Business Strategy of M&S in Ireland

Nowadays, M&S is known as a household name in the realm of the apparel and, recently, food industry. However, the market environment has not always been just as auspicious for M&S as it currently is. Quite the contrary, the organization faced a significant crisis recently due to a string of bad decisions made as early as 2001 (Mellahi, Jackson & Sparks 2002). Having failed at several critical steps in the development of its business strategy, the organization could not retain its customers, not to mention attracting new ones, and, therefore, found itself in a deep crisis (Molinero, Bishop & Turner 2005).

By failing to isolate the factors that affected its performance in the Irish market, M&S created a vortex of bad decisions into which it ultimately fell, only having revived its business after reconsidering its business strategy toward product diversification, customer relationships, and thorough market analysis.

Strategic Analysis and Positioning

Table 1. SWOT Analysis.

According to the SWOT assessment performed above, M&S’s performance was faltering in 2001. The organization could not determine its strategic direction, which resulted in the mismanagement of its financial decisions and a range of poorly thought-out choices that inevitably led to a crisis within the company. M&S had obvious strengths, including a very impressive presence developed in the Irish market, as well as the focus on diversifying its production line (Scott & Walker 2017). However, the company’s strategy toward the management of the challenges associated with the new market, as well as its approach toward handling the difficulties observed in the Irish economy, appeared to be entirely backward.

The refusal to consider other channels except for British suppliers for its clothes has also played a notorious role in the company’s downward progression in the Irish market. While maintaining collaboration with the British partners would help in producing exquisite clothes by M&S’s traditional performance standards, the necessity to invest in product diversification and the development of the firm’s food sector made it quite difficult to maintain the established extent of quality given the demands of British suppliers (Shapira 2017). Outsourcing would have been a better option, yet it would have meant a drop in the quality of clothes, which M&S could not afford without an appropriate rebranding strategy, which the organization neglected to conduct.

The absence of a business strategy that would have helped the organization to become instantly recognizable and gain the trust and support of new customers is the main contributor to M&S’s failure in Ireland. Having to split between the promotion of its clothing as a part of its traditional routine and the marketing of its food products, M&S could not get the amount of attention that it needed to establish itself as a recognizable brand (Soltani-Fesaghandis & Pooya 2018). As a result, an immediate failure ensued.

When dissecting the exact factors that led to M&S’s demise in Ireland, one should name not only the inability to market its products adequately but also the misunderstanding of what would have made the promotion process successful. The absence of any preparedness toward the challenges that the digital market suggested entailed a string of disappointments for the company, making a lot f its target audience neglect its offers. As a result, M&S, which was supposed to become a memorable and recognizable brand, remained in obscurity.

Table 2. Porter’s 5 Forces Analysis.

The results of Porter’s 5 Forces analysis show clearly that M&S was not ready to expand its business. Therefore, while the organization’s intent to diversify products was quite reasonable, the lack of market analysis and the assessment of customers’ demands, as well as previously made financial decisions that did not reflect well on the company’s performance, led to M&S’s hasty retreat from the European economic environment.

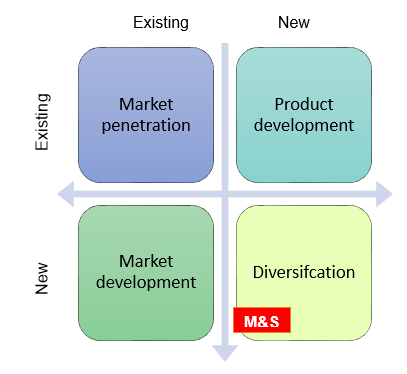

As the Ansoff Matrix (see Fig. 1 above) shows, the organization attempted at entering an entirely new market environment with the products that it has already developed for its home market, which is a reasonable choice in case a firm is willing to reduce risks.

By focusing on diversification and yet neglecting the research of its target market, M&S Ireland failed to establish a presence in its new setting and, thus, suffered a severe blow to its popularity, financial capacity, and overall reputation that it used to enjoy before the 2001 catastrophe. In 2001, the organization announced that it was going to shut down a range of its outlets in most of the European market, including the United Kingdom, France, Germany, Belgium, Spain, and several other countries (Toms & Zhang 2016). The observed situation became particularly prominent in the Irish market, where M&S had to cease all of its activities to retain some of its financial assets and reduce the expected losses and the damage to its reputation to a minimum.

What M&S Ireland Did After 2001 to Create / Renew Sustainable Competitive Advantage for the Organisation

2001 has been particularly difficult for M&S Ireland, with the company’s reputation having been soured significantly after several noticeable blunders. The company made a string of bad decisions that caused it to close the majority of its shops across Europe and face a very real threat of closing the business down entirely (Osborn 2001). Looking back at the 2001 catastrophe, one will realize that the marketing failure and the losses that M&S sustained did not occur overnight; quite the contrary, the rapid downfall of the organization in Europe was predetermined in 1998 when M&S made the life-changing decision to foray into the U.S. economy (Osborn 2001).

To address the embarrassment that M&S faced in 1998-2001, the company had to revisit its business strategy entirely and set the course for a different approach toward marketing, customer segmentation, and brand development.

The decision to shift from the traditionally rigid principles of managing its internal processes defined by the British culture and standards, in turn, was one of the core changes within M&S’s business strategy that allowed the company to move away from its 2001 failure. After the unsuccessful attempt to establish a presence in the European markets with the marketing model intact, the organization decided to consider making its production line more diverse. Specifically, further development of Per Una, a new clothing brand that would help the firm to attract the attention and support of new and younger audiences, made future revival possible (Eley 2019). Therefore, the shift from the stale traditions and the attempt at bringing innovative solutions into the company worked quite well for M&S.

To make its competitive advantage sustainable, M&S began to increase the extent of product differentiation as a means of increasing its sales and, therefore, its profit margins. The described approach seems to be the direct response to the limitations of the digital economy, which does not have the exact equivalent of the strategy of increasing the number of online outlets, as M&S used to do when it operated primarily in the offline context. Therefore, the company’s current approach seems to be based on maximizing value at all costs, which is why M&S may seem indiscriminate regarding the strategies that it chooses to increase its revenue.

Although the observed trend in M&S’s range of strategic approaches toward managing the business is quite expected, it still comes off as rather desperate. Therefore, altering the specified framework slightly may have a positive effect on M&S’s performance. The redesign of the company’s cost management approach will help to reduce the economic shock that it experienced on the described time slot and encourage M&S to accept change as a part of its business strategy.

Evaluating M&S Using SWOT and Porter’s Five Forces

Current Situation

Admittedly, the actions taken by M&S have been quite successful so far, with the company has recovered from its recent failure in the 2000s and restoring faith in its services among its customers. However, the company has been struggling in its attempt at expanding and catering to a wider range of people from other backgrounds. Therefore, the incorporation of the tools that would help the firm to implement better customer segmentation and product differentiation strategies is currently required. As a result, M&S will develop the competitive advantage that will help it to market its products more effectively and gain a much stronger position in the Irish market, as well as enter the global economic setting.

Being prolific in the apparel and retail industry is quite a challenging task given the range of competition, the complexity of the supply chain that one has to establish in it, and the multiple quality standards that an organization has to uphold to gain traction within the global community. However, M&S has managed to gain both an impressive reputation and a range of devoted customers despite its unexpected dive in revenues and overall performance in late 2018 – early 2019 (Force 2019). Although the organization showed a tremendous decline in its performance and revenue on the specified time slot, it managed to revisit its corporate strategy by making a complete turnaround in its corporate strategy and revisiting its approach toward product branding.

Strategic Analysis and Positioning

Table 1. SWOT Analysis.

As far as the weaknesses are concerned, addressing them will require revisiting the presently applied framework for managing the company’s supply chain, specifically, the manufacturing process. Currently, the use of manual labor has been the main source of the observed rapid increase in the extent of costs suffered by the company (Grębosz-Krawczyk & Siuda 2019). However, reducing the amount of manual labor and transitioning to a new model of production that involves automation may cause M&S its trademark quality and the distinguished look that its products have. The specified concern is related mainly to the clothes that the organization produces since the specified items are typically positioned as luxury brands and marketed to the target audiences as such to capitalize on the luxury trend (Kumagai & Nagasawa 2016).

Table 2. Porter’s 5 Forces Analysis.

The current extent of the company’s performance has been moderately effective, with M&S’s business strategy representing a significant improvement compared to the crisis suffered by the organization in 2007 (Toms & Zhang 2016). However, the current level of competition in the market coupled with the fact that M&S fails to attract a very large segment of the possible target population leads to the realization that M&S may need to update its current marketing approach. Introducing diversification and encompassing other market segments, the organization will be able to attain even greater success.

Table 3. Strategic Planning.

The mission and vision of M&S in 2019 are strikingly different from those of the 2000s, mostly due to the decision to use a new business strategy. Currently, M&S targets to increase its sustainability and introduce environmentalism into the set of its functions (Calu et al., 2016). The trend that M&S has been pursuing is quite lucrative due to the opportunity to attract the attention of Millennials (Kumagai & Nagasawa 2016). Moreover, the change in the firm’s values will allow M&S to introduce a more ethically sound approach toward its production processes.

However, even the current rendition of the company’s mission, vision, values, and objectives could use improvements. Presently, the company lacks a sustainable approach toward financial management that would allow for a cost-efficient framework. The specified change would lead to better marketing due to the availability of a greater range of tools and strategies for introducing M&S’s new products into the target environment.

Moreover, the fact that M&S has been omitting several segments of potential customers due to its current focus on luxury items and the unwillingness to transfer to the marketing approach that would attract the attention of younger audiences shows that the company could use a massive change. Therefore, the focus on developing the marketing strategies that would allow M&S to grab younger audiences’ attention should become the main vector of the firm’s development.

In its turn, the lack of a clear competitive advantage that would help M&S to be seen as superior when compared to cheaper alternatives is quite noticeable. M&S needs to introduce a new competitive element into its marketing equation to garner success among the younger crowd, which is why the existing vision and mission of the organization will require further shaping. Along with the focus on expansion and the marketing strategy, the company should also consider implementing the financial framework that would help it manage its resources more sparingly. Thus, the firm will maintain its status, also exploring the opportunities with attracting younger audiences.

Further Strategic Chances

Given the current situation at M&S, one might recommend the company to revisit its marketing technique to target younger audiences and appeal to other segments apart from the current one. While being quite lucrative, the current marketing strategy exempts a vast variety of buyers from its equation, which suggests that M&S loses a range of opportunities in its selected market. The company needs to learn from past mistakes and avoid investing in the idea that has worn out its welcome a decade ago. Instead, M&S will need to learn to consider future trends and make comparatively accurate forecasts regarding shifts in the demands within the target market.

Admittedly, the idea of product diversification has been a breeze of fresh air for M&S since it has helped to refocus the organization’s framework for operating in the global market. Moreover, the foray into the industry of supermarkets and grocery stores has helped the company to create new ties with a different segment of customers, thus establishing itself as a company that caters to the needs of different types of buyers (Kumagai & Nagasawa 2016).

Moreover, the company is clearly in need of an innovation-based business strategy that will make the process of introducing change into its setting comparatively effortless. Although M&S has updated its business strategy to refrain from the traditionalist approach that it has inherited as a part of the company’s British cultural legacy, few steps have been made to integrate the idea of change into M&S’s very body of operations. As a result, while having improved its business performance significantly, the organization still needs to adjust to the ever-changing market and the constantly shifting trends in market demand.

Given the need to expand and the risks that M&S will face in a new setting and with new audiences, as the 2001 foray into the European market has proven, M&S will need the support of other influential companies. Therefore, the reconsideration of the current business strategy aimed at restricting M&S’s marketing approach and its supply chain will be needed. Specifically, the supply chain of M&S will have to be expanded to include a greater number of retailers and distributors. While the current set of suppliers that M&S uses seems to be sufficient, the company may require a greater number of new options, which is why the infrastructure of M&S’s supply chain will change.

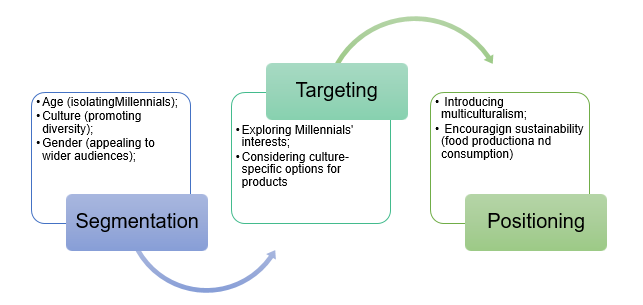

Finally, the set of marketing techniques and strategies currently used by the organization will need to be altered. While the change in the customer segmentation framework that M&S adopted can be seen as a major step toward progress, further changes will be needed to make the organization gain weight in the target economies once again. Applying the STP model, one will see that the company will have to perform a better analysis of the needs and demands in the target environment, primarily, in the Irish and European markets for clothing, as well as food and groceries (see Fig. 2). By splitting its target audiences into clusters based on their age, gender, socio-cultural background, and other characteristics, M&S will be able to create the marketing approach that will appeal to them.

Currently, the company seems to have been experiencing difficulties in attracting audiences belonging to the younger generation, as well as creating a framework for appealing to customers from different cultural backgrounds. Similarly, M&S has been encountering difficulties positioning its products and creating a strong brand image that would appeal to a wide range of buyers. Therefore, one may advise the company to invest in market research and R&D, at the same time reducing the costs taken for certain processes within its supply chain, such as transportation. The latter, in turn, can be achieved by revisiting the infrastructure of the SCM process. As a result of changes in the current business strategy, the company’s performance can become salvageable and even reach a new level of efficacy.

Furthermore, the appeal to a wider audience and a new marketing strategy for attracting younger audiences may help M&S in increasing its competitive advantage and creating a unique brand identity. A detailed psychographic analysis of the company’s potential customers will be most needed since it will define the marketing approach that the company will undertake. Given the current situation in the apparel industry, as well as in the one of food and grocery, the company may need to focus on the strategy of product diversification and the use of digital channels, specifically, social media, to appeal to buyers.

The organization has already started exploring the options for customer-specific marketing rather than the generic approach that it has been adopting for years (Calu et al., 2016). However, the described step will require changing M&S’s priorities from managing its business as a set of separate processes linked by a common goal to the creation of an interactive interdisciplinary environment where collaboration and information sharing become the main priority (Killian & McManus 2015).

Remarkably, with the proposed change, one will be able to introduce the concept of innovation and a customer-oriented approach in the development of the marketing tools into M&S’s setting more actively. While the company has been contemplating the idea of innovative production and decision-making, there has been no consensus regarding the application of innovative principles to the company’s design (Calu et al., 2016). However, with change being brought to M&S, the company may shift toward innovative thinking as the method of making decisions and managing key operations.

As far as the marketing issue and especially the change in branding is concerned, M&S will have to change its approach toward the promotion of its products, especially as far as the clothes are concerned. To appeal to a younger generation ad connect to a different age group, the organization will need to create an entirely new brand that will be based on the idea of being unique and delicately leveling the specified need with the necessity to reduce costs. The latter might become quite a problem for M&S given the fact that the organization has built its entire reputation based on the concept of using clothes as the marker of the buyer’s wealth and social status (Bahng, Yang & Reilly 2016).

However, after redefining the corporate values and focusing on the exploration of the culture of buyers and other customer-specific information, M&S will address one of the major demands of its new audience, which is the appeal to the uniqueness and individual experiences of each customer (Calu et al., 2016). The emphasis on the enhancement of customer-specific strategies will also help to improve M&S’s competitive advantage, making it unique due to the combination of high-quality standards and the ability to appeal to a wide range of audiences by establishing rapport with them and meeting their culture-specific needs.

The current use of responsible marketing is one of the highlights of M&S’s recent change in its business strategy since it allows positioning the company as caring and moral due to its focus on making ethical decisions. In its attempt at diversifying its services and creating new brands, the company should make the audiences notice the fact that it adopts only sustainable practice and strives to meet the set environmental and sustainability-geared standards. The appeal to sustainability is expected to become one of the major drivers in building the company’s competitive advantage and creating a name for its new brand.

Finally, M&S has to revisit its approach toward managing external and internal processes. The principles of corporate governance as a critical part of the business strategy are needed to maintain control over every aspect of M&S’s performance. With an increase in the number of details added to its supply chain, M&S may fail to keep the track of each f them individually, which suggests that M&S should offer greater flexibility in its controlling functions.

Reference List

Bahng, Y, Yang, JH & Reilly, A 2016, ‘A qualitative approach to understanding Hawaiian apparel manufacturers’ exports: strategic marketing resources, dynamic capabilities and export barriers’, International Journal of Export Marketing, vol. 1, no. 1, pp. 96-113.

Calu, A, Negrei, C, Calu, DAS & Viorel, A 2016, ‘Reporting of non-financial performance indicators‒a useful tool for a sustainable marketing strategy’, Ecostor, vol. 1, no. 1, 977-993.

Eley, J 2019, ‘The formidable challenge of rejuvenating M&S’, Financial Times. Web.

Force, ET 2016, ‘Opinion statement ECJ-TF 2/2015 of the CFE on the decision of the European Court of Justice in Commission v. United Kingdomm (‘final lossess’)(case C-172/13), concerning the’Marks & Spencer exception’, European Taxation, vol. 56, no. 2/3, p. 87-93.

Grębosz-Krawczyk, M & Siuda, D 2019, ‘Attitudes of young European consumers toward recycling campaigns of textile companies’, Autex Research Journal, vol. 19, no. 4, pp. 394-399.

Hasnin, NE, Tanim, TR & Alam, KMS 2017, ‘A study on selected firms of the apparel industry to find out the motive behind firms to exercise corporate social responsibility–‘to buy goodwill’or ‘out of good intention’, Australian Academy of Accounting and Finance Review, vol. 2, no. 1, pp. 23-43.

Jin, H, Miao, Y & Park, ST 2018, ‘A case study of Marks and Spencer lost China’, Journal of Industrial Convergence, vol. 16, no. 2, pp. 15-23.

Killian, G & McManus, K 2015, ‘A marketing communications approach for the digital era: managerial guidelines for social media integration’, Business Horizons, vol. 58, no. 5, pp. 539-549.

Kumagai, K & Nagasawa, SY 2016, ‘The influence of social self-congruity on Japanese consumers’ luxury and non-luxury apparel brand attitudes’, Luxury Research Journal, vol. 1, no. 2, pp. 128-149.

Mellahi, K, Jackson, P & Sparks, L 2002, ‘An exploratory study into failure in successful organizations: the case of Marks & Spencer’, British Journal of Management, vol. 13, no. 1, pp. 15-29.

Molinero, CM, Bishop, H & Turner, M 2005, ‘The distress of Marks & Spencer PLC in 2001: a multidimensional scaling analysis/Los problemas de Marks & Spencer PLC en el 2001: análisis de escalamiento multidimensional’, Cuadernos De Estudios Empresariales, vol. 15, p. 107.

Osborn, A 2001, ‘M&S’s European catastrophe’, The Guardian. Web.

Rigby, E 2016, Marks & Spencer sets out new vision of ‘sustainable’ multichannel retail. Web.

Scott, P & Walker, JT 2017, ‘Barriers to ‘industrialisation’for interwar British retailing? The case of Marks & Spencer Ltd.’, Business History, vol. 59, no. 2, pp. 179-201.

Shapira, Z 2017, ‘Entering new markets: the effect of performance feedback near aspiration and well below and above it’, Strategic Management Journal, vol. 38, no. 7, pp. 1416-1434.

Soltani-Fesaghandis, G & Pooya, A 2018, ‘Design of an artificial intelligence system for predicting success of new product development and selecting proper market-product strategy in the food industry’, International Food and Agribusiness Management Review, vol. 21, no. 7, pp. 847-864.

Tan, JY & Yu, M 2019, ‘Corporate social responsibility: consumer perception for the UK apparel companies’, Journal of Marketing Management and Consumer Behavior, vol. 2, no. 4, pp. 32-45.

Toms, S & Zhang, Q 2016, ‘Marks & Spencer and the decline of the British textile industry, 1950–2000’, Business History Review, vol. 90, no. 1, pp. 3-30.

Yu, M, Cao, D & Tan, JY 2019, ‘CSR-consumption paradox: examination of UK apparel companies’, Journal of Fashion Marketing and Management: An International Journal, vol. 23, no. 1, pp. 124-137.