Background

Richard Thaler is an American economist, a scholar, and an educationist. He has spent several years teaching economics at institutions of higher learning in the country. The book, Misbehaving: The Making of Behavioral Economics, addresses major flaws and weaknesses of conventional economic theories, concepts, and principles.

The intended audience is economics scholars and students who have fully embraced traditional economic models and theories. The scholarly credibility and importance of the material are demonstrated in the content and how the information is presented. Modern economics has become highly specialized and narrow in a way that it ignores other fields such as experimental science and economics. The author feels that the deliberate effort by economists to ignore other fields in social sciences when developing their concepts, models, and principles is a major weakness.

The inability to understand human behavior when making major economic policies may have devastating impact.The global economic recession that started in the United States mortgage market and spread to other industries across the world is a perfect example of the danger of ignoring principles of psychology and experimental science (Ogaki Tanaka, 2017). The assumption that traditional economists make is that people and entities will always make rational decisions. However, this primary economic assumption has major flaws that have been disregarded for decades. For one to make a rational decision, one needs to have a perfect knowledge of the issue at hand. The problem is that the constant distortion of facts by the political class, religious leaders, and the media creates confusion. As such, many people make their decisions based on half-truths and misinformed opinions. It is also important to note that socio-political and economic forces may cloud the judgment of people when making decisions.

It is common for people to make decisions that economists may consider irrational because of their beliefs. During the last general election in the United States, there was a sharp division in opinion among political supporters of President Trump and supporters of the Democratic candidate (Puaschunder, 2020). In such an environment, it is almost impossible for one to make a rational judgment. Their decision will be based on information from the party they support instead of facts. An individual or an entity that fails to acknowledge these realities and bases its decisions solely on economic principles may suffer a major loss. People will misbehave by taking unnecessary risks or failing to take advantage of an opportunity primarily because of their political views.

Behavioral economics seeks to address the flaws of traditional economic theories and concepts. It focuses on the behavioral patterns of people based on numerous factors, as explained by psychologists. It seeks to integrate economics with other major social science concepts. As shown in this book, although major economic theories and principles are essential when making decisions, individuals and entities should not ignore theories and concepts in other fields in social sciences. Human behavior can sometimes be unpredictable and using a single model to assess and predict it may sometimes fail to give an accurate picture. In this book review, the researcher seeks to critically assess how the author presents the concept of behavioral economics, explains the challenges of traditional economic theories, and uses various styles to convince the audience.

Summary

The main theme in this book is that primary agents in an economy are people who tend to be predictable and error-prone. Traditional economic models and theories assume that people tend to be rational as they seek to get maximum benefits from their actions while at the same time trying to avoid losses as much as possible. It may be true that rational people will avoid losses and try to maximize their benefits as much as they can. However, people also tend to misbehave. Bias is one of the factors that make people misbehave, taking decisions that deviate from standard economic principles and beliefs. In the United States, many people tend to believe that products manufactured in China are fake or substandard. As such, when making a decision, their judgment will likely be clouded by their bias against Chinese products. They will fail to appreciate the real value of a product because the perceived value defines their decisions.

The economic environment also defines the behavior of an individual beyond what is explained in the concepts of economics. While most of these traditional theories assume that human behavior is universal based on specific assumptions and principles, it is evident that people from rich countries tend to make their purchasing decisions differently compared to those from poor countries. These behavioral factors are largely downplayed or ignored in most of the traditional economic concepts. As such, some of the frameworks in this field fail to make sense in a real-world situation.

In this book, Thaler seeks to address human miscalculations and errors, and how they relate to economics, in what he defines as misbehaving. He argues that behavioral economics can no longer be ignored by companies, non-profit entities, and government bodies. Major economic mistakes are made by these entities when they solely rely on traditional theories. This theory assumes that every individual will act rationally, which means that they will make similar choices when presented with similar forces. However, this argument has been proven as misleading through various evidence-based studies in psychology.

People will misbehave (make a decision contrary to principles of economics) because they lack accurate information, their judgment is clouded by biases, the desire to help others or the society, or any other socio-economic and political factors. These deviant behaviors are increasingly common in society, but traditional economic concepts fail to consider them. The author argues that it is necessary to incorporate psychological and social science principles into economics. Behavioral economies take into account the unique behavior of humans and how their actions may be influenced by other factors beyond the need to make economic gains. The scholar concludes the book by stating that the field of behavioral economics still needs further research to be fully developed.

Economic Concepts, Theories, and Models

The book criticizes and appraises various economic theories that have remained popular for decades. Thaler (2016) argues that behavioral economics seeks to take into considerations human behavior into consideration when making economic assumptions. The mistake that Econ do is that they assume that people will always act rationally, observing traditional economic concepts. In this section, the focus is to discuss specific economic concepts and theories explained and criticized in the book.

The Concept of Demand and Supply

One of the traditional and widely used economic theories is the demand and supply law. According to Puaschunder (2020), this theory explains the willingness of people to buy or sell a given product depending on its current market price. When a product has a high price in the market, many people will be willing to sell, but in the process, the number of those willing to buy will drop. These market forces will naturally be adjusted to the price level where the number of sellers (in terms of the number of products they make available in the market) equals the number of buyers (in terms of the quantity they are willing to purchase. On the other hand, when the price falls, the number of suppliers will drop while the demand will increase. The same market forces will adjust these changes until it reaches equilibrium.

The book, Misbehaving: The Making of Behavioral Economics, criticizes this theory as one that fails to take into consideration the behavior of people. Thaler (2016) explains that sometimes trends in the market are defined by unique market forces beyond the explanation of this economic concept. For instance, when a product is out of fashion, its demand will drop significantly. Depending on the market segment targeted, a drop in the price of such a product will not attract buyers. It will force players in the industry to switch from the product to a new one that is favored by customers. This unique behavior of customers. Which define their purchasing decisions are best explained through behavioral economics. This branch of economics goes beyond traditional beliefs and embraces concepts and theories of psychology and sociology.

Prospect Theory

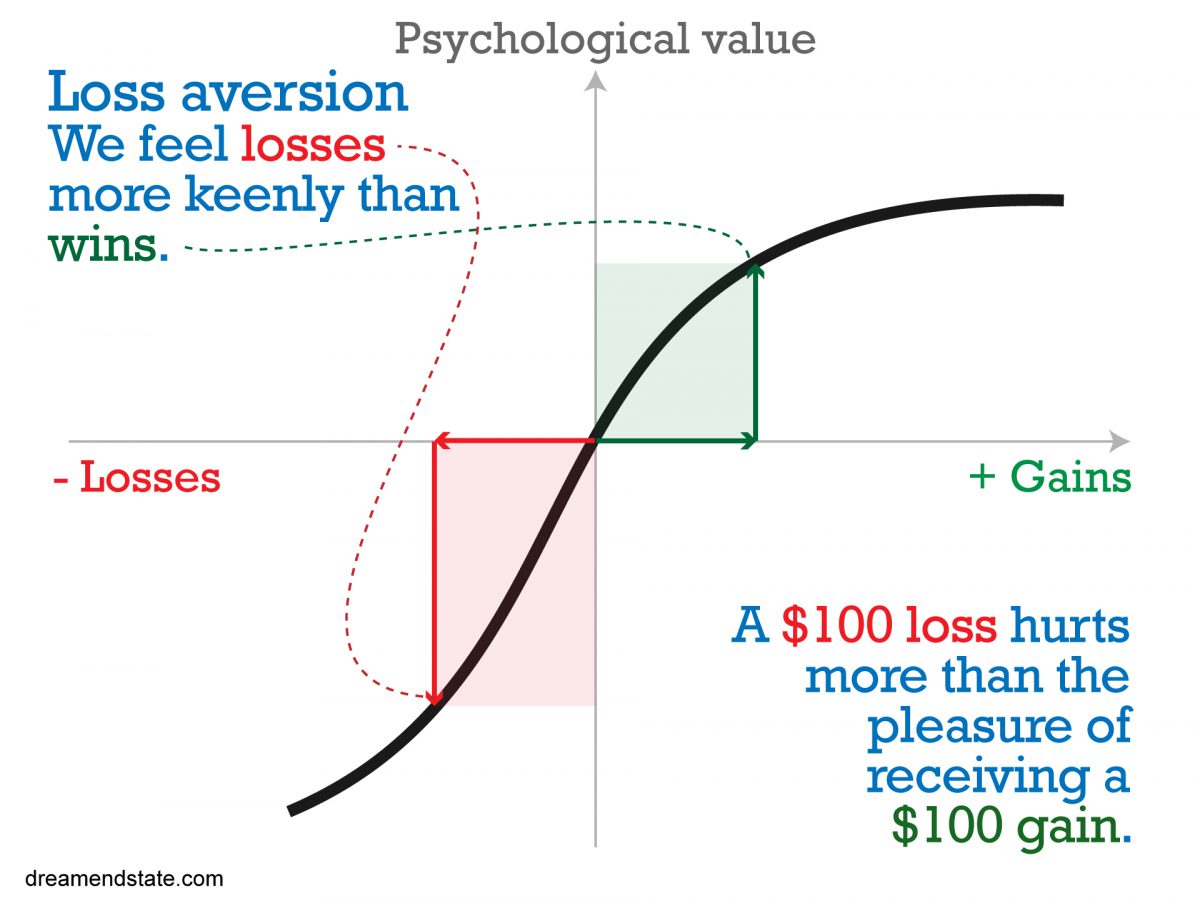

The book uses prospect theory to further explain human behavior that often goes against traditional economics. Also regarded as loss-aversion theory, it holds the belief that people tend to place more weight on perceived losses than gains (Teitelbaum & Zeiler, 2018). When an investor is presented with symmetrical situations where the probability of gaining equals that of losing, they are more likely to ignore such an investment. It explains that more often people are more pessimistic than being optimistic. The decision places greater emphasis on the pain of losing than the pleasure of winning. As shown in figure 1 below, people tend to feel greater pain of losing an amount of money than the pleasure they have when they gain the same amount. As suggested in the model below, the prospect of winning must be twice as much as losing for one to be at a point where they can choose any of the options available.

The prospect theory contradicts some of the concepts explained in expected utility theory when one needs to make a decision whose payoffs are not certain. The expected utility theory is a model that explains how perfectly rational people will act. It holds that such a decision will be based on personal preferences and one’s risk appetite (Puaschunder, 2020). Prospect theory challenges this view by explaining that individuals who are not risk-averse will be hurt more by losses than they take pleasure in gains. As such, they have to take calculated risks, taking into consideration numerous environmental factors beyond economic models. Their optimism can easily be affected by the reality that chances of losing are equally high.

The book further explains the application of this theory with the help of the principle of diminishing sensitivity. This theory holds that as one’s wealth grows, the impact of a given increment in wealth reduces (Altman, 2020). The impact of earning $ 100,000 for a college graduate who is just starting a job is significantly greater than it is to a chief executive officer who is a millionaire. The mistake that some of the traditional economic models make, according to Thaler (2016), is that everyone will make the same decision. The principle of diminishing sensitivity challenges this economic view. Wealthy people tend to make decisions differently when compared to peasants when the expected gain or loss is the same.

Value Theory

This theory, which is one of the philosophical concepts, focuses on explaining why, how, and the level to which people value things. This ethical theory classifies things as being good or bad based on the morals of society (Moscati, 2019). It helps to explain why people value specific things based on various socio-cultural factors. There is always an intrinsic desire for people to do the right thing, and as such, when they are presented with choices, they are more likely to select the option that is socially accepted. They may ignore something that is economically rewarding primarily because of the desire to remain ethical.

In most cases, economists ignore these factors that define human behavior. Thaler (2016) believes that traditional economists failed to understand the impact of socio-cultural forces on human behavior, as explained in this theory. In their series of experiments, the author explains that in many cases, people are willing to ignore the economic benefits primarily because of the desire to do a good thing. For instance, borrowing money at interest is an economically viable activity. The lender stands to gain an economic reward from such an activity. However, a person who has embraced Islamic principles considers the practice as usury. As such, they will be willing to sacrifice the profit for the sake of upholding religious principles. From an economist’s perspective, such an individual will be misbehaving in doing so. However, behavioral economists understand that decisions that people make are not always entirely based on economic returns.

Theory-Induced Blindness

The book, Misbehaving: The Making of Behavioral Economics, argues that most traditional economists have embraced some of the economic concepts and models that they are blinded by them. Thaler (2016) uses theory-induced blindness to explain the rigidity of some of the traditional economists. The theory is based on the premise that once an individual accepts a given theory and uses it to make decisions, it becomes impossible to identify its flows. For a manager who embraces the theory of demand and supply to set the price, they may fail to take into consideration numerous other factors that define the decision that customers make.

A judgmental error may arise when they predict future price changes primarily based on this theory. They may target a period when the supply of the given product is low and predict that the price will be high as the demand is expected to increase. However, the demand may fall in tandem with the drop in supply. In such a case, the price may drop as the supply drops, which goes against the principle of demand and supply. This book reiterates the need for managers, policymakers, and government officials to go beyond some of the economic principles.

Human behavior cannot be entirely based on some of these concepts. The unpredictability of human behavior requires a deeper analysis of socio-economic and political forces in society. For instance, Americans have for a long time been considered to spend more and save less of their income, while Chinese tend to save more and spend on the basics (Puaschunder, 2020). The behavior is based on the socio-economic forces and the fear of what the future brings. The United States has one of the lowest unemployment rates in the world (Teitelbaum & Zeiler, 2018). As such, most Americans are sure that they will make more money when they spend their current earnings. On the other hand, the Chinese have, for a significantly long time, been faced with the issue of unemployment. The desire to protect their future forces them to save most of their earnings and spend only on basics. Theory-induced blindness explains that a manager may fail to understand these obvious socio-economic forces when defining the buying behavior of customers.

Evidence

The book challenges some of the fundamental principles and concepts of economics that have defined modern practice in many companies and government entities. As such, it is necessary to provide evidence that can effectively back the arguments and new concepts presented. The following are the major evidence and examples that the author has presented to back the argument in support of behavioral economics.

Empirical Evidence from the Ultimatum Game

The ultimatum game has gained popularity in experimental economics when a researcher seeks to assess the level of fairness versus greediness when one is making a decision. In this book, the author explains the puzzle that the proposer faces. The ultimate goal of the proposer is to have the largest share of the sum of money to be shared. However, there is the fear that if the other party rejects the offer, then everyone loses in the process (Moscati, 2019). As such, there is an attempt by the proposer to make an offer just enough to convince the other party and still allow them to remain with the largest share. Thaler (2016, p. 295) reports that in most of the experiments they did, many “proposers offered 40%” of the sum shared. They believe that is the equilibrium point where the proposer gets the maximum satisfaction and the respondent is motivated enough with the reward that they cannot reject it. However, this decision could not be easily associated with selfishness or fairness.

The book explains that a 40% share is not far from an equal distribution of wealth. As such, one may argue that the decision to provide such a fair offer was motivated by the proposer’s selflessness. However, it is also possible that their primary motivation was greed. Given a choice, they would give a much lower offer. However, the fear (and greed) of possibly losing everything motivates them to be fair to the other party. They know that the decision of the other party will influence the outcome. The generosity, therefore, maybe a way of influencing their decision. As such, it is important to embrace behavioral economics to understand some of the unique decisions people make, which may not be justified using traditional economic concepts.

I strongly support this claim made concerning this theory. In many cases, it may not be enough to analyze the behavior of people from one angle. Just like in this theory, there is always selfish and selfless motivation. They all act in unison to define decisions that people make. I believe that using a concept that allows one to analyze all the perspectives that define one’s decision is important.

Diminishing Sensitivity in Support of Prospect Theory

One of the major models of behavioral economists is the prospect theory, which holds that people tend to be risk-averse. To help demonstrate the practical nature of the theory, they used the principle of diminishing returns. The experiment revealed that people often avoid making choices if the chances of losing are higher or equal to that of winning. The majority of people tend to be pessimistic when thinking about the future (Puaschunder, 2020). The assumption that they make is that chances of losing are often higher, and they always prefer avoiding the pain associated with it. However, they did prove that people tend to be happy when they win. However, a unique trend was observed in their experiment. The level of satisfaction with a specific amount of gain diminishes as the level of wealth increase (Thaler, 2016). $100,000 may mean a lot to a peasant, but to a billionaire, they may not even realize that their wealth has increased by that amount. I agree with the evidence presented here in support of behavioral economics.

Most economic models hold the belief that all rational people will act in the same way. However, one’s behavior is often motivated by, among other factors, their social status. A peasant may be willing to sacrifice rest and fun to earn $100,000 in a week, as most economic models do. However, for some billionaires, the same amount is not worth sacrificing their day of rest. It is not enough motivation to make them do something. Based on my review of many economic concepts and theories, these behavioral factors are largely ignored in traditional theory. The assumption that people are likely to behave similarly is highly misleading.

House Money Effect Experiment

The author explains an experiment that they conducted based upon wins and losses. In the experiment, three scenarios were presented to the participant. In scenario 1, a person had just won $30. The researcher was interested in determining their chances of taking a risk following a win. The experiment revealed that upon winning a bet, one is more likely to take a risk even if there is a 50% chance that they may lose in the process of doing so (Thaler, 2016). In scenario 2, a participant had just lost $30 in a bet. They were given similar choices as was the case in scenario 1. The outcome of the experiment shows that participants were twice more risk-averse after a loss than they were when they won. The pain of losing in the previous bet makes them less likely to be interested in the offer because there is the fear of having a similar experience.

In scenario 3, the focus of the researcher was to ascertain what it would take an individual who lost a previous bet to make a similar risk. Findings of the investigation revealed that it will be willing to make the bet if the possibility of loss is eliminated, even if the chances of winning are reduced from 50% to 33%. They concluded that once somebody has lost a bet, they will avoid the game unless they are assured that the risk is eliminated. Alternatively, the incentive should be significantly increased if the chances of loss and gain were to remain the same. In their experiment, they explained that although the decisions made by the participants were financially (economically) motivated, it is likely that the amount involved in the gain or loss also played a role. One would not have serious thoughts when it comes to gaining or losing $50. However, if the amount is increased to $50,000, the behavior is likely to be significantly different.

I believe in the argument presented in this experiment, which confirms that decision that a rational person makes is influenced by numerous factors, including human behavior. Gambling is a common phenomenon not only in the United States but also in many other countries around the world. Those who gamble rationally- excluding addicted gamblers who engage in the game without weighing the risks involved- are influenced by numerous factors. One of the factors, as was shown in the experiment done in this book is their past wins or losses. Based on personal experiences, I tend to take more risks after a series of wins. However, I become more risk-averse after a major loss. The fear of another loss and the pain associated with it makes an individual risk-averse.

The other factor presented in the experiment is the amount involved. An individual may not worry much about losing $9 to win $30. However, the dynamics in one’s reasoning pattern changes when the amount of money presented is bigger. When the amount to be lost is significantly high, an individual is less likely to take the risk because of the impact. On the other hand, when the amount to be won is high, an individual will take the risk. This human behavior sometimes contradicts economic principles on how rational people should behave. As such, using traditional economic principles and models may lead to a wrong prediction of how an individual or a market may behave.

Using behavioral economics, it is possible to integrate these traditional models with psychological theories of human behavior and motivation. The approach makes it possible to have a more accurate prediction of human behavior. Contemporary economists are more willing to challenge some of the economic principles because of the failure to take into consideration the fact that people sometimes misbehave. An individual may choose to lose a large amount of money primarily to demonstrate their status in society, which goes against traditional economic principles.

Critical Review of the Book’s Arguments

It is important to critically review the arguments of the book, with my view on the core arguments presented and the approach that the author took to communicate with the readers. In this book, the main argument presented by the author is that major economic models, theories, and concepts failed to take into consideration the unique behavior of people. These models have based their argument that every person and entity will always act rationally, to maximize their benefits and minimize their losses. However, the author argues that in many cases, people tend to fail to act rationally. Many socio-economic and political factors tend to cloud the judgment of people.

The book explains that the lack of correct information, which is a highly common phenomenon in society, may make an individual make a decision contrary to the expectations of an economist. Similarly, cultural practices and the political environment may motivate an individual to make a decision that may not make economic sense. As such, firms that fully base their policies and strategies on these economic models may end up making wrong market predictions. I strongly support this argument presented by the author in their effort to promote behavioral economics. Sometimes major economic models fail to take into consideration factors such as limited market knowledge, cultural practices, political influences, peer pressure, and many other socio-economic and political factors that may cloud people’s judgment. Some of these models and theories need to be reviewed or applied alongside other new behavioral economics models for them to be effective.

Strengths of the Text

The book has several factors that make it simple to read and easy to understand its contents. One of the unique factors about the book is the constant use of personal accounts of events that happened to the author. Although this approach has its weaknesses, as discussed below, it makes the reader believe that the book is based on real events. The author picks specific economic theories, such as the concept of demand and supply, analyzes them based on real-life experience, and makes it easy for a reader to appreciate their weaknesses. Thaler (2016, p. 295) notes, “When the host finally ended the banter and demanded that the two players choose which ball to play, Ibrahim, who had appeared to be highly skeptical of Nick’s pitch, suddenly switched from the ball he had originally selected to the other one.” In this statement, the author describes a complex theoretical model using a simple discussion with a friend. As such, a reader can understand how the concept can be applied in a real-life situation.

The book demonstrates that there was extensive empirical research that was conducted by the author throughout its authorship. Thaler (2016, p. 248) says, “I once asked the owner of a ski lodge why he didn’t charge more during the Christmas week holiday when demand is at a peak and rooms have to be booked nearly a year in advance.” In this social experiment, the author was interested in determining the relationship between the demand of a product and its price. Instead of basing the argument on already existing theories, the author decided to experiment. In this experiment, it emerged that the proprietor who was targeted not only has a limited understanding of the concept of demand and supply’s relationship with pricing but is also unwilling to sacrifice customer loyalty for quick gains. Traditional economists explain that prices will automatically increase as the demand for products goes up (Altman, 2020). In this simple experiment, however, it was proven that this model does not hold at all times. In some cases, traders focus on sustainability and customer retention as opposed to making quick profits.

The use of jokes in the book can be considered as both a strength and a weakness. Economics has remained one of the complex subjects that many students would avoid for other alternatives considered simple (Puaschunder, 2020). The book takes a different approach to simplify major economic concepts. I noticed that just when someone is about to start thinking of how to interpret a complex macro-economic concept, the author introduces a joke that fuses the tension. Such jokes make it possible for a reader to press further. It is essential to understand that in most cases, the jokes are relevant to the topic under investigation and help in interpreting an economic model or concepts being discussed.

The reliability and trustworthiness of a given scholarly work are often determined by, among other factors, the academic background and professional experience of the author. The author, Richard Thaler, is an accomplished economics professor who has taught for decades in various institutions of higher learning in the country. His wealth of experience gives him the authority needed to criticize major economic principles. His friends, Amos and Danny, had the academic background to facilitate effective research. Trusting their work is easy because of the extensive research they have conducted in the field. The period that it took to author this book also enhances its credibility among readers.

Weaknesses of the Text

It is important to admit that the book has some weaknesses that affect its ability to communicate critical information effectively. One of the major weaknesses of this document, based on my experiences and belief, is the use of the first-person pronoun. In academic documents, it is often advisable to use a third-person pronoun. The document tends to be more authoritative when the author takes himself out of the picture (Ogaki & Tanaka, 2017). It creates the impression that the document is based on evidence, not personal opinion. However, the author took a unique approach in this text. Altman (2020) argues that when reading material, one tends to doubt facts presented as opinions as opposed to evidence-based reports.

I believe the author took this approach because of his wealth of experience in economics, years spent teaching economics in institutions of higher learning in the United States, and their popularity among scholars in this country. As such, they believed that people will easily value their opinions as raw as they presented them. The problem is that most of the readers of this book, especially those who are not in the United States, do not know this author or the authority he commands in this field. As such, they can easily dismiss his opinions unless it is presented in a standard scholarly way.

The author has taken the time to explain some of the activities that may not be necessary for an economic report. Taking time to explain the opinion of his friends about his character was largely unnecessary in this scholarly material. For instance, Thaler (2016, p. 118) says, “Next time you have Oreos to give away, please do not offer me the ‘one cookie now’ option, or even mention the word Oreo. Just wait fifteen minutes and bring me my three cookies.” This is a piece of information that is not expected of a scholarly report. I believe that eliminating such unnecessary information about personal experiences and jokes would have helped condense this material. It would have been possible to reduce the number of pages from over 380 to probably 250 pages of pure facts.

When reading this book, sometimes it becomes challenging to pick economic facts. As mentioned above, one can easily be made to believe that this is a work of fiction. The author discusses economic principles then makes a radical shift to talk about an experiment that they did with students or a group of people in a specific location. The approach is relatively confusing for scholarly material. I believe this is more appropriate when one is making a presentation to peers before writing the final piece. As such, it creates a feeling that this book is a draft or a major economic work that still needs condensation. When a reader has such a feeling, then it becomes difficult to trust the information presented. I had a feeling that some facts would change when writing the final document.

The use of jokes and funny stories may be persuasive, but for scholarly material, I consider it highly inappropriate. This may be the new trend of writing scholarly materials, but my experience and knowledge make me feel that such a style of writing is more appropriate for works of fiction. When one is trying to make sense out of a new concept that challenges existing fundamental theories of economics, the use of jokes dampens the trust in the book. I felt that it creates a feeling that the author is making general jokes. I also noticed that the author introduced numerous personal information that does not add any meaningful value to the document.

Concluding Recommendation

The book, Misbehaving: The Making of Behavioral Economics, is critical of some of the fundamental beliefs and practices of traditional economists. The approach that the author used, using personal pronouns, jokes, and personal experiences and views, may make it less academic. In some paragraphs and pages of the book, it appears as if it is a book of fiction or autobiography. As such, it may not be taken as serious scholarly material that addresses major economic principles and theories. However, the method may have been deliberate. The author takes a radical shift from traditional principles and theories of economics. In doing so, they decided to use a different approach that is rarely used in scholarly materials.

The author presents the information based on personal experiences and as a story of the actual things that happened during the authorship period. Information presented in the book is factual and the critic made by the author is based on experiments. As such, it is an evidence-based report that emphasizes the need to redefine some of the traditional economic principles. It holds the view that behavioral economics is essential because it goes beyond theories that exist to take into consideration the impact of socio-economic and political forces when making decisions. I believe this book accurately presents emerging realities that economists have to consider. Before making a decision based on an economic theory, I recommend that one should not ignore the principles and concepts of psychologists who study the human mind from a social perspective. People tend to misbehave, which means that they may easily fail to act in a given way that was expected by an economist. As mentioned in the discussion above, I believe that the book would have been more authoritative if it had fewer personal stories, some of which are not directly related to economics.

References

Altman, M. (2020). Smart economic decision-making in a complex world. Academic Press.

Moscati, I. (2019). Measuring utility: From the marginal revolution to behavioral economics. Oxford University Press. Web.

Ogaki, M., & Tanaka, S. C. (2017). Behavioral economics: Toward new economics by integration with traditional economics. Springer.

Puaschunder, J. M. (2020). Behavioral economics and finance leadership: Nudging and winking to make better choices. Springer.altm

Teitelbaum, J. C., & Zeiler, K. (Eds.) (2018). Research handbook on behavioral law and economics. Edward Elgar Publishing Limited.

Thaler, R. H. (2016). Misbehaving: The making of behavioral economics. W. W. Norton & Company.