Tiptop computers’ limited is a private limited company that deals with manufacturing and repairing of computers. Tiptop computer limited has the capacity to accept orders from other manufacturing companies or from individual persons, as it has a well skilled labor force, which is not fully utilized for future expansion, modern machines and high technology capacity.

Before committing to accept any given order, various issues have to be looked at and serious decisions must be made. For instance, the company has been awarded an order to manufacture and assemble 100,000 units of a special type of printers called ‘power boost printer’ which should be delivered in a period of seven months.

Before the management made the final decision, either to take or refuse the order, it has to evaluate various financial factors such as the direct wages, supervision expenses, overhead cost which includes machine and general expenses, machine depreciation cost, materials cost among other expenses.

For the printers to be made and completed on time various services should be provided. Services such as labor, machine hours, raw materials, time and space should be provided. Whether the contract is adopted or not, some factors will still have to be maintained and paid for.

As there is no need to purchase new machine in order to perform the contract, labor and machine cost remains as non-relevant costs as they will not affect the decision made, this is because they will not increase the cost of running the company in any way. Cost of purchasing raw materials and opportunity cost will be relevant cost; this is because for the company to produce the printers, it has to incur the cost of purchasing materials needed.

The amount of money that will be lost due to diverting the resources from the main course of manufacturing computers to manufacturing printers should be calculated as relevant cost. It’s estimated that the raw material will cost the company a total of $ 800,000, if the company decides to maintain its course without making a decision to adopt the contract this money could not have been spent.

Opportunity cost being the cost incurred due to decision made by the company to adopt a contract, become the relevant cost, if the company made a choice of not accepting the contract. Time spent in manufacturing the printers could be spent in manufacturing of computers, which is the main function of this company.

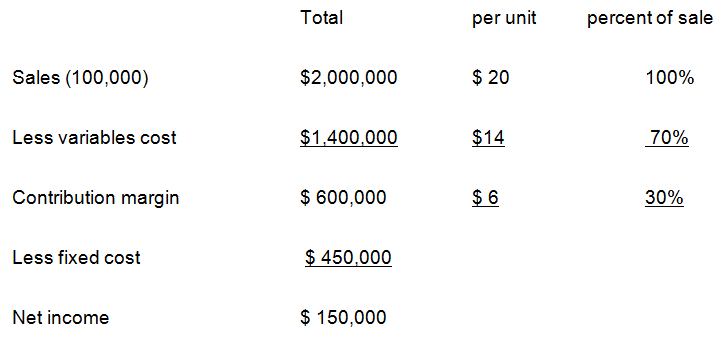

The decision made is based on the revenue expected from the sale of these printers. Each printer is expected to be sold at $20 after being assembled. The sale is estimated to produce the revenue as follows;

Contribution margin ratio of the company is calculated as follows

Cm = ($ 600,000/ $ 2,000,000) × 100 = 30%

From the above calculations, it shows that the company will make a profit of 30% if the order is accepted. Thus, the decision should be made to accept the contract as it proves to be viable, from the marginal contribution.

References

Jae, K. S., & Joel, G. S. (2008).Schaum’s Outline of Theory and Problems of Managerial Accounting. New York: McGraw-Hill.

Siegel, J. G. & Shim, J. K. (2006). Accounting handbook. 4th Edition. New York: Barron’s.

Colin, D. (2009). Management and cost accounting. Upper Saddle River: Cengage.

Agriculture and Consumer Protection (ND). Relevant Costs for Decision Making. Agriculture and Consumer Protection. Web.

Jay, B. (2004). Relevant costs for decision-making. Web.