Retirement is a crucial stage of life. Nobody would want to be without funds after retirement. It is therefore important to invest towards retirement in such a way that returns are maximized and loses/risks are kept at minimal (Bodie, Kane & Marcus, 2010). Investment for retirement begins with defining what one needs at retirement. The savings needed for an individual to attain what is needed at retirements are affected by a number of factors. These include the risks that an individual is willing to undertake, an individual’s flexibility, and an individual’s approach to investment. A retirement investment calculator should take into consideration different security mixes based on the aforementioned facts to come with the best mix that will help an individual attain his/her desired goal.

Investment Strategies/Mechanics

Successful investment mixes take into consideration existing investment securities with respect to investment mechanics to come up with appropriate investment options within a portfolio. Various dynamic models of finance are important in portfolio management. Investment portfolios take into consideration cash flows originating from asset/operational investments, invested assets produced income, invested assets sub-classes, tax calculation and investment securities. Existing retirement investment options include IRA, Roth IRA and 401(k). Traditional IRA works on a basic principle of tax deferment. Money remains untaxed as long as it is in account. Based on this technique, the investor works on the assumption that the account will experience positive growth with time and what would otherwise have been lost to tax will be retained by the investor. Basically though, this retirement savings plans come with a lot of restrictions. For instance its major disadvantage is a stiff penalty in case of cash withdrawal before one attains age 59.5 years. Different IRA’s are available and each presents individual tax implications and requirements for one to be eligible.

Traditionally, savings made under the IRA account are subject to tax deductions. An individual’s taxable income is lowered. Tax breaks are offered by the government on expectations that more taxable income will be available in future. The saved amount therefore grows with tax imposed on it deferred (Almagro & Gbezzi, 2003). Interests, dividends and capital gains are not included in an individual’s annual income for taxation purposes. The amount accumulated becomes taxable upon withdrawal. It is important to note that this method lacks flexibility in time plan changes and in case of plan changes, stiffer penalties that would compromise set target are levied (Almagro & Gbezzi, 2003). 401(k) on the other hand takes a reverse approach. Money is taxed as it is earned (Almagro & Gbezzi, 2003). Withdrawals after 59.5 years is attained are not subjected to taxation as is the case in IRA. Often this method is attractive to the government. This method unlike IRA is more flexible as an investor can use the money as when need arises. Additionally, changes can be easily made to an investment plan if it is not meeting its target without fear of increased penalties.

Asset Allocation, Risks and Returns

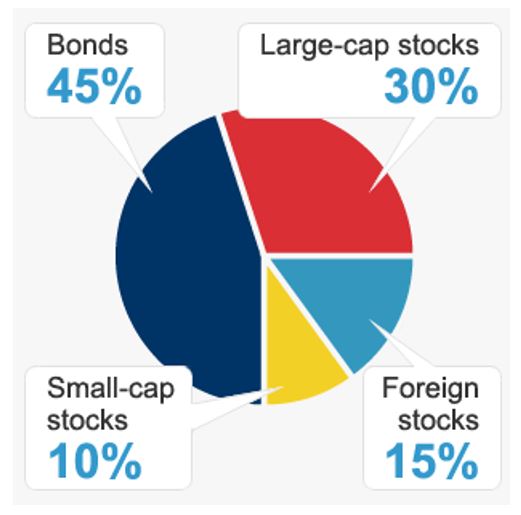

In consideration of existing risks and my investment target, the asset allocation shown below is chosen. Justifications for its choice and risk versus reward features that facilitate the investment mix choices are discussed thereafter.

Investment options vary across the markets. They may be in form of cash, debt securities, stocks, mutual funds, derivatives, or as commodities. Investment securities are often engineered in such ways that they take into considerations factors which influence investment decisions (Sullivan & Steven, 2003). Such investments carry little interest and are vulnerable to increased risks during inflation periods. Debt securities on the other hand, offer fixed periodic payments as its returns and at maturity offer capital appreciation. This type of investment is much safer and poses minimal risks as compared to equities. Stock buying as an investment includes sharing of profits accrued by the corporate. They more risky and volatile compared to bonds (Jeffrey, Douglas & Stephen, 2009). As seen each investment options presents its own unique set of risks and hence an individual approach to investment is a necessary tool in determination of which investment approach best suits an individual. Investment securities include mutual funds, bonds, stocks and derivatives. Bonds refer to loan types or debt security over a specified time where the issuer gives interest at an earlier predetermined rate (Jeffrey, Douglas & Stephen, 2009). Payment of principle amount is done at later dates often referred to as the date of maturity. Bond issuers have the option of paying interest at specified intervals or as a lump-some payable at maturity. They generate fixed income treated as interest. The common bond issuing technique is underwriting. Some of the commonly issued bonds include treasury bonds, high yield bonds, sinking bond funds and participating bonds among others (Kevin, 2008). They bear minimal risks to investment.

Stocks are classified as either common or preferred. Majority stock issuance is done in this form. Common shareholders are not entitled to any payments in case of a company’s bankruptcy until such time that all creditors, holders of bonds and the preferred shareholders are paid (Kevin, 2008). On the other hand, the preferred stocks are to an extent representative of the company’s ownership though they do not come with equal voting rights as the case of common shareholders. Additionally, the holders are guaranteed of fixed dividend issuances forever. The holders are also paid off prior to payment of common shareholders in case of liquidation. However the shares are callable and the company may at any one time choose to purchase them for a given reason. This makes this option significantly an uncertain investment option. Mutual funds draw money from a number of investors and invest the same into investment securities earlier discussed (Brennan &Subramanian, 2002). The funds manager trades the investment in compliance with the objective for which it was formed. In the case of mutual funds, risk are distributed across a number of investors and hence the burden in case of the venture suffering a given risk.

Plan rationale

The chosen investment plan is founded on a number of factors. These include the investment time frame, i.e. the period of time for which the investment is expected to mature, the risk tolerance that I intend to take, my flexibility to investment, and caution t possible losses. Bonds are given a major percentage because of their future assurance and limited exposure to risks. They offer the best alternative for long-term investment as the principle sum is paid at later date when appropriate thus availing retirement cash. Stocks offer quick returns and cater for the time limits necessary to attain the set objective. Small cap stocks and foreign stocks offer more quick returns that cater for minimal time limit. The same is true for foreign stock. Large stock bear some level of risk but also offers quick returns that speed up attainment of the goal. In general the mix takes into consideration the aspects earlier described.

References

Almagro, M. & Gbezzi, T. L. (2003). Federal Income Taxes. PCAS, 75(2), p 95-162.

Bodie, Z., Kane, A. & Marcus, A. (2010). Essentials of investments: 2011 custom edition (8th ed.). Boston, MA: McGraw Hill.

Brennan, M. & Subramanian, J. A. (2002). Investment Analysis and Price Formation in Securities Markets. Journal of Financial Economics, 38 (11), p 432 – 298.

Jeffrey, H. B., Douglas, K. C. & Stephen, R. F. (2009). Trading Volume and Stock Investments, Financial Analysts Journal, 65(2), p 67.

Kevin, A. H. (2008). Investment Options. Journal of Investment and Trade Development, 4(3), p 56 -59.

Sullivan, A. & Steven, M. S. (2003). Economics: Principles in action. Upper Saddle River, New Jersey: Pearson Prentice Hall, p 271.