Dubai’s openness to international trade is the most important factor in Dubai’s rapid development. Dubai’s policy on international trade has encouraged the development of infrastructure to support trade. Infrastructure built to support trade includes roads, airports, and power plants among others. The rapid development in real estate can also be attributed to international trade.

Trade in Dubai was affected by bureaucratic procedures in the 1990s. There were very many procedures that a business entity went through before it could be allowed to operate. The process of setting up a business was slow because of manual procedures.

The government in Dubai took corrective measures by forming Dubai Trade in the early 2000s (Emirates Competitiveness Council 6). Dubai Trade was an organization formed to speed up the process of starting up a business in Dubai. The Dubai Trade Portal provides online services for licensing and business inquiries.

Dubai’s openness to trade is enhanced by the operation of Free Zones. The Free Zones are isolated areas within Dubai that allow foreigners and local people to engage in business without paying common taxes such as corporate tax and income tax. Foreigners are allowed to own 100% of any business entity (Dubai Economic Council 12).

The Free Zones are set up in specific areas and may deal with specific products. An example of a free zone is the Dubai Internet City. It covers companies that deal with information technology and associated products. Dubai Healthcare City is another example of a free zone that specifically attracts medical expertise. Other Free Zones may attract capital from multiple sectors such as Jebel Ali Port Free Zone.

The Dubai government has pursued policies that have reinforced its dominance in regional trade. Imported goods are charged low custom duties. They are charged a 5% custom duty except for alcohol and tobacco (International Business Publications 103).

According to economic theory, comparative advantage applies to a country that produces a specific product at a lower cost than others. Most governments use custom duties to protect local industries from countries that have a comparative advantage. The government in Dubai pursued openness to trade as its main economic policy.

There were not many local industries to lobby the government for protection from international trade. As a result of Dubai government’s policy on international trade, the value of goods traded through Dubai has increased at a rate that is 12 times the rate of increase in the global worth of goods traded across borders in the last 2 decades (Emirates Competitiveness Council 9).

Before 2000s

Trade became difficult because of bureaucratic procedures that were required to obtain a permit. A trader venturing into UAE had to be inspected by “customs, health authorities, Free Zones, sea and airport services among others” (Emirates Competitiveness Council 4).

Traders were required to present the required documents in person. Dubai government had formed the Dubai Ports, Customs and Free Zone Corporation (PCFC) to oversee the engagement of international trade.

Dubai’s openness to trade is enhanced by the operation of the Free Zones. The Free Zones are isolated areas within Dubai that allow foreigners and local people to engage in business without paying common taxes such as corporate tax and income tax. One of the examples of Free Zones is Dubai Airport Free Zone. It is involved with the trade of a wide variety of goods and services.

Another example of a Free Zone is the Dubai Healthcare City that attracts medical expertise and related products. Dubai Internet City established in 2000 at a cost of US$250 million is also a Free Zone. The government allows foreign companies operating in the Free Zones to obtain100% ownership. They are also exempted from paying corporate tax for a period of 50 years.

Businesses are also exempted from income tax and capital gains tax. They can also transfer the entire profits to their preferred international destination (Library of Congress – Federal Research Division 19). Most Free Zones are located close to seaports or airports with a few exceptions located in areas set aside as export processing zones.

Dubai gained its competitive advantage as a regional hub in the Gulf region through Dubai Creek. The Dubai Creek provided a naturally-deep harbor that was unrivaled in the Gulf region.

The Dubai Creek provided a better port than other areas in the UAE. In 1958-59, the Dubai Creek was dredged which allowed it to receive larger ships. It provided an advantage because ships in the Arab region had to be stopped about 2 miles from the shores due to shallow waters (Jones 196).

The government through its economic policies has enhanced the advantages that Dubai had developed by modernizing its ports. Dubai’s Jebel Ali port was developed in the 1970s. It is recognized to have the largest man-made harbor in the world (Emirates in the UAE par. 4). The other emirates lacked the same advantage as Dubai in using seaports.

Dubai chose to support a diversified economy because there was a forecast that its oil reserves would be depleted by 2015. Nyarko (8) explains that Dubai recognized that its economy could not be sustained by oil reserves early enough to develop policies that enhanced diversification. Abu Dhabi accounted for 90% of oil produced in UAE.

Abu Dhabi was producing 2.5 million barrels per day when Dubai was producing 240,000 barrels per day by 2006 (Nyarko 8). Abu Dhabi has been supporting other emirates through its oil revenues. Abu Dhabi has also been pursuing diversification policies but not at the same pace as Dubai. Its oil reserves may last more than a hundred years.

Two reasons emerge that made Dubai pursue a different economic policy. One is the historical advantage provided by Dubai Creek in the 1960s. Oil production also started in the 1960s in UAE when Dubai was already developing into a regional hub.

The second reason is that it had oil reserves that were projected to run out by 2015. Its oil production is also minimal compared to UAE in general. The other emirates relied on oil revenues and grants from Abu Dhabi which produces 90% of the UAE oil (Nyarko 8).

After 2000s

The other emirates have also adopted Free Zones after reports of their success in Dubai. WTO (37) discusses that all the other five emirates excluding Abu Dhabi have followed the policy of establishing Free Zones after Dubai’s success. The first Free Zone was established at Jebel Ali Port in 1980 (WTO 37). Several other Free Zones have been established ever since.

There were 22 Free Zones in UAE by the end of 2005 (WTO 38). Some of the Free Zones are dedicated to a specific economic sector such as Dubai Internet City, and Knowledge Village. Some of the Free Zones cover multiple sectors (Welcome to UAE Free Zones, par. 1). They are mainly focused in processing exports such as the Jebel Ali Port Free Zone.

The Free Zones have been effective in attracting FDI and human capital. The highly skilled labor and new technology attracted by the Free Zones has kept the quality of goods and services to standards similar to advanced economies. Dubai is more successful by being a pioneer in setting up the Free Zones in UAE.

The PCFC was transformed to become the Dubai Trade which brought together stakeholders from the private sector and the government. Dubai Trade became an independent entity in 2006. Dubai Trade reinforced e-services. Dubai Trade portal linked traders to common regulatory services such as Dubai Customs, and DP World (Emirates Competitiveness Council 6).

In 2008, Dubai Trade collaborated with DP World to launch Rosoom Electronic Payment Gateway which removed the delays in transactions that were being experienced because customers could not make online payments (Emirates Competitiveness Council 7). The creation of Dubai Trade has increased access to services. It has reduced the speed and cost of exporting and importing commodities.

The Dubai International Financial Center (DIFC) was launched in September 2004 to facilitate international trade and foreign investment. It is a self-regulation financial free zone that allows investors to trade in financial assets and foreign exchange (Library of Congress – Federal Research Division 12).

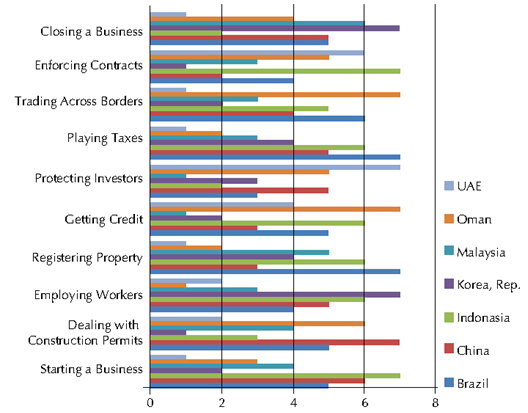

Dubai economic policy offers great support to international trade. Most of its policy implementations are an effort to ease linking to international trade (see Figure 1). Schiliro describes that Dubai is a “regional center for finance, real estate development, shopping, exports and re-exports” (6). Dubai has established itself as a service economy.

Dubai Openness to International Trade

Modern trade policies use a combination of theories. Sometimes the mercantilist theory may require the protection of local industries. Comparative advantage may require countries to produce commodities in which they have a lower marginal cost. Sen (3) discusses that international trade in the neo-classical trade theory focuses on opportunity cost.

The theory focuses on optimization of productive efficiency, consumption, and the utilization of factor inputs at full capacity. Dubai appears to have followed the optimization rule. It tries to use its resources at full capacity. For example, its arid land is better used for real estate than for agriculture.

The emirate offers passage for exports at a lower cost rather than applying trade restrictions. The indirect benefits associated with the handling of goods and services help to build the economy.

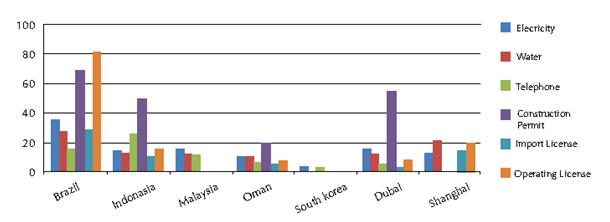

Dubai ranks highly considering the time taken to obtain a permit. As it can be seen in Figure 2, only construction may be delayed when waiting for a permit. Construction activities take 55 days for one to obtain a permit (Dubai Economic Council 7). However, it is not much different from other countries which also take longer in the construction sector.

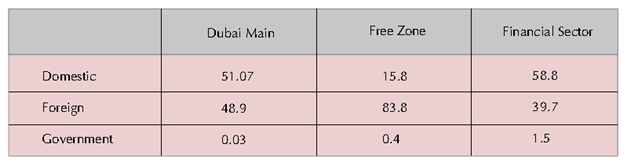

The Free Zones allow foreigners to own enterprises entirely. Foreigners can hold up to a 100% of a business entity. Foreign ownership in the Free Zones has an average of 84% foreign ownership compared to 49% in Dubai Main.

Dubai Main is the area that operates using local laws which excludes all privileges found in the Free Zones. The government restricts foreign ownership of businesses in Dubai Main to 49% (Dubai Economic Council 12). Corporate tax and income tax are charged as usual. The government holds a very small percentage of enterprises in Dubai (see Figure 3).

The Free Zones have a higher rate of training workers compared to Dubai Main. Firms that train workers represent 30.3% of firms in the Free Zone compared to 11.4% in Dubai Main (Dubai Economic Council 20). Dubai is able to benefit from transfer of expertise from foreign workers. Sections of the law also ensure that locals are employed. According to economic theory, knowledge influences economic growth.

Dubai Main has the higher total factor productivity in the retail sector, IT, and real estate compared to the Free Zones (Dubai Economic Council 21). The Free Zones that deal in goods only allow wholesale of commodities. Firms have to transfer their products to Dubai Main if they want to engage in retail.

The custom charges in Dubai are lower compared to other emerging economies. Imported goods are charged a 5% custom duty except for alcohol which is levied 50% and tobacco products are levied 100% (International Business Publications 103). The low custom duty has been influential in making Dubai successful in international trade.

The government benefits in the Free Zone areas through rates paid on offices, warehouses, and development of other physical structures. There are benefits of services such as registration, licensing, and permits. The area also attracts foreign investment (Dubai Economic Council 22). Trade is also able to enhance the tourism sector. The Free Zones have enhanced rapid development by attracting highly skilled labor, technology, and finance.

Results on Trade Policy

Dubai has experienced a higher economic growth rate than the other emirates except for Abu Dhabi which relies massively on oil revenues. In 2012, Dubai real GDP grew by 4.4% compared to 7.7% in Abu Dhabi (The Economy – Gross Domestic Product, GDP, par. 1). Trade in Dubai has increased at a rate which is over 12 times that of the overall international growth rate (Emirates Competitiveness Council 9).

From 1994 to 2009, global worth of commodities involved in cross border trading increased from US$5 trillion to US$11 trillion. It represents a 120% cumulative growth. Within the same period, “Dubai’s export rose by 1500%, to a value of US$14 billion” (Emirates Competitiveness Council 9). It shows that policies on international trade are effective.

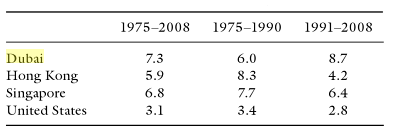

Dubai has experienced a higher real GDP growth rate than either Singapore or Hong Kong between 1991 and 2008 (Al Sadik and Elbadawi 122). In the period Dubai growth rate was 8.7%, Hong Kong 4.2%, and Singapore 6.4% (see Figure 4).

Dubai is compared to Singapore and Hong Kong because of a similar focus on international trade. Hong Kong and Singapore provide hubs for East and Southeast Asian countries. Dubai provides a hub mainly for the Arab and Gulf region. It also provides a hub for other areas in the world because of the advantage provided by its low custom duties and other privileges.

Conclusion

Dubai rapid economic growth is attributed to its openness to international trade. Modern ports, real estate, medical expertise are some of the development areas that are directly influenced by its openness to international trade. The government needs to keep reviewing its policies on international trade to maintain the competitive advantage it has developed.

The competitive advantage has been enhanced by government policies such as the low custom rates, the privileges in the Free Zones, and supporting infrastructure. The government can maintain a competitive advantage by adopting modern technology as fast as they are innovated.

Works Cited

Al Sadik, Ali, and Ibrahim Elbadawi. The Global Economic Crisis and Consequences for Development Strategy in Dubai, Basingstoke: Palgrave Macmillan, 2012. Print.

Dubai Economic Council. Business Environment, Enterprise Performance, and Economic Development in Dubai, Dubai: Dubai Economic Council, 2011.

Emirates Competitiveness Council. “Dubai Trade – Building Competitive Advantage through Collaboration.” Policy in Action. 03 (2012): 1-12. Web.

Emirates in the UAE 2013. Web.

International Business Publications. United Arab Emirates Business Law Handbook Strategic Information and Laws, Washington, DC: Int’l Business Publication, 2012. Print.

Jones, Jeremy. Negotiating Change: the New Politics of the Middle East, London: I.B. Tauris, 2007. Print.

Library of Congress – Federal Research Division. Country Profile: United Arab Emirates (UAE), Washington, DC: Library of Congress – Federal Research Division, 2007. Web.

Nyarko, Yaw. 2010. “The United Arab Emirates: Some Lessons in Economic Development.” UNU-WIDER Working Paper. 2010/11 (2010): 1-13. Web.

Schiliro, Daniele. “Diversification and development of the UAE’s Economy.” MPRA. 47089 (2013): 1-16. Web.

Sen, Sunanda. “International Trade Theory and Policy: A Review of the Literature.” Levy Economics Institute Working Paper. 635 (2010): 1-23. Web.

The Economy – Gross Domestic Product, GDP 2013. Web.