Introduction

The United States of America dollar is the most used currency and therefore suitable for carrying out international trade America holds about 59% of the world’s total reserves. Therefore when the American economy is affected by anything be it a boom or the recession the effect is likely to trickle down and then the world is most likely to experience the same because the supply and demand of the dollar is also affected.

As the world’s strongest economy since 1944 today America has a GDP of over $ 14.3 trillion and furthermore home to approximately 40% of the world’s billionaires the United States economy founded upon the principles of capitalism and free market therefore encouraging free trade and expansion among investors, businessmen and entrepreneurs (Hynson 2010).

American economy is a key participant in international trade and therefore any happenings in its economy will ultimately affect other countries that are its partners.

America also is home to approximately to 140 of the words largest companies this is approximately twice the number of companies from any other country thus, it generates almost 80% of its income from its multinational companies.

It therefore means that during the recent recession coca-cola was forced to re-strategize its operations in order to adjust to the 2007-10 recession, this meant that the business slowdown that affected America spread to Coca-Colas multinational franchises (Hynson 2010).

Furthermore the collapse of the American financial systems which caused a shortage in the supply of the dollar had a big impact on all the facets of international trade and like an infected wound the effects spread across the world, consequently plunging the world’s economy into the mud. “America sneezes the world catches a cold become famous after the American global slowdown spilt to the rest of the world” (Graham 2008).

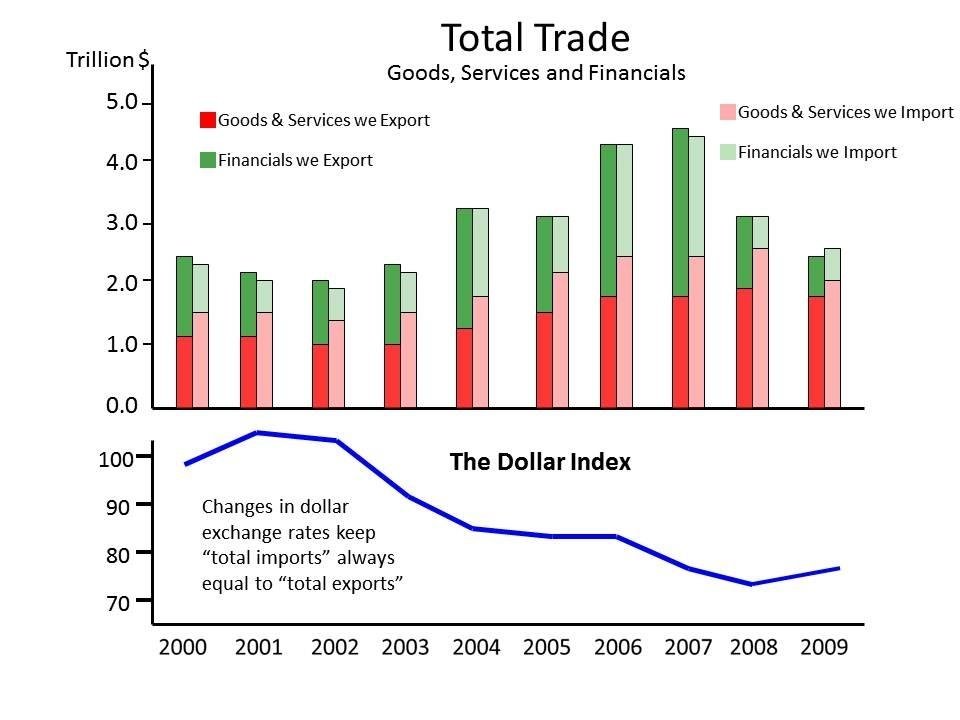

Adopted From Hynson, (2010). The credit crunch.

Diagram Showing the Level of Activity between Imports and Exports That America Gains In International Trade Activities Together With Changes in the Dollar 2000-09.

The United States of America is home to the greatest companies and institutions in the world such as coca-cola, General electric, and Wall Mart, General Motors, Bank of America and Nike who serve the worldwide market and produce goods and services to many nations in the world in the import and export market.

They therefore provide jobs and income for individuals, investors and governments and therefore America in turn affects the global economy.

Coca-cola for example is a multinational company which generates almost 80% of its income from its multinational companies it therefore means that during the recent recession coca-cola was forced to re-strategize its operations in order to adjust to the 2007-10 recession, this meant that the business slowdown that affected America spread to Coca-Colas multinational franchises (Hynson 2010).

Furthermore the collapse of the American financial systems which caused a shortage in the supply of the dollar had a big impact on all the facets of international trade and like an infected wound the effects spread across the world, consequently plunging the world’s economy into the mud (Gross 2010).

Furthermore when America sets policies and legislation that are involved with facets of the economy, trade and financial regulation the rest of the world are many times forced to review their legal framework in order to continue trading with them. It is therefore right to say that Americas financial and trade policies are likely to influence either directly or indirectly the policies of nations who trade frequently with America (Gross 2010).

Summary representing issue

Multinational companies operating in America are spread all over the world and therefore the American culture and law is reflected in these organizations that are located around the world.

Therefore most of the times when the headquarters back in America are faced by hurdles which may be financial, legal, social, political or economical then therefore when a shock effect occurs and a trickle effect follows and the consequences of these effects trickle down to other branches in the company which are part of its multinational chain.

When the American economy prospers therefore such companies and subsequently the nations under which these countries operate in are more likely to benefit. The benefits therefore may end up trickling to employees, investors, employers and governments end up also enjoying themselves. When the American economy experiences a contraction or a slowdown then the same is most likely to face the same situation.

Many economists have complained that Americas influence on the global economy is dangerous and could occasionally plunge other countries into economic trouble. It is therefore high time that countries come up with mechanisms to limit the influence that America has on other countries. For example putting limits on the influence that America has on foreign policy that America has on other countries can be one solution.

The Chinese government has been accused by America recently for undervaluing their currency and therefore unfairly gaining from this as far as international trade but china on the other hand has made it clear that America will not be allowed by the Chinese government to intimidate Chinese authorities to adjust financial and economic policies to please America.

This is mainly because China as a nation is one of the few countries that were not strongly affected by the recent economic slowdown of 2007-10 that trickled down to the rest of the world as a result of the downfall of the American country.

Infact the Chinese economy experienced growth while the rest of the world went forth to see their economies and investments contract. This action may some indication that Americas influence and dominance in the American economy is diminishing.

Concerns about the Issue

America is a member of the G-20 and therefore America either directly or indirectly affects international banking policies by pushing agenda that favors their economy and the dollar.

At the end of the day this policies control the international monetary framework that determines the demand and supply of money in various countries which are members of the international trading community and the overall liquidity framework of the globe therefore in turn this goes to affect global levels of employment, saving, investment, taxes and the purchasing power of people.

The USA has a foreign direct investment ( FDI) of approximately $2.5 trillion this is value doubles that of any other nation. The funds going into foreign direct investment are those including for companies such as Ford, Starbucks, Coca-Cola, General Motors, General electric and many other companies that operate as multinational companies.

Furthermore America has a total investment of approximately $ 3.3 trillion held in other countries across the world (Cooper 2008).

The recent recession of 2007-10 recession in America led to a credit crunch spelt doom for many businesses around the world, that operated as multinational companies the shortage of funds to expand and improve business for business organizations and the shortage of funds for consumers to buy products led to closure in worst case scenarios and change of strategy by companies which intended to survive (Steiner 1997, p. 5).

In Britain, Starbucks which is an American multinational company which had about 700 stores, which serve around 2 million customers daily, were forced to close down and consequently employees lost their jobs and citizens of Britain who were consumers missed their regular cups of coffee, furthermore starbucks was forced to close their branches in Australia and Israel due to the global economic slowdown that emanated from the united states of America (Lisa 2008).

American banks which happened to be multinational companies such as the bank of America, city banks, Lehman brothers who are spread across the world had to cut down on their spending and therefore borrowing money in other countries like Japan became difficult therefore affecting international business.

Many individuals lost jobs and their earnings.

For example It is claimed that the credit crisis of 2007 was triggered by a liquidity shortfall in the United States banking system, the dollar being the world’s largest currency of international trade, which led to the collapse of many financial institutions around the world especially Europe the United States banking system was accused of using unsound business policies and models that lead to the credit crunch (Gross 2010).

Furthermore the government’s lack of a comprehensive legal framework to govern the United States banking system also came into question. The United States government was forced to intervene and bail out bankrupt financial institutions such as A.I.G and other companies such as General Motors’ which had opened multinational companies’ worldwide (Gorrod 2007).

Financial institutions were not the only business corporations that were affected, but also small businesses felt the heat, with little money for consumers to spend and massive job losses companies were forced to rethink their strategies and business models in order for them to be able to scan the environment and find new opportunities that would enable them tap into new opportunities and at the same time stabilize their revenue flows and survive in such a hostile business environment (Johnson et al. 2008, p. 55).

The world’s stock markets like London, Frankfurt, Tokyo and other parts of the world were also affected and in turn the financial consumers confidence in the financial systems fell sharply.

The American influence on the global economy started back in 1944 and since then the dollar became the main currency of international trade. If the supply of the dollar falls then interest rates worldwide will raise due to increased demand for the dollar and if the supply of the dollar becomes abundant the interest rates will fall (Brigham & Houston 2009).

It is therefore this way that the price of commodities in the international market can then be controlled. Countries like The Arab emirates, china and Japan also hold a lot of American dollars in their reserves. The recent recession which caused a worldwide shortage of the dollar currency in turn led to the decline of oil prices.oil prices fell from a price of almost $160 to around $ 50(Cooper 2008).

This meant that investors who had held a lot of capital through investing in the oils market lost billions of dollars. The profits of major oil companies like shell and British Petroleum so a plunge in the value of stock and subsequently profits.

Furthermore even billionaires like Roman Arkadyevich Abramovich who is a wealthy Russian who owns the Chelsea football club who is a major investor in the oiling industry saw his net worth decrease rapidly this goes ahead to show how the changes in the demand and supply of the American dollar can in turn affect people who invest and do business all over the world.

Economists believe that there is both positive and negative influence that comes from the American economy and therefore it is the duty of world governments to create economic, financial and trade policies that will be used to reinforce the positive and desist from absorbing effects that may arise from negative influence (Rowbotham 1998).

China is one country that has ensured that it maintains its sovereignty as far as economic issues are concerned and therefore has no allowed pressure from the United States of America and other countries from compromising with its economic sovereignty. Using the dollar as the universal currency of trade has proven dangerous with the recent economic slowdown that happened in the United States of America.

United States banking and financial system was accused of using unsound business policies and models that lead to the credit crunch (Gross 2010). Furthermore the government’s lack of a comprehensive legal framework to govern the United States banking system also came into question (Cooper 2008).

Therefore the economies of many countries which hold on to dollar dominated deposits will always end up being under the influence of America as far as their economies are concerned.

Conclusion

The dollar is the world most traded currency in the world it is used in carrying out international transactions between many nations of the world and therefore in turn this means that when the united states department of finance and legislature set their economic policies which affect the demand and supply of the dollar other countries of the world will also be affected by this decisions.

Furthermore by being a member state of the G-20 America directly affects global economic policies. Happenings such as the recent recession have proven that economic happenings in the United States of America have a big bearing in the overall economic situation in the globe.

It is therefore up to various governments to set policies that will strengthen the positive influence arising out of the American economy and at the same time set policies that ensure that America’s negative influence on their economies shall not prevail (Olsen & Eadie 1982).

References

Brigham, E.F. & Houston J.F., (2009). Fundamentals of Financial Management. New York, NY: Cengage Learning.

Cooper, G., (2008). The Origin of Financial Crises. London: Harriman House.

Gorrod, M., (2007). Risk Management Systems: Technology Trends (Finance and Capital Markets). New York: Palgrave Macmillan.

Graham T., (2008). The Credit Crunch: Housing Bubbles, Globalization and the Worldwide Economic Crisis. London: Pluto Press.

Gross, D., (2010). Did obscure accounting rules cause the credit crunch. News Week. Web.

Hynson, C., 2010. The credit crunch. North Mankato: Sea to Sea Publications.

Johnson, et al. (2008). Exploring corporate strategy: texts and cases, 8th edn. Financial Times Harlow: Prentice Hall.

Lisa, B. L., (2008). Starbucks Corp said on Tuesday it plans to close 600 underperforming U.S. stores and cut up to 12,000 full- and part-time positions, as it copes with an economic downturn and increasing competition. Reuters. Web.

Olsen, J., & Eadie, D., (1982). The Game Plan: Governance With foresight. Washington, D.C: Council of State Planning Agencies.

Rowbotham, M., (1998). The Grip of Death: A Study of Modern Money, Debt Slavery and Destructive Economics. Philadelphia: Jon Carpenter Publishing.