Introduction

The era is known for fast developing consumerism patterns. As the consumption grows, so does the use of resources. Consumption of energy, the all-important resource for production of goods and services, is therefore on the rise. Oil forms a key energy source and it is because of the fast-growing consumerist society that despite a consistent increase in the oil prices over the years, its use has not decreased. Instead the use of oil has kept growing over the years.

In fact, if we take a look at the state of oil prices 20 years back in late nineties, we find a totally different picture. At that time analysts were echoing the dismal state of the economies of the countries whose mainstay was oil exports. The Economist (1998) in a report stated, “The fall in the oil price has stopped for the moment. But these days, oil shocks hurt producers more than consumers”. Can we repeat the same statement now? In fact, now the situation is in sharp contrast; today we are ruing to the fact that crude oil prices are headed to the roof. The oil dependent countries are happy and OPEC appears to have become much more relevant now. BBC (2008) in its recent report state that, “Oil prices have touched fresh highs as traders bet that violence in key producing nations will hurt supply.” This statement in a nutshell summarizes the reasons behind the upward march of the crude oil prices.

Price of any commodity in general is determined by the law of demand and supply. As per this law, ‘all other factors remaining constant, the higher the price of a product, the smaller number of people will demand it. Or in other words, the higher the price, the lower the quantity demanded.’ But if we look at the historical perspective, it is found that oil, the source of energy has also defied this law. The demand for oil continued to increase even when the prices kept increasing. With majority of the share going in favor of Middle-East nations, the oil is not only the source of energy, but in today’s global scenario, it has become an important source of political power as well. There are nations whose economies are badly hit as a result of increased oil bill, but as of now, the geo-political circumstances and the oil majors appear least interested in resolving the problems of such countries.

Oil: The Historical Perspective

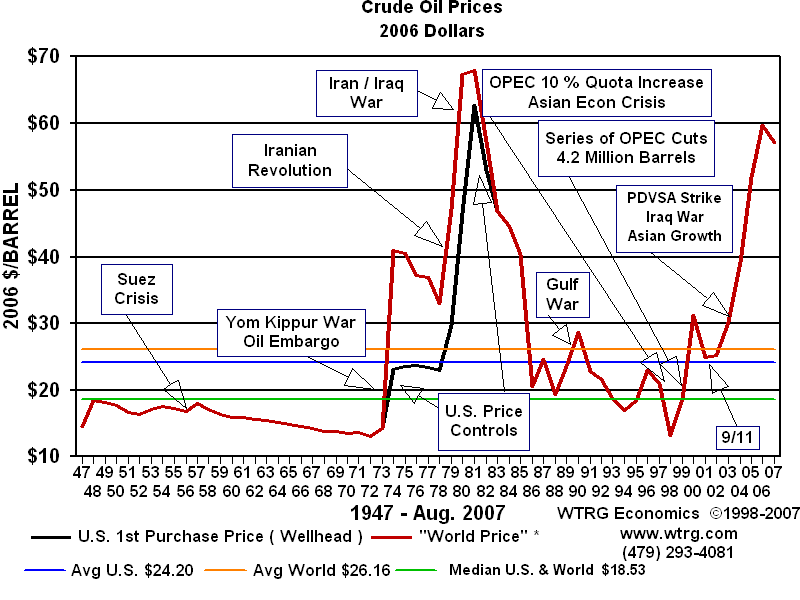

If we take a look at the oil prices of the last 50-60 years, we find that till the early 1970s, the prices of crude oil kept hovering around $15-20. But the huge strength of oil was realized by the oil producing nations in 1973, when they all decided to stop exporting oil to US and other western nations, in retaliation to the US assistance to Israel in the Yom Kippur War. Oil prices started moving upward all around the globe as it became a much-desired commodity in the consumerist society in western nations. At that time, the world used to be divided in two blocks with somewhat different political ideologies and differing opinions about the global issues. At that time, to some extent the oil price rise remained subdued because of the mutual influences of the Soviet block and the American block, but the Iranian revolution proved to the real anathema for the world community. It resulted in reducing levels of oil exploration from the Middle East region and thus resulting in sharp rise in oil prices. A realization also dawned upon the US that the ‘oil power’ has to be in control if one needs to have a say on world affairs.

The events thereafter proved more disturbing for the oil rich nations of Middle East. Subsequently we saw the bitterness between Iran and Iraq translating into full fledged war, which further pushed up the oil prices at never before levels. The crude oil prices started touching the levels of $70. After hovering at these levels for couple of years, and as Iran and Iraq started seeing the futility of continuing with the war, the prices started receding. The prices again saw a spurt when Iraq attacked Kuwait and engulfed its oil well into fire in August 1990. But that proved to be a short-lived misadventure of Iraq and oil prices came back to normal levels i.e. $25. Subsequently though, the Organization of Petroleum Exporting Countries (OPEC) had to cut down the daily oil exploration limits in order to contain further fall of oil prices. These developments appear somewhat in line with the law of demand and supply. But, after the era of globalization started firming up its grip on nations around the world, more and more economies started implementing the policies of liberalization.

These developments gained momentum after the disintegration of USSR and USA gaining in stature in world polity. On the one hand the income levels of people started rising, while on the other hand the increasing levels of competition in provisioning of goods and services ensured that the consumer can be persuaded to purchase a car, even if that meant taking a hefty loan from the bank. This tendency led to increase in the consumption of fuel. Therefore, even when the US led forces attacked Iraq or global economy went into recession, the oil consumption levels kept increasing and so did the crude oil prices. OPEC block have so far summarily rejected the calls to hike production levels so that the prices could be brought down, thanks to pure economics. It is at this juncture that the oil consumption seems to defy the law of demand; rise in the prices has not led to slightest decrease in demand, instead it has been increasing day by day.

Effect of Oil Price Rise on General Consumer and Small Businesses

While the oil rich nations and their economies have been relishing the rise in oil prices, it has certainly affected the budget of a general consumer and the resources of a small business. ‘Economics’ is the key driver in carrying along the resources, benefits, and people to people exchanges. The marketing communication techniques resorted to by the companies in persuading the consumer to go for their products prove to be quite inviting in nature. Once the gullible consumer falls into the trap, it starts having an impact on his consumption habits, which obviously reflects on his spending. But the levels of income have also risen sharply over these years. It is true that not everybody is that lucky to have higher levels of earnings, and there are nations, particularly in the developing world, with a large segment of population still living below the poverty lines, but the IT era has also brought in windfall of opportunities for nations like India, which used to be one of the poorest nations. Today, India can very well boast of a record number of millionaires. But all nations cannot be termed as that lucky.

Similarly, the small business owners have also been adversely affected. With opening up of economies, Multinational corporations started going places from one country to another. Since they had a sound financial backing, so they could easily offset the increasing levels of energy consumption. The MNCs rely on penetrating pricing strategies, which implies selling at prices which do not even provide a profit margin. These MNCs would make up for this shortfall, once they establish themselves firmly in the respective regions/ nations. In the meantime, the small business owners are not in a position to sustain the rising levels of energy costs and the decrease in volumes, as they cannot match up with the fiercely competitive pricing strategies of the MNCs.

Such losses coupled with rising energy bills leaves an indelible mark on the prospects of small business owners, which ultimately results in closing down of the venture or ends up being bought by a wealthy MNC. The proponents of Liberalization and globalization claim that globalization has opened up newer vistas of trade and business all around the globe. It is said that opening up of economies has now tilted the balance in favor of market forces, which is helping the consumer by way of providing quality at reasonable prices. But on a closer look, it appears quite clear that while competitive pricing is helping the consumer to some extent, but this advantage is undone, to a great extent, by the compulsive buying, which is a result of aggressive marketing techniques of MNCs. Similarly, the increasing role of marketing principles in determining the policies of governments has left to smaller and marginal businessman at the mercy of the market forces, which are clearly not in favor of them.