Executive Summary

Solomon et al (2010) suggest that consumer behavior is about studying the processes involved in the selection, purchase, use or disposal of products or services that are designed to satisfy the needs and desires of the customers. Based on this premise, this report evaluated the customer behavior in the salty snacks market of Australia. The report also considered the “Salty Snacks Analysis” of John Dawes to analyze the salty snacks market in Australia.

Based on theoretical observations and consideration of the market background, the report concludes that the brands operating in the salty snacks market have to undertake significant efforts in establishing their brands to position them to capture sizeable market share. The establishment of brand loyalty is another important consideration. The brands have to consider the likely implications of social marketing issues in their advertising strategies to reach the target customers.

Introduction

Research has found more than 14,000 uses for salt. One of the main uses is to make food tasty and edible. Salt blends well with bland starches such as potato, corn, rice, and wheat, and it works to bring out the flavor of roasted nuts and other snacks. With the changed eating habits of consumers, salty snacks have become one of the increasingly important food items in the daily consumption of people.

The longer working hours and more working people in the household have resulted in a shift toward the consumption of ready-to-eat food and other food items like salty snacks. More and more people go in for salty snacks, while at work or driving or any public gathering. This fundamental shift in consumer behavior has given rise to the growth in the consumption of salty snacks in most of the countries all over the world. Firms manufacturing salted snacks must have a thorough understanding of consumer behavior to maximize the return on their investment in marketing and advertising.

Market research provides data and information on the needs and preferences of consumers, likely demand at various price points, and the choice of suitable promotional methods. The market research also provides information on the success or otherwise of different brands and a comparison of the performance of different brands to assess the competitive structure of the market. One such exercise is “Salty Snacks Analysis”. Based on the learning from the analysis of branding and brand positioning, this report presents a critical evaluation of the analysis and a report on the salty snacks market in Australia.

Background

The global salty snacks industry witnessed a slow growth between 2005 and 2007, with a potential for improvement in the subsequent years, because of changes in the eating habits of the consumers. By the end of 2007, the salty snacks market reported total sales of US $ 16 billion and the market is expected to reach the level of US $ 21 billion in 2013, as reported by Mintel in its August 2008 report (Fay, 2009). The financial crisis of 2008 benefited the salty snacks industry with the growth in the industry, at 6% during 2008, as against the expected growth rate of 4%.

The increased sales might be because of increased entertainment at home and reduced eating out by the customers. The increase in the global salty snacks market volume was reported at 3.6% for 2008, accounting for 8.9 billion kilograms. The compounded annual growth rate of the market volume during the period 2004-2008 was 3.5%. While the processed snacks represented the largest proportion of the market represented by 41.8%, potato chips account for 26.9% of the market. Americas are the largest contributor to the revenue of the industry accounting for 48.3% of the total revenues and the Asia-Pacific region contributes 29% of the total revenue of the market. Supermarkets and hypermarkets are the major distribution channels, which account for 53.5% of the market value. Independent retailers including convenience stores account for an additional 19.8% of the market distribution (Market Line, 2009).

Products like potato chips, corn chips, and extruded products constitute the salty snacks product industry in Australia. The market excludes nuts and rice crackers. As reported by Mintel, In the Australian context, during the global economic downturn, the sales for potato chips jumped 22%. Similarly, other salty snacks experienced a boost in sales fueled by the economic recession. Markets for tortilla chips increased by 18%, popcorn market by 17% and the cheese snacks market increased by 20%, since 2007 (Drake, 2009).

However, sales of these items are most likely to taper after the recovery of the economy. Over the next five years, the market for Potato chips is expected to increase by 3% on an annual basis, while the tortilla chips market might increase by 4%. Despite the increased sales in 2008, there have been apprehensions in the sustenance of the same level of growth rate, because of the expected changes in customer behaviors, when the economic situation changes in the later years. It, therefore, became important for the salty snack manufacturers to develop customer loyalty at a point of time when the consumers would try newer varieties to enhance the pleasure of their staying in-house.

Current Trend of Salty Snack Market

In the present day context, an average Australian consumer is keen to go in for a health-based snack. This has necessitated the manufacturers of snack items, which tend to take care of this requirement and at the same time not compromising on flavor. According to recent researches, the average consumer is not willing to try out a new product, unless he is offered a new flavor or he is offered a healthy product, which is fat and oil-free.

“In terms of taste, change is evident as potato chips, the largest stakeholder of the Snack Food sector, has found classic flavors like salt, salt, and vinegar, barbecue and chicken have been abandoned, making way for new flavors such as tandoori, honey and sweet chili, sour cream and honey soy chicken,” ( With an increased focus on consuming healthy snacks, the trend is toward introducing snacks having nutritional values and rice-based snacks such as rice crackers have gained prominence over traditional salty snacks like potato chips. The market has a large potential for fat-free snacks, as no manufacturer has so far been able to provide a snack, which tastes good and at the same time, does not affect the health of the consumer.

Until such time, any manufacturer fills this gap, the opportunity is likely to remain dormant and the manufacturers have to consider this segment in their product innovation measures. This product segment presents a great opportunity for a new entrant or an already existing player, provided the product meets the requirements of both taste and nutrition. For being accepted in this segment, manufacturers have to involve themselves in research and development aimed at constant innovation. The product does not matter so long as the manufacturer can provide a tasty snack of significant nutritional value.

Competitive Context

In one of the consumer surveys conducted by Mintel, the majority of participants indicated that they would like to shift to other snacks, which are not harmful to health such as “pita chips and crackers” (Fay, 2009), rather than consuming regular snack items. This finding suggests that some portion of the consumers is willing to switch their consumption from salty snacks to other healthy alternatives, which will have an impact on the manufacture and sales of salty snacks in Australia too. Generally, crackers have garnered an image that they do not harm the health of the consumer. This product line is likely to compete with traditional salty snacks like potato chips, especially, because of the introduction of innovative products in crackers made of “whole grains” and which are “Trans fat-free” (Fay, 2009).

“While many salty snacks are also trans fat-free, the pretzel segment is one of the few to offer whole-grain items. The line between crackers and salty snacks has been fading, as cracker manufacturers introduce products positioned more as “snacks” than as meal accompaniments. Healthy snacks, such as fresh fruits and vegetables, granola bars or dried fruit snacks, do offer some competition for salty snacks” (Fay, 2009).

These products can meet the “snack” part of the consumer requirements and they present themselves as suitable alternatives. However, these products may not be able to satisfy the “salty” urge, which drives the consumers to look for salty snacks to fill in their snack time. Therefore, these products do not pose stiff competition to salty snacks.

Some of the products like pretzels and nuts, which fall in the category of salty snacks, also catch up with the “healthy” snack requirements of consumers. Those consumers, who are keen on eating more healthfully, are most likely to move away from potato and tortilla chips (which have only “empty calories” in the purview of health-conscious consumers) toward the consumption of pretzels and nuts, which are considered healthier snacks as compared to chips. This tendency though not significant is likely to have some impact on the market for potato chips.

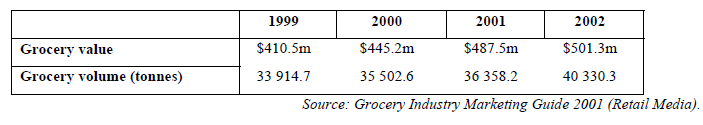

Based on the available figures, the value of the market is shown below.

The value of the market in 2007 was $ 2 billion and it is expected to grow up to $ 2.3 billion in the year 2012. However, this growth implies a significant dip in the growth rate as compared to the previous five years. The growth rate for the period from 2002 to 2007 was 7.6%. This dip in growth rate can be attributed to the increased health awareness among Australians, which has acted to reduce the spending on salty snacks.

Despite slow revenue growth, the industry is considered to be in the growth phase of the life cycle. The growth phase has encouraged companies to indulge in more acquisition efforts.

Starting from the year 2007, nutritious snacks have become the fastest-growing market segment. The market for healthy snacks expanded by 22% over the year 2007, accounting for 11% of the market. Considering the shift in the consumers’ preferences Frito Lay, which controlled 32% of the market share purchased the Sakata brand, which was an Australian rice snack forming part of the healthy snack market.

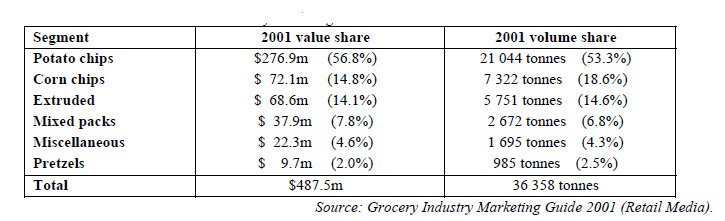

The market segment and share of different products as per the available figures are shown below.

Although there is a shift in the consumer preference to healthy snacks, the proportion of different segments of the salty snacks remains more or less the same even presently, with potato chips controlling a major portion of the market. The overall growth in the market was 5 to 7% per annum until 2008, after which the growth has shown a dip.

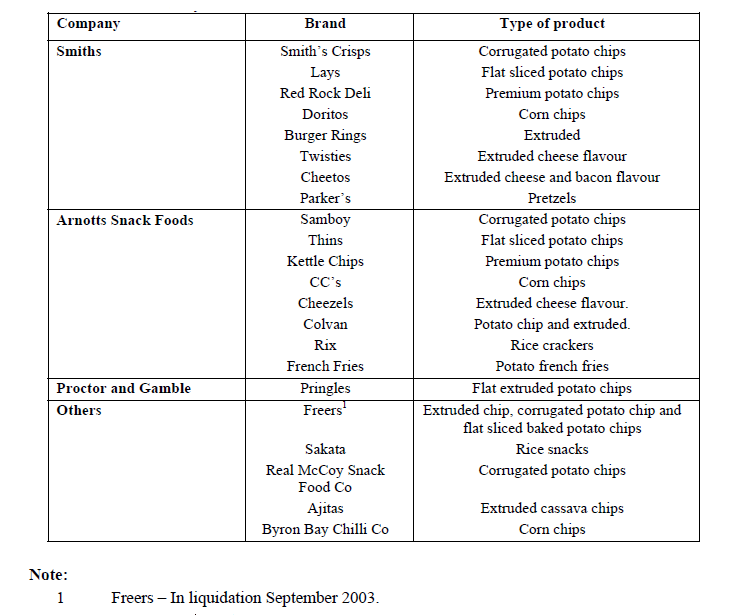

Two major players dominate a large proportion of the Australian salty snack market. They are (i) Salty Snack Food Company, part of Pepsico and (ii) Arnott’s Snack Foods, a wholly-owned subsidiary of Campbells Soup Company. These two companies promote their products by allocating large amounts of advertisement budgets. Competition in the Australian Snack Foods market is intense. The players target specific market segments and adopt various marketing strategies to capture maximum market share. Because of intense competition among brands and their advertising and sales promotion, the market share among various brands appear to be extremely volatile, making the “Salty Snacks Analysis” interesting and informative. The following table shows some of the brands operating in the Australian salty snacks market.

Based on the preference and tastes of the consumers, the Australian Salty Snack market is divided into different segments – (i) health-conscious consumers, (ii) convenience, (iii) kids and (iv) premium. The brands focus on the different segments depending on the nature of their products.

Another important factor, which affects the marketing of salty snacks in Australia, is the social marketing issues connected with television advertising of food including salty snacks. Various non-government organizations have called for restrictions or outright bans on television food advertising aimed at children. This will have a significant impact on the sale of different brands of salty snacks.

With this background information on the salty snacks market, the next section analyzes the impact of branding and brand positioning on salty snack brands in Australia, since branding is an important element in the marketing of salty snacks in Australia.

Analysis and Recommendations

The success of the marketing strategies of salty snack brands in the Australian market depends on the ability of the brands to create strong brand loyalty by positioning their brands appropriately. The marketing strategies suggest the creation of a unique brand that represents the superior product attributes in terms of price, availability, and quality. Especially in the case of salty snack products, branding plays a significant role in ensuring sizeable market share for the brands. The fact, that two companies dominate the Australian salty snack market reflects the power of brand creation and focusing the marketing strategies towards branding and brand positioning.

Market Segmentation

The purpose of market segmentation is to undertake the promotion of the products based on the consumption patterns of potential customers. Segmentation involves the subdivision of a market based on some common features of the consumers constituting the market. Segmentation facilitates firms to focus their marketing energy to garner significant competitive advantage over competitors. Marketing is the process of evaluating and developing the market for a particular product.

This process takes place by identifying the need of the customers for particular products and meeting such needs of such customers on an acceptable basis. Different definitions of the term marketing exist. Alderson (1957 cited in Brassington & Pettitt, (2003, p 5) defines marketing as an exchange process between an organization and the consumers of its products or services. Successful marketing is, in fact, a complex process.

A simple marketing model promoted by Kotler & Armstrong, (2000) explains marketing as the process of delivering products and services by an entity in exchange for money. Segmenting is an important component of marketing. Mintel has made a classification of the salty snack market comprising of eight separate segments – “potato chips; tortilla chips; snack nuts and seeds (including corn nuts); popcorn; pretzels; extruded cheese; snacks; corn snacks; and other.” However, for our analysis, the salty snack market is divided into three categories – Potato chips, Extruded and Corn snacks – with four brands in each segment considered.

Potato chip sales show a high level of penetration in the market, with more than 41% market share and topping every salty snack segment. Although potato chip sales have increased because of the recessionary trends, it is unlikely that the same trend would continue, as poorest nutritional values accompany the largest share of sales

Corn snacks show slight growth and as an alternative to potato chips. There is continued innovation, especially with the introduction of new flavor concepts. “Limited innovation and consumers’ perception of this product as unhealthy are expected to contribute to a continued sales decline” (Fay, 2009). The following table drawn from the “Salty Snacks Analysis” illustrates the above position.

Except in the case of Brand BB Corn chips, all other brands in the corn segment have performed poorly, which shows the lukewarm reception for corn-based products in the market. Even in the case of BB, the penetration might have been possible because of the performance of the brand in potato and extruded segments. The growth in the sales of corn products might be complementary to the sales of the brand in the other product segments.

Brand Extension

“Extensions in salty snacks can run the gamut between new flavors, innovative shapes and novel containers. Changing consumer tastes have had a direct influence on product innovations for snack foods, resulting in a richer variety of spices, herbs and other flavor enhancers, such as roasted garlic” (Roberts, 2003). This has also made the market a highly segmented one. The best example for this type of product segmentation is gourmet potato chips, which consists of the thicker and crunchier varieties and this product has gained more popularity among the consumers. These products also reflect the latest flavor trends (Roberts, 2003).

“Manufacturers also have responded to consumers’ hectic lifestyles by introducing more-convenient packaging. Simply put, a snack on the go is a meal substitute for many, and some regard it as the fourth meal. Such single-serve products could lead to several changes in the market, notably rising prices” (Roberts, 2003).

Market Penetration and Purchase Duplication

The learning from the work of John Dawes has given rise to the consideration of the issues of market penetration and its likely impact on purchase duplication by the customers. Sharp et al (2002) have done extensive work on market penetration and duplication issues in a market like that salty snacks market. The analysis indicated that with higher penetration, the purchase duplication is likely to be less as compared to those products, which have lower penetration levels. Marketers have to consider purchase duplication within brands of the same product segment and product segments. However, they must consider the relative market size of each product segment, instead of basing their decision on the purchase duplication coefficients of products/segments. Salty Snacks Analysis provides the following penetration levels concerning the different brands reviewed.

Table: Penetration Levels of Different Brands.

Penetration levels are important information in the analysis of the average duplication as worked out in the Salty snacks analysis provides the information on the penetration levels of different brands. The average penetration levels are obtained based on the ability of the brands to penetrate other product segments. It is observed from the working that those brands, which have penetrated well in the market, have been able to penetrate other product segments more. The following table drawn from the working on salty snacks analysis explains this proposition.

Table: Expected Duplication Levels of Different Brands.

The expected penetration levels show that in the case of brands like BB Standard, high potential for penetration still exists, which the brand can use to expand its business in the existing products or by entering into new product segments in the areas of Extruded and/or Corn products. BB has already proved successful in extending to the Corn segment. Two important elements need the consideration of the brands – brand loyalty and customer segmentation.

Consumer Behavior and Segmentation

Consumer behavior is one of the important determinants of marketing strategies. Blackwell et al., (2001) define consumer behavior as actions of the individuals in pursuit of having products or services for their consumption (p 6). Consumer behavior concerning a certain product or service is analyzed to ascertain the response of the potential customers to different advertising strategies of an organization. Analysis of consumer behavior is undertaken to enable the organization to build and disseminate a “unique selling point” to its potential customers so that the company can achieve its marketing and advertising goals. Michman (1991) argues that consumer behavior is a function of the “lifestyle and personality” of a consumer.

Marketing of salty snacks poses significant challenges to the marketers and consultants because of different consumer preferences. These challenges make it important to look at the market structure and preference segmentation in tandem. Market Structure research may indicate the in a typical market, consumer’s first purchase decision might pertain to the size, with consumer’s preference extending to either small size or extra-large size.

The next decision of the consumers is “whether to purchase a branded product or private label.” Those consumers, who prefer to buy private label products, make their purchasing decisions by deciding between different types of salty snacks, caring rarely about health aspects. On the other hand, consumers who prefer to buy branded salty snacks, limit their choice between products having perceived health benefits such as baked products as against regular salty snacks like chips.

If the market structure analysis reveals that consumers who prefer baked salty snacks have the highest levels of loyalty to the category, then a brand manufacturer may react to this situation and might devote the maximum thrust to introduce baked or low-fat varieties in the market. However, there is every chance that consumers who are loyal to baked salty snacks might represent a very low percentage level of this category of buyers. Then it would not make sense to reduce the market penetration of regular products. Therefore, brands have to segment their products based on actual buyer behavior rather than depending on market surveys.

Although it is not a healthy habit, research by Mintel on American consumers of salty snacks reveals that 50% of the children, teenagers and young people in the age group of 18-24 years confirm that they consume salty snacks five times in a week or more. The research also reveals that even adults have the habit of eating salty snacks 4.8 times on average in a week or more, which works out to almost once a day.

Brand Loyalty

According to practitioners and scholars, building a strong relationship between the brand and the consumers is the last step in the process of building a brand (Dyson et al., 1996; Franzen, 2001). Brand loyalty is one of the key enablers of this process. There have been several types of research conducted, which were centered around the determinants of brand loyalty and the impact of brand loyalty on sales growth of different brands (Fornell et al. 1996, Kapeferer, 1997). Jacoby & Chestnut (1978) define brand loyalty resulting from two components: “1) A favorable attitude toward the brand, and 2) Repurchase of the brand over time”. Enhanced repurchases by the customers would reflect the behavioral intention of the consumers (Martesan, 2004).

By building strong brand loyalty, a particular brand can penetrate other product segments easily based on brand loyalty. This is evident from the following analysis. In the case of BB Standard since this is a powerful brand, having established strong brand loyalty was able to penetrate other brands more as compared to penetration by other brands. This brand could also extend to other product segments.

Table: BB Standard – Brand Penetration Levels into Other Brands.

Recommendations

Considerable theoretical evidence based on the current research suggests the positive correlation between customer satisfaction and loyalty. Satisfaction has been one of the means of achieving strategic ends of customer loyalty and retention, which have a direct impact on the profitability of the organization. The current research suggests establishing a strong brand image as one of the key elements in improving the performance of the brands.

It is imperative that firms competing in the salty snacks market of Australia consider the purchase duplication between brands within the same product and between other products (segments) in the market. The analysis highlights the strong presence of such a customer attitude to prefer alternative brands. Brands must undertake periodical market information surveys to identify the impact of purchase duplications and the effect of penetration on the duplications. This will help them to identify their relative position in the market and suitably adjust their marketing strategies to achieve the desired sales outcome.

Loyalty is a deeply held commitment on the customer side. This commitment is to exhibit the intention of making repurchases of a specific product or service consistently over time. The intention to repurchase should not be hindered by any situational influences. In this context, the recent social marketing issue is one of the aspects that different brands operating in the salty snacks market must consider, while deciding their marketing strategies. This issue has a different impact on different stakeholders including television companies and the consumers, apart from the brand owners. It is for the brand owners to consider ways of attracting potential consumers without violating the social market rules or expectations.

Conclusion

Customer satisfaction measured in terms of the value derived by the customer by the comparable quality and price of the products has a tremendous effect on improving customer loyalty, and at the same time, brand positioning has an important role to play in improving the sales of different brands. Through secondary research, this study has provided theoretical support to the hypothesis that in the case of salty snack products in the Australian market, the brand image and positioning will influence customer loyalty largely.

This report discussed several issues relating to the branding of the salty snack products in the Australian market. The central focus of the research was to identify the factors that influence the purchase of duplication between brands. Brand image, positioning, and loyalty are the important factors identified by the study to have a strong influence on the establishment of significant market share by the brands in the Australian salty snacks market. The impact of purchase duplication among brands within the same product segment and between segments was studied. The research also considered the impact of social marketing issues on different stakeholders associated with the salty snacks market.

References

Blackwell, R., Minard, P. & Engel, J., (2001). Consumer Behaviour, 9th Edition. London: Prentice-Hall.

Brassington, F. & Pettitt, S., (2003). Principles of Marketing 3rd Edition. London: Prentice-Hall.

Drake Isobel, (2009), Potato Chip Sales Surge. Web.

Dyson, P., Farr, A., & Hollis, N.S. (1996).Understanding, Measuring, and Using Brand Equity Journal of Advertising Research, 36, 6, 9-22.

Fay Kat, (2009), Article: Salty Snacks. Web.

Franzen, G. & Bouwman, M. (2001) The Mental World of Brands: Mind, memory and brand success Henley-on-Thames, Oxfordshire, UK: World Advertising Research Center (WARC).

Fornell, C., Johnson, M.D., Anderson, E.W., Cha, J., & Bryant, B.E. (1996) The American Customer Satisfaction Index: Nature, Purpose, and Findings. Journal of Marketing, 60, 4, 7-18.

Jacoby, J. & Chestnut (1978). Brand Loyalty. Measurement and Management New York: Wiley & Sons.

Kapeferer, J. N. (1997). Strategic Brand Management. Great Britain: Kogan Page.

Kotler, P. & Armstrong, G., (2000). Marketing – An Introduction 5th Edition. Upper Saddle River NJ: Prentice-Hall.

Market Line, (2009), Savory Snacks: Global Industry Guide. Web.

Martesan Anne, (2004), Building Brand Equity: A Customer-based Modeling Approach’ Journal of Management Systems Vol. XVI No 3.

Michman. R.D. (1991) ‘Lifestyle Market Segmentation’ New York: Praeger Publications.

Roberts William, (2003), Market Trends Category Analysis: Snacking: The Fourth Meal. Web.

Sharp, B, E. Riebe and J.G.Dawes, (2002). A Marketing Economy of Scale- Big Brands Lose Less of their Customer Base than Small Brands. Marketing Bulletin, 13, Research Note 2.

Solomon, M. R., Russell-Bennett, R., & Previte, J., (2010), Consumer behaviour: buying, having, being, Frenchs Forest, N.S.W.: Pearson.