Introduction

Major reforms were introduced to the Companies Act in 2006 and the Companies Act 2006 has been christened as a ‘historic bit of legislation in U.K. The CA 2006 pursued the significant principle of preparing shareholders to be the chief controllers of behaviour of corporate rather than the government. A company is required to have adequate flexibility and freedom mainly to create wealth as they being managed for the advantageous of its members collectively. To achieve this objective, it was felt by the U.K government to restructure both the governance and corporate law so that it promotes and facilitate companies to frame internal controls and structures that would strengthen transparency and trust and direct to achieve better performance.

The CA 2006 preserves the primacy of the main goal of companies namely the maximisation of profits for the advantageous of the company shareholders. The CA 2006 has introduced new provisions in the act to safeguard the interest of the shareholders as a whole. Thus, under Part 10, s.172 of the CA 2006, directors have been imposed with a moral duty to work for the success of the company for the advantageous of the shareholders as a whole. (Sheikh 2008:3).

This section notifies that the director’s obligation to work for the success of the company for the benefit of its shareholders on its entirety and may not be for the advantageous of other constituents or stakeholders. This approach repudiates the “multiple approach” and peruses the “enlightened investor’s value “as recommended by CLR and Law Commissions. The main reason for this option is that the multiple approach thereby facilitating directors accountable for nobody, since there is no unambiguous benchmark for measuring their performance. Thus, s.172 gives prominence to long-run aspect rather than short-run aspect, approach in corporate decision making process under s.172 (1) (a). (Searly & Worthington 2007: 293).

Thus, this research essay looks into the various aspects of newly introduced s.172 of CA of 2006 and arrives at conclusion whether the director of the company has moral duty to shareholders only or to other stakeholders like employees, creditors, society and environment also.

Analysis

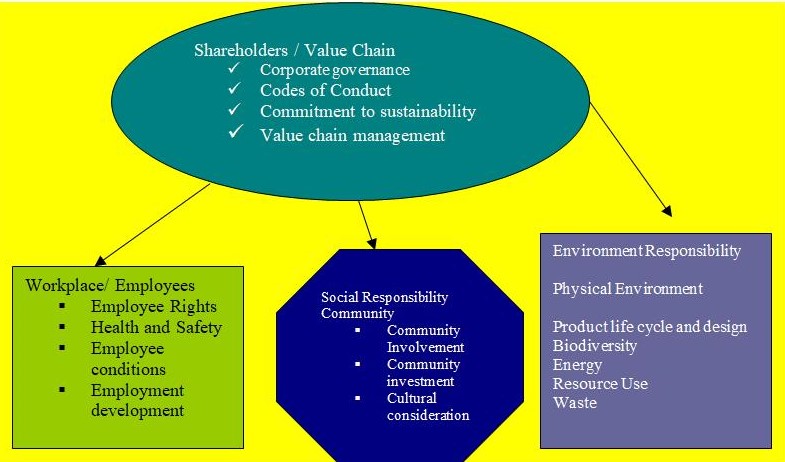

It is wrong to assume that maximisation of profit is not the sole goal of the companies. Rather, a company has a conscience and soul and is exercising its corporate social responsibility in society and carryout the philanthropic activities also. Other than its shareholders, it is caring for its suppliers, customers, environment and the wider community. Though, corporate’s sole objective is to maximise its shareholder’s wealth but it has to be more benevolent now.

Its directors are the custodians, trustees, guardians and gatekeepers for the probable claimants of the corporation. Thus, CA 2006 makes an arousing of social awareness in corporate directors. Thus, the section 172 (1) of the CA 2006 now demands directors to use their corporate social responsibilities towards groups larger than shareholders as it has made a “social law.”

Thus, the above section requires directors to have concern to the interests of other probable beneficiaries on the corporation including the employees. The company’s business association with customers, suppliers and others; the effect of corporation activities on environment and the community; the effect of desirability of the company maintaining an esteem of a high criterion of business ethics and the necessity to act fairly as between the members of the company.

Hence, directors have now social and legal duties to discharge their functions by a contemplation of those claims on the company. (Sheikh 2008:3).

Director’s duty to advance the victory of the company

Section 172 (1) of the CA 2006 demands a director of a company to function in a manner that it deems , in utmost good faith , would be likely to result in the successful growth of the company for the advantageous of its shareholders as a whole and in doing so have concern to the under mentioned.

- The probable outcomes of any decision in the long run under s.172 (1) (a) of the Companies Act.

- To take care of the concerns of the employees of the company under s.172 (1) (b) of the Companies Act.

- The necessity to promote business relationships of the company with customers, suppliers and others.

- The impact of the company’s functions on the environment and the community.

- The option of company maintaining a status for high standard of business conduct.

- The requirement to function fairly as between the shareholders of the company. (Sheikh 2008:395).

The responsibilities inflicted by s.172 of the CA 2006 will be applicable to any laws or rule of law demanding directors, in some scenarios, to deem or to act in the best interests of the creditors of the company.

Under the concept of “enlightened shareholder value “, the duty to encourage the success of the company systematises the present law fiduciary obligation obliged on a director. Thus, these obligations have two components namely a director must function in a style he deems it in good faith and would be mainly liable to work for the success of the company for the advantageous of the members as a whole.

Further, the director in achieving this goal, he must have more considerations among the other things to the elements explained in s 172 (3) of the CA 2006.

The conclusion as to what will accomplish success and what comprises such success, is one of the good faith judgment of the directors. In both the houses of English parliament, there was much heated argument as regards to what constitutes “success.” In HL debates of Grand committee which was made on 6 Feb 2006, Lord Freeman observed that directors of the successful company will achieve success to the shareholders also by taking into account of long-run gain and long-run popularity. (Sheikh 2008:395).

The predominance of the company is noteworthy. As a separate entity, if the interests of the company are in divergence with the member’s interests at its entirety or in any case some of them, it would seem that the interests of the company should be desired as laid down in Mutual Life Assurance Co of New York v Rank Organisation Ltd ([1985] BCLC 11, 21). (Searly & Worthington 2007: 293).

This makes certain that business decisions, for instance, tactics and strategies are for the directors and not subject to verdicts made by the courts, pertains to good faith. However, the phrase “good faith” is not defined any where but certainly a director’s intent and motive will be taken into consideration in evaluating this duty and the good faith of the director is likely to taken into consideration in circumstances of each case. Bad faith may be applicable where, for instance the director has functioned beyond his authority or fraudulently, illegally or where an indecent intent or improper is established and clinches a broad spectrum of such kind of conduct.

Moreover, s.172 of the CA 2006 requires that a director

- Must have functioned in utmost good faith;

- He might have made certain that his activities would most probably to encourage success of the company.

- It also demands that the accomplishment of the company must be “for the advantageous of its shareholders as a whole.”

It is to be noted that according to the aspects spelled out in s.172(1) of the CA 2006, the obligation to implement adequate diligence , skill and care as explained in s 174 of the CA 2006 have to be adhered.

S 172 of the CA 2006 continues to recognise six factors to which a director must have concern in concluding whether his actions would encourage the interests of the directors or not. It is spelled out clearly that in respect of every business decision made, the directors must have concern, among the other things, focus to the six factors. It is to be taken into account that the “six factors” are acquiescent to the overriding obligation of the directors to endorse the success of the company. (Sheikh 2008:397).

In Bartlett v Barclays Bank, it was observed by the court that it is the duty of the director to conduct the business as a trustee with an analogues care as an ordinary sensible man of business. Thus, the trustees should act equitably and fairly between various beneficiaries.

Moreover, the principles of corporate social responsibilities include various obligations including the preserving the environment and to practice “philanthropic principle. “ Thus, companies may offer donations to the local community to construct schools or drainage etc. Hence, the principle of ‘enlightened shareholder value is, hence, unfastened link to corporate social responsibilities.

In Re Forest of Dean Coal Mining Co, it was observed by the Court that directors are trustees or managing partners who manages the business not only benefit of themselves but also for the benefit of all other shareholders.

However, in Selangor United Rubber Estates Ltd v Cradock, the court opined that directors have business to manage and exercise functions in a business style and hence they are not trustees.

Further, since there are large numbers of case law on director’s powers and duties and hence, the court are now less prepared to compare the director’s obligations with that of trustees. (Sheikh 2008:401).

Members and Directors to finalise what ‘success” connotes

Business judgments and good faith of directors should be taken into considerations to encourage the success of the company. On company to company basis, success has to be measured. A success can be defined as long -term advantageous conferred on the members of the company. However , success has not explained to connote whether it denotes the increased dividend rates or enhanced market value of the shares or increase of net worth of the company substantially or whether it mean the some other achievements like stability and long-run growth of the company.

Success for the members at its entirety

For the member’s interest as a whole, the directors should make long-term decisions. It would be considered as infringement of duty to promote success of the company, if it is aimed at the promotion of section interest as laid down in Mills v Mills (60 CLR 150 (High Court of Australia)). Ainslie Mills , the Plaintiff and his uncle , Nelson Mills , the defendant were not only the largest shareholders of the family owned company but also the two directors of the company.

The Managing director, Neilson Mills owned the lion’s share of ordinary shares whereas Ainslie Mills mostly owned the preference shares. Majority of directors including the plaintiff passed a resolution by which the carried over profits were capitalised and issued as fully paid bonus shares to the ordinary shareholders of the company. Thus, this resolution largely strengthened the voting power of the ordinary shareholders which includes Neilson Mills, the managing director of the company and reduced the privileges of the preference shareholders to share in case there is a winding up proceedings. It is to be observed that had the bonus shares not issued, such accumulated profits might have distributed as dividends to the ordinary shareholders of the company.

Perhaps, this decision did not usurp upon the rights to dividend or either ordinary shareholders or preference shareholders. Lowe J observed that the majority of the directors had functioned with honesty in what they deemed to be in the best interest of the company. Though, the managing director did benefit from this resolution, it did not invalidate the actions of the directors and this verdict was upheld by the High Court.

In this case, Australian court held that if majority of directors had functioned faithfully in what they considered to be the best option for the company, though the single shareholder is going to be benefited by the majority of director’s decision, it did not vitiate it and the lower court’s view was upheld by the Australian High Court. (Searly & Worthington 2007: 290).

Subjective test: Directors to make decisions

In good faith, the directors of the company should make decision as to how to foster the success of the company for the advantageous of shareholders as a whole as laid down in Smith and Fawcett Ltd. In Howard Smith Ltd v Ampol Petroleum Ltd and in Regentcrest Plc v Cohen ([2001] 2 BCLC 80 ,105) , it was held that it was not the duty of the court to question whether the director’s decision was in the best interest of the company objectively or whether the director’s had the honest belief and whether it was a logical one or not. (Searly & Worthington 2007: 294).

As regards to particular factors

When read with s.170, s.172 (1) makes it obvious that the obligations obliged on directors are to take into account the concerns of persons other than the company. For instance, suppliers, employees, community, customers and however directors do not have any direct duty those persons. Hence, the directors are under obligation to the company alone. (s.170)

Conflicting Issues

Where there exists conflicting courses of action while considering the different factors, directors must initiate their own good faith business choices to foster the success of the company.

Failure to have concern to the particular issues

In case, where a director functions without perusing the kind of consideration as demanded by subs (1), a court is likely to conclude that the director was in infringement of his duty as laid down in Software (UK) Ltd v Fassihi. However, had the director have taken all steps for the success of the company, how would court would arrive its decision is not clearly spelled out. Since the Act is silent, the court may approach this by way of two following possible ways.

- As laid down in Charterbridge Corporation Ltd v Lloyds Bank Ltd , the director might have acted in bona fide and hence would come to a conclusion that there has been no infringement of his duty or

- A court may find that breach has caused no injury or harm (see Attorney-General, Lord Goldsmith, Hansard HL, 09/05/06, col 846).

- It may be relevant for the court to look into the subs (1) as it explains only some and not all of the issues deemed to be applicable to decisions arrived by the directors.

Is a director is to maintain a paper trial?

During the legislative process, apprehension were expressed that s.172 would demand directors to keep a ‘proper trial’ all business decisions made and there is possibility that lot of litigation may arise in future in this respect. However, the government refuted that intention of s 172 is not to introduce a “tick-box” culture where directors would be demanded to take into account each issue one by one. Thus, the section requires a director to arrive at good faith business judgments to advance the success of the company for the long-run benefit of its shareholders as a whole. If directors have acted within the parameters, they would not be held liable for a “process failure.”

Is s.172 will result in increased litigation?

One another criticism was that s.172 may result in increased litigation as it may fail to take in cognisance of specific factors. However, government was of the view that this was hyperbolised. Government is of the view that as long as if the directors have made business decisions with adequate skill, care and diligence, they are unlikely to be hold for infringement of their duty.

In the House of Common, at the committee level, it was observed that the class of probable litigants will be negligible as it will be frequent to recognise any loss and hence of risk of litigation would be negligent. Further, other common remedy is available in the CA like the removal of directors. Action under s 172 is possible only when there is a loss to the company. It is to be recalled here that an infringement of duty to promote the success of the company alone is unlikely to result in significant calculable financial loss. (Searly & Worthington 2007: 295).

Is it a defence or a duty?

In Welfab Engineers Ltd, ((1990) BCLC 833) it was held that where directors have made a good faith business decisions over employee’s interests for the short-run financial gain, for example, to advance the success of the company for the advantageous of its members as a whole, then such legitimate business decision cannot be confronted.

Likewise, directors cannot be forced to make business decisions according to broader interest of the environment and the community and they are safeguarded from criticism if they decided to do so.

Is s 172 makes it obligatory for directors to divulge misconduct?

In Item Software (UK) Ltd v Fassihi, it was held that a director who functions in infringement of his fiduciary duty is under a further obligation to divulge the breach to the company if such admission is demanded by the general equitable duty to act with upper most good faith in what the director thinks to the best interests of the company. Thus, any breach of duty may involve a further infringement in failing to disclose. Moreover, the further infringement may end in loss of employment benefits like share options, termination rights, pension benefits and may offer justification for summary dismissal as laid down in Tesco Stores Ltd Pook ([2003] EWHC 823 (Ch)).

Moreover, in British Midland Tool Ltd v Midland International Tooling Ltd([2003] EWHC 466 (Ch)), it was held that a director has an equitable duty to divulge the infringement of duty committed by fellow directors and if this is what the director, acting bona fide, thinks to be in the best interests of the company and the similarity with the statutory obligations in s 172 is more perceptible.

Is it the duty of the director to function in utmost good faith for the triumph of the company?

The obligation to function with good faith in the interest of the company includes the onus to divulge any delinquency by the director to the company. This concept has been clearly settled in Item Software (UK) Ltd v Fassihi ([2004] EWCA Civ 1244 , [2005] 2 BCLC 91 ( Court of Appeal)) case. In this case, the defendant was functioned both as director and an employee of the Item Software (IS) which is a distributor of Isograph products. IS tried to renegotiate with Isograph its distribution agreement with more favourable terms during November 1998. In the middle of the negotiation, the defendant Fassihi approached the Isograph with the plan of floating of a new company mainly to take over the distribution business from IS.

At the same, as a director of IS, he persuaded IS to adopt a tough stand as regards to negotiation of terms for the renewable of contract with the Isograph.

Due to tough stand perused by the IS, Isograph refused to accept the terms and as the result, the negotiation broke down. As the result, Fassihi new company got the distribution contract whereas the contract with IS was terminated by Isograph.

On knowing the double role played by the Fassihi , IS not only ousted him from the employment but also initiated legal proceedings against him as it tantamount to infringement of duty both as a director and employee of the company who has to function bona fide in the interest of IS. Fassihi also charged with the allegation that he failed to disclose his misconduct to the company.

In this case, Arden LJ observed that a director has a fiduciary duty and is accountable for the success of the business of the company. A director has to act in good faith and in the best interest of his company. This duty of devotion is the “time-honoured” rule as per verdict made by Goulding J in Mutual Life Insurance Co of New York v Rank Organisation Ltd ([1985] BCLC 11, 21). (Searly & Worthington 2007: 297).

Is a director owes any duty to Creditors of the company?

Under s 172(1) of CA 2006, a new duty is inflicted on directors of a company to work for the success of the company for the benefit of its shareholders as a whole and is dependent upon any rule or enactment of law demanding directors, in some cases, to believe or act in the interests of creditors of the company under s 172 (3).

In Winkworth v Edward Baron Development Co Ltd ([ 1986] 1 WLR 1512 [House of Lords]), Lord TEMPLEMAN observed that a company is having a duty to its creditors either current or future. A duty is due by the directors both to the creditors of the company and to the company to make sure that the business of the company are appropriately managed and that its asset is not squandered or misappropriated by the directors against the interest of the creditors. (Searly & Worthington 2007: 282).

Is a director owes any duty to Employees of the company?

S 172 (1) (b) now requires directors to take care of the interests of the company’s employees in general and the interests of its members as a whole. However, the wording of this section connotes that the interests of the employees should be preferred at the cost of the interest of the members. However, the directors are free to initiate business decisions that may be adverse to the employees but takes care of long-run profitability and the interests of the members.

Moreover, this debate can cut both ways: a business decision that is hated by shareholders or members or unfavourable to their interest may also be supported because in accomplishing it, the directors may take in to consideration of its impact on the company’s employees.

In Re Wetfab Engineers Ltd([1990] BCLC 833), it was alleged by the company’s liquidators that directors who were under insolvency, had inappropriately disposed the business of the company at a lower value. However , Hoffmann J held that directors were not liable since the deal was made to engage the company’s whole employees and work-in-progress whereas another offer though quoted higher price had rather disinclined to take the workforce or to continue the business and they were interested only the company’s freehold’s property. (Searly & Worthington 2007: 282).

Refusal of derivative claims under s 263

Section 263 lays out the criteria the courts must employ for granting its approval to shareholders to initiative derivative claims. Under section 263 (2), if a director acting in pursuance with s 172 i.e. the obligation to work for the triumph of the company would not seek to continue the claim. Thus, a member cannot proceed for initiating a derivative claim under section 263 if the director has acted in accordance with the section 172. (Searly & Worthington 2007: 538).

Barclays Bank Corporate Governance Report

Due to requirements under s.172 of CA 2006, Barclays Bank corporate governance report 2007 includes the following under the heading “The Board “. Under the sub-heading “Role of the Board “Barclays Bank Corporate governance report states that as per the requirement of Company Law of UK , directors must function in a way that they deem , in good faith would be nearly probable to advance the triumph of Barclays for the advantageous of the members as a whole. In executing the same, the Directors must have concern to the following among other issues:

- The long term effect of any likely outcome of the any decision of the board.

- Taking into the account of the interest of the employees of the Barclays Bank.

- The necessity to develop business relationships with the various stakeholders of the Bank like customers, suppliers and others.

- Barclays bank’s desirability to maintain a high standing for great metrics of business demeanour.

- The necessity to function fairly as between Barclays bank’s shareholders.

It is stated further that the board of Barclays is accountable to shareholders for fostering and yielding sustainable member value through the administration of the Barclays group’s business. Thus, Barclays bank strives to make sure that management maintains an opt balance between delivering short-run goals and promoting long-run growth of its business.

British Gas Sustainability Report 2008

Under Corporate Social Responsibility, British Gas in its sustainability report of 2008 remarked as follows:

- We made a positive contribution to the safeguard of the environment.

- We implemented internationally acknowledged best practices and went beyond the compliance with local environmental regulations.

- We minimised the possible barest level any negative impacts of our manufacturing operations on the environment.

- The Greenhouse gas (GHG) releases from our operations under BG’ Group’s umbrella fell by 0.5 million tones in 2008 alone.

Under “Society “heading, the following observations have been made by the British Gas in their CSR report of 2008.

- We attempt to make sure that our neighbouring societies are benefited from our presence on a continuing basis.

- We do pay attention to neighbouring societies and pay attention to their needs.

- Within area of our influence, we do support human rights in the neighbouring areas of the society where we operate.

Under “Our People” heading, the following observations have been made by the British Gas in their CSR report of 2008.

- We respect our employees with decency and fairness.

- We assist employees to foster their talents.

- We consider that all injuries to our employees are preventable and have introduced adequate safety measures.

- We offer safe, healthy and secure work atmospheres.

Corporate Social Responsibility: (CSR)

Conclusions

For the first time, s 172 of CA 2006 imposes some duties on directors of the company. While accomplishing their obligations to shareholders, this section demands that directors should give precedence to the interest of the shareholders, but while doing so, they have concern to the other elements like the interest of the local communities, their employees and safeguarding the environment. Though, this has been claimed by the NGO’s as great success to their efforts but this will have least impact on liabilities of MNC’s due to its vague standards and applications. (Eroglu 2008: 220).

The reorganisation of duties of director’s which has concluded in the new section 172 of the CA 2006 symbolises an obvious and welcome acknowledgement that the significance of a company shareholders cannot be permitted to success over the interest of other stakeholders in the company.

In other words, the director’s duty to success of the business and for the betterment of the shareholder’s interest as a whole can be achieved only with the accomplishing the duties to employees, society and to the environment. Thus, shareholder’s interest and corporate social responsibility are the two sides of the coin and cannot exist individually.

List of References

- Barclays Bank. (2007). Corporate Governance. Web.

- British Gas. (2008) Corporate Social Report. Web.

- Clarke Thomas. (2007). International Corporate Governance. London: Routledge.

- Eroglu Muzaffer. (2008). Multinational Enterprises and Tort Liabilities. London: Edward Elgar Publishing.

- Searly L & Worthington Sarah. (2007). Cases and Materials in Company Law. Oxford: Oxford University Press.

- Sheikh Saleem. (2008). A Guide to the Companies Act. London: Taylor & Francis.