to such countries. In addition, countries with open markets are likely to import products at low costs (Schiff and Schiff, 2010). Consequently, they will focus on developing their productive industries and enhancing their economic strength.

Therefore, protectionism presents challenges to foreign firms that seek to expand in international markets in terms of several trade barriers, unfair competition with protected domestic firms, and expensive trade licences among other challenges. Such firms should seek for investment opportunities in open market countries with liberalised trade policies. This would lead to economic success through high volumes of trade because open markets facilitate trade.

It is also important to understand the major beneficiaries of protectionism. Generally, when governments introduce protectionist policies, they aim to protect some industries but not others. On this note, governments would consider industries, which could have significant influences on domestic politics (Hazlitt, 1988). For instance, in the US, governments have selected their influential steel, agribusiness, textile, and lately IT industries for protection against any foreign competition or acquisition.

However, other unprotected industries have faced fierce competition from foreign firms, as well as higher prices of products from the protected domestic industries. One may focus on the protected industries and note that they are highly important for the government. However, industries have deep relations when viewed from economic principles.

One must acknowledge that arguments for protectionist laws have some merits. For instance, governments save jobs, avoid financial ruins through subsidies, and could be critical in seeking for trade partnership in the global market.

However, for every benefit of protectionist laws, governments must make subjective decisions on industry protection and identify industries that will incur costs of domestic protection (Lindsey, 2001). Governments should not select industries for protection based on their political influences, and they should apply economic principles and treat all industries in the same way.

Protectionism comes with economic costs, which are not easy to ignore. Thus, fundamental issues should not be about potential costs. Instead, the focus should be on industries, which will bear such costs. While governments can provide responses to such questions, people also have economic freedom to choose their products.

Recent trends

The most common trade barriers exist between the US and China. These two countries show how protectionist laws work in a global market. However, apart from the US and China trade wars, other countries have trade barriers too. Miller noted that the World Trade Organisation (WTO) released a report, which indicated that many countries were yet to refrain from protectionism (Miller, 2009). The WTO member countries had “130 protectionist measures to implement” (Miller, 2009).

Some of these protectionist measures included “state aid funds, higher tariffs, immigration restrictions and export subsidies” (Miller, 2009). For instance, in 2009, Russia focused on a comprehensive increment of all tariffs, Japan concentrated on reviewing its sanitation laws to restrict food imports while South Africa embarked on reviewing its spending patterns to favour firms owned by the blacks at the expense of white-owned firms.

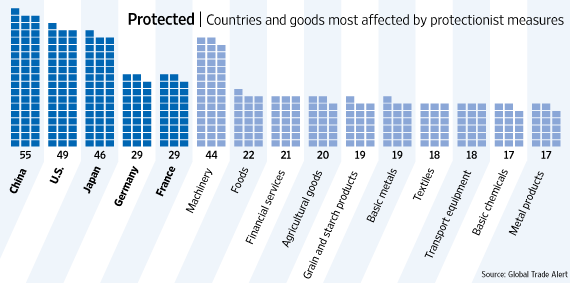

From the above figure, “China has been the main target for most governments’ protectionist laws” (Miller, 2009). China faces trade barriers from 55 countries, which have enacted measures to restrict Chinese exports (Miller, 2009). The US and Japan have 49 and 46 protectionist measures respectively.

On the other hand, the growing economy of Brazil has attracted Chinese imports. Consequently, Brazilian government has introduced some “non-tariff trade barriers and protectionist measures, particularly in the automotive and light manufacturing sectors” (Deloitte, 2012) to protect domestic industries.

Impacts of protectionist measures

First domestic firms, which depend on government protection and subsidies, may not be able to compete well in the export global market. Import barriers are responsible for high prices due to high costs for intermediate needs. Consequently, export products become highly priced than the global market prices.

This may force such domestic industries to lose market share to foreign firms. Moreover, there are also possibilities of retaliation from other countries. Second, protectionism affects the entire economy of a country as any rise in the cost of product leads to a drop in the gross domestic product (GDP). Third, protectionist measures also affect the global economy negatively as world exports and incomes drop.

Finally, protectionist laws slow down economic growth for all nations. In other words, the global market requires complete liberalisation to improve actual incomes for emerging economies. Therefore, for any foreign firm seeking to expand its operation in the international market, it should choose countries without several trade barriers, protected industries, and government interference.

Conclusion

The concept of protectionism emanated to control trade issues that resulted from international trade. However, not all market issues require protectionist laws like some economists had believed. Today, some economists have argued and demonstrated that protectionist laws are ineffective and inappropriate ways of fixing market failures. One major challenge is that protectionist laws protect few individuals and leave majorities to bear the ultimate costs.

Not even the poor masses who work in such industries should bear the costs. However, in most cases, protectionist measures place huge responsibilities on individuals who least deserve them. That is, only few individuals benefit from protectionist laws. Overall, protectionist laws are major obstacles to economic growth as this essay has shown. Thus, an open economic strategy can facilitate economic growth and eliminate trade barriers.

Reference List

Bhagwati, J 1988, Protectionism, MIT Press, Cambridge.

Bhagwati, J 2004, In Defense of Globalization, Oxford University Press, New York.

Deloitte 2012, Competitive Brazil: Challenges and strategies for the manufacturing industry, Intergraf Ind. Gráfica Ltda, Brazil.

Friedman, T 2000, The Lexus and the Olive Tree: Understanding Globalization, Farrar, Straus and Giroux, New York.

Griswold, D 2001, Walls of Steel, Carlton Press Corporation, New York, NY.

Hazlitt, H 1988, Economics in One Lesson: The Shortest and Surest Way to Understand Basic Economics, Three Rivers Press, New York.

Lindsey, B 2001, Against the Dead Hand: The Uncertain Struggle for Global Capitalism, Wiley, New York.

Miller, J W 2009, Protectionist Measures Expected to Rise, Report Warns. Web.

Schiff, P and Schiff, A 2010, How an Economy Grows and Why It Crashes, Wiley, New York.

Spruiell, S 2006, Protectionism – Tariffs, Subsidies, and Trade Policy. Web.