Cash Flow Summary

The bars in the above graph represent the amounts available from:

- Earned income (wages and self-employment)

- Social Security

- Qualified plan additions and distributions

- Investment additions and distributions

- Misc – (inheritances, sale of residence, retirement account minimum distributions, Life insurance)

The line illustrates the annual expenses including:

- Personal living expenses

- Planned debt expenses

- Specified special expenses

- Planned deposits to investment and retirement accounts

- Miscellaneous expense items

- Taxes

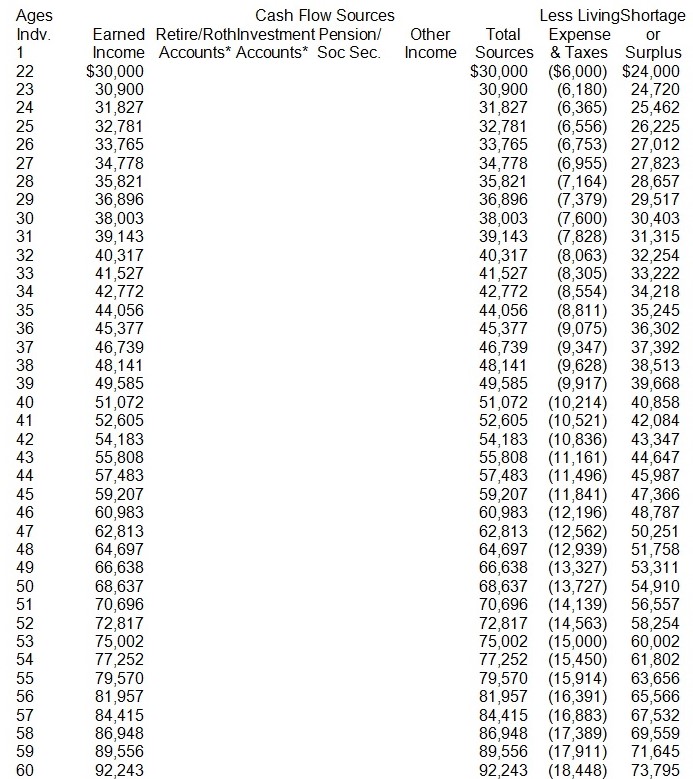

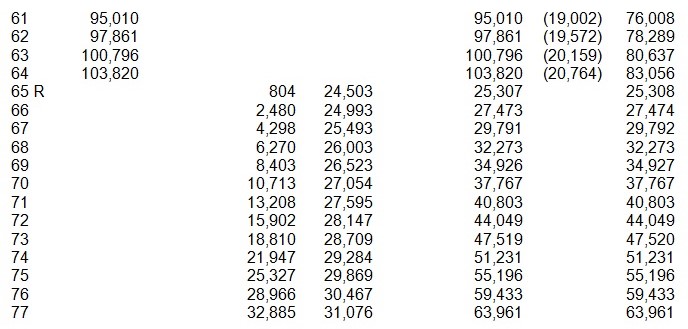

Note: The Cash Flow report provides the actual numbers that create the preceding Cash Flow Summary graph.

Cash Flow

Actual future investment returns, taxes, and inflation are unknown. Do not rely upon this report to predict future investment performance.

Lessons from Financial Plan

The money tree Personal Financing Plan program is not only user friendly, but also convenient. Even though the program’s report should not be fully relied on by users due to unpredictability of actual future investment returns, inflation rate, and level of taxes, it acts as a guideline for individuals and Personal Financing Planning experts. The process of performing the money tree Personal Financing Planning is enlightening and helpful in numerous ways to individuals who want to secure a future for their families as well as students pursuing career in Personal Financing Planning. It shows that Personal Financing Planning is a complicated and involving process that requires the involvement of professionals. The most important lesson one can learn from the process is of the various sources of individual’s income and their influence on his or her Financing Plan. Main sources of fund for individuals include salaries from employment, retirement benefits, savings, and inheritance. According to the report, individuals who spend less than they earn save more and therefore have more money for investment than those who spend more. The common areas of individual expenditure include, education costs, loan repayments, regular living expenses such as food, clothing, medicine, and transport, and planned expenses. An individual’s ability to control his or her spending consequently leads to increased savings.

Secondly, the Personal Financing Planning calculation process using money tree gives users opportunity to learn the various factors affecting their future level of investment and earnings. For example, persons who start saving from earlier ages accumulate more money before retirement than those who start at old age.

Additionally, I have learned that the main sources of individual’s earnings after retirement are investment and pension. The amount of earnings from investment depends on the amount invested, while value of pension depends on percentage of basic earnings signed. If an individual saved more during employment, he or she may still earn more even after losing salary.

The program also confirms that Personal Financing Planning decisions face many uncertainties. Factors such as government taxation plan change regularly and may affect an already laid out plan negatively. Inflation rate is also unpredictable, thereby rendering the planning results provisional but not final. In fact, the success of a Personal Financing Planning is dependent on the accuracy of the prediction of inflation rate and tax level.

Finally yet importantly, I have come to realize that the Financing Planning process involves consideration of many economic parameters, which only competent and well-trained individuals can perform successfully. It requires knowledge on loan policies, environmental scanning techniques to help in identifying investment opportunities, government tax policies, and accurate prediction of current economic trends and their effects on various business ventures. Ordinary individuals cannot complete these tasks.