The background of the study

- Saudi Airlines was incorporated as short haul and a low cost airline;

- The firm served both domestic and international routes;

- The firm has undergone huge transformation attributed to its unique services and iconic flight crew;

- The airline has been consistent in its profitability as well as market leader;

- The airline offers services based on customer needs.

From the beginning, the Saudi Airlines’ brand has not been instrumental towards its success. Nevertheless, in the recent years, the airline has implement brand strategy that has enhanced services delivery according to the customers’ needs. The brand strategy has been adopted by most of established firms as well as other aspiring airlines in the regions. The reason why the Saudi Airlines’ brand strategy is unique is that the management takes leadership in the implementation of the brand strategy (Boetsch, Bieger & Wittmer, 2011). As a result of the laxity by the airline staff to offer quality services, the customers number dropped by 68% according to DataGuru.org (2012) survey techniques.

Introduction

- Offering quality services has been the major aim of Saudi airline;

- The airline is operating within the struggling airline industry to offer excellent services;

- To survive amid increased competition the airlines has adopted various strategies including;

- Cost cutting;

- Sound management of unpredictable demands;

- Ensuring adherence to tight quality requirements;

- Generally, customer satisfaction should remain at the core of business strategies for the airlines in the industry.

According to various studies that have been done, the airline industry have the lowest scores in terms of customer satisfaction compared to other industries in the region (Fiorino, 2006).

The aims and objectives of the study

The major aim and objectives of this project is to investigate, discuss and determine:

- The concepts of quality service delivery and brand strategy within the airline industry focusing on the services being applied in the Saudi airlines;

- The customers’ expectations and experience with the airline services;

- The brand strategies that the firm should adopt to remain competitive;

- The major quality issues affecting service at Saudi airlines;

- How satisfied are the clients to the services provided by the airline;

- What competitive strategies have Saudi airlines applied in order to advance its brand;

- The impact of the Sky-team partnership particularly on customer’s satisfaction.

Research questions

Upon conclusion of the study, the obtained outcomes should respond to the following questions:

- What are the major qualities issues affecting service at Saudi airlines?

- How satisfied are the respondents to the services offered by the airline?

- What competitive strategies has Saudi Airlines defined in order to compete with the three operating firms in KSA?

- What are Saudi Airlines strategic plan for the next five to ten years to extend their loyal customers while achieving marvelous quality of service?

Literature review

In the reviewed literature, the following are discussed about the airline and the airline industry:

- Quality services within the airline industry;

- Services offered by the airline;

- Services offerings through strategic alliances;

- Excellent services delivery;

- Building the brand;

- Brand strategies;

- Developing cost advantages through brand strategies;

- Developing a brand that delivers results.

Quality services within the airline industry

- The exceptional airline customer service is created when:

- The firm is capable of meeting the expectations of its clients;

- The services match the clients’ perceived notion that their wants and prospects are being met by the airline;

- The customer satisfaction is improved;

- Delivering the excellent services is difficult in an atmosphere where others are held accountable;

- The delivery customer services should be approached holistically;

- Improved customers’ satisfaction is critical for the long-term growth and sustainability;

- Improved customer experience is significant for the success of the airline;

- The airline should establish customer driven vision as well as branding strategy;

- The airline brand is what the airline stakeholders perceive about the airline services and products being offered.

The airline brands are either ad hoc or strategic. The ad hoc brand is the customers’ opinion or perception of the typical experiences encounters they have had with the airline or what they have been told and read about the firm (Teichert et al., 2008). Strategic branding is what the airline management has put in place to ensure that better services are delivered to the customers (Iatrou & Alamdari, 2005).

Services offered by the airline

Services based on innovation provide competitive advantage to the airline.

Technological development drives the quality innovative services and the airline brand strategy are based on these services delivery.

Innovative services enable the airline:

- Access new markets;

- Increase the client based;

- Remain competitive.

Services innovations that have been applied by the airline includes:

- The strategic alliance;

- The use of electronic ticketing;

- The self-services check-ins;

- Common-use self-service;

- Check-in kiosks;

- Bar-coded boarding passes;

- RFID-enabled luggage handling.

The innovations have transformed the airline services making the process of handling customers more effective, efficient, less costly and quickly.

Consistent with Tiernan et al. (2008) study findings, three ways exist in which clientele can be drawn in the eminence services deliverance. These include listening to the needs of the customers, understanding to their requirements and finally having dialogue with the customers. The process is called user-based innovations to the services delivery (Tiernan et al.,2008). The airline has applied the user-based innovation to improve on its services delivery. Through user-based innovation, customer satisfaction and on flight experiences are enhanced.

Services offered through strategic alliance

The airlines are entering into strategic alliances to ensure.

Services delivery and customer benefits are enhanced:

- Reduced risks;

- Lesser resources commitment;

- Joint marketing benefits;

- Shared customer base;

- Increase network-wide cooperation.

The main driver for the airline to join Sky-team as part of the strategic alliance is to expand its network beyond the current regional market.

By being a member in the strategic alliance, the airline believes that its passengers will increase because of the combined common flyer plans amid various factors.

To benefit fully, the airline must improve its services delivery.

The increased developments of the technology provide more opportunities for the airline to develop new services (Chang & Yeh, 2002). In essence, technological innovations should be incorporated within the business strategy in order to further differentiate the airlines’ services from those of other competitors (Gilbert & Wong, 2003).

Excellent services delivery

The excellent services delivery includes the personalization of the services.

The personalization of services strategy involves:

- Designing visible element of the whole trademark practice;

- Design a unique and desirable uniform for all its cabin crew;

- Training of the cabin crew on the auspices of the industry.

Embrace the Asian values together with their hospitality described as:

- Compassionate;

- Affectionate;

- Tender;

- Well-designed;

- Peaceful.

Building the brand

Saudi Airlines should decide on a brand strategy that would differentiate its products and services from other firms in the region.

Understand the characteristics of the brand are critical for the implementation of the brand strategy.

The airline brand should be driven by technological innovations:

- The airline services and products should be unique to the customers;

- The unique products should differentiate the airline from both competitors.

Technological knowhow should determine the product innovation and brand strategy.

The airline should ensure that it upholds its premature flotilla of airliners within its most important space carters.

The corporation should maintain its technological innovations throughout (Gursoy et al., 2005). The entire brand benefits cannot be communicated at the same time (Chen & Chang, 2005). For the airline to achieve high service quality, it must retain and sustain its brand advantage through unwavering from the original strategy (Gronroos, 2001).

The brand strategies

The airline should include its communication policy as part of the brand strategy.

All new services being launched should be communicated in an exciting and fabulous disposition to emphasize the objectives of the airline brand.

All airline messages should be communicated through:

- Iconic firm artistry;

- Dressings;

- Different premises and locale.

The company should remain focused and consistent in the communication of its brand in order to achieve the aims of its strategies.

The entire airlines brand strategy and its positioning should ensure delivery of excellent customer services.

For the airline to achieve high service quality, it must retain and sustain its brand advantage.

The brand strategy should be geared towards achieving the excellent services delivery.

The slogan as well as the aspirations of the airline to commit itself towards provision of the quality services should be conveyed exclusively and consistently in both the old and the digital media with an aim to attract larger customer base (Gliatis & Minis, 2007).

Cost advantages through brand strategies

For every brand strategy, there must be costs and benefits that are involved.

The firm must develop pecuniary and predetermined cost framework that will:

- Permit continuous investments;

- Proper execution;

- Comprehensive performance;

- Sustain the trade name;

- Offer cost advantage.

Well-built pecuniary capabilities will enable the firm:

- Support the development of infrastructures;

- Support research and development;

- Be innovative through the adoption of new technology.

All these activities will be attained at condensed overheads (Babbar & Koufteros, 2008). The long-term leases can be reduced so that the airline can afford newer and more effective and efficient airplanes that minimize the cost of repairs and avoid delays. Further, the airline can improve on its brand strategy by maintaining new infrastructure. In other words, the fleet should be current. The aircrafts should be of younger generation that is cost effective in terms of reduced fuel consumption. To reduce on the costs of fuel, the airline should hedge its fuel contracts in advance to stay away from recurring and unpredictability in the fuel prices (Gliatis & Minis, 2007). Moreover, the good financial base will allow the airline to settle short-term debts that are incurred. The good financial base adds to the competitive advantage for the airline.

Developing a brand that delivers results

A brand that delivers results should be:

- Best performing;

- Consistent;

- Effortlessly managed;

- Maximizes on the airline revenue;

- Command price premiums;

- Control costs.

The brand strategy should ensure that the airline maximizes on its revenue and command price premiums (Chen & Chang, 2005).

Research methodology

Research methodology will discuss:

- The study design;

- Sampling and sampling procedure;

- Instrumentation;

- Data collection;

- Techniques of the data analysis.

The study design

The study is designed in form of the sources of data and methods of data analysis.

The data was collected from:

- Primary sources;

- Secondary sources.

Primary sources and method of data analysis

The project will be majorly quantitative study and the data will be gathered as well as analyzed through:

- Survey;

- Step level techniques.

The survey data collection method and the step level data analysis are considered because:

- They rarely stand a chance of disqualifying any notable alternative explanations

- They surmise to the event causations.

The survey will be conducted through:

- Administering self-designed questionnaires;

- In-depth interviews.

Secondary sources

The secondary research data and information will accrue from:

- Airline records;

- Any other documentation that have been filed by the organization;

- Review of information concerning the airline services delivery.

Sampling and sampling procedure

A hundred clients will be selected.

Clients will be selected via:

- Convenience simple online random sampling strategy.

From the sampled clients the questionnaire will have to be administered equally at the same time within a particular period.

The sampled respondents will be categorized according to:

- Gender;

- Age group;

- Educational background.

Gender, age group and education background

The sample size will comprise of:

- 60 men and 40 women;

- Fourteen between the age of 21-30;

- 40 respondents from the age of 31-40;

- 36 between the ages of 41-50 while ten are from 50 and above.

In addition, the sampled respondents will also be categorized according to their educational levels.

Instrumentation

Data will be acquired from primary and secondary sources.

Primary data will be gathered through:

- Administration of questionnaires;

- Observation;

- Interviews will also be conducted to clients.

A comprehensive exploration instrument will be developed after being satisfactorily tested.

Only the selected and amended items will be included in the questionnaire.

Data collection

Primary data will be collected through:

- Administration of questionnaires;

- Observation;

- Online interviews;

- Occasional conversations.

The questionnaire will be administered to a hundred respondents.

The questionnaire will be both open and close ended.

Secondary data will be collected from airline records.

Different scales will be applied in survey questionnaire:

- Ordinary scales.

- Reliability scales.

Data analysis technique

- Acquired data will be edited to identify mistakes;

- Data will be analyzed both quantitatively and qualitatively;

- Secondary data will be analyzed through content analysis;

- Regression analysis will be used to establish correlations;

- Spearman’s correlation, percentages, frequency distribution and deviations will also be used;

- Line graphs, tables and bar charts will be used to make quantitative data simple.

Data findings

The focus of this chapter is to present empirical findings of the survey.

During the analysis:

- First, the respondents were categorized according to their age group, gender and educational background;

- Secondly, the quality services attributes are scrutinized and argued;

- Lastly, the most important data from open-ended questions are scrutinized and summarized.

Online survey was chosen due:

- To its simplicity and the spread of the expected target respondents;

- The ability to collect qualitative data.

The data analysis has been performed using:

- The Microsoft excel;

- The Webropol Insight Statistical Analysis Tool (WISAT);

- Spearman correlation.

The spearman’s correlation coefficient indicates the statistical dependence between two variables in case where the p-value is below 0.05, the correlation exists.

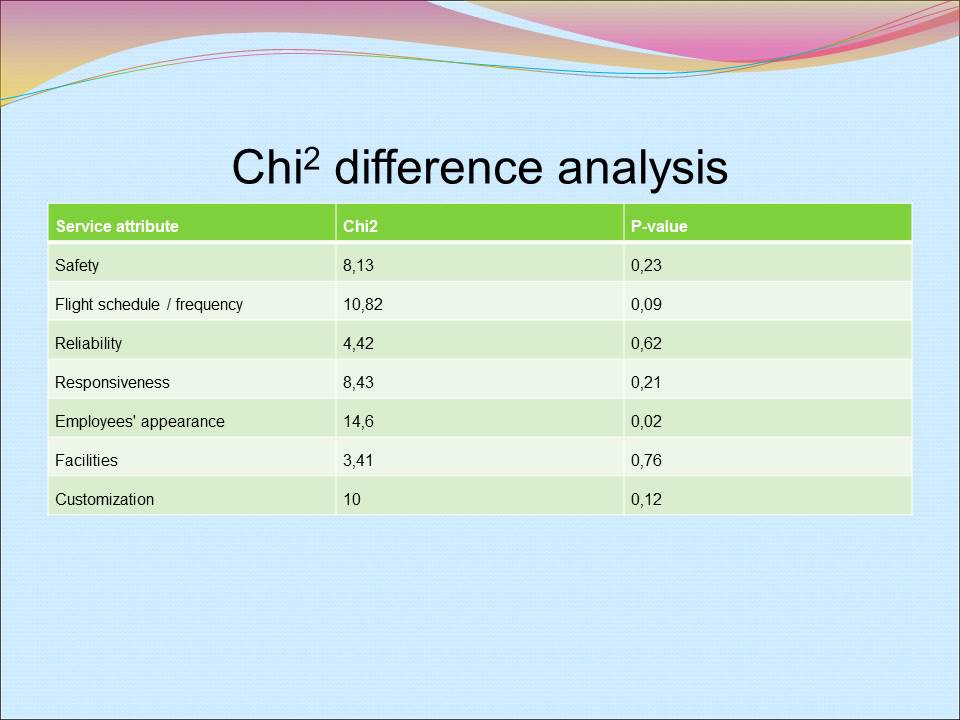

Chi² difference analysis

Respondents profiling, gender and age group

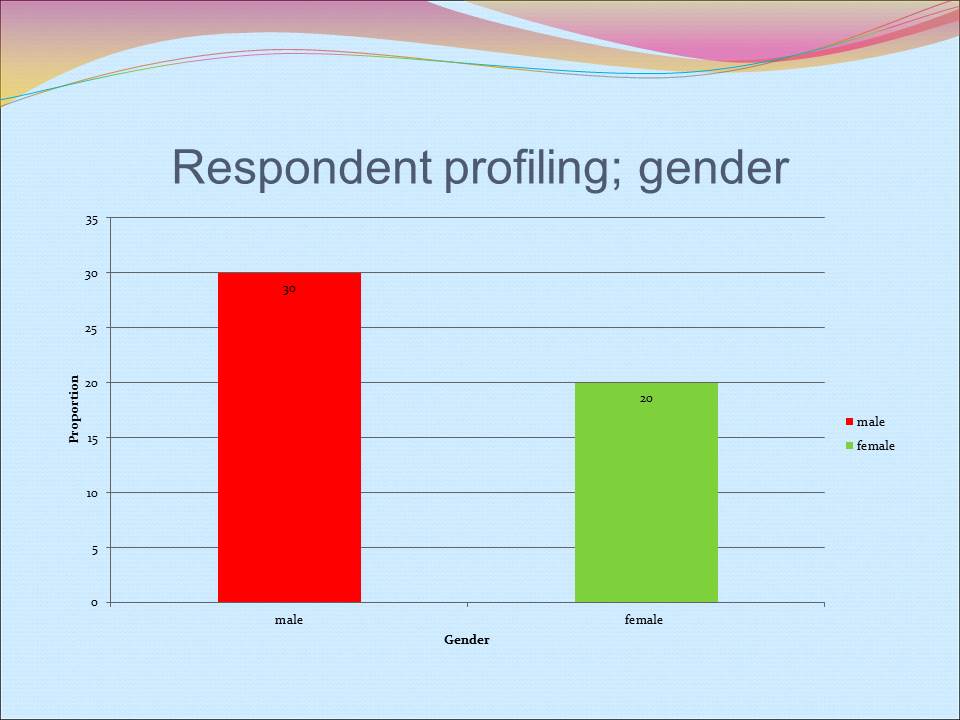

Out of 50 respondents:

- 20 were female;

- 30 were male.

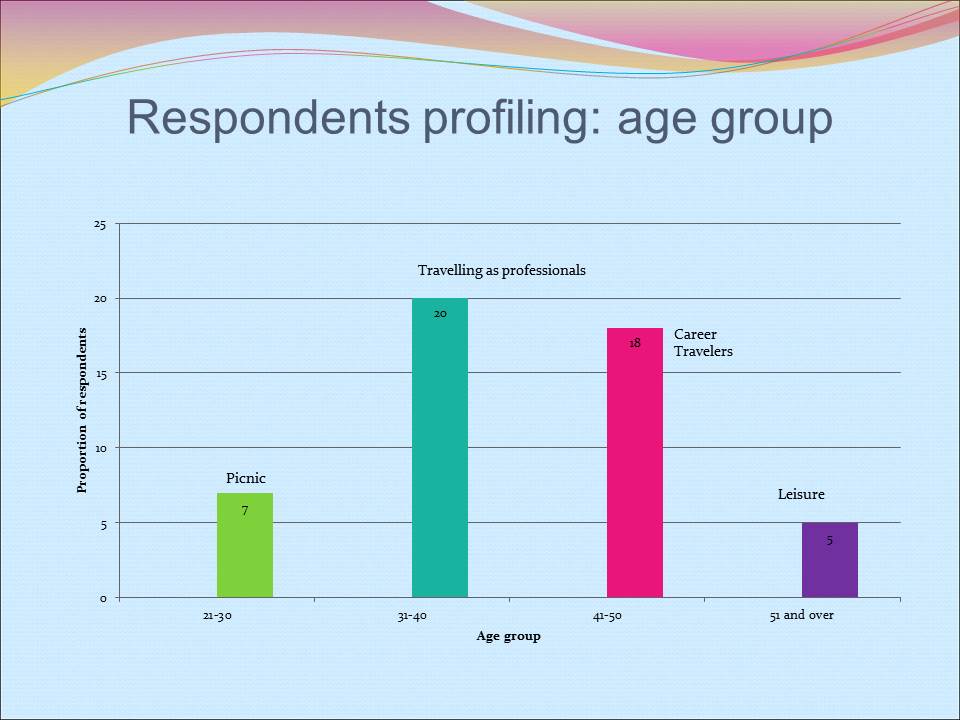

According to age group:

- 21-30 were seven,

- 31-40 were twenty,

- and 41-50 were eighteen while 51 and above were five.

As can be observed, the majority of airline customers are between the ages:

- 30-40 years representing young professionals travelling either as tourists or on behalf of their companies;

- 41-50 years at the peak of their careers travelling on their own or on behalf of their companies.

Respondent profiling; gender

Out of 50 respondents, 20 were female while 30 were male.

Respondents profiling: age group

According to the age group, 21-30 were seven, 31-40 were twenty, and 41-50 were eighteen while 51 and above were five.

Respondents profiling: Travel class

According to the response:

- 90% of the respondents travel for personal reasons.

This could be indicated by their use of economy class:

- Only one percent travel for business reasons.

This represents only 5 respondents out of 50 while 45 travel using economy class.

However, most of the travelers are likely to combine the reasons for travel.

The business class travelers agree that they are the most affected by the flyer programs of the airline compared to the economy class.

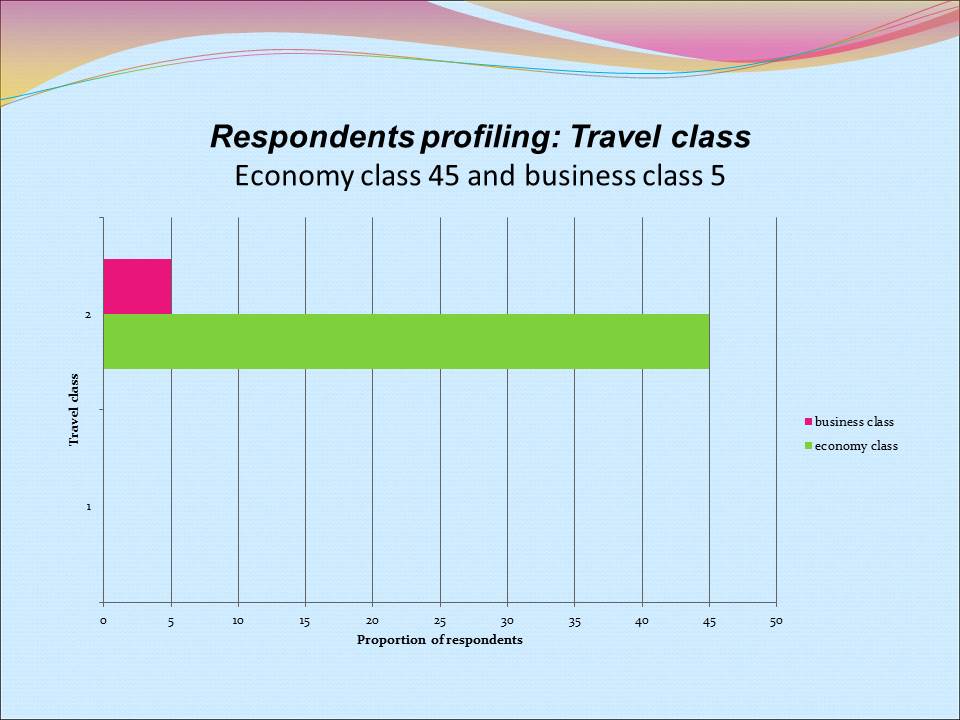

Economy class 45 and business class 5

Five respondents out of 50 travel using business class while 45 travel using the economy class.

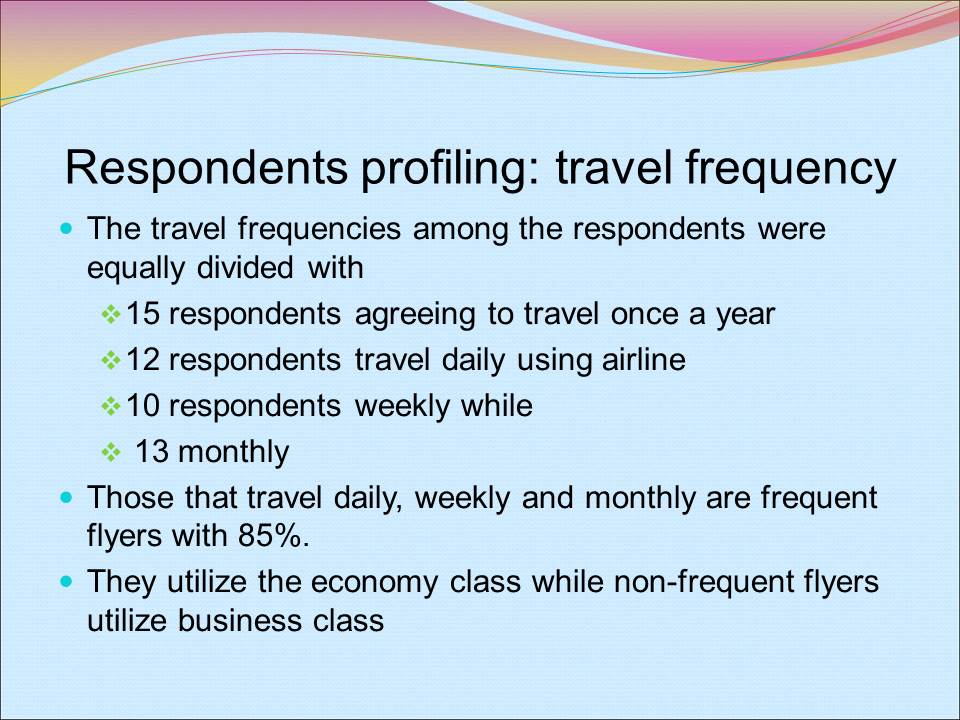

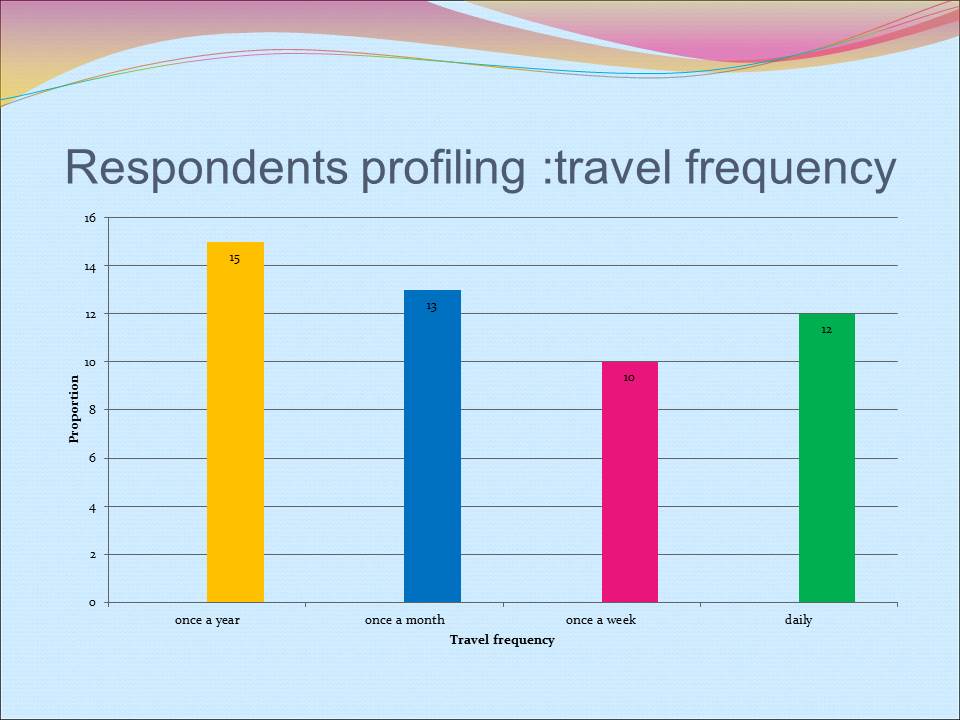

Respondents profiling: travel frequency

The travel frequencies among the respondents were equally divided with:

- 15 respondents agreeing to travel once a year;

- 12 respondents travel daily using airline;

- 10 respondents weekly while;

- 13 monthly.

Those that travel daily, weekly and monthly are frequent flyers with 85%.

They utilize the economy class while non-frequent flyers utilize business class.

The travel frequency among the respondents were such that15 respondents travel once a year, 12 respondents travel daily, 10 respondents travel weekly while 13 travel monthly.

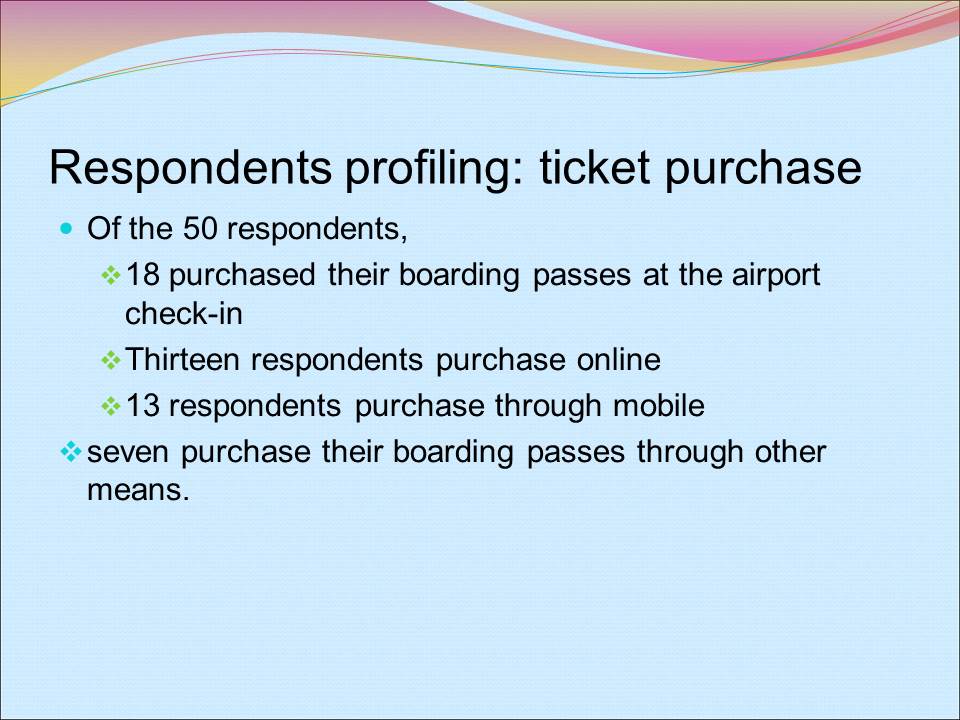

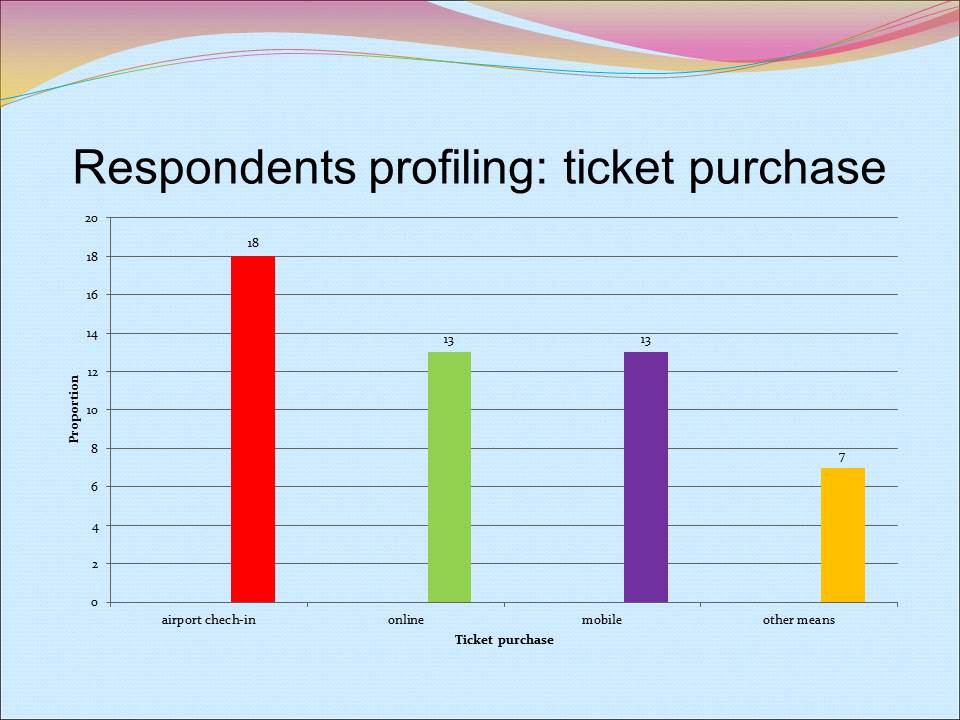

Respondents profiling: ticket purchase

Of the 50 respondents:

- 18 purchased their boarding passes at the airport check-in;

- Thirteen respondents purchase online;

- 13 respondents purchase through mobile;

- seven purchase their boarding passes through other means.

Of the 50 respondents, 18 purchases their boarding passes at the airport check-in, 13 respondents purchase online, and 13 respondents purchase their boarding passes through mobile while seven purchase their boarding passes through other means.

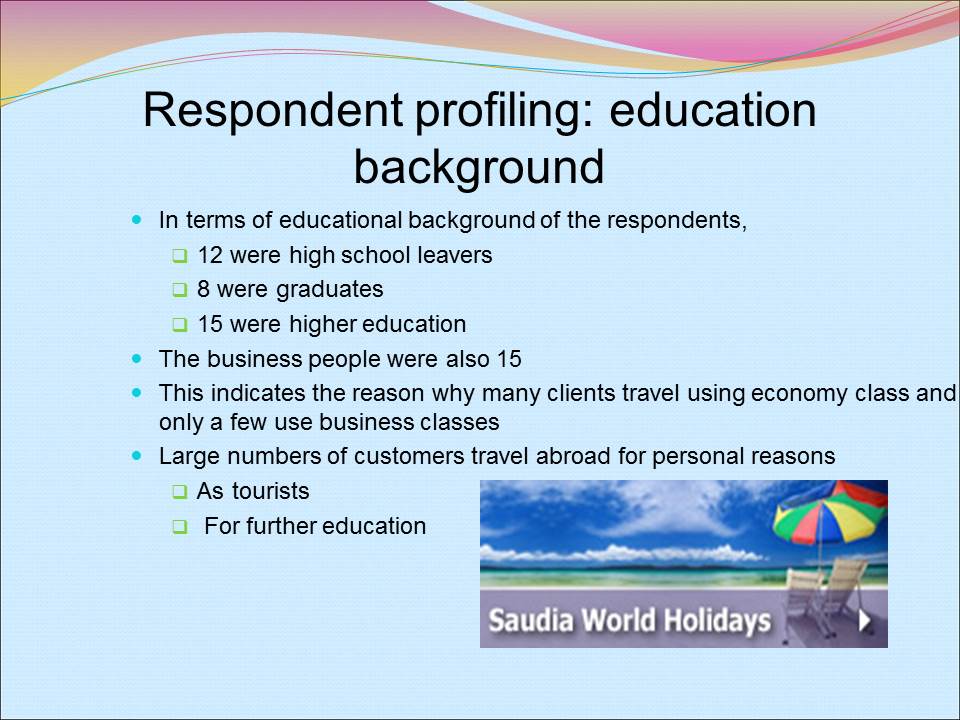

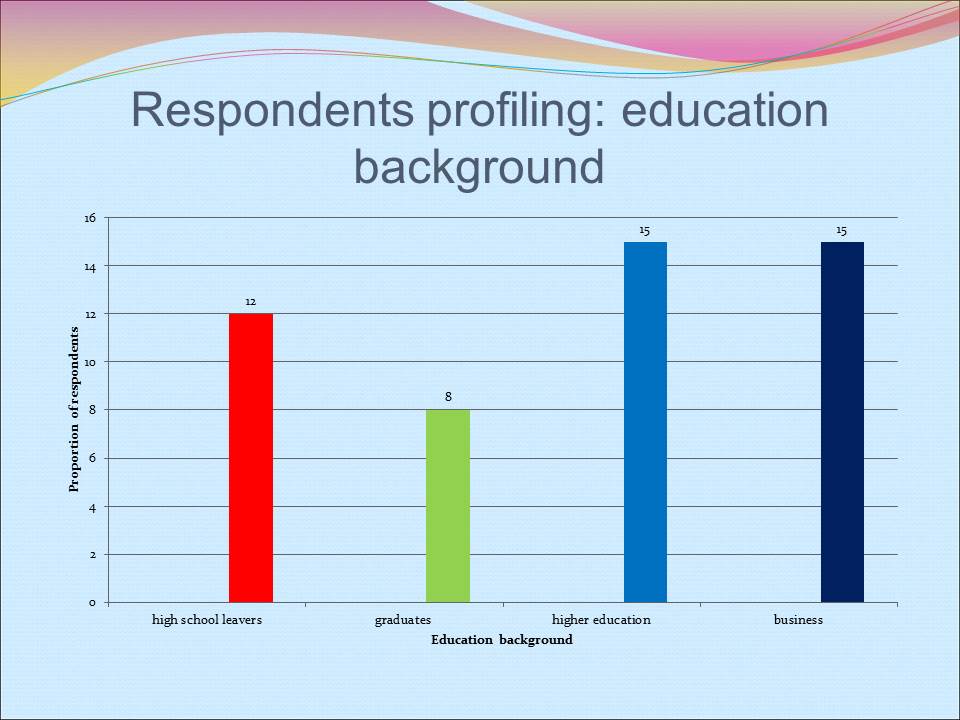

Respondent profiling: education background

In terms of educational background of the respondents:

- 12 were high school leavers;

- 8 were graduates;

- 15 were higher education.

The business people were also 15.

This indicates the reason why many clients travel using economy class and only a few use business classes.

Large numbers of customers travel abroad for personal reasons:

- As tourists;

- For further education.

In terms of educational background of the respondents, 12 were high leavers, 8 were graduates, while higher education was 15. The business people were also 15.

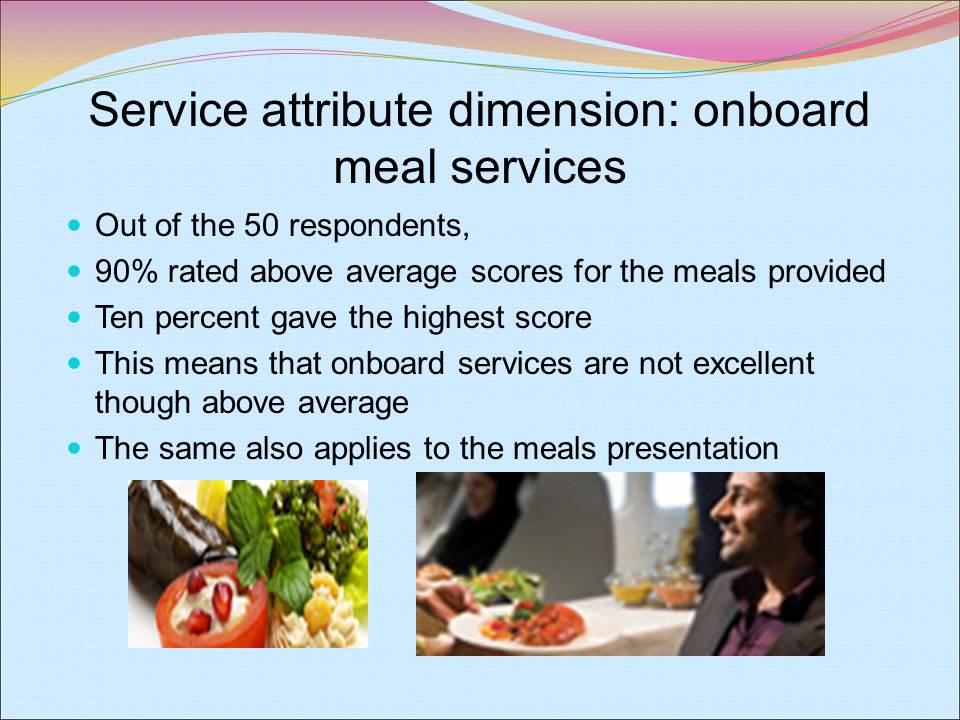

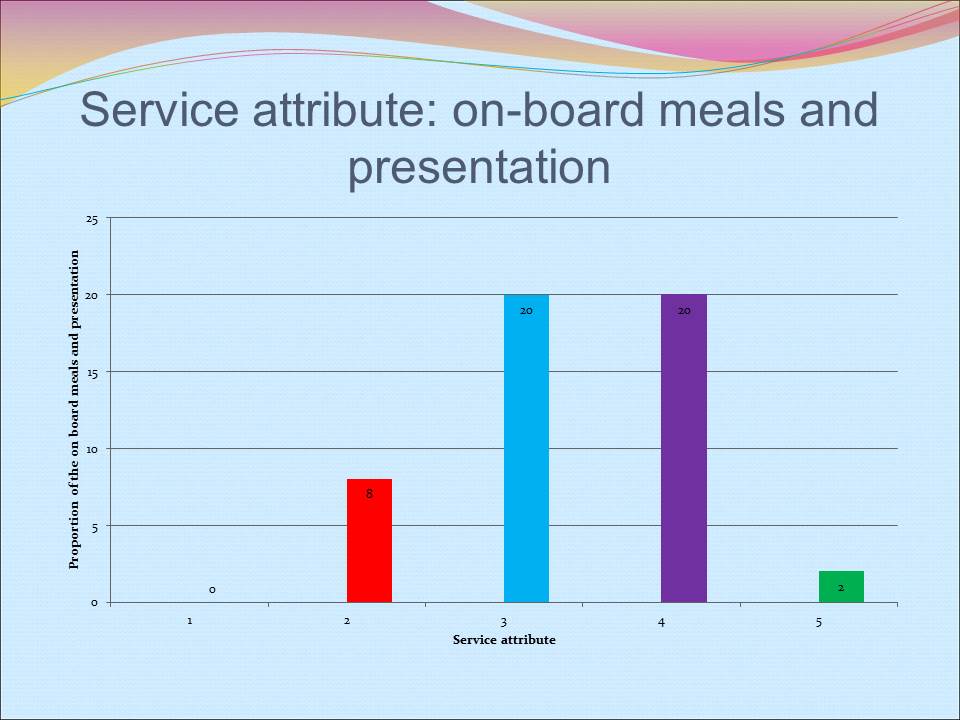

Service attribute dimension: onboard meal services

- Out of the 50 respondents,

- 90% rated above average scores for the meals provided,

- Ten percent gave the highest score,

- This means that onboard services are not excellent though above average,

- The same also applies to the meals presentation.

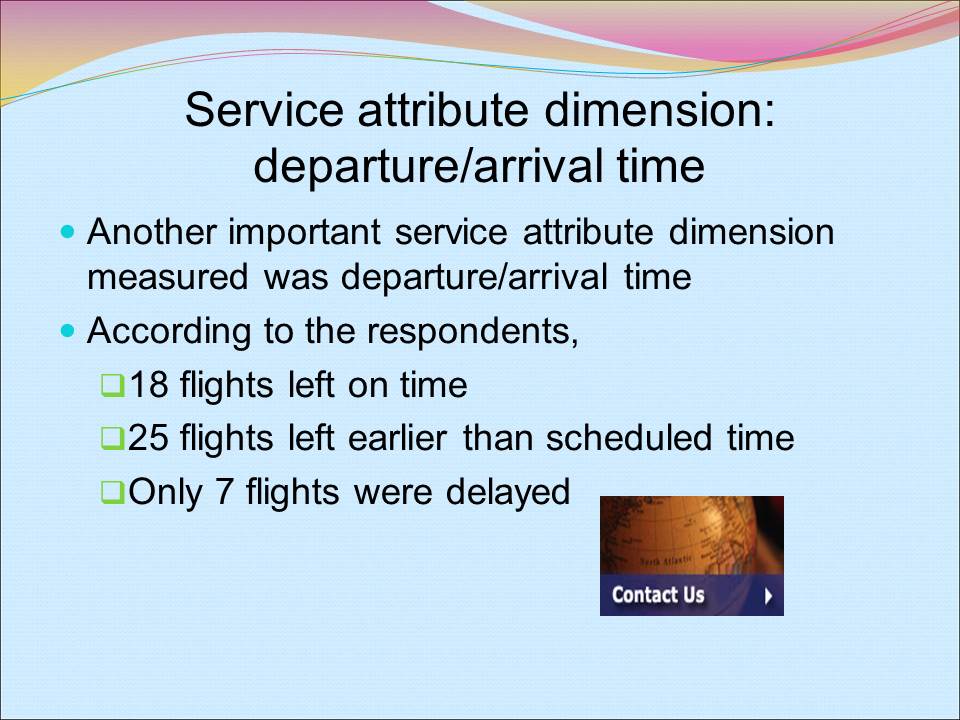

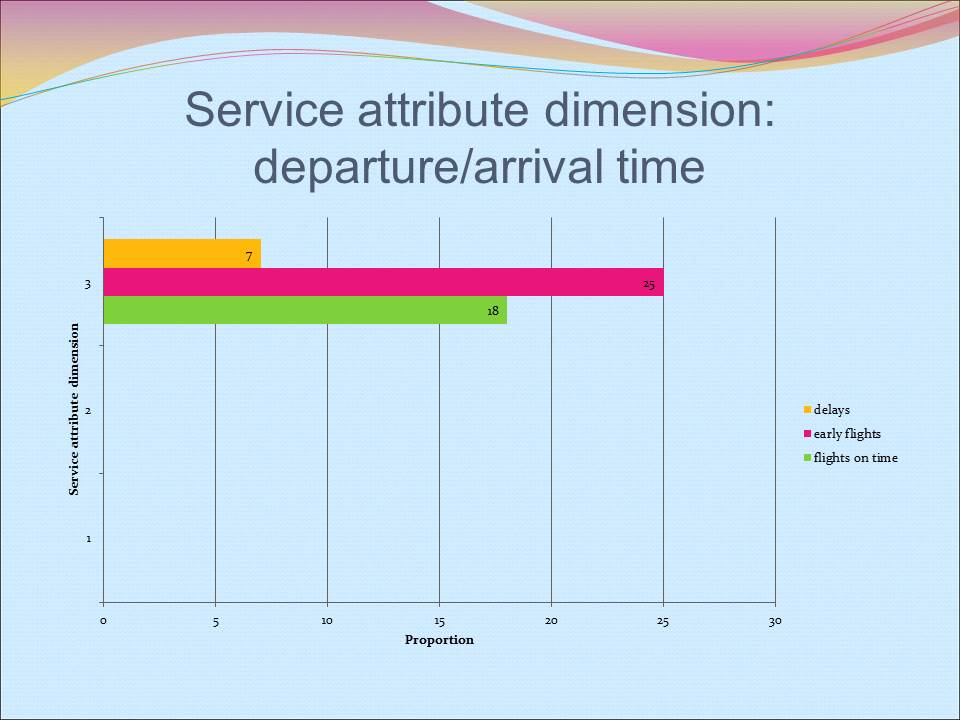

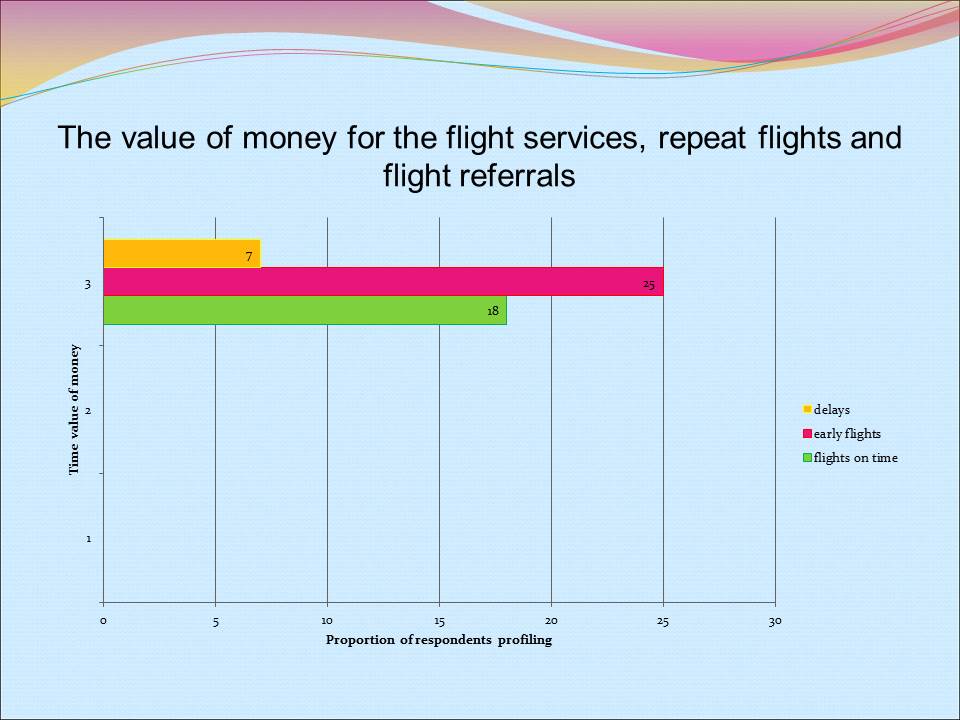

Service attribute dimension: departure/arrival time

Another important service attribute dimension measured was departure/arrival time.

According to the respondents:

- 18 flights left on time;

- 25 flights left earlier than scheduled time;

- Only 7 flights were delayed.

According to the respondents 18 flights left on time, 25 flights left earlier than the scheduled time while only seven flights were delayed.

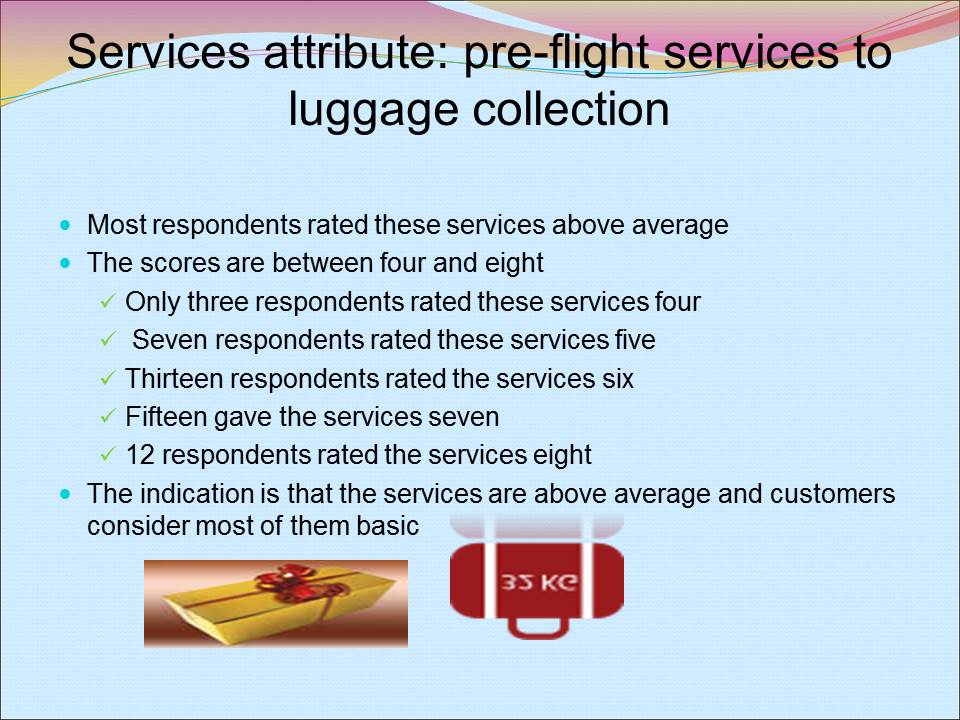

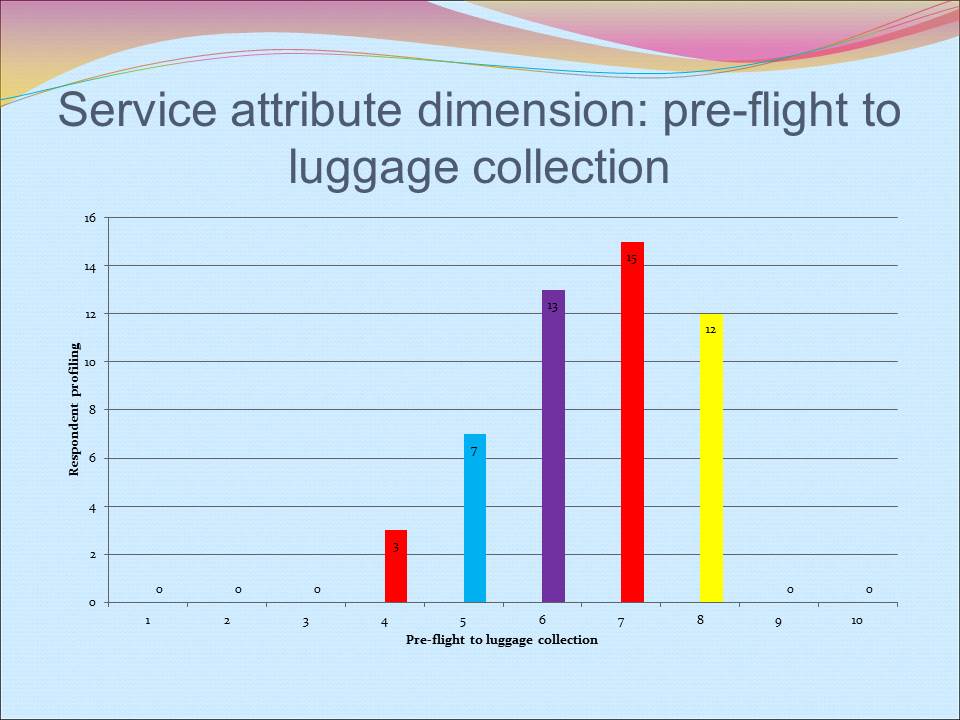

Services attribute: pre-flight services to luggage collection

Most respondents rated these services above average.

The scores are between four and eight:

- Only three respondents rated these services four;

- Seven respondents rated these services five;

- Thirteen respondents rated the services six;

- Fifteen gave the services seven;

- 12 respondents rated the services eight.

The indication is that the services are above average and customers consider most of them basic.

According to the responses, only 3 respondents rated these services four, seven respondents rated the services five, thirteen respondents rated the services six, fifteen given the services seven while 12 respondents rated the services 8.

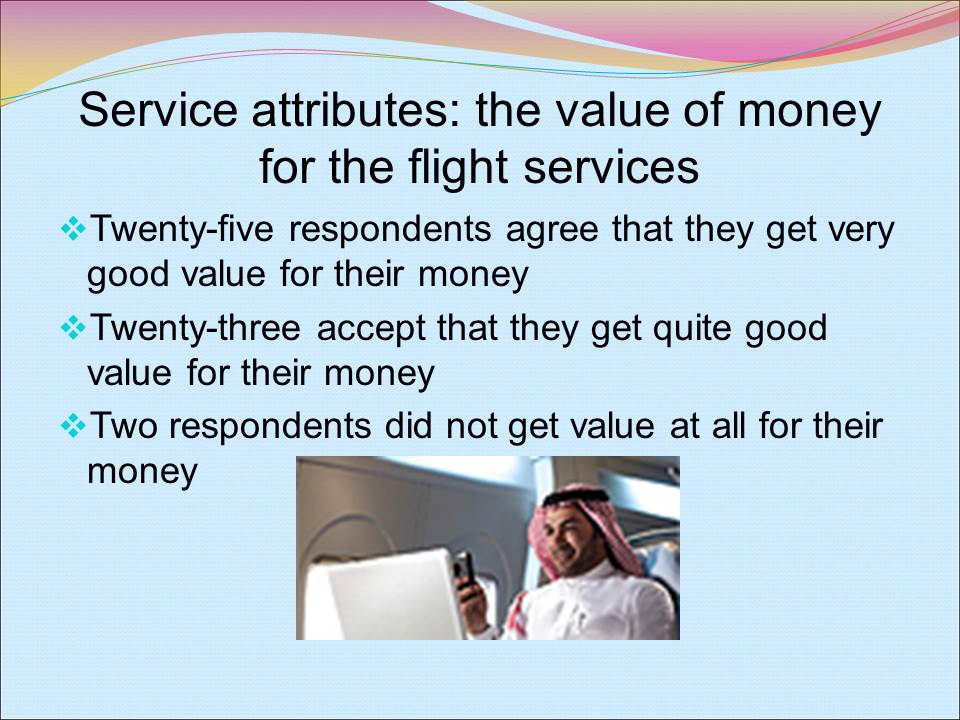

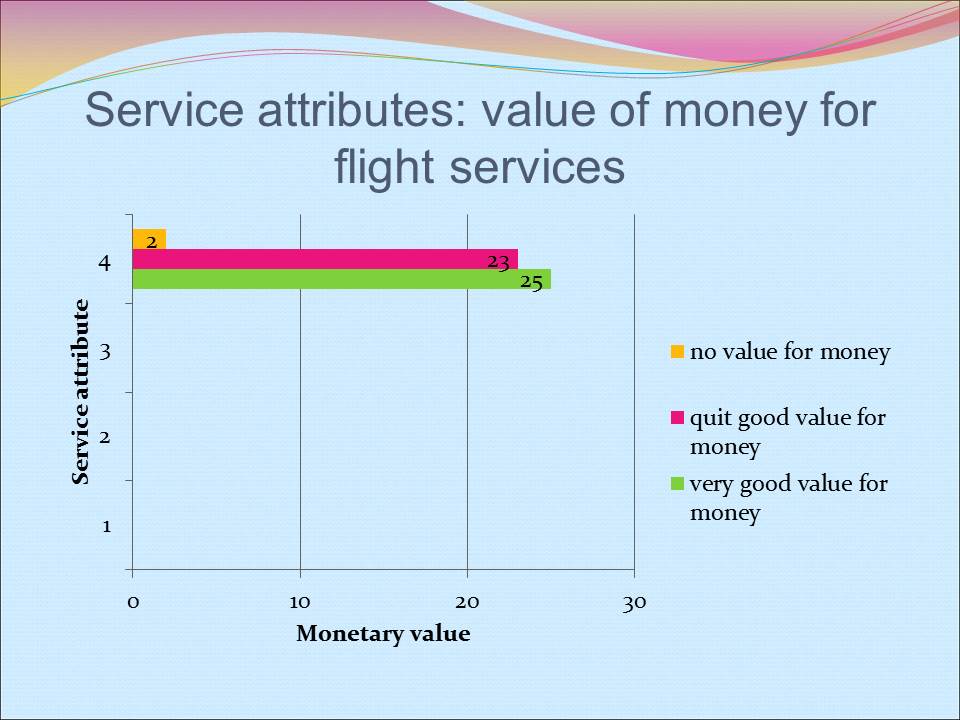

Service attributes: the value of money for the flight services

- Twenty-five respondents agree that they get very good value for their money;

- Twenty-three accept that they get quite good value for their money;

- Two respondents did not get value at all for their money.

When the respondents were asked whether the flight provided value for their money, 25 respondents agree that they get very good value for their money, 23 accept that they get quit good value for their money while only two respondents did not get value at all for their money.

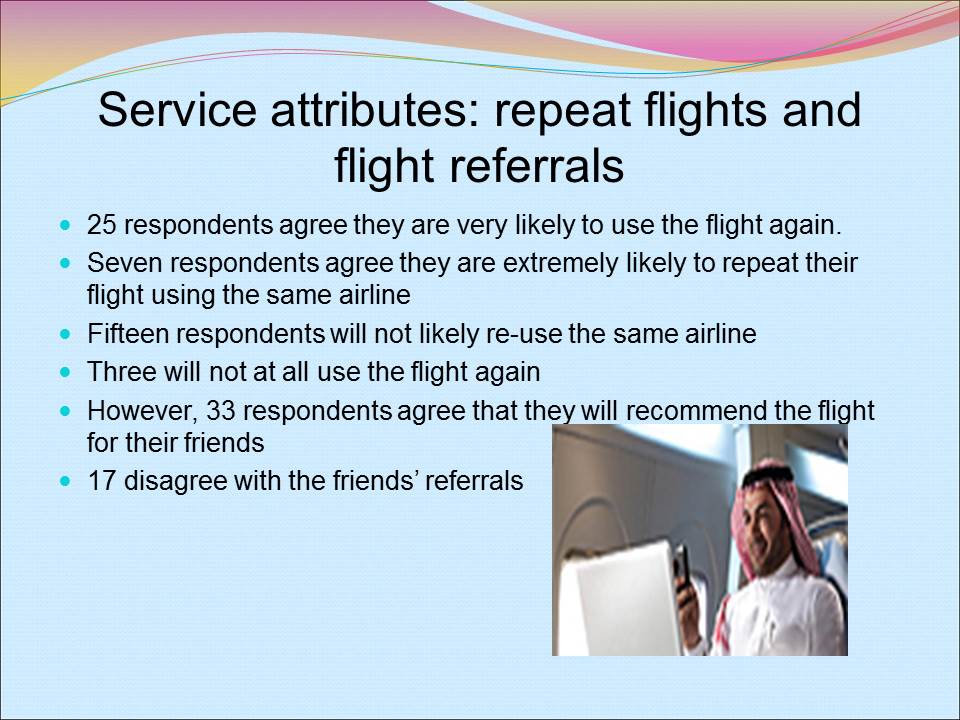

Service attributes: repeat flights and flight referrals

- 25 respondents agree they are very likely to use the flight again.

- Seven respondents agree they are extremely likely to repeat their flight using the same airline.

- Fifteen respondents will not likely re-use the same airline.

- Three will not at all use the flight again.

- However, 33 respondents agree that they will recommend the flight for their friends.

- 17 disagree with the friends’ referrals.

Analysis and discussions

- It is noted that steps at the ticket purchases and the arrival/departure steps are equally important for clients.

- The respondents rate other enhancing services highly important.

- The airline must improve on these services to provide maximum satisfaction to customers.

- Service quality attributes are also rated as extremely important.

- Service attribute such as the proactive measure in case of delay is more important to the customers than on-time arrival/departure.

- Respondents emphasize on the services basic to air transport.

- Respondents also criticize the economical carriers pricing model.

- Customers are charged independently for every service consumed.

- Service providers ought to offer their services as par consumers needs.

- Communication to the customers is just equally important like any other services provision.

- Services such as the staff behavior and clean facilities were considered neutral.

- Neutral services attributes are considered not important but critical in the satisfaction of the customers.

Conclusion

The quality of services is:

- Measured using a gap between expected and perceived services;

- Directly linked to the profitability and the loyalty of customers;

- Key to the success of the company.

Empirical results show the significance of aspects of service quality such as timely arrivals, availability of information and communication.

Customers expect high quality services from their service providers.

Services that are offered during flight such as quality food, entertainment and polite treatment by staff go an extra mile in satisfying clients hence winning their loyalty.

Generally, there is a direct correlation between quality service delivery and the customer satisfaction, customer loyalty and profitability of the firm.

Recommendations

The airline management should understand their customers and their expectations in order to offer quality services.

The airline management should emphasize on the components of services that need improvements and do away with components that do not add value to customers.

The management should understand the client’s basic value aspects offered during transportation including timely information for decision-making, timely communications in case of delays or cancellations.

On-flight services are equally important and the management should improve on such services.

The airline management should not underestimate the significance of the airline safety.

The management should spend less on customization and emphasize on the improvement on the quality services.

Limitations of the research

The results cannot be fully relied upon.

It is important for the firm to get information from other sources such as customer feedback, market research as well as other strategic activities before drawing a conclusion.

The survey results were drawn from limited research results, which limit the coverage of the airline customers.

The target group mostly consisted of young professionals whose preferences can easily change with changes in the service delivery as well as development of their careers.

These views are limited hence do not reflect the behavior of the general airline public.

References

Boetsch T, Bieger, T & Wittmer, A 2011, “A customer value framework for analyzing airline services,” Transportation Research on Air Transport Marketing vol.54 no.1, pp.71-84.

Chang, Y-H & Yeh, C-H 2002, “A survey analysis of service quality for domestic airlines,” European Journal of Operational Research, vol.193, pp.166-177.

Chen, F-Y & Chang, Y-H 2005, “Examining airline service quality from a process perspective,” Journal of Air Transport Management, vol.11, no.2, pp.79-87.

DataGuru.org 2012, A compilation of survey response options, Web.

Fiorino, F 2006, “Business not as usual,” Aviation Week and Space Technology, vol. 165 no.3, pp. 50-75.

Gilbert, D & Wong, RKC 2003, “Passenger expectations and airline services: a Hong Kong based study,” Tourism Management, vol.24, no.4, pp.519-532.

Gliatis, VA & Minis, IE 2007, “Service attribute-process matrix: a tool for designing and managing services,” Journal of Systems Science and Systems Engineering, vol.16, no.3, pp.257-276.

Gronroos, C 2001, “The perceived service quality concept – a mistake?” Managing Service Quality,vol.11 no.3, pp.150-152.

Gursoy, D, Chen, M-H & Kim, HJ 2005, “The US airlines relative positioning based on attributes of service quality,” Tourism Management, vol.26 no.6, pp.57-67.

Iatrou, K & Alamdari, F 2005, “The empirical analysis of the impact of the alliances on airline operations,” Journal of Air Transport Management,vol.11, no.4, pp.127-134.

Teichert, T, Shehu, E & von Wartburg, I 2008, “Customer segmentation revisited: The case of the airline industry,” Transportation Research, vol.42 no.11, pp.227-242.

Tiernan, S, Rhoades, DL & Waguespack Jr, B 2008, “Airline alliance service quality performance – an analysis of US and EU member airlines,” Journal of Air Transport Management, vol.14 no.3, pp.99-102.

Tiernan, S, Rhoades, DL & Waguespack JB 2008, “Airline service quality: exploratory analysis of consumer perceptions and operational performance in the USA and EU,” Managing Service Quality, vol.18 no.3, pp.212-224.