Introduction

The global business environment is dynamic with globalization and technological changes affecting many businesses. Because of these changes, it is necessary that firms establish the best strategies that can sustain their future objectives rather than make them quit the market.

Following these challenges, firms have increased competitiveness using strategic planning with the management establishing existing business conditions in the business environment that are used to establish the best strategies that can increase the competitiveness of the firm after their implementation.

The national bank of Ras al-Khaimah is called RAK Bank. As a joint public company for stocks, the Bank offers such services to the citizens of the United Arab Emirates. It has about 7.1 billion dollars total assets and is one of the most competitive banks in the Unites Arabs Emirates.

The government owns about 53 percent of the shares in the bank. Top officials of the bank come from the prominent Emirati families in the United Arabs Emirates. It provides its services to corporate bodies, small businesses, and retailers. It was classified as the best bank in the United Arabs Emirates in 2012. The bank has a high return on the assets. It has a hundred percent output for the input it makes in business.

This paper will focus on this bank with the aim of coming with a comprehensive Organizational Report that highlights major aspects of the bank and the industry. These include organizational structure, competitive nature of the organization, its competencies, among others (Laudon, 2009).

Objectives of the study

This study aims to:

- Find out the organizational dimension of Ras al-Khaimah Bank,

- Establish the efficiency of the organizational structure of the bank,

- Discuss the Bank’s strengths, weaknesses, opportunities, and threats, and

- Compare the different aspects of the industry to the bank’s performance.

Importance of the Study

The findings of this study will be important to the Managers of UAE banks in the formulation of both their corporate and operations strategies. Application of the findings will be helpful to these banks to compete from an informed point of view. The information obtained also shed light on the most appropriate model in the formulation and implementation of the most competitive operations strategy in the UAE Banking sector.

Customers will benefit as their needs and expectations will be met in the products that the banks offer them, which contribute to greater customer satisfaction. It will also help researchers and academicians in the advancement of the theory and empirical evidence in banking strategy. In addition to this, the study findings will apply in the general service industry (Reimann, 2010).

Reviewing the effects of fraud cases is crucial in determining the status of the efficiency of financial Population of a country, region, or continent may play a great role in the performance of financial institutions. This is significant if the population contribute to increased economic activities within the respective region.

The population of the United Arab Emirates has been increasing over the past years, and the trend is most likely to continue considering the past increase. Furthermore, the expected population in the future will also be determined to forecast on the likely effects on financial institutions efficiency.

The influence of population growth on economic activities will also be studied because economic activities influence the efficiency and performance of financial institutions, especially lending institutions (Khalid, 2010).

Methodology

This paper will be largely analytical in nature. While focusing on primary information from the company’s website, the paper will also analyze and focus on the analysis of secondary data. This data will encompass the whole banking industry in the UAE in comparison to the RAK Bank’s performance over the years. Using this information, the researcher will make conclusions regarding the various organizational aspects of the bank.

Collection of Data

The paper will largely depend on secondary data to make conclusions. It will also depend on expert analysis and other industry pundits. The researcher will also look into the future to determine the performance of the bank about other banks and in comparison to previous periods.

Findings of the Study

Organizational Structure

For any successful organization, the five pillars (dimensions) of organizational structure has to be set, defined, and finally made operational. These five dimensions of organizational structure include specialization, standardization, centralization, and finally configuration.

From examining how the dimensions of a given organizational structure have been put in place, the efficiency of a company can be easily determined. Large organizations such as RAK Bank need to have an organizations structure, which consists of the above-connoted activities. For maximum productivity, the organizational dimensions have to be blended in such a way that they facilitate optimum production.

Organizational structure is determined by several factors. These factors include but not limited to, technology, size, and environment. These factors determine the organizational structure by imposing economic or other types of constraints on the given organization and thus force the organization to choose certain structures over others. These dimensional factors are unique in such a way that they are independent of each other.

Moreover, the organizational structures are more bureaucratic in one characteristic and less bureaucratic in other characteristics. At RAK Bank, the structures are such that there is flexibility in decision-making. Hence, the organizational structure is hugely horizontal or flat after the CEO who makes strategic decisions (Kettell, 2010).

Specialization refers to the process of division of labor within the given organization. Additionally, specialization entails distributing duties among a number of positions. With standardization, the organization’s employees make the organization to progress efficiently while at the same time giving independence to the employees, though depended on each other with some degree.

In this form of dimension, employees in the upper apex are accountable and responsible for the entire organization. The different divisions of the company become an autonomous unit since the middle line of management has control, thus the organization adopts a divisional management structure. This type of dimension is characterized by many self-independent sufficient units but is coordinated at the central headquarters.

SWOT Analysis-Strengths and Opportunities

The bank’s competence can be accounted for various factors within its structure. Firstly, the bank has a wide network within the United Arabs Emirates. It has about thirty-three branches in the federation. This enables the bank to reach many clients in its system and get higher returns.

The high number of customers enables the bank to compete with the other banks favorably. As a result, the output is very high and the income rates are economically viable (Kenny, 2009).

RAK bank uses technology for operations and advertisement. This approach is a competitive strategy that helps them to gain popularity and attract the attention of investors in the company. It has integrated into almost every technology that is useful to the customer in its operation. For example, the bank uses online banking, mobile banking, and phone banking.

The integration of the various forms of the technology enables the bank to serve the clients in an easy manner. Customer’s satisfaction encourages them to carry out transactions in RAK bank. This has been an important pillar to the prosperity of the bank. In addition to technology, it adopts the recent modes of payment and saving.

Therefore, they use credit cards, Debit cards, and prepaid cards. Moreover, the bank advertises itself through Facebook, Twitter, YouTube, and Google Maps. The wide inclusion of technology helps it to become competitive and solvent than most banks in the UAE (Kenny, 2009).

The bank has incorporated various forms of businesses in its services. For example, it offers insurance services to its customers. When the bank offers services that are related to banking, they have an advantage over other banks.

This is because the client prefers getting the services simultaneously into funding for the services in a separate place. This is the principle of diversification. The principle asserts that a diversified business is self-insured. It makes a self-insurance against low business periods and maintains it solvency (Hassan Al-Tamimi, 2007).

Another crucial source of its competence is the marketing approach they use. They assert that the advertising messages should follow the four Cs rule. The rule asserts that the messages should confident, combative, clear, and cheeky. It advertises itself by maintaining a firm economic stand during economic downturns and depression (Kenny, 2009). This stand induces the clients’ confidence and encourages investment.

In its advertising structure, it uses prominent products and events to convince people to use their services. For example, the bank encourages clients to buy jewelry during valentine using the credit card. This captures the interest of the clients and promotes a business (Laudon, 2009).

The banks participate in social events that help it to advertise itself. The events include environmental initiatives, providing educational support to the citizens and other events. This approach helps in creating a good reputation in the community (Kettell, 2010).

SWOT Analysis-Weaknesses and Threats

Money laundering is a factor that affects the efficiency of financial institutions and organizations around the globe. The United Arab Emirates attracts several investors due to the potential of investments in the region. Although the United Arab Emirates attract several investors, it is still prone to money laundering activities.

According to the data obtained during the research process, developed countries are more prone to money laundering activities that developing states. This is due to the expectation of high returns and the number of finances circulating is developed economies. The economic activities of the United Arab Emirates have been increasing over the years.

Furthermore, the reported cases of money laundering have been increasing in the state (Hassan Al-Tamimi, 2007). The money laundering cases have been on the rise over the years and intensity increasing consistently. According to the collected data, the number of money laundering cases was rated at 5.27.

However, this increased two times in the successive financial year and three times, four times and five times in successive financial years (Hassan Al-Tamimi, 2007). Financial institutions are prone to fraud. Fraudulent activities may affect the functions and efficiency in the operation of most financial institutions.

According to the data collected during the research, it was observed that several fraud cases are pending among financial institutions in the United Arab Emirates. It is also evident that 2007 was the year that the country registered the highest number of fraud cases due to the increased economic activities and speculated returns in most ventures in the country.

Furthermore, most of the fraud cases were not solved, which affected the efficiency or performance of financial institutions that were involved or affected. Thousands of fraudulent cases among financial institutions were reported in 2007, and 2,732 were not solved and recorded as pending. The number of fraud cases among financial institutions decreased in 2008 compared to 2007 because only 2364 cases were recorded as pending, while others were solved.

Furthermore, in 2009, 2031 cases were pending, 1887 pending in 2010 and 1719 pending in 2011. Considering the trend that the market has recorded over the past years, especially between 2007 and 2011, the pending fraud cases have been decreasing, which is an indicator that efficiency has been improving (Hassan Al-Tamimi & Amin, 2007).

According to the obtained data during the research, the number of pending cases is expected to decrease even in the future as it has been decreasing over the years, especially between 2007 and 2011. This has affected the efficiency of financial institutions in the United Arab Emirates too. The trend clearly revealed that efficiency of financial institutions in the United Arab Emirates increased with decreased pending fraud cases. Moreover, the decrease in the number of pending fraud cases was consistent and significant (Hassan Al-Tamimi & Amin, 2007).

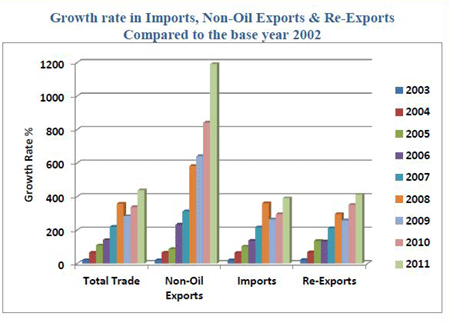

A diagram illustrating the amount of exports and imports of the United Arab Emirates between 2003 and 2011

Porter’s 5 Forces Analysis

Threat of New Entrants

The economies of scale current players are experiencing, the level of product differentiation, and the capital required to begin operations in the industry determine this force. The UAE Banking industry has relatively high barriers of entry. Large banks already experience huge economies of scale because of widespread operations and have the advantage of experience.

Threat of Substitute Products

Substitute products serve almost a similar purpose as the industry product but may not be in the same product line. There are few substitutes for banking in the UAE. The major alternative for banking is use of other microfinance institutions. With the economic downturn, consumers have been unable to use as many bank products as they used to (Chow, 2005).

Bargaining Power of Buyers

The power of buyers is low. There are very many buyers and the market is fragmented. Bank services buyers seldom make collective purchase decisions in order to minimize costs. Usually, individual buyers decide what products to buy and from which bank. Corporate buyers have slightly higher power but they are rare. Banking is a critical commodity. This gives the supplier an upper hand and reduces the buyer’s bargaining power.

Bargaining Power of Suppliers

The bargaining power of suppliers is high if there are few suppliers and many buyers and if the product supplied is critical to the buyer’s business. In the UAE banking industry, there are many independent banks. Hence, the bargaining power of a bank such as RAK is relatively low (Berger, 1997).

Competitive Rivalry within the Industry

This is the strongest force in operation within the UAE banking industry. There are few dominant banks fighting to maintain their market shares. The smaller banks are competing in market growth. Companies have employed extensive product differentiation to crowd out competition.

They have also invested heavily in research and development. They compete on first mover advantage and innovation. Those who manage to innovate, charge competitive charges on their products. High competitive rivalry reduces an industry’s profit potential (Hassan Al-Tamimi & Amin, 2007).

Industry Comparison (Competition Aspects)

The table lists some of the banks in UAE and compares the various measures of competitiveness among them.

The results obtained from the study clearly indicate that the amount of input determined the amount of output and efficiency of financial institutions in the United Arab Emirates. According to the results obtained from the research, it is evident that most efficient financial institutions in the United Arab Emirates invested large amounts of input in their operations to accumulate maximum or desired output.

Furthermore, the most efficient financial institution in the United Arab Emirates was RAK Bank because its efficiency was rated at 1 as opposed to other financial institutions whose efficiency rating was relatively lower. Furthermore, the research clearly illustrated that the output/input ratio determined and influenced the relative efficiency of financial organizations or institutions in the United Arab Emirates.

Generally, organizations or institutions with higher output/input ratio had the highest relative efficiency rate. RAK Bank had the highest output/input ratio at 0.797192103, while Sharjah Islamic Bank had an output/input ratio of 0.465227336, and was considered the least efficient financial institution in the United Arab Emirates (Hassan Al-Tamimi & Amin, 2007).

References

Berger, L. (1997). The Efficiency of Bank Branches. Journal of Monetary Economics, 40.1: 141-162.

Chow, S. (2005). The Effects of Management. Accounting, Organizations & Society, 7.1: 209-226.

Hassan Al-Tamimi, H. & Amin, L. (2007). Evaluating the operational and profitability efficiency of a UAE-based commercial bank. Journal of Financial Services Marketing, 11.4: 333-348.

Hassan Al-Tamimi, H. (2007). Factors Influencing Performance of the UAE Islamic and Conventional National Banks. Global Journal of Business Research, 4.2: 10-19.

Kenny, G. (2009). Diversification Strategy How to Grow a Business by Diversifying Successfully. London: Kogan Page.

Kettell, B. (2010). Frequently Asked Questions in Islamic Finance. Hoboken, N.J.: Wiley.

Laudon, T. (2009). E-Commerce: Business, Technology, Society. Upper Saddle River, N.J.: Pearson Prentice Hall.

Reimann, C. (2010). Dimensions of Structure in Effective Organizations: Some Empirical Evidence. London: Wiley.