Introduction

Saudi Arabian Monetary Agency (SAMA) has been in operation since the year 1952. The agency was founded during the reign of King Abdulaziz (Saudi Arabian Monetary Agency, 2015). Being the central bank of the Saudi, the institution is entitled to handle financial transactions affairs of the government, production of the national currency, strengthening Saudis currency, and overseeing insurance companies, finance companies, and exchange dealers.

Analysis

Before the establishment of the bank, Saudi Hollandi Bank used to act as the Saudis central bank. Saudi Hollandi Bank used to stockpile Saudis gold reserves. Similarly, the bank used to receive oil revenues on behalf of the Kingdom. With the launch of SAMA in the year 1952, the bank relegated the above responsibilities (Ramady, 2014). Apart from handling financial responsibilities, the institution operates a money museum (Saudi Arabian Monetary Agency, 2015). The museum displays ancient Islamic and non-Islamic money, current currencies, resources used in the production of currencies, and images depicting how bills and currencies are produced.

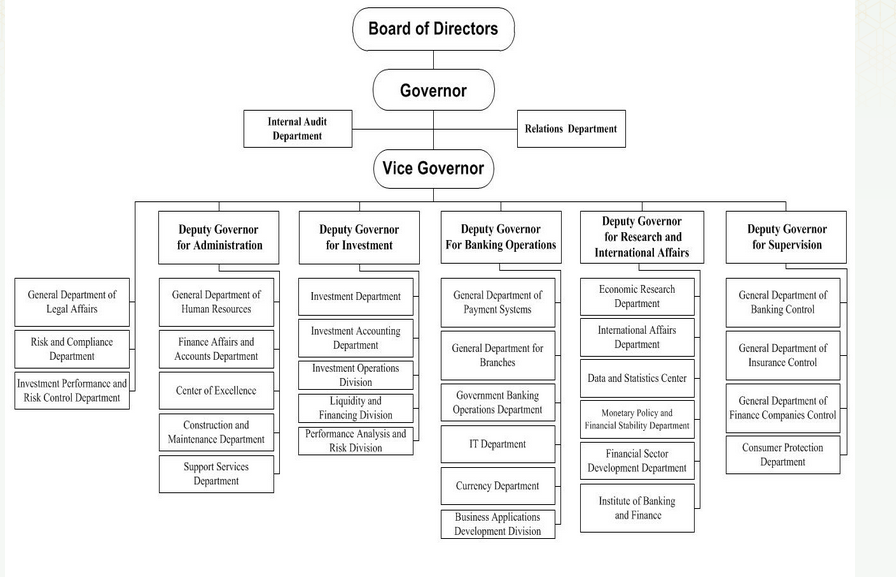

A board of directors supervises the functions of the institution. The board is made up of the governor, vice governor, and three designated associates from the private sector (Saudi Arabian Monetary Agency, 2015). The terms of selection are four years for the governor and assistant governor. The years can be extended through a royal decree. The associates from the private sector’s terms of selection are five years. All members of the board can only be fired through a royal decree. The institution’s top management includes the governor, the vice governor, and five deputy governors. The image below is a table illustrating the institution’s organization structure.

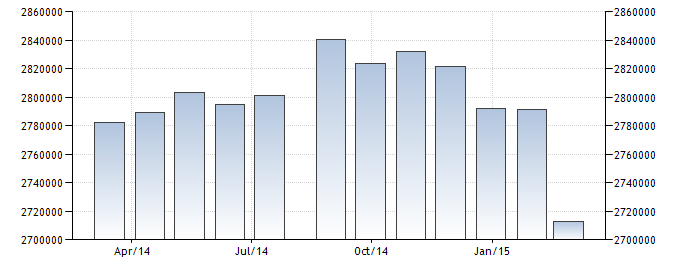

The figure below illustrates a bar graph indicating the institution’s balance sheet for the years 2014 and 2015 (Saudi Arabian Monetary Agency, 2015). The document is denominated in SAR. The SAR is fixed at a certified rate of 3.750 compared to the USA dollar. Based on the figure, the Kingdom’s central bank balance sheet reduced to 2712925 million SAR in February of this year from 2791153 million SAR in January of the same year. The bank’s balance sheet is approximated at 1221583.13 Million SAR for the last 15 years. The balance sheet documented a record high of 2840291 Million SAR during August last year. The record low of 186459 Million SAR was documented during the September of the year 2002. All Saudis currencies dispensed by the institution are fully supported by correspondent gold deposits.

SAMA has a section called Internal Audit. The Internal Audit acts as an operation and management control tool (Mohamed, 2010). As a management tool, the audit controls and assesses the efficacy of other controls. Predominantly, it controls over information technology systems, which are vital to the institution (Alhozaimy, 2010). The aim of the section is to the management team by facilitating analyses, reviews, endorsements, and observations with respect to the activities assessed.

Conclusion

In conclusion, it should be noted that SAMA has been in operation since the year 1952. The institution is mandated to handle financial transactions affairs of the government, production of the national currency, strengthening Saudis currency, and overseeing insurance companies, finance companies, and exchange dealers. A board of directors supervises the functions of the institution.

References

Alhozaimy, Y.(2010). The Islamisation of Saudi Arabian Monetary Agency and the Financial System in the Kingdom of Saudi Arabia, Experience from Selected Muslim Countries. Social Science Research Network Journal. 3(2), 95-97. Web.

Mohamed, A. (2010). The Saudi Arabian Economy Policies, Achievements, and Challenges. (2nd ed.). Dordrecht: Springer. Web.

Ramady, M. (2014). Evolving banking regulation and supervision: A case study of the Saudi Arabian Monetary Agency (SAMA). International Journal of Islamic and Middle Eastern Finance and Management. 1(2), 235-250. Web.

Saudi Arabian Monetary Agency. (2015). Saudi Arabian Monetary Agency Economic Reports. Web.